- Over 800 million XRP coins were transferred within a South Korean exchange in the last trading session.

- The price has increased by over 4% in the last 24 hours.

As a seasoned crypto investor with battle-tested nerves and a knack for navigating volatile markets, I find myself intrigued by the recent XRP happenings. The 800 million coin transfer within South Korea’s exchange has certainly turned heads, and it’s not every day you see such a massive movement of digital assets!

On November 5th, there was a significant shift in XRP as WhaleAlert highlighted a remarkable transaction involving 866,092,944 coins.

These coins were valued at approximately $803.8 million and were moved from Bithumb to multiple wallets.

Examining the significant withdrawal has sparked a lot of curiosity, leading us to closely analyze XRP’s transactions coming in and going out, as well as its daily active addresses, to gain a clearer picture of the current market mood.

The big question remains — could this substantial withdrawal indicate a shift in market behavior?

Ripple effect on XRP inflow, outflow

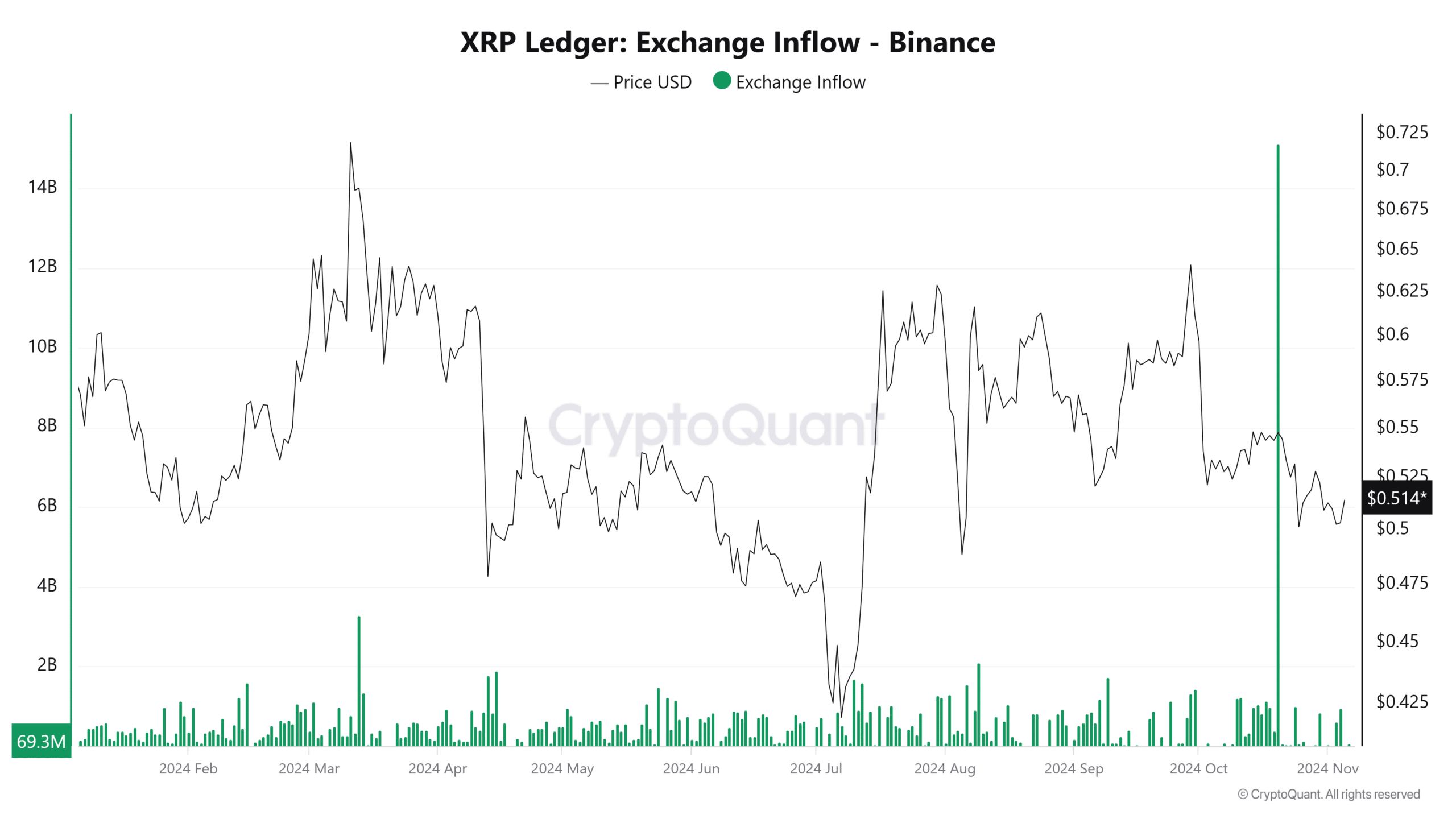

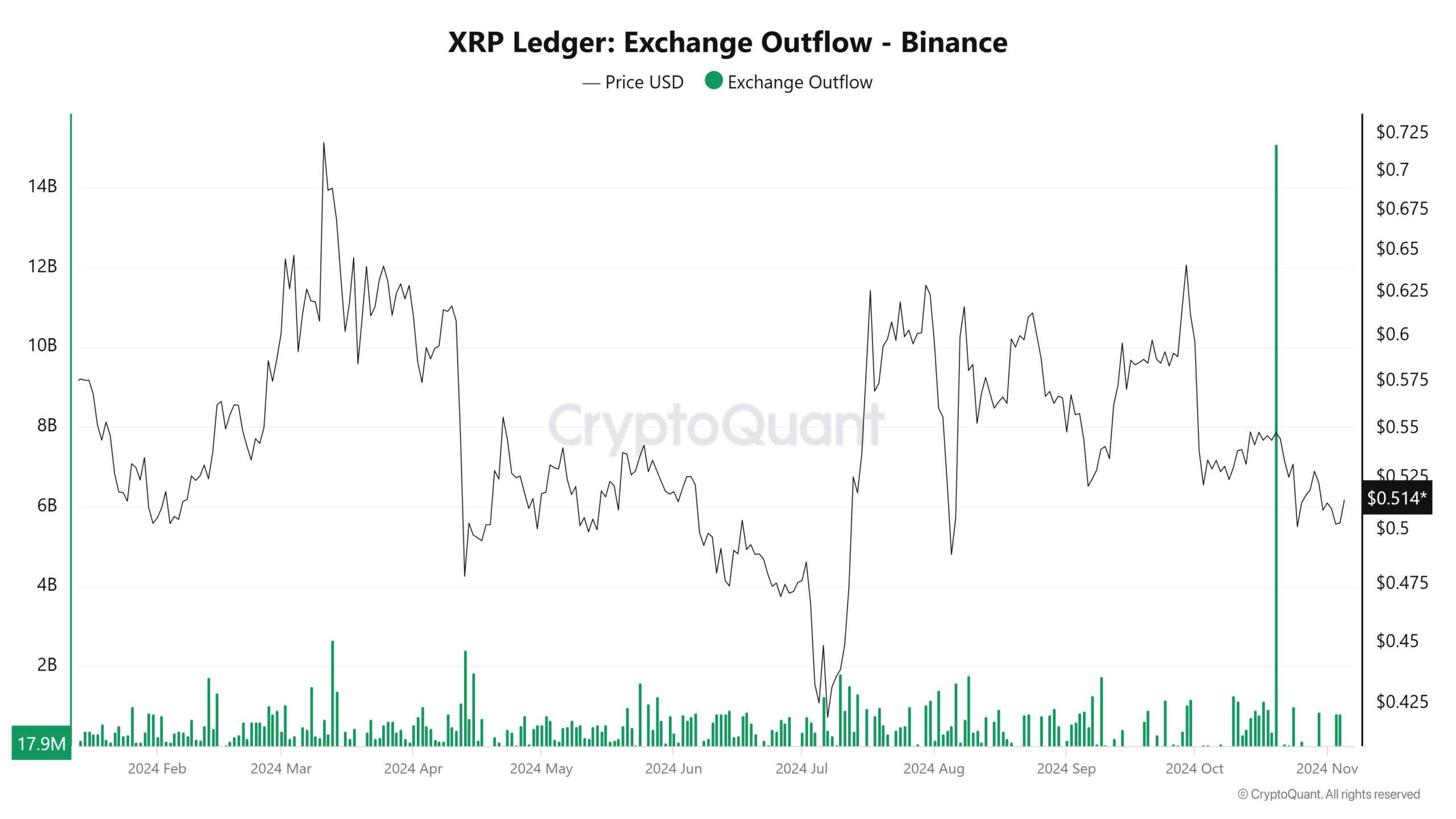

This notable withdrawal of XRP has drawn attention towards the movement trends, specifically focusing on the deposits and withdrawals, notably at Binance.

Increased withdrawals from exchanges, as we’ve seen lately, usually mean that XRP owners are transferring their assets elsewhere. This might suggest they plan to hold onto XRP for a longer period or are implementing different investment strategies.

In other words, when there’s an increase in inflows, it usually means that sellers are putting more tokens onto the exchanges, possibly for trading or to cover debts (liquidation).

Looking at the latest transfer activity on Binance, this movement appears to align with a timeframe of increased withdrawals. This could suggest that investors are exercising caution due to market uncertainty.

Nevertheless, there were no significant surge in inflows during the recent trading period. The inflows amounted to approximately 15.5 million XRP, while outflows were somewhat larger, totaling about 16.5 million XRP.

This pattern indicates a market that seems to be cautiously hopeful, with participants showing a preference for holding onto assets rather than selling them, which could possibly signal an underlying bullish feeling.

Stable trends in daily active addresses

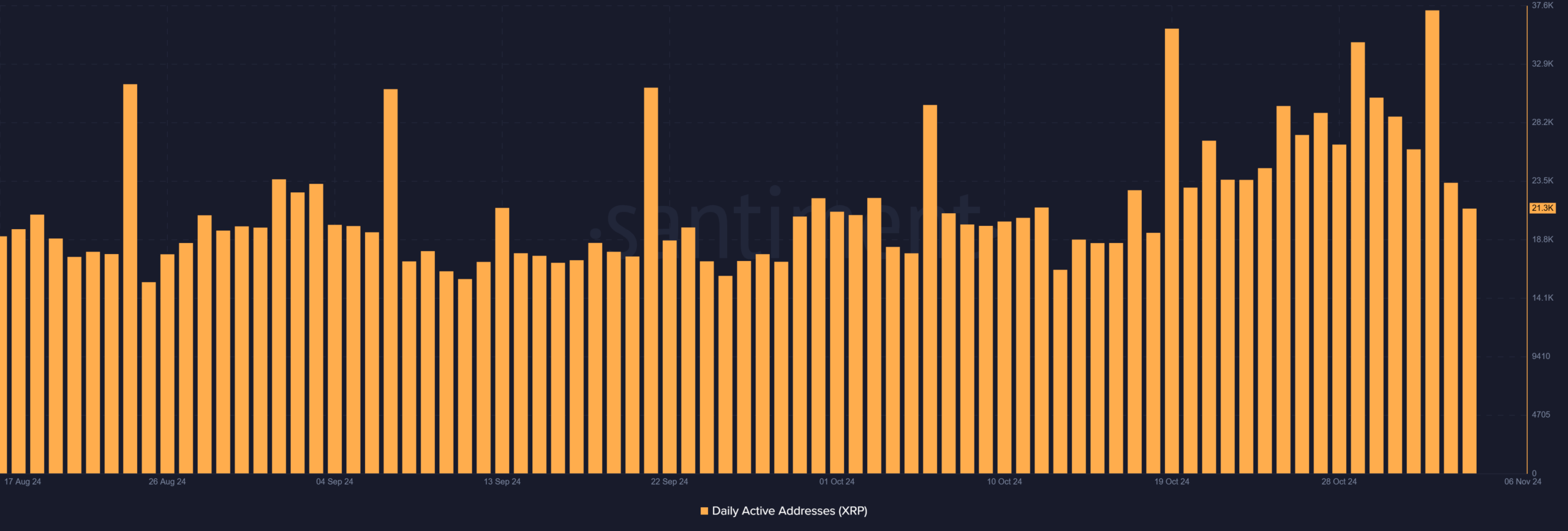

As an analyst, I’ve recently examined the daily active addresses associated with XRP on Santiment. The data showed a persistent pattern without any substantial fluctuations during the latest trading period.

Apart from a peak on November 2nd that saw active addresses exceeding 37,000, the figure typically hovers around 21,000 to 23,000.

As a crypto investor, I’ve noticed a consistent level of interaction within the XRP community, with no noticeable spikes in activity that might suggest unusual interest or hype.

Historically, surges in active wallets tend to come before changes in price, because heightened network usage might indicate an approaching market turbulence.

On the other hand, the existing state of stability implies that although there’s ongoing curiosity, it seems unlikely that significant, sudden changes will occur soon.

Price dynamics amid withdrawal

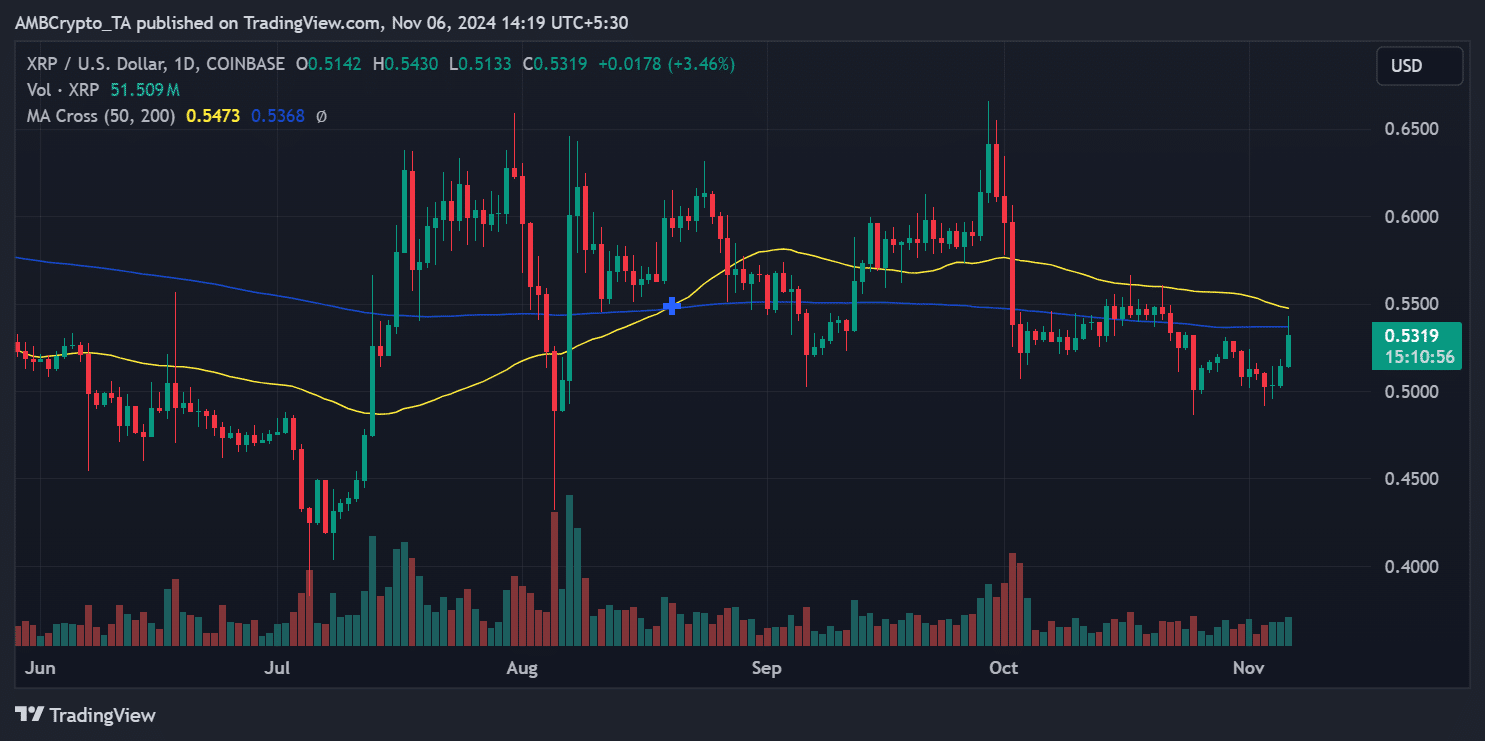

After a significant transfer of XRP, technical assessment indicates that XRP is trending towards a potential resistance level around $0.53.

Although the transfer of whales (large investors) occurred, the price of XRP has maintained its stability, possibly due to the positive influence of the overall crypto market’s rise as Bitcoin achieves new record highs.

The 50-day average for XRP is still below its 200-day average, suggesting a prolonged downward trend. Yet, there are hints that the short-term direction could be changing.

The Relative Strength Index (RSI) was close to its neutral level, implying that the market could continue in its current state of stability or potentially surge upwards if there’s a rise in buyer demand.

It seems this significant transfer of XRP was likely just a regular transaction involving an exchange’s reserve funds, which might explain why there were no significant fluctuations in the overall flow.

Yet, this action continues to provide crucial information about market fluctuations, revealing a mix of cautious hopefulness from investors and consistent user interaction within the network.

In the ever-changing landscape of markets, tracking these trends closely becomes crucial for gaining insights into the potential pathway of XRP’s future movement.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Elon Musk’s Wild Blockchain Adventure: Is He the Next Digital Wizard?

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

2024-11-06 22:15