- BNB has seen strong bullish momentum, with its price at $585.40, rising 4.49% over the last day.

- Short positions around $583 could face pressure if BNB surpasses $590, potentially sparking volatility.

As a seasoned analyst with over two decades of experience in the financial markets under my belt, I must say that the recent bullish momentum exhibited by Binance Coin (BNB) is nothing short of remarkable. With its price currently hovering at $585.40, it’s hard not to be impressed by this digital asset’s resilience and potential for growth.

Recently, the value of Binance Coin (BNB) has exhibited strong upward movement. As we speak, it is being traded at approximately $585.40, marking an increase of 4.49% over the past day.

At the moment of this report, the total market capitalization of BNB stood at an impressive $84.36 billion. Over the past day, it experienced a growth of 4.49%. As trading activity increases, there might be a potential for further upward momentum in the price trend for this altcoin.

Over the past day, the trading volume for BNB spiked up to a massive $2.09 billion, marking a 30.91% jump, suggesting a significant rise in market engagement.

As a researcher, I’ve noticed an increase in trading activity that has elevated the volume-to-market capitalization ratio to approximately 2.46%. This surge suggests heightened trader interest in the market, which could potentially indicate a bullish trend as demand for BNB strengthens and intensifies further.

Traders eye $600 as BNB nears resistance

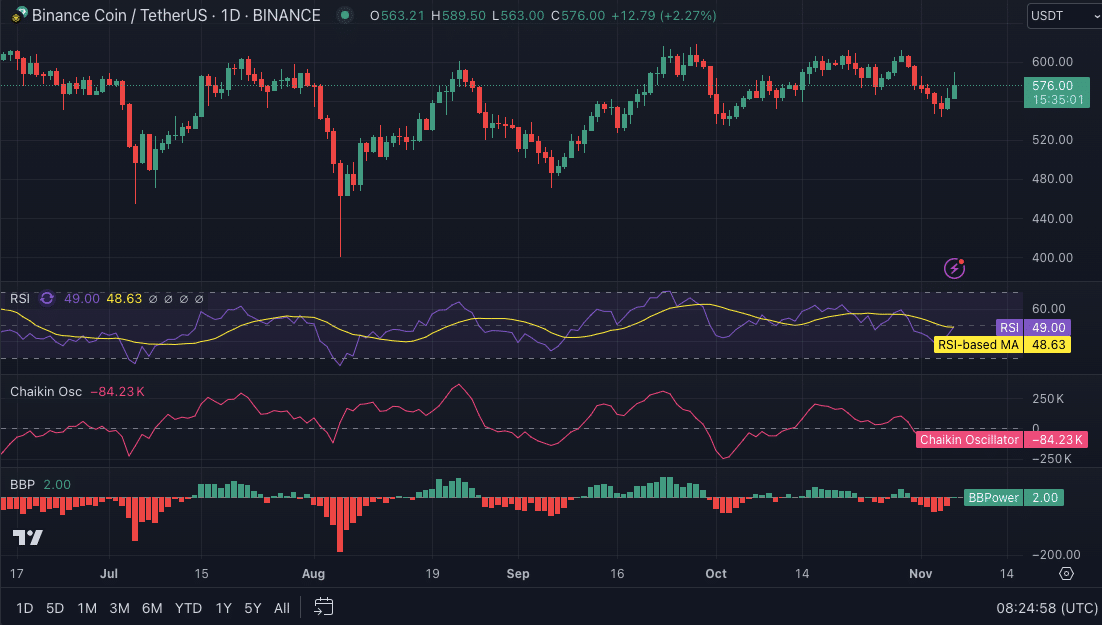

Over the past day, BNB experienced a 3.49% rise to reach $582.86, indicating a steady uptrend. At 51.61 on the Relative Strength Index (RSI), the market’s feeling is neither bullish nor bearish, hinting at a neutral stance.

Despite a hint of purchasing activity, the Relative Strength Index (RSI) doesn’t indicate any strong directional signals at the moment, allowing Binance Coin’s (BNB) price some flexibility to move up or down.

In simpler terms, the Chaikin Oscillator, which measures the buying pressure of Binance Coin (BNB), indicated a low level of accumulation (-35.529K) in the market, suggesting that buyers are not currently accumulating BNB extensively.

This metric frequently suggests a decrease in money flowing into the economy, potentially affecting the longevity of the ongoing upward market tendencies.

Therefore, if there’s weak buildup, it might serve as a warning for short-term bulls looking for solid backing.

As a crypto investor, I find it crucial to keep an eye on changes in buying patterns, even though the oscillator indicates a more cautious stance.

If the momentum of BNB continues to gain strength, it could potentially disregard this indicator’s cautionary signal, thereby facilitating more price growth.

Nevertheless, this measure may limit significant price surges without a change in market fluidity, especially among short-term investors. In simpler terms, it might restrict rapid increases in price without any alteration in the ease of buying and selling assets within a brief time frame.

As we move ahead, the Bull Bear Power (BBP) showed a slight incline at 1.5, suggesting a modest tendency for BNB’s trading to lean towards increases.

This slight positive reading showed that BNB was trading within the upper hand, suggesting that the current bullish sentiment may continue.

For traders, finding a balance that seems advantageous is possible, but it’s crucial to remain vigilant as Binance Coin (BNB) approaches the $600 resistance point, since significant changes could occur at this level.

Short positions face pressure above $590

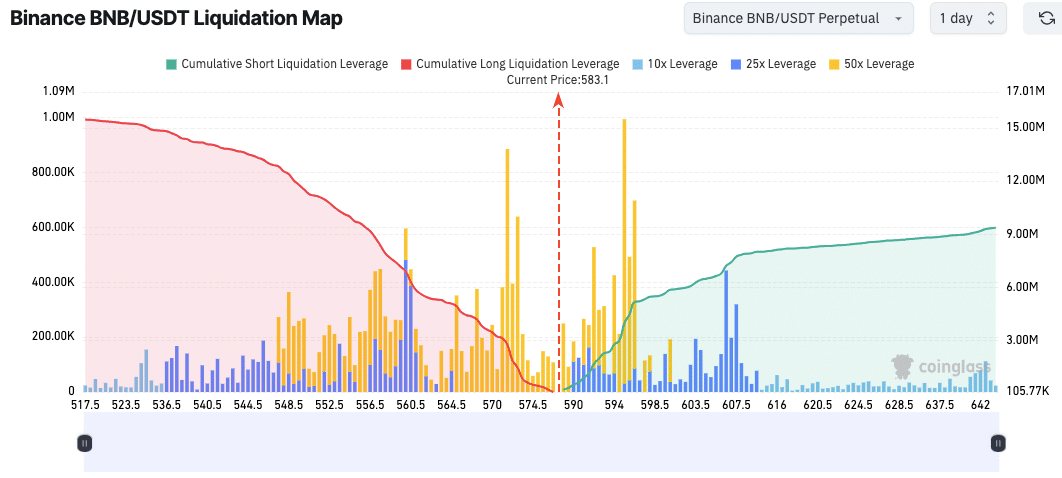

The liquidation plan for BNB has highlighted areas of focus, particularly positions around the $583.1 mark, which might cause fluctuations in price due to their concentration.

The map highlighted a gradual buildup of short positions that could face liquidation pressure if prices surpass $590.

When the price dips below $570, there’s a predominance of long liquidations. This suggests that further price decreases might lead to a chain reaction of long position closures.

Investment opportunities with significant multipliers, particularly the ones offering 50 times the initial investment, tend to concentrate near the prices of $575 and $594. These specific price levels suggest areas of increased market volatility or potential danger.

Read Binance Coin’s [BNB] Price Prediction 2024–2025

Should Binance Coin (BNB) experience significant price fluctuations, these closely packed positions could amplify market volatility, potentially leading to a chain reaction of liquidations.

This arrangement implies that if there’s a considerable price fluctuation around these points, it might trigger substantial short-term price changes.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Rick and Morty Season 8: Release Date SHOCK!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-07 06:16