- WIF pumped +20% in 24 hours amid a broader market rally on US election day.

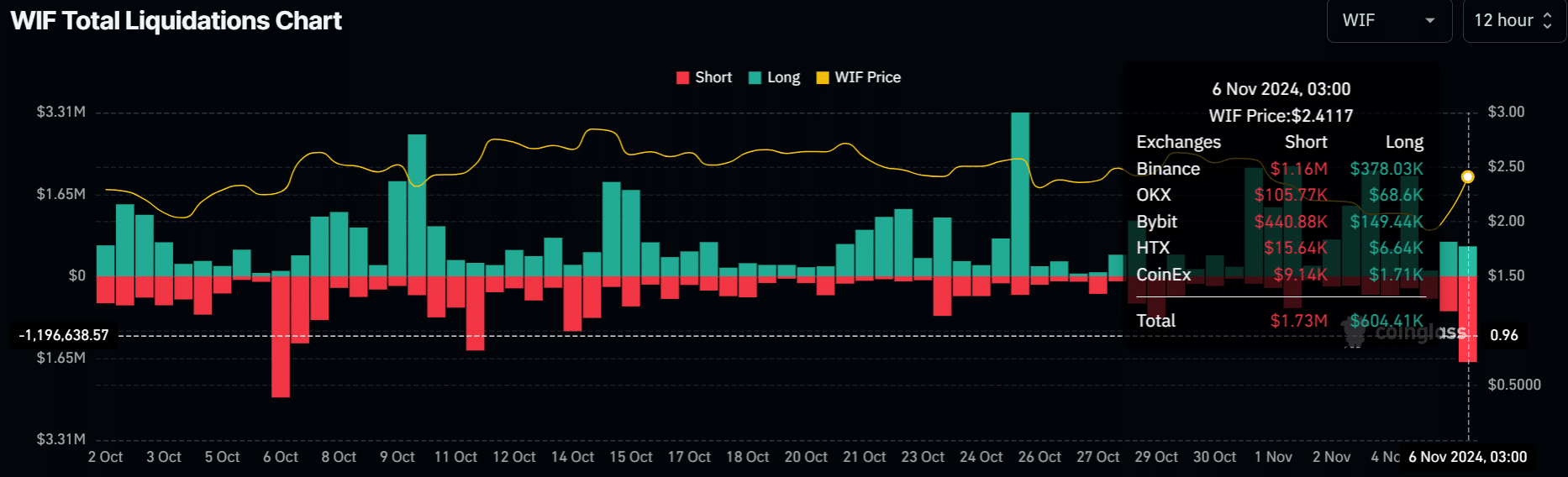

- Nearly $2 million worth of short positions were liquidated in 12 hours

As a seasoned crypto investor with a knack for identifying undervalued assets and a flair for spotting market trends, I find myself intrigued by the recent surge of Dogwifhat (WIF). With my fingers on the pulse of the crypto world, I’ve seen many memecoins come and go. However, WIF’s performance during the US election day rally has caught my attention.

On the day of the U.S. election, cryptocurrency markets experienced a significant rise. Bitcoin [BTC] reached a brand-new record high (ATH) as it appeared that Trump might win, leading to an increase in its value. Meanwhile, memecoins like dogwifhat [WIF] saw a surge, with a 20% increase over a 24-hour period.

At the point of publication, a sizeable fuse was present on the daily candle, implying that the post-election surge might experience some moderation. However, let’s consider where one of the popular meme coins could head following the U.S. election?

WIF’s next step

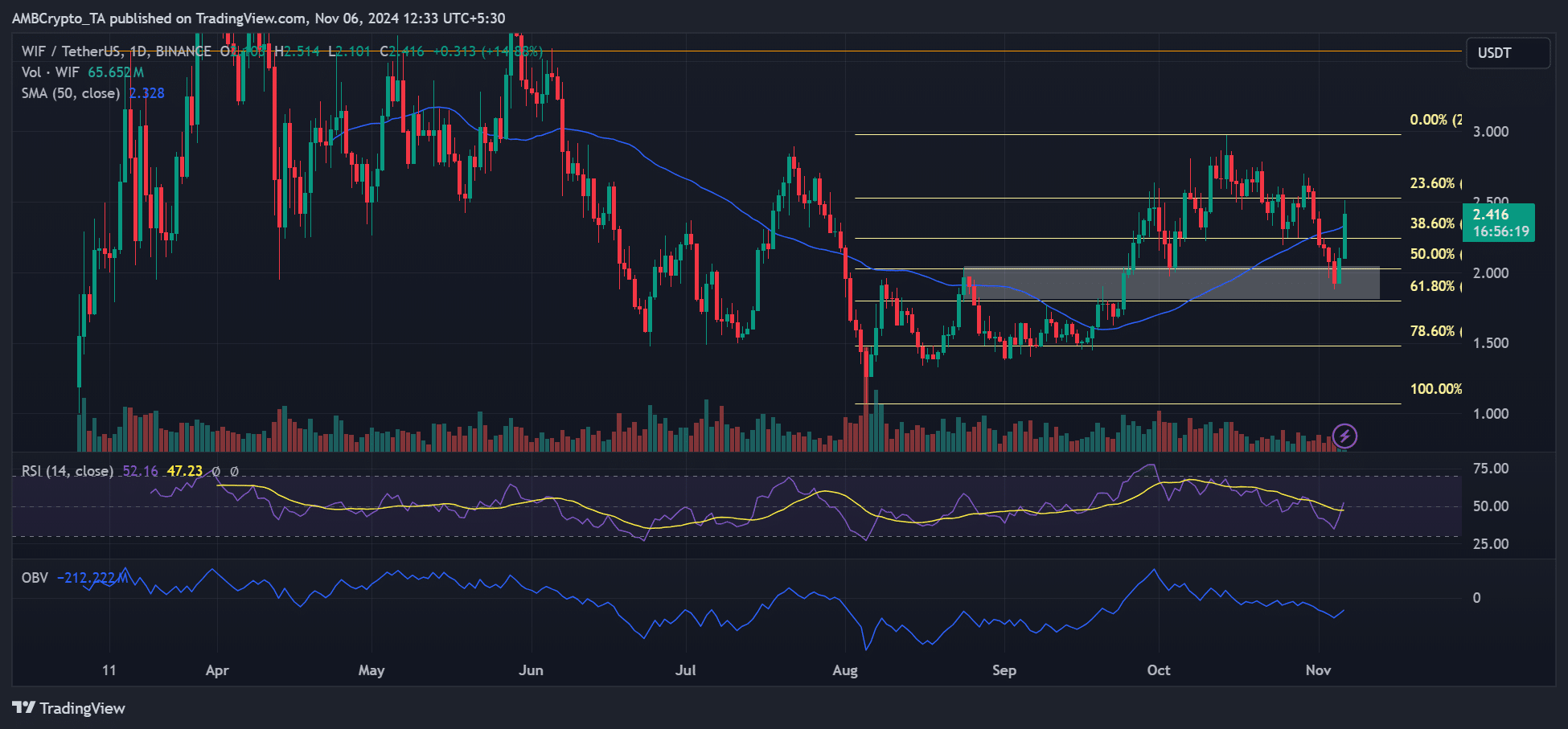

Given that certain traders may choose to lock in profits from the rally related to the elections, a potential pullback might bring WIF down to $2.245 (representing the 38.6% Fibonacci level) or back to the ‘golden zone’. Following this potential dip, it’s possible that the memecoin could resume its upward trajectory.

In such a scenario, sidelined bulls could seek market re-entry at the above support levels.

As a crypto investor, I’m optimistic that a breakthrough above $2.5 could propel WIF towards its October highs around $3, given Bitcoin continues its bullish momentum.

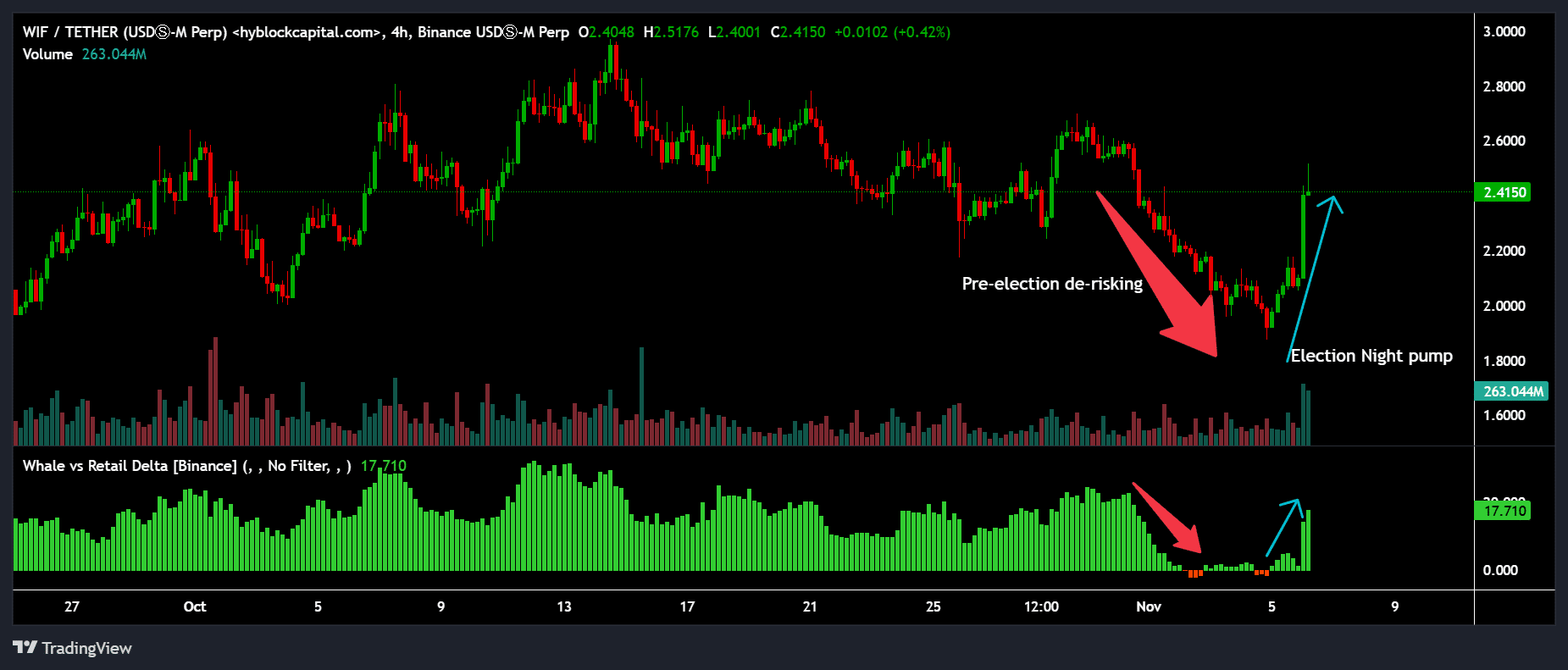

WIF whales exposure

This was contrary to the significant de-risking seen before the election, as they reduced positions, tanking WIF. Should whale appetite persist for the memecoin, the rally could be pushed higher.

Read dogwifhat [WIF] Price Prediction 2024-2025

The above bullish outlook was also supported by massive liquidation of short positions. In the past 12 hours, before press time, $1.7 million worth of short positions (betting for WIF price decline) were wiped out.

In short, it appeared bears had no market edge, at least in the short-term, with election enthusiasm at a fever pitch. If so, any WIF pullback could be a great buying opportunity if the uptrend continues.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Elden Ring Nightreign Recluse guide and abilities explained

2024-11-06 19:03