- Whale activity suggests a potential shift in sentiment as large AAVE holders offload assets.

- Technical indicators signal bearish momentum, though on-chain engagement metrics show steady interest.

As a seasoned researcher who has navigated through countless crypto market cycles, I can say that the current situation with AAVE feels reminiscent of a game of chess—the whales are making their moves, and we’re left to analyze the board for signs of the next checkmate or stalemate.

Currently, Aave [AAVE], a significant name in the world of decentralized finance (DeFi), is experiencing increased selling pressure. This is due to large-scale investors, commonly known as “whales,” dumping substantial portions of their holdings. Notably, recent transactions show transfers to popular exchanges such as Binance, MEXC, and OKX.

Significantly, approximately 25,790 AAVE valued at around $3.39 million was transferred to MEXC and Binance, each receiving roughly half of this amount. Furthermore, major institutional players Cumberland and Galaxy Digital deposited 10,000 AAVE and 7,897 AAVE respectively into their accounts.

Currently, AAVE is being exchanged for approximately $129.58 per token, representing a minor 0.14% increase over the preceding day. The surge in significant transactions has sparked speculation: Is this temporary fluctuation or the start of a broader change in sentiment towards AAVE?

Technical analysis: Is a further decline on the horizon?

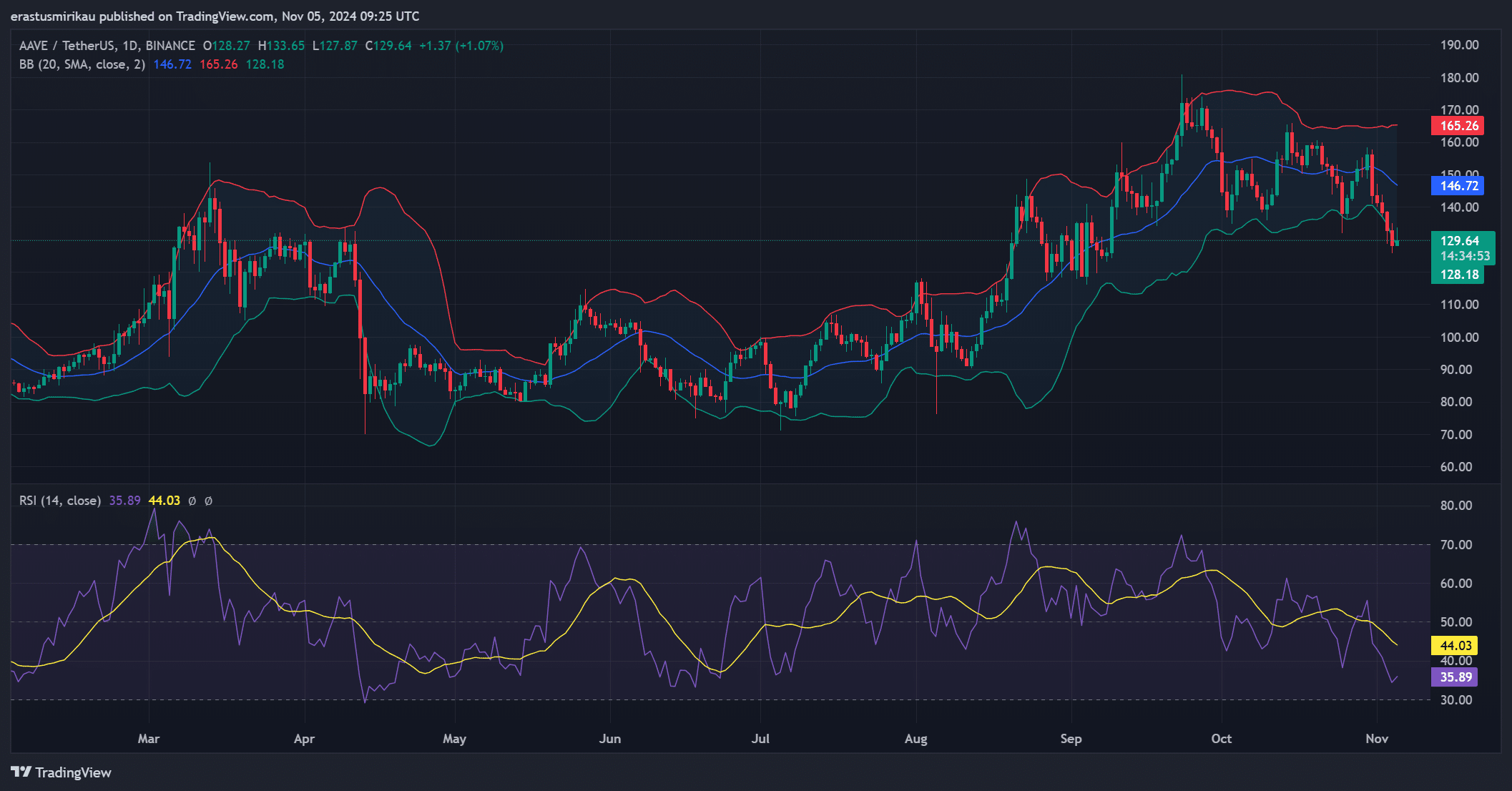

In simpler terms, the technical indicators hint at a conflicting forecast for price fluctuations. The Bollinger Bands (BB) indicate heightened volatility as the price approaches the lower band, which typically signals bearish trends and downward pressure. If selling continues, there’s potential for further decreases in price.

Currently, the Relative Strength Index (RSI) stands at 35.89, nearing the region where assets are considered overbought and may attract investors seeking bargains.

Should purchasing momentum not strengthen, the downward trend might persist. As such, traders are advised to practice extra vigilance, particularly when prices hover near the lower Bollinger Band.

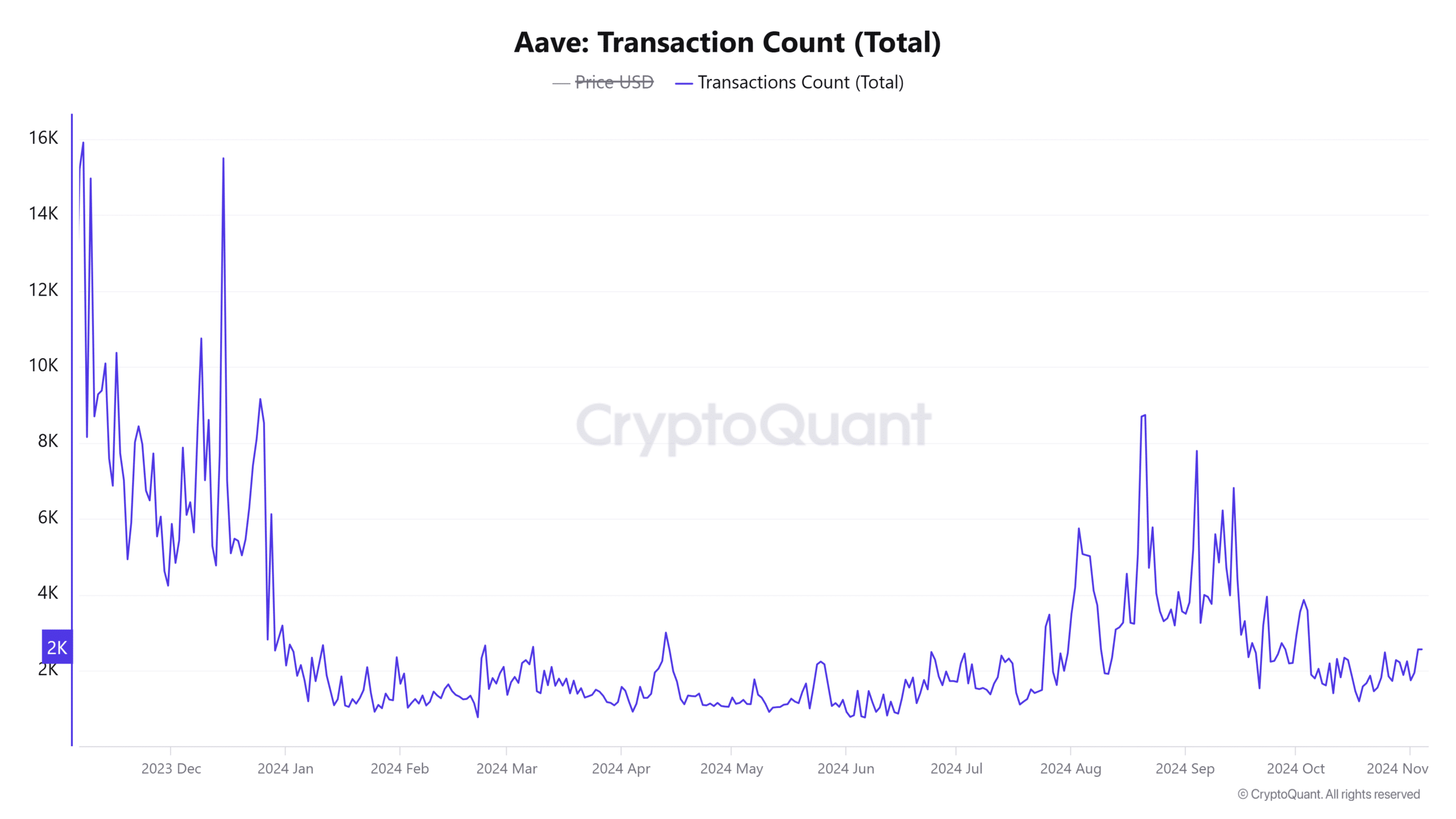

AAVE active addresses and transaction count

Despite the whale-driven selling pressure, on-chain metrics indicate steady engagement. The transaction count currently stands at 2.67K, a modest increase of 1.03% over the last 24 hours, while active addresses grew by 1.08% according to CryptoQuant.

An upsurge in activity might indicate that individual investors remain engaged, balancing out the selling force exerted by major players. Yet, a surge in active accounts alone may not be sufficient to counteract the impact of ‘whale’ actions unless there is a significant increase in retail purchases.

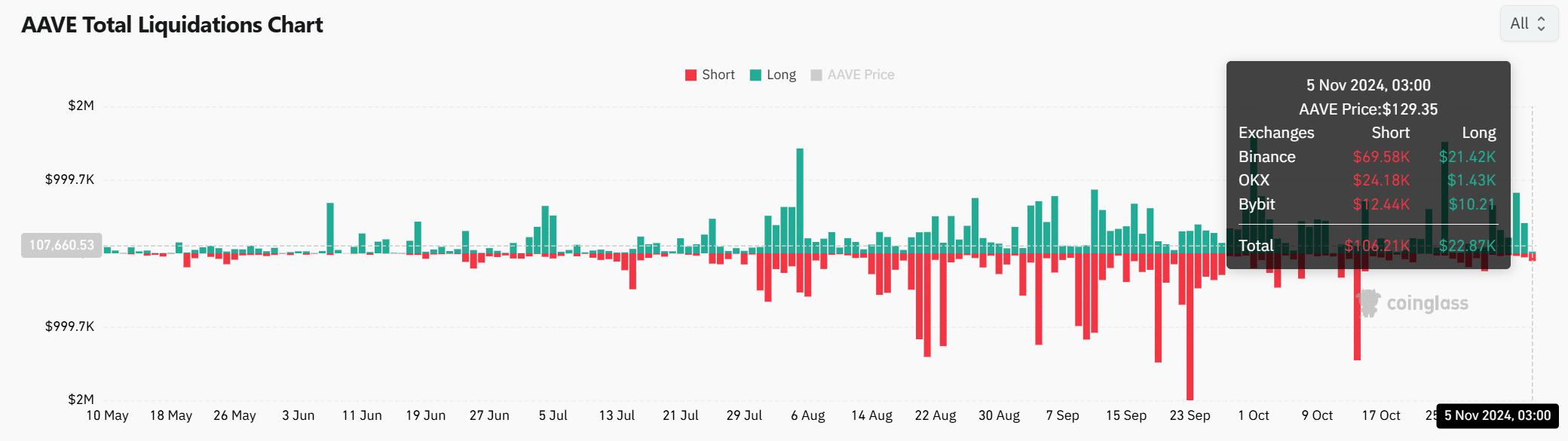

AAVE liquidations: Could this trigger further volatility?

Liquidation data adds a crucial dimension to AAVE’s outlook. As of the latest report, $106.21K worth of short positions and only $22.87K in longs were liquidated across platforms like Binance, OKX, and Bybit.

This skew indicates a dominant pessimistic outlook among traders, who are consistently taking protective measures for potential price drops. If this trend continues, it could intensify the market’s downward push, especially when stop-loss orders are activated on long investments.

Read Aave’s [AAVE] Price Prediction 2024–2025

To put it simply, the African American Virtual Exchange (AAVE) is currently facing a tough time. There’s been a lot of big investor activity (whales), bearish trends in the technology, and high numbers of liquidations. The mix of whale selling and technical signs suggests a need for caution.

On the other hand, the continuous rise in active wallets and transactions indicates that retail enthusiasm persists. If the present market sell-off leads to a sustained downtrend or just a short-term fluctuation will largely hinge on the resilience of retail purchases and future whale activity.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- The Lowdown on Labubu: What to Know About the Viral Toy

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

2024-11-06 07:03