- As Trump won the U.S. presidential elections, Bitcoin soared more than 7.7%.

- The crypto community is waiting to see if Trump can fulfil his promises.

As a seasoned crypto investor with a front-row seat to the tumultuous rollercoaster ride that is the digital asset market, I can’t help but feel a sense of cautious optimism as Donald Trump takes office. The U.S., being a financial powerhouse, has always held significant sway over the global economic landscape, and its stance on cryptocurrency can have far-reaching implications for the entire industry.

As a financial analyst, I’ve often observed that the United States, with its robust economic might, has consistently held a significant influence over the global financial terrain.

In terms of cryptocurrency, it’s particularly important to note that this digital asset class often encounters regulatory hurdles within a nation.

Following Donald Trump’s latest election win, there’s been a shift in focus towards the United States’ tentative yet substantial involvement in the realm of cryptocurrencies.

When the results came in, Bitcoin (BTC) broke through the $75K barrier for the first time ever, reaching a new record high. However, it has since experienced a dip, providing insights into possible future price fluctuations.

Trump’s pro-crypto stance

After securing his win, Trump was congratulated by Nayib Bukele, another prominent figure in the cryptocurrency world, previously known as Twitter, highlighting the worldwide interest in how his presidency might influence cryptocurrency regulations.

Following Trump’s victory, there’s been much discussion about whether he will be able to deliver on the bold pledges made in his campaign, which could potentially propel the larger cryptocurrency market, such as Bitcoin, to previously unseen peaks.

According to SpotOnChain, at Bitcoin Nashville, Donald Trump made several notable promises. These included his intention to promptly fire SEC Chairman Gary Gensler, create a National Bitcoin Reserve, and eliminate capital gains taxes for Bitcoin transactions.

Crypto demand and impact of promises

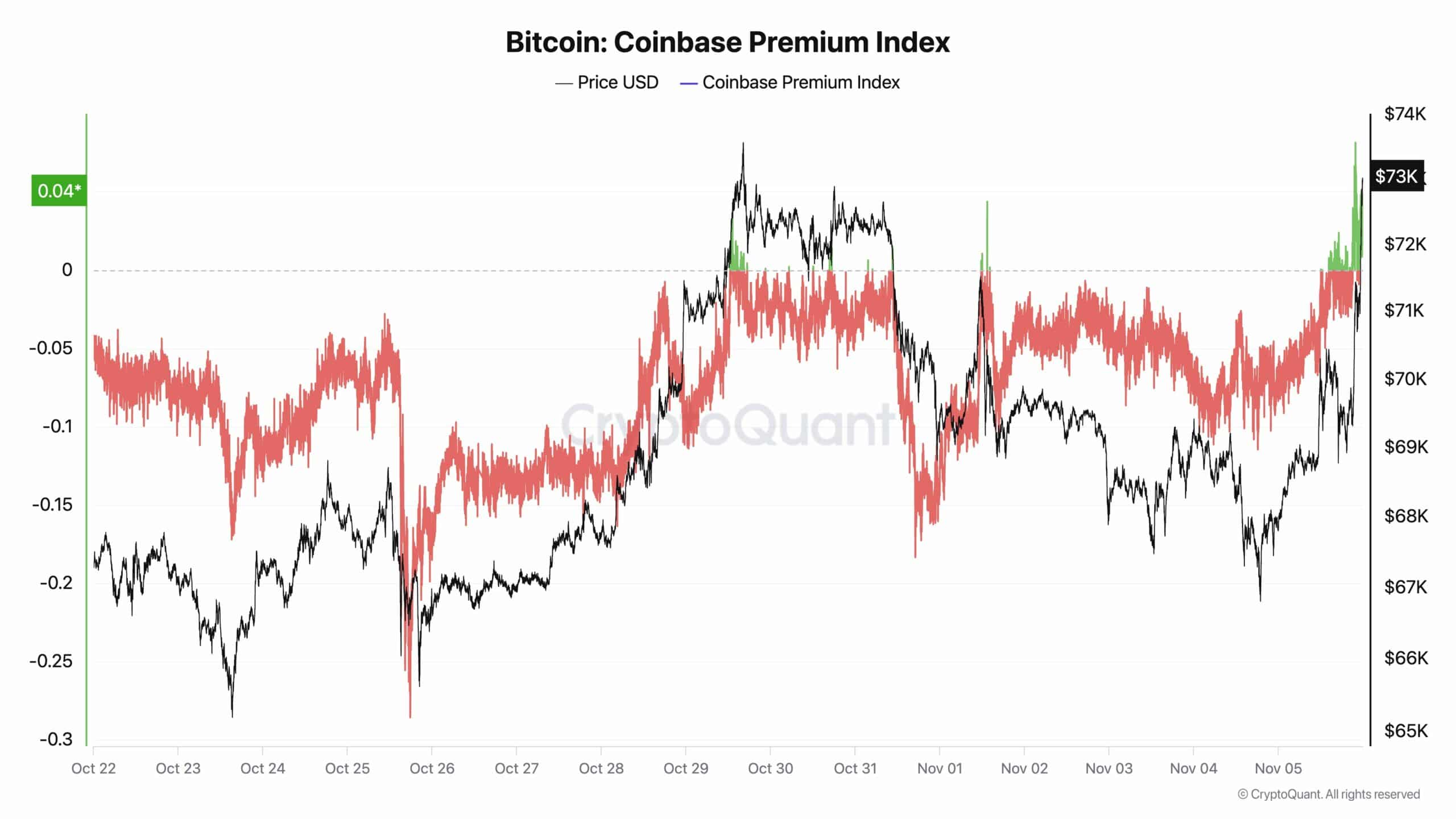

Following Donald Trump’s election, there was a significant 7.7% increase in Bitcoin’s value. This surge was indicated by a spike in purchasing activity, particularly within the United States, as suggested by the Coinbase Premium Index.

The index’s significant spike suggested an optimistic market sentiment towards Trump’s anticipated pro-crypto regulations.

On November 1st, it became evident that the market reacted strongly due to the anticipated policy shifts after Donald Trump’s election.

Is it plausible that Trump can fulfill these commitments? His comments following the election provide some insight into his strategy, stating that his government intends to work tirelessly to bring about an “era of prosperity” or “golden age” for the United States.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This discourse sparked interest within the cryptocurrency circle, causing numerous individuals to ponder potential changes in regulatory guidelines and an increase in market action that might follow.

With Trump’s inauguration approaching, the cryptocurrency community eagerly awaits to see if his administration will advance their pro-cryptocurrency plans. This could spark a new phase for Bitcoin and other digital currencies within the U.S. economy.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-11-06 23:03