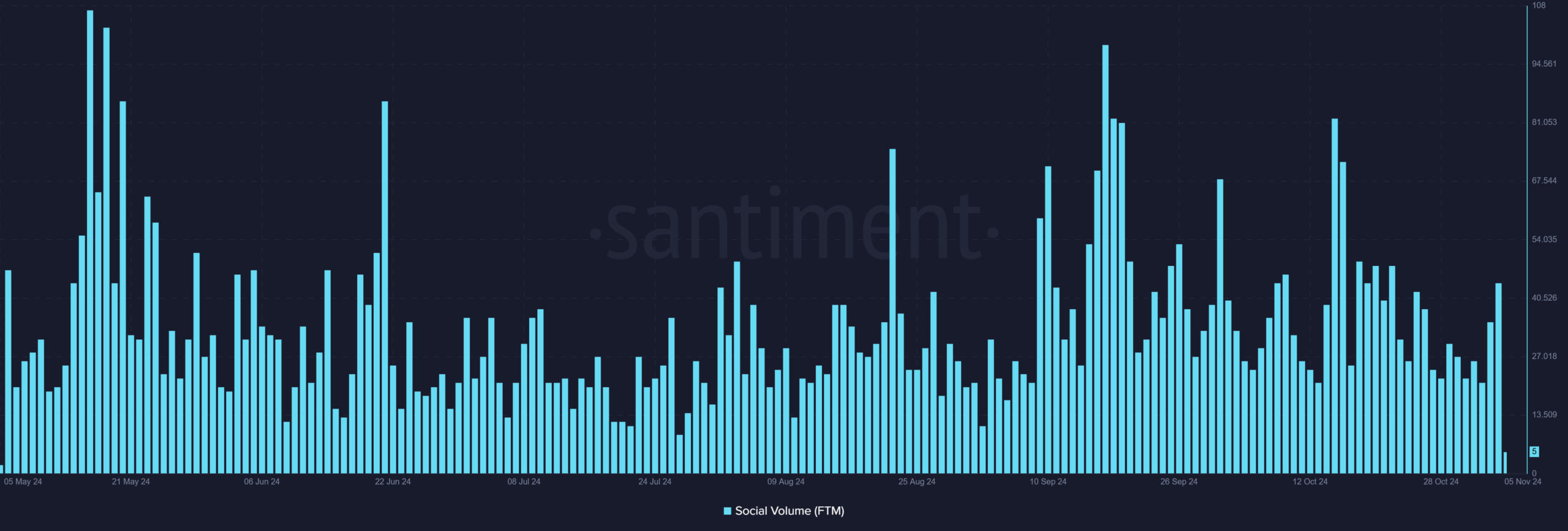

- Fantom social volume peaks coincide with increased whale accumulation, suggesting strong institutional interest

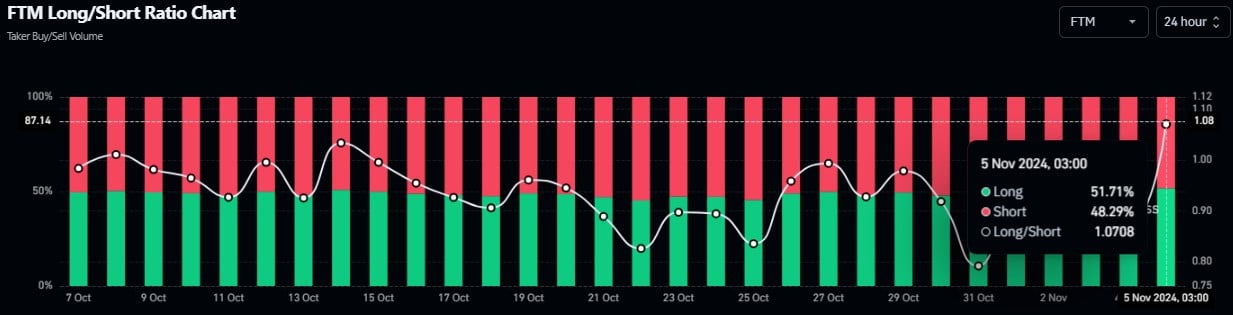

- Long/short ratio shift above 1.07 indicates growing bullish sentiment.

As a seasoned crypto investor with over a decade of market experience under my belt, I find the current Fantom [FTM] situation intriguing. The convergence of strong institutional interest, positive social sentiment, and bullish positioning suggests that we might be on the cusp of another significant price rally for FTM.

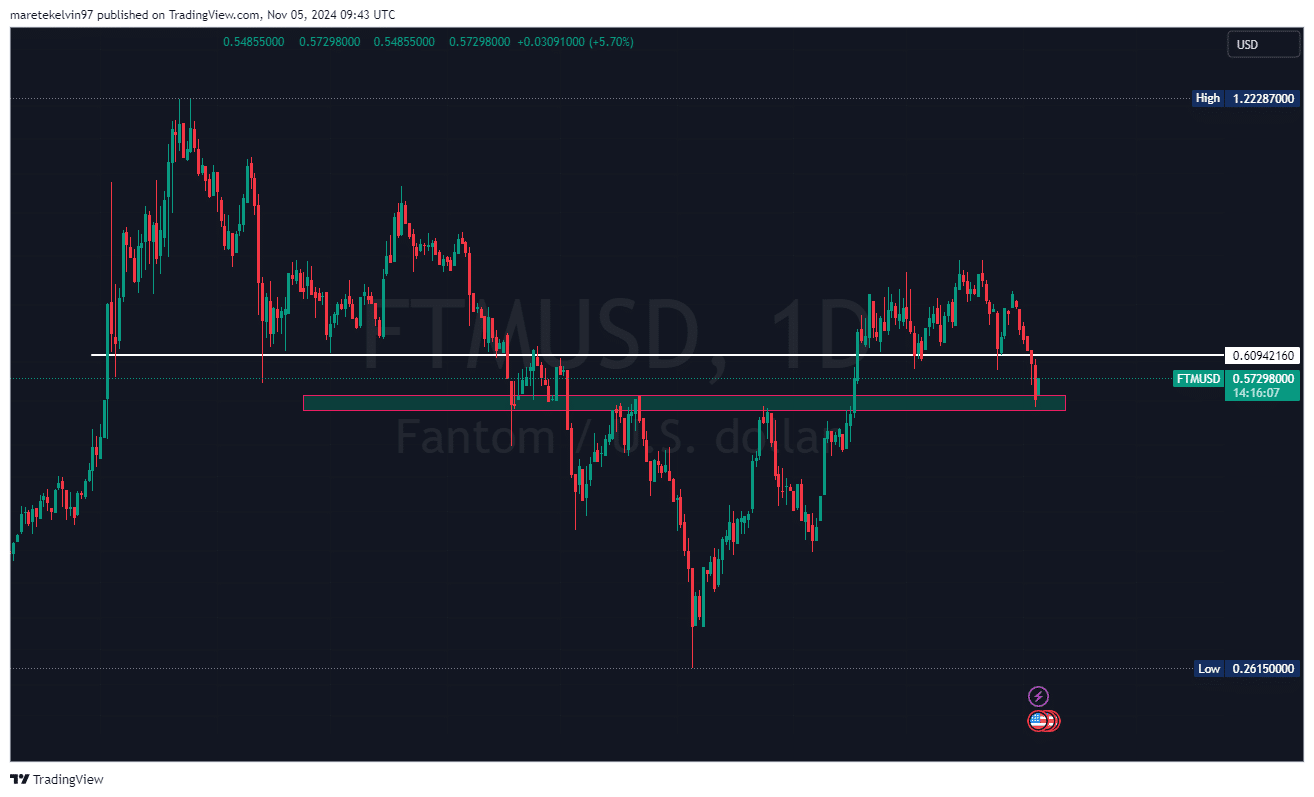

As a researcher, I’ve noticed that Fantom [FTM] has demonstrated remarkable resilience by maintaining a significant support level at approximately $0.54. This observation comes in the wake of the recent market fluctuations.

The behavior of the altcoin’s price shows a noticeable trend of consolidation, as the present trades are mostly focusing on this significant mental barrier.

This comes after FTM experienced a significant recovery from its previous lows.

Fantom large players moves in

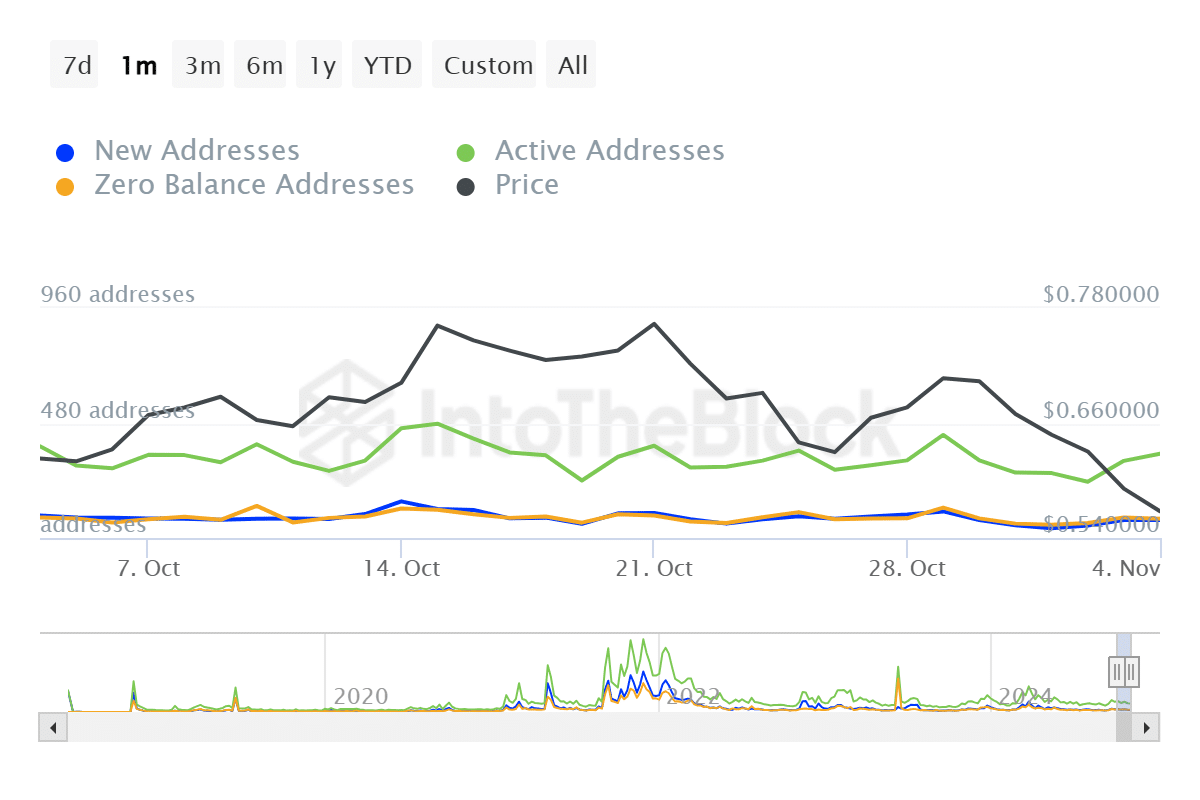

According to an analysis by AMBCrypto, there’s been a significant increase in the number of large investor accounts (whales), while the number of active addresses has continued to grow steadily, as per the latest data from IntoTheBlock.

Approximately 960 unique addresses have been consistently active on the network, indicating ongoing institutional involvement. Such persistent activity patterns often signal upcoming significant price fluctuations, as big investors often amass assets during periods of market consolidation before major price swings occur.

Social metrics heat up

Additionally, the social activity levels for altcoins have significantly increased, reaching heights last seen around September 2024.

A rise in social interaction is closely linked to past surges in Fantom’s price. The current spike in social media activity, along with heightened trading activity, implies a growing interest from the market.

Fantom bulls take the lead

Building on the previously mentioned favorable opinions, AMBCrypto delved deeper by examining Santiment’s long/short ratio data to assess the market trend.

The altcoins long/short ratio has crossed above 1.07, indicating a clear bullish bias among traders. This shift in positioning is particularly significant given the recent Fantom consolidation phase.

Approximately half of the positions on Fantom (around 51.71%) are currently long, whereas short positions have diminished to approximately 48.29%. This could indicate a possible shift in the market trend towards a bullish direction.

What is ahead for FTM?

A strong combination of growing whale involvement, favorable public opinion, and optimistic investment strategies builds a convincing argument for continued price rise.

Read Fantom’s [FTM] Price Prediction 2024-25

Historically speaking, it seems that when these indicators line up, Fantom tends to enjoy a prolonged period of price growth.

If the ongoing test of the $0.57 support level holds firm, it might act as a launchpad for the price to climb further, especially if social interest in the asset keeps growing.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-11-06 12:39