- Analyst foresees Bitcoin mirroring gold’s rally.

- Meanwhile, the possibility of a dip also remains.

As a seasoned analyst with over two decades in the financial markets under my belt, I’ve seen bull runs and bear markets come and go. Watching Bitcoin’s meteoric rise to new heights has been nothing short of captivating. The parallels drawn between Bitcoin and gold are intriguing, and if Tony Severino’s analysis holds true, we might be in for quite a ride.

It seems that the ambition for Bitcoin (BTC) to reach unprecedented heights is becoming a reality. The dominant cryptocurrency has surpassed its old record, soaring above $75,000 and breaking the previous high of $73,777 set in March.

Amid the heightened anticipation surrounding the U.S. presidential election, I find myself immersed in a surge of renewed excitement within the cryptocurrency realm. The election’s impact has undeniably rekindled curiosity about this dynamic sector.

Currently, one Bitcoin is being traded at approximately $74,319. According to information from CoinMarketCap, this represents an impressive surge of 8.82% in the last day, and a truly significant yearly growth of 112.88%.

Will Bitcoin follow gold?

While BTC’s record high has fueled market optimism, the question remains: will the bull run last?

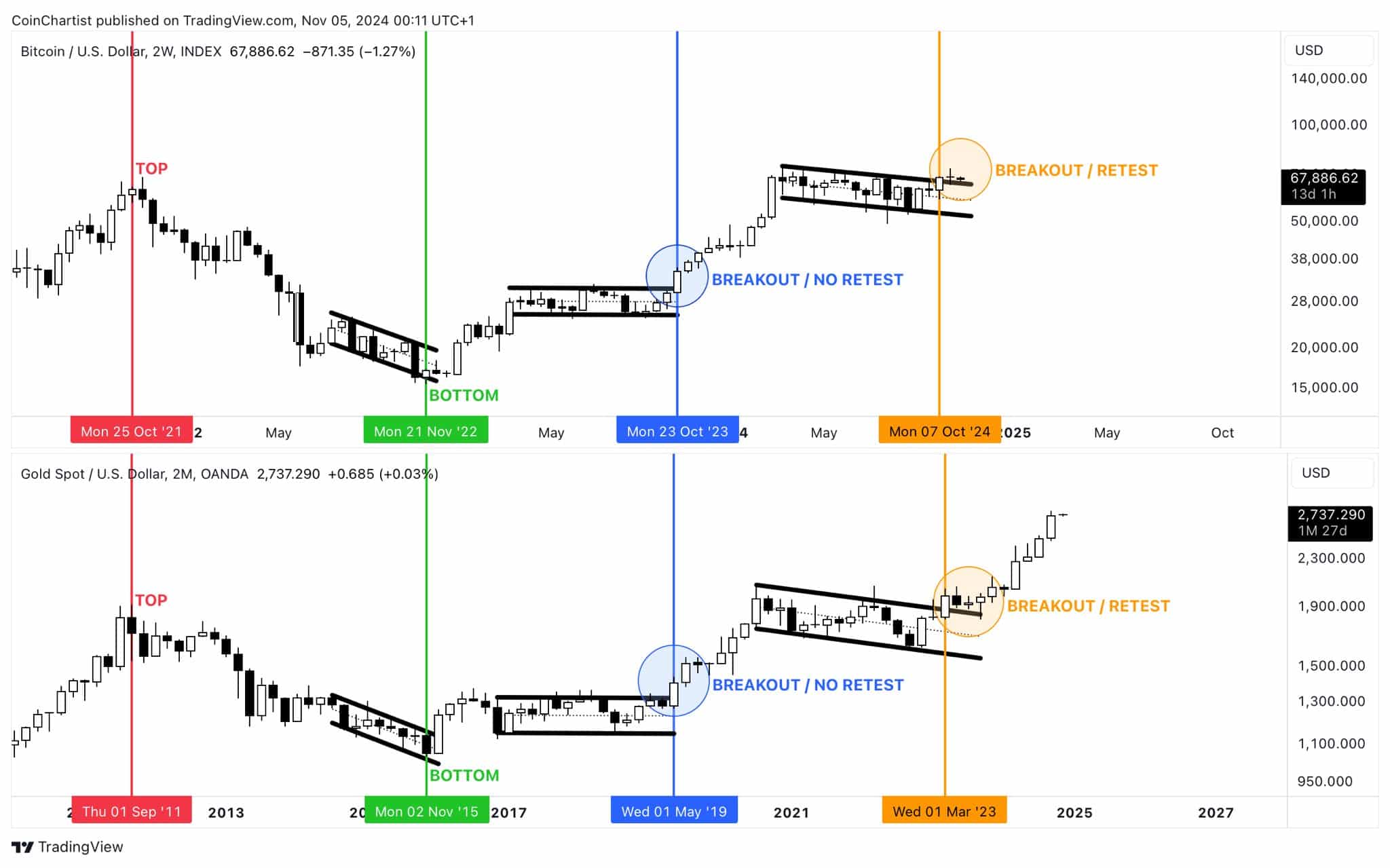

Recently, Tony Severino – a cryptocurrency analyst and the founder of CoinChartist – expressed his thoughts about Bitcoin’s potential future trends on platform X. He posited that Bitcoin’s path could resemble that of gold.

According to Severino’s study, the relationship between Bitcoin and gold appears to be rooted in their similar price fluctuations over time. These two assets often display repeated peaks, troughs, and breakthrough trends. It seems that Bitcoin tends to mimic gold’s patterns, but with a delay of several years.

If Bitcoin mirrors gold’s past trend, the recent surge might mark the start of a positive period for Bitcoin, much like gold experienced during its rally in March 2023.

Severino pointed out that although Bitcoin may still need further testing, it’s worth noting that its trajectory is generally moving upwards.

“New ATHs by EOY, $100K+ by end of Q125.”

As an analyst, I foresee a potential revisit at approximately $64,500 prior to any significant Bitcoin rallies.

BTC to $188k?

As a researcher, I find myself echoing the bullish sentiments of Matthew Sigel, Head of Digital Assets Research at VanEck. Sigel has suggested a possible surge in Bitcoin’s price following the upcoming elections, drawing parallels with the post-election rally we witnessed in 2020. In his own words, he commented: “Just as we saw with X in 2020, I believe there could be a similar post-election rally in the price of Bitcoin.

“If this cycle produces half of 2020’s returns, that’s 175% or $188k.”

According to a recent report by AMBCrypto, historical data suggests that the time following elections can trigger substantial increases in Bitcoin’s price. Therefore, such a forecast may not be entirely unrealistic.

Bitcoin vs gold

Although many were thrilled by Bitcoin reaching a new record high in U.S. dollars, not everyone was as excited. Peter Schiff, founder of Schiff Gold and a vocal critic of Bitcoin, pointed out on his show that despite this achievement, Bitcoin is still 27% lower than its maximum value when compared to gold.

As an analyst, I partially attribute Bitcoin’s surge to speculative wagers fueled by the belief that a potential return of Trump, seen by some as a Bitcoin-friendly candidate, to the White House could impact its value positively. Nevertheless, I maintain my skepticism, echoing Schiff’s sentiments that:

“That’s one of several promises Trump will break.”

In the crypto world, there’s growing curiosity about what might happen next, as Bitcoin’s surge in value fuels intense discussions. Some believe this rise is an indication of even greater profits ahead, while others express caution.

In the upcoming months, we’ll discover if this increase marks the beginning of an extended bull phase for Bitcoin, or if it’s just another high point in its ongoing trend.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-11-06 13:44