- RUNE saw a sharp 15% drop, likely triggered by panic sell-off by a major whale.

- Price action has started recovery and increased volume could spark a real bounce.

As a seasoned researcher with years of experience navigating the tumultuous seas of the cryptocurrency market, I have seen my fair share of whale-induced storms. The recent 15% drop in RUNE appears to be no exception, seemingly triggered by a major whale’s sell-off on Kraken. However, as we know too well in this industry, what goes down must eventually come up, and the recovery in RUNE’s price action is a testament to that.

In the last 24 hours up until now, the cryptocurrency known as RUNE, which is associated with THORChain, has seen a significant decline of around 15%. This drop appears to have been instigated by panic after a large investor (often referred to as a ‘whale’) sold off a substantial amount of RUNE on the Kraken exchange.

At the moment of reporting, the whale had taken out around 2.85 million RUNE, equivalent to roughly $12.35 Million, and subsequently exchanged some of it for Bitcoin [BTC] via ThorSwap.

After changing 9.69 Bitcoin, the whale transferred all of it to Kraken. On the other hand, the 2.7 million RUNE tokens were shipped to Binance instead.

Impact of whale sell-off on RUNE’s price

The rapid sale of whales noticeably lowered the price of RUNE in the short term. Yet, it didn’t appear to present a major long-term risk to the token’s potential worth.

THORChain, a decentralized exchange (DEX) built on the Layer-1 blockchain, remains committed to facilitating cross-chain trades, focusing primarily on major Layer-1 platforms. This ongoing support strengthens its likelihood of widespread adoption.

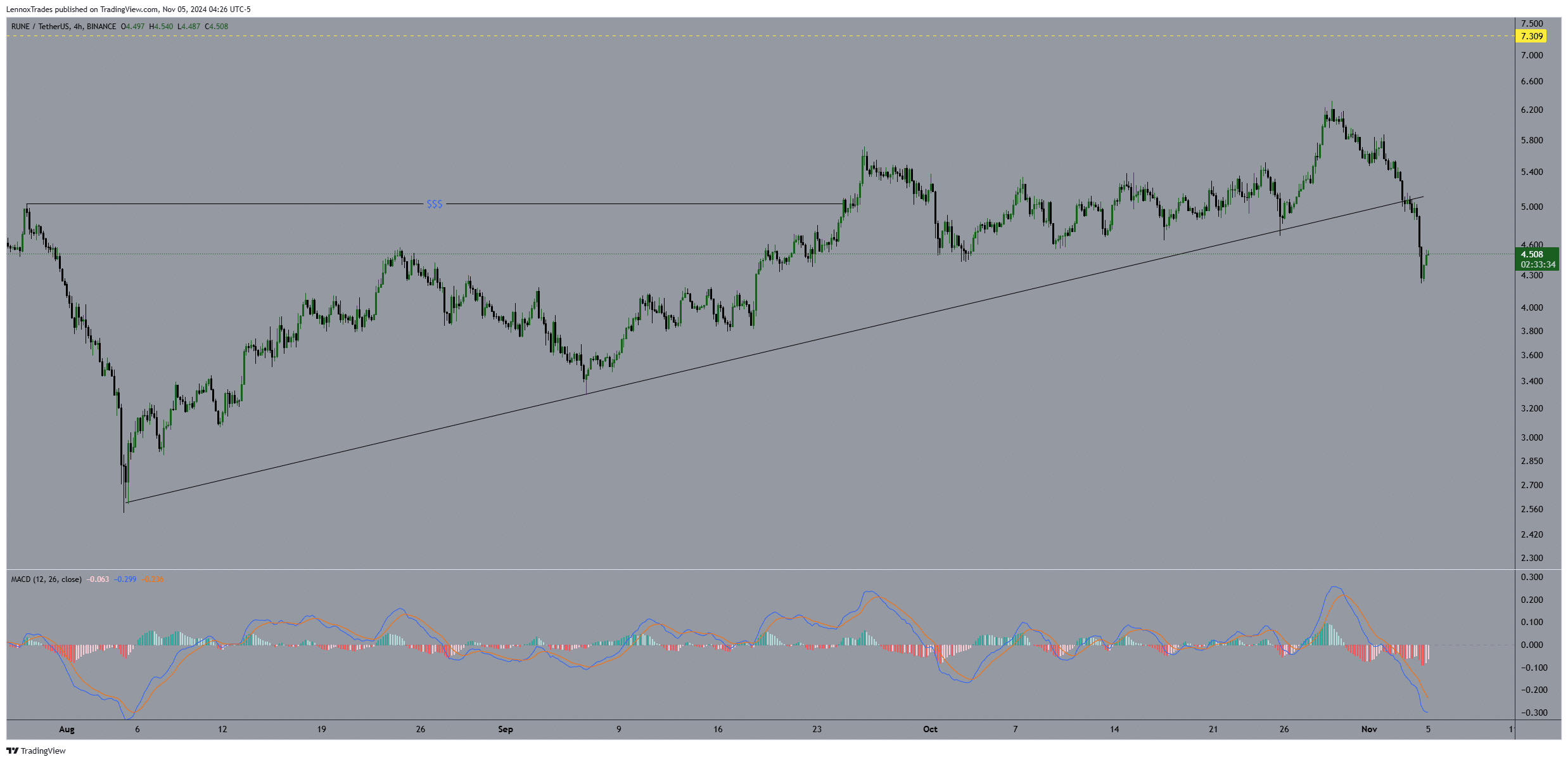

On the 4-hour chart, the RUNE price displayed early indications of a rebound, even though technical indicators, known for their sluggish response to sudden price fluctuations, had yet to provide a definite signal.

rune/usdt indicates an effort towards recuperation, following its rebound from around $4.50. This action suggests that there may be emerging purchasing enthusiasm at this price point, potentially establishing a fresh region for potential support.

Following its inability to hold onto the rising trendline, RUNE dropped below the $5 mark, eventually settling near the $4.50 region.

The MACD line crossed below the signal line, signifying that bearish forces have been more influential in the latest market trends.

Despite the recent bar graph suggesting a possible decrease in sales velocity, it provided investor optimism about a steady comeback.

Initially, the rising line served as a floor for RUNE prices, but it has since transformed into a barrier. For RUNE to show a bullish reversal, it must rebuild its strength and surpass this obstacle.

Should RUNE continue to hold its ground above the $5.5 mark, it might potentially reach the previous peak at $7.30. Nevertheless, a definitive reversal hinges on increased trading volume and a convincing breach of these resistance levels.

Volume and TVL

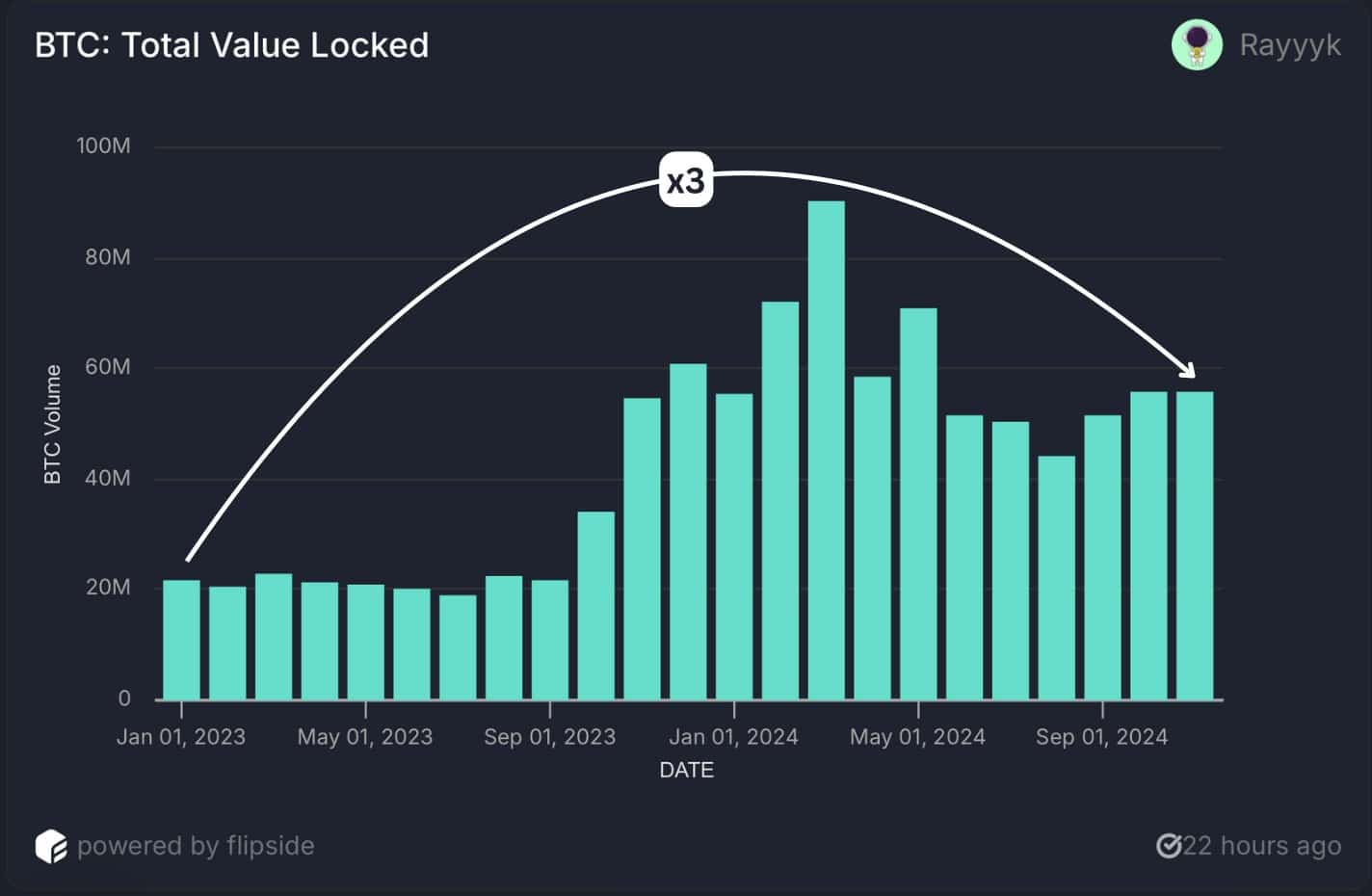

In the meantime, the weekly trading volume for RUNE reached a record peak of $78 million, indicating increasing market attention even amidst current price fluctuations.

Furthermore, the locked-in value of Bitcoin within THORChain has more than tripled since 2023, highlighting the growing interest in THORChain’s cross-chain liquidity solutions.

It appears that these elements indicate that while RUNE experienced temporary selling, its long-term foundations seem robust. Potentially, future movements in the price may profit from restored market trust.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

2024-11-06 08:07