- BTC’s 8% election pump outperformed U.S. stocks.

- Whale entities trimmed exposure despite the post-election bullish expectation.

As a researcher with a background in economics and finance, I have witnessed numerous market cycles, and I must admit that the current performance of Bitcoin (BTC) is quite remarkable. The post-election surge of BTC, outperforming U.S. stocks by 3x, is an unprecedented event in the financial world.

On U.S. election night, Bitcoin (BTC) experienced a significant increase of almost 8%, reaching a brand new peak of $75,410 on the Coinbase trading platform.

As I pen this down, Bitcoin (BTC) is momentarily dipping just below its all-time high, currently pegged at approximately $73,800.

Despite the fact that all markets experienced a surge after Donald Trump’s apparent influence, it appears that the ‘Trump Trade’ performed more favorably in Bitcoin compared to US equities.

Over the last five business days, Bitcoin increased by approximately 6%, outperforming both the S&P 500 Index (SPX) and the Nasdaq, with these indices experiencing a more modest growth of just 1% during that period.

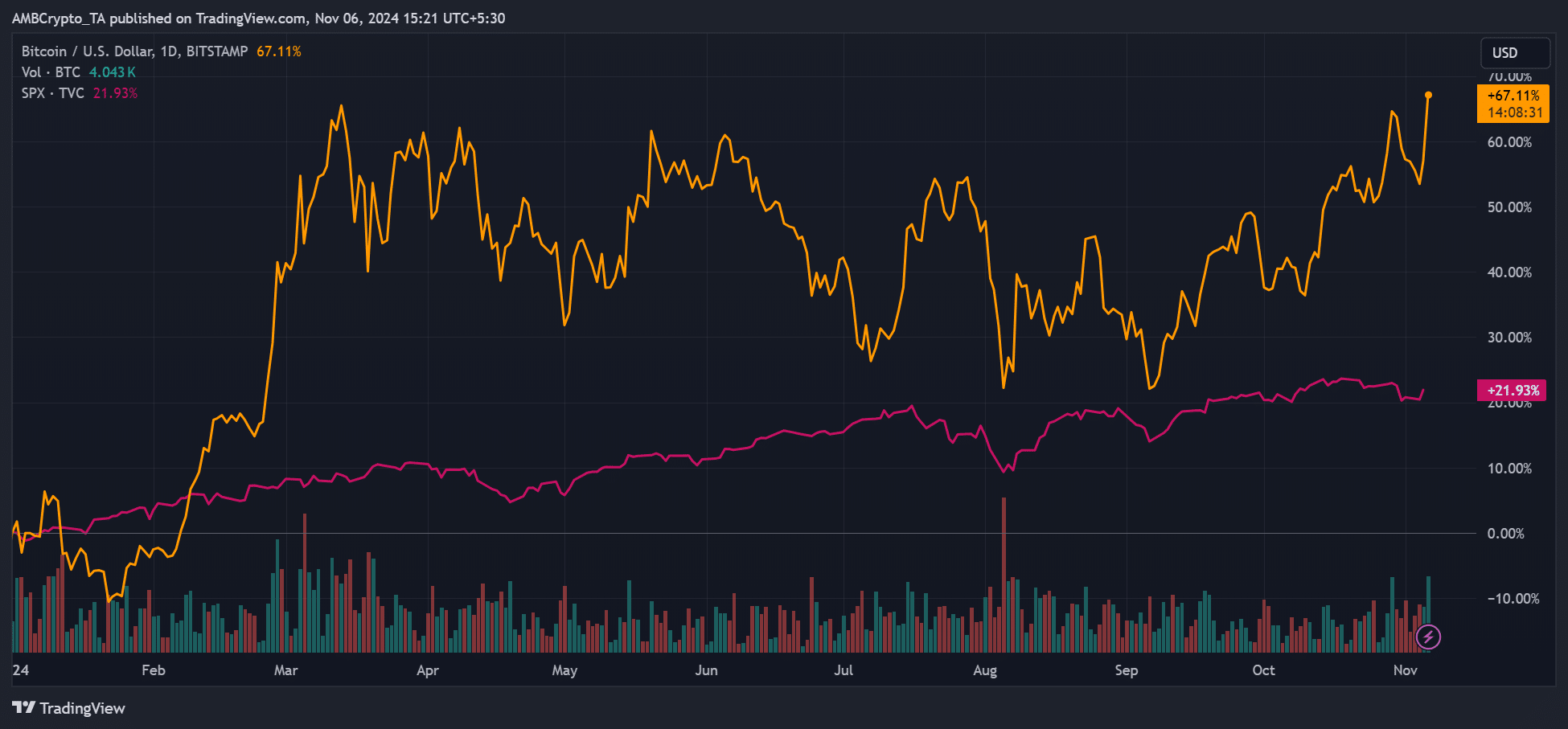

As an analyst, I am observing a significant year-to-date (YTD) performance trend. Bitcoin’s gains have extended to approximately 67%, which is nearly double the return of the S&P 500 (SPX), standing at around 22%. In essence, this means that Bitcoin has outperformed U.S. stocks by a factor of three in the same timeframe.

Post-election BTC outlook

According to past trends following U.S. elections, Bitcoin might maintain its impressive upward trajectory.

As a financial analyst, I’ve been closely monitoring Bitcoin’s performance, and based on my observations, the recent spike might just be the initial step in a potential bull run aiming for the $100K mark. This is according to the insights shared by Stockmoney Lizards, a reputable BTC analyst.

#Bitcoin: A journey has only just begun. For today and tomorrow, there might be fluctuations or unpredictable movements. The coming weeks, however, could potentially turn predominantly positive.

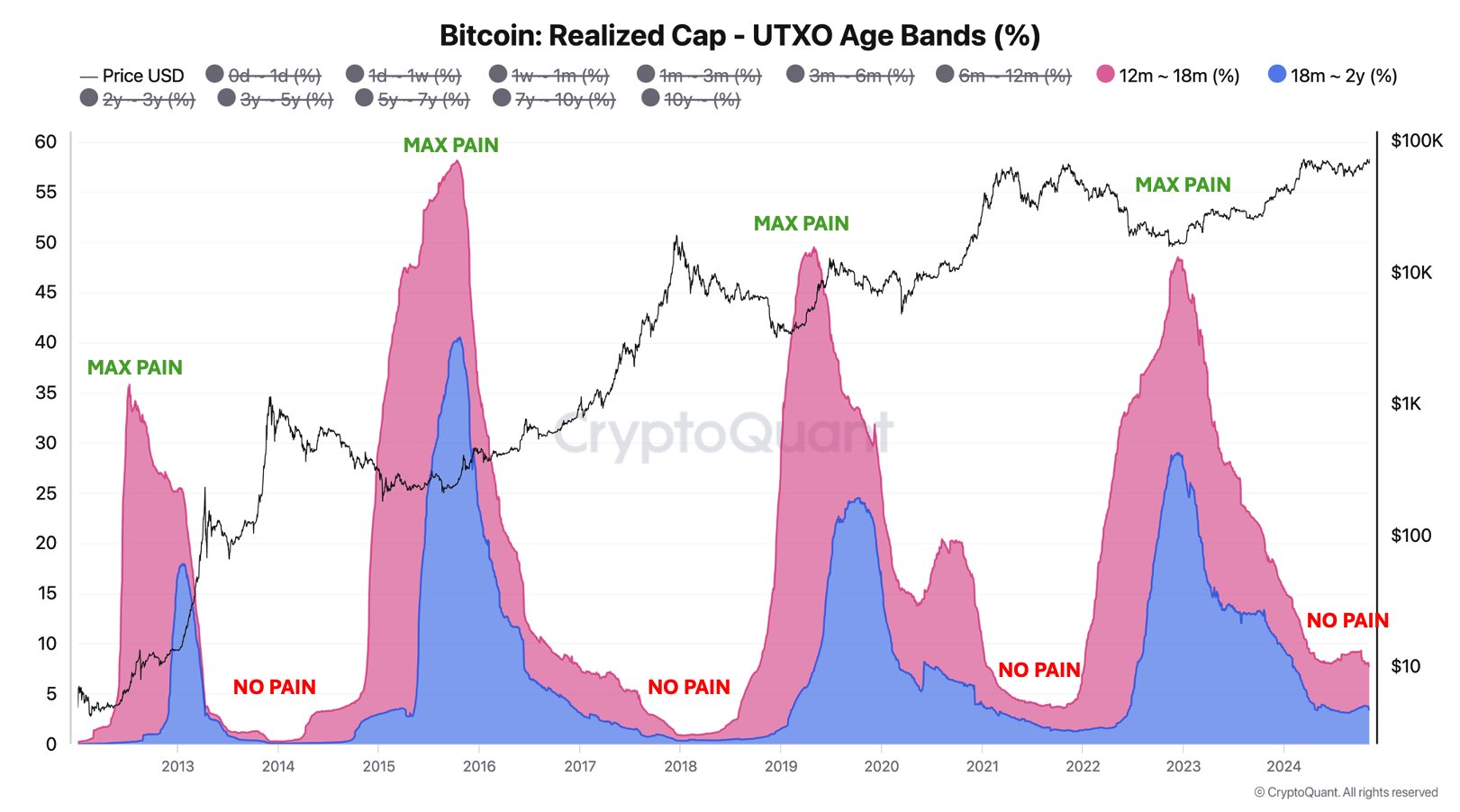

Nevertheless, CryptoQuant’s founder, Ki Young Ju, advised against setting too high of expectations regarding potential Bitcoin (BTC) returns. He predicted that the maximum increase BTC might see would be approximately 30% to 40%, which translates to a price range between $96,000 and $103,000.

It was pointed out that those investors who have kept their investments despite the bear market might start selling to realize their profits. Additionally, Young Ju mentioned,…

There’s a potential increase of 30-40% ahead, but it won’t be as dramatic as the 368% surge we experienced from $16K. At this point, it might be wise to think about gradual selling instead of going all-in on buying, in my opinion.

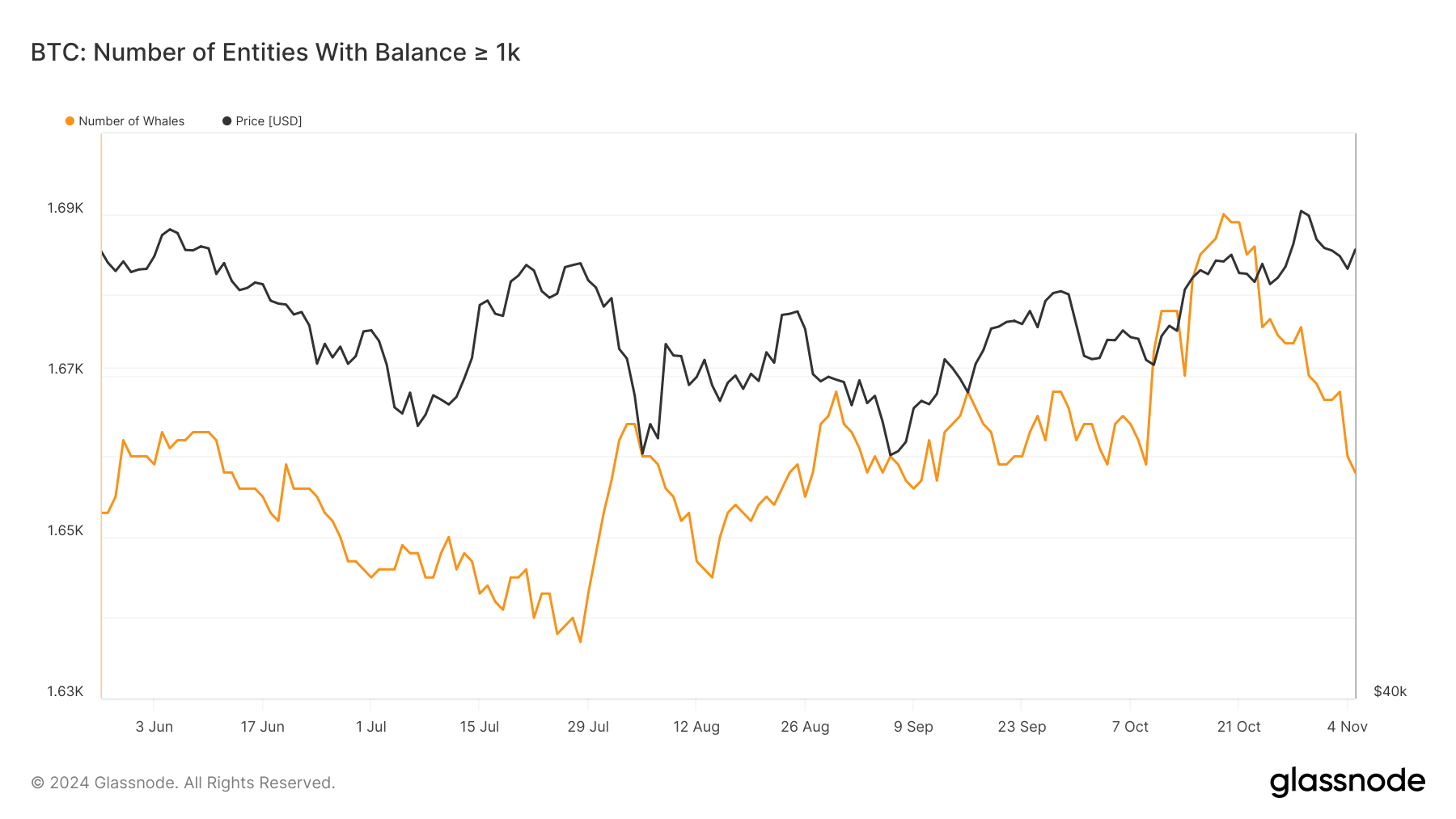

It seems that Young Ju’s perspective might be unfolding, given the decrease in the count of whale accounts holding more than 1K Bitcoin.

According to data from Glassnode, the number of whale holders (entities owning over 1,000 Bitcoin) decreased from 1,690 in mid-October to 1,658 by November 5th. This suggests that some major players have reduced their Bitcoin holdings during the last two weeks.

Read Bitcoin [BTC] Price Prediction 2024-2025

It’s unclear if the recent record highs in Bitcoin are due to short-term political maneuvering before elections or a larger, long-term strategy for cashing in profits.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

To summarize, experts believe that Bitcoin’s future prospects are optimistic, with estimates suggesting it might reach between $90,000 and $100,000 in the current market cycle.

On the other hand, it appears that whale entities are reducing their involvement, a situation that the founder of CryptoQuant anticipates may become more pronounced in the future.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Masters Toronto 2025: Everything You Need to Know

2024-11-07 03:04