- Bitcoin cleared its March high, pushing it towards a new ATH on the charts

- Metrics suggested the crypto could potentially go as high as $80k

As a seasoned crypto investor who has been around since the early days of Bitcoin, I must say, this latest surge towards a new ATH is nothing short of exhilarating! The last time we saw such a meteoric rise was during the 2017 bull run, and while I’ve seen my fair share of market volatility, this feels different.

Today, Bitcoin (BTC) has made headlines once more as it momentarily surpassed its previous record high ($75,116) on U.S. Election Night. Although there’s been some decline since then, at the present moment, the digital currency is trading slightly below that peak figure, holding a value of approximately $74,791.

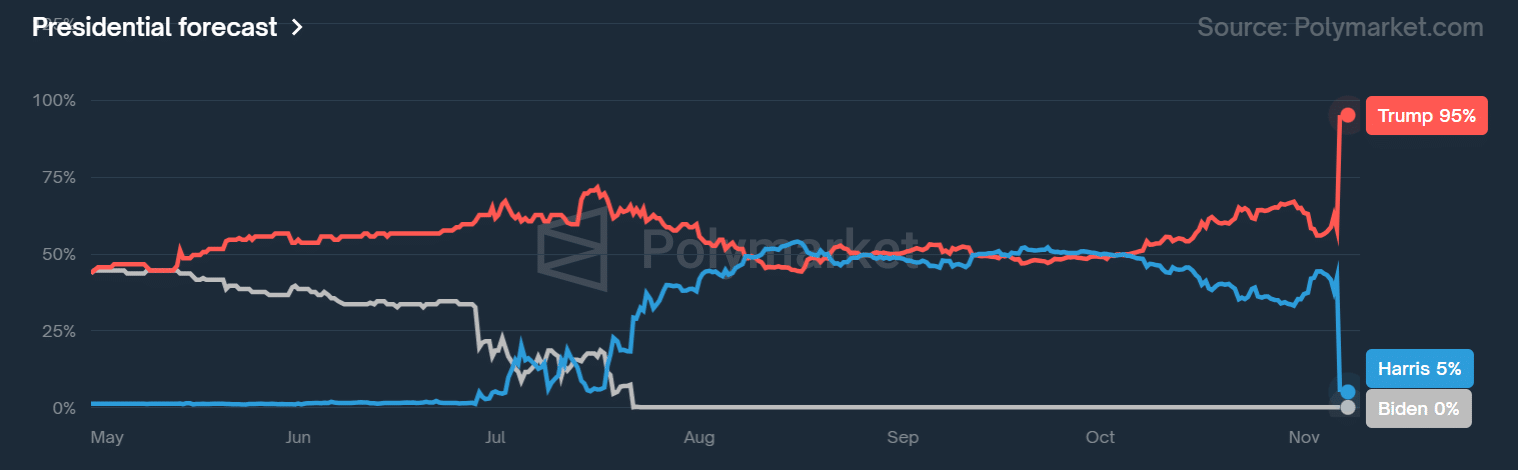

That’s not all though as the odds of a likely Donald Trump win surged above 90% on Polymarket. This confirmed some of the election targets AMBCrypto projected based on the U.S election’s outcome.

Based on these initial findings, it appears that if Trump is officially declared the winner, the market trends might suggest a potentially positive or bullish direction.

Given that Bitcoin has surpassed $70k, one might wonder if it’s too costly to invest at these prices, or if there’s still potential for late investors. To shed light on this, let’s delve into crucial evaluation indicators and network statistics to uncover some insights.

What’s next after BTC’s new ATH?

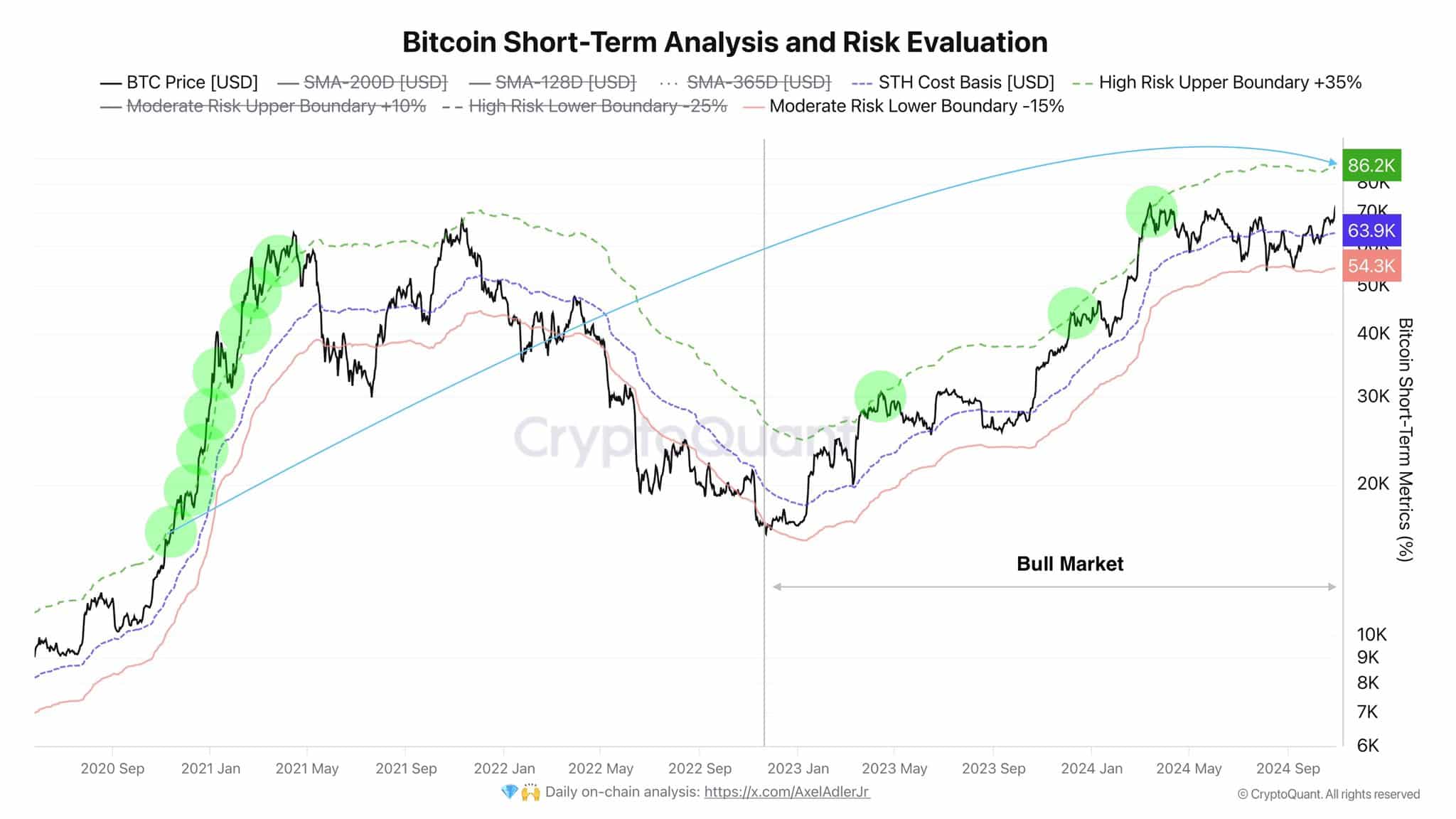

According to a short-term risk assessment by CryptoQuant analyst Axel Adler, it’s anticipated that the price of Bitcoin could potentially reach $86k in the near future. In his own words, he stated this as a possible target.

At approximately $86,200, the direction of the ongoing bull run will be determined. If the price exceeds this level and establishes a robust bullish trend, we’ll get to witness the highly anticipated market movement that everyone has been eagerly anticipating.

2020 marked a dramatic surge for Bitcoin as it breached the highly speculative upper limit. In 2024, this level might prove crucial to keep an eye on and potentially surpass.

Huge room for an extra BTC rally

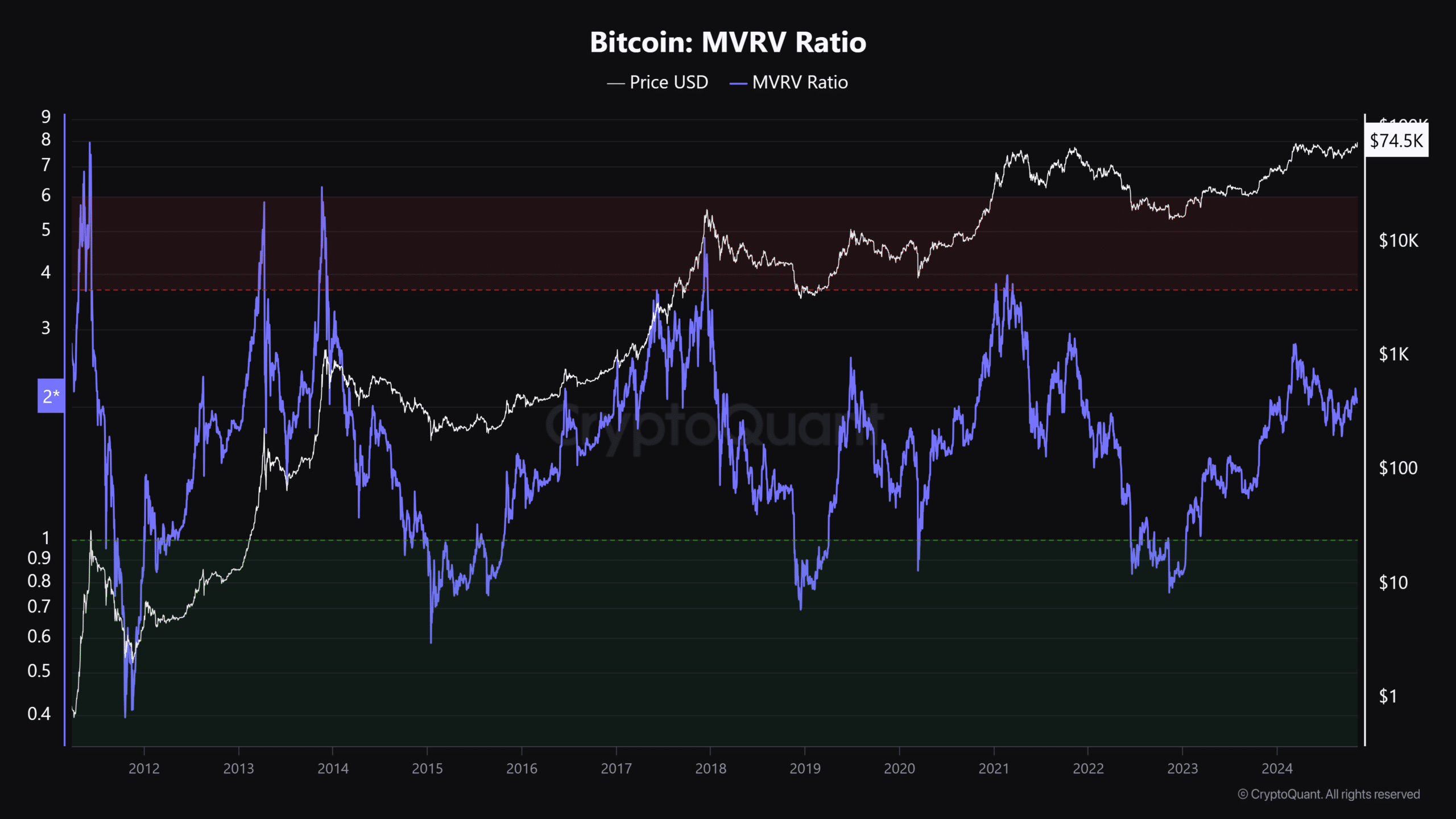

The MVRP (Market Value to Realized Value) proportion, another evaluation indicator, suggested substantial future growth. This metric helps determine if Bitcoin is underpriced (a bargain) or overpriced (too costly).

Although Bitcoin recently reached a new all-time high, it was still relatively inexpensive according to the MVRV (Modeled Value Realized to Market Value), currently at 2. This appeared similar to the patterns from 2017/2020, preceding its significant price surges. Generally speaking, an MVRV ratio of 4 or more is often seen as overpriced or overvalued, while a value below 1 is typically considered undervalued.

Read Bitcoin [BTC] Price Prediction 2024-2025

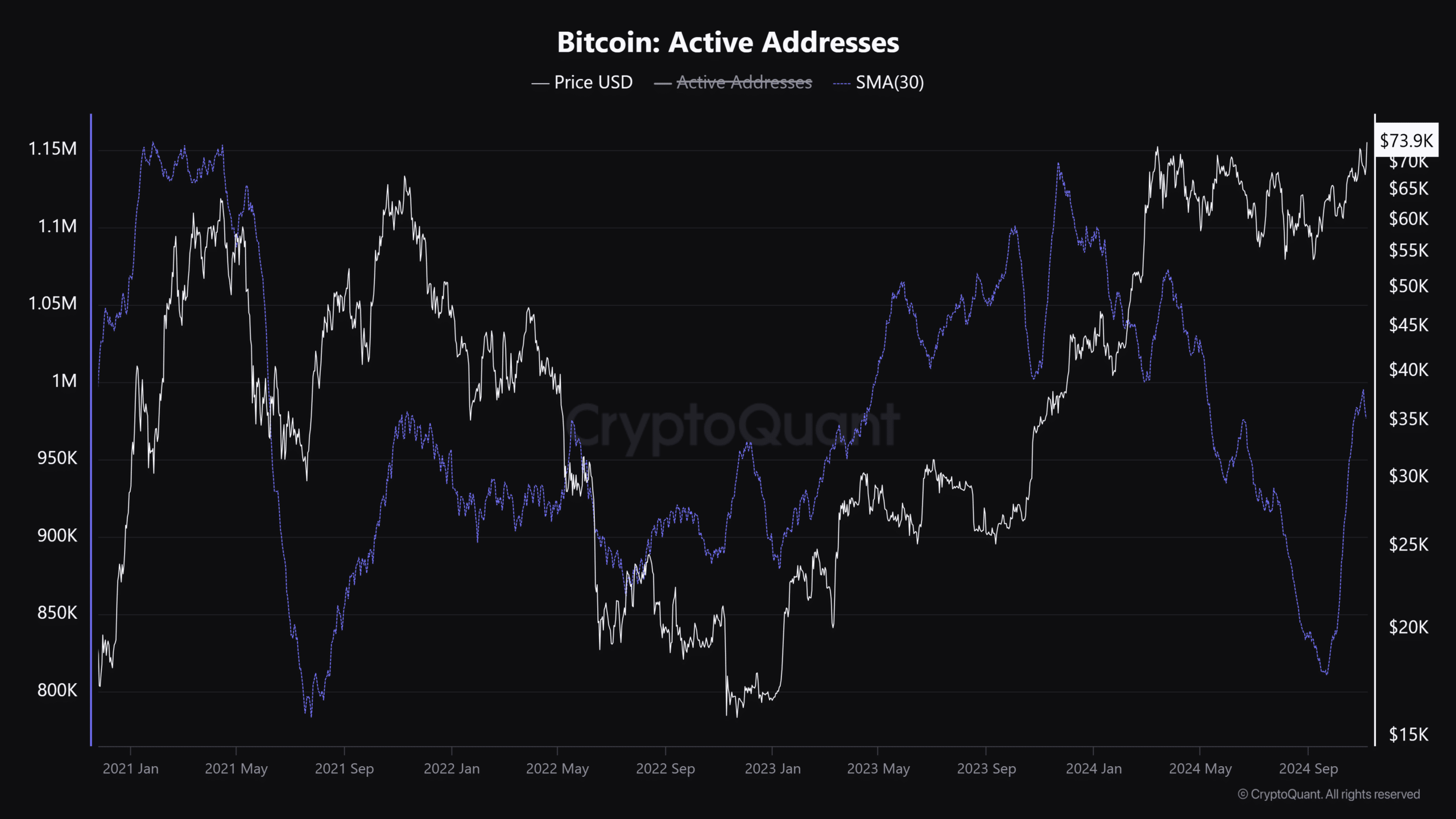

Ultimately, the surge in Bitcoin’s price was accompanied by a flourishing growth in the network as well. Daily active addresses, which had dipped to their lowest point since September, began to rebound, moving steadily towards the 1 million threshold – an indication of increasing demand and market engagement for BTC.

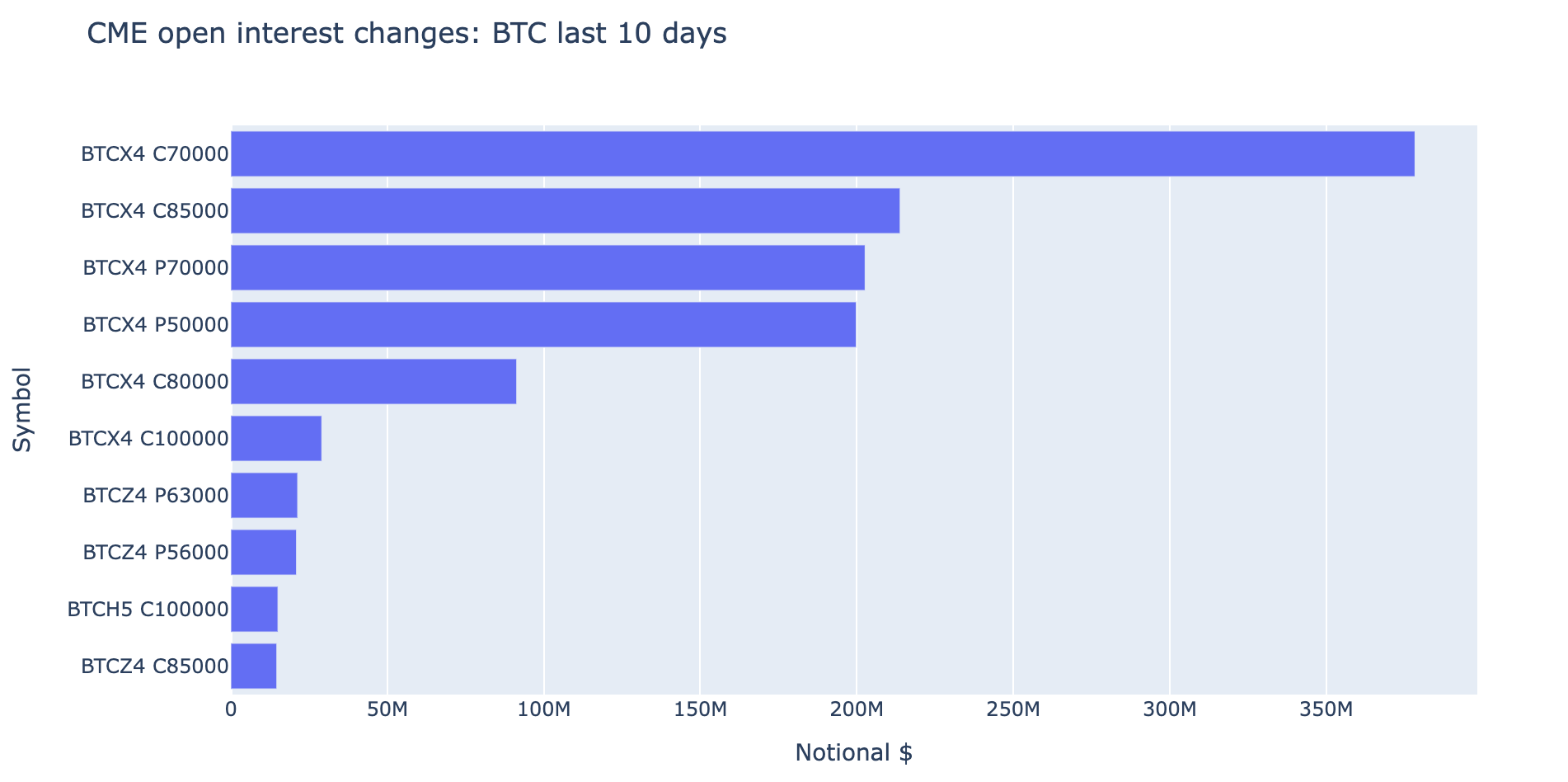

In the Options market, following the surpassing of the $70,000 mark, significant investors have made substantial wagers anticipating Bitcoin prices to reach $80,000 and even $85,000 by November, based on recent trends in CME Bitcoin Futures deposits.

Currently, even with the deadline approaching, there remain safeguard investments worth $50,000 in place, likely to protect against potential gains by Kamala, as per the observations of well-known Options trader Peter Stewart. In his words, these are precautions taken if Kamala emerges victorious.

“CME has introduced a similar type of option (with a lower premium) for November 29th in the 85,000 Calls, as well as another one for the 80,000 Calls. On the safety side, they bought a $200 million worth of options spread between November 29th 70,000-50,000 Puts.

As an analyst, I’ve come to find that the medium-term outlook points towards a potential target of around $80K. Nevertheless, it’s crucial to keep in mind that any unfavorable updates concerning the macroeconomic environment or a victory by Kamala Harris could potentially challenge or postpone these optimistic forecasts.

Read More

- The Lowdown on Labubu: What to Know About the Viral Toy

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Masters Toronto 2025: Everything You Need to Know

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

2024-11-06 09:27