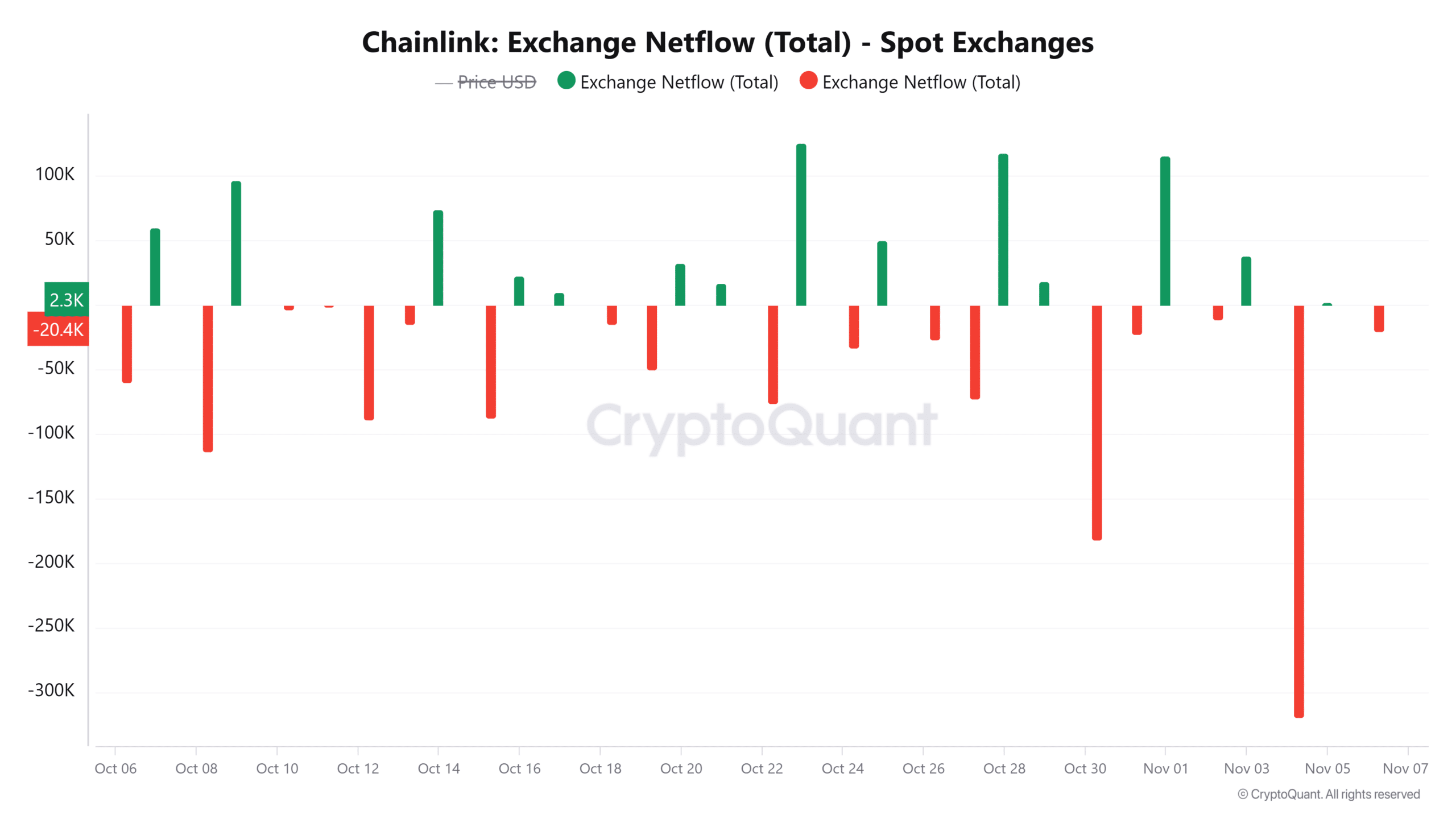

- Chainlink has posted steady outflows over the past month, showing easing selling activity.

- A surge in buying activity and network usage could also fuel more gains.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I find myself cautiously optimistic about Chainlink [LINK]. The recent surge in LINK’s price and the easing sell-side pressure are indeed encouraging signs. However, it is essential to remember that the crypto market can be as unpredictable as a rollercoaster ride at an amusement park.

1) After a 10.5% surge in the past day, Chainlink’s [LINK] price appeared to be turning away from its bearish pattern, currently trading at $11.85. This increase is due to traders choosing to remove their LINK tokens from exchanges.

Based on data from CryptoQuant, there has been a significant outflow of LINK from spot exchanges over the past month. In particular, LINK outflows reached a 30-day peak on November 4th.

As a researcher, I’ve observed a notable increase in the holding of LINK tokens by traders, indicating a reluctance to part with these assets. If this trend continues and the selling pressure subsides, LINK seems poised for an upturn or recovery.

Are buyers behind LINK’s rally?

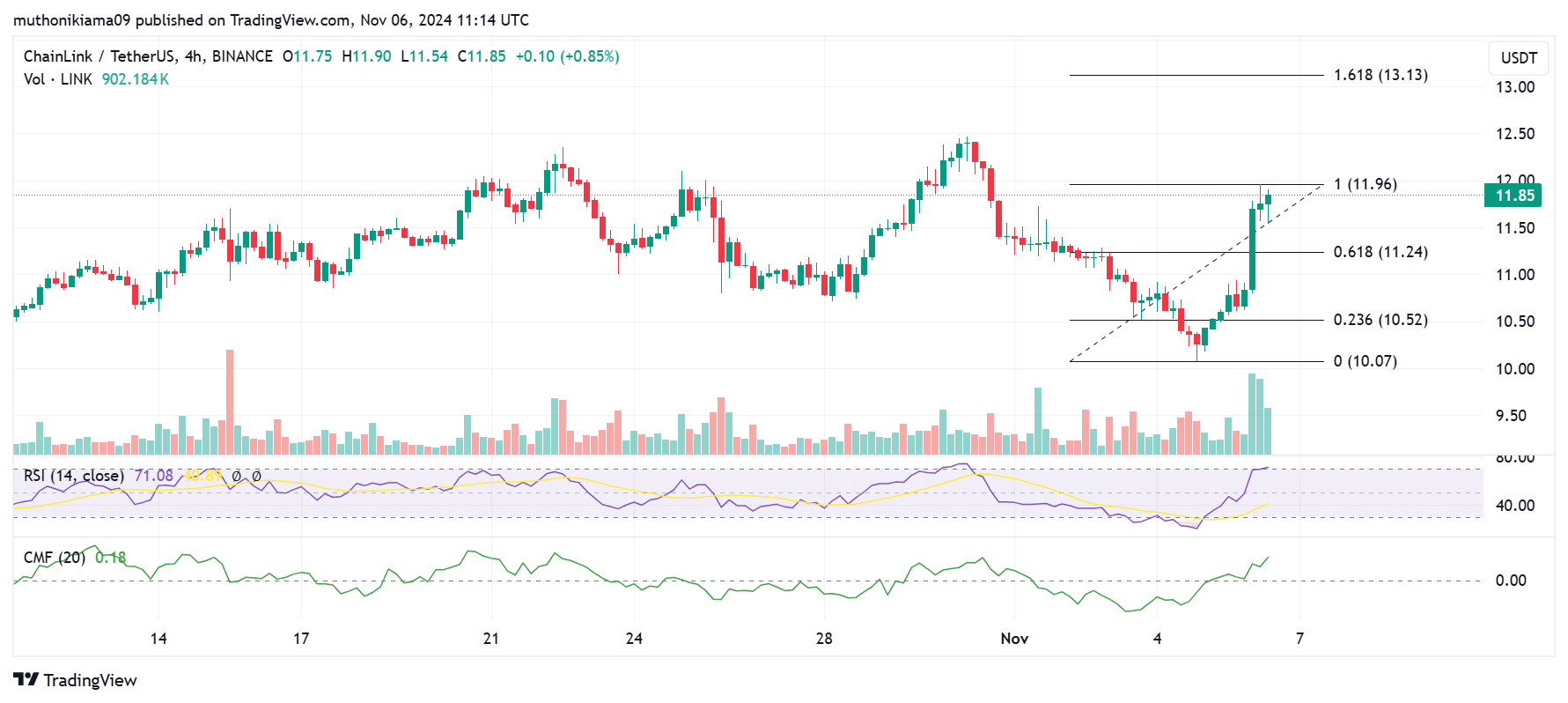

To see LINK move past its bearish patterns and achieve substantial growth, it requires backing from sellers. Examining the four-hour chart indicates that buyer demand is picking up steam.

As a researcher examining market trends, I noticed an escalation in the Relative Strength Index (RSI), reaching a value of 71. This surge suggests a strong bullish momentum, implying that the recent upward trend is driven by increased buying activity.

The Chaikin Money Flow (CMF) also shows buying pressure after flipping positive and reaching a value of 0.17.

If this buying activity continues, the next target for LINK is the 1.618 Fibonacci level ($13.13).

On the four-hour chart, there’s evidence of a U-rebound following a decline, suggesting a strong comeback for LINK. This trend is bolstered by growing optimism, potentially indicating a prolonged upward trajectory.

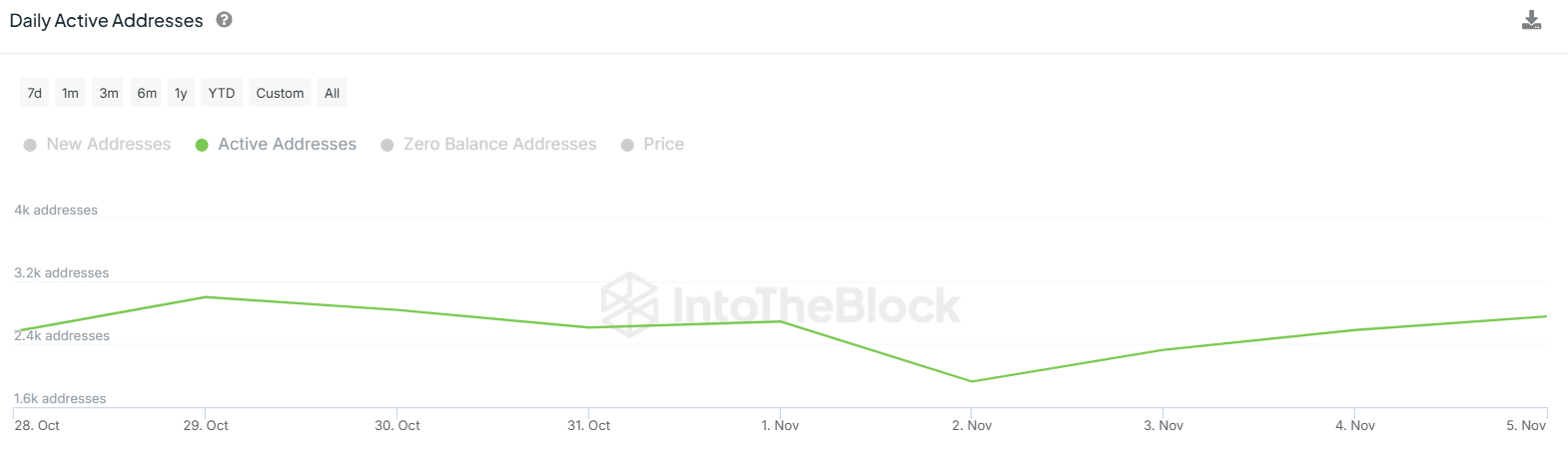

Besides buyers, rising activity on the Chainlink blockchain could also be a catalyst for growth.

Chainlink blockchain usage on the rise

Based on a recent post from Santiment, it appears that Chainlink is currently leading all Real World Asset (RWA) projects in terms of development activity growth. Over the past month, the level of development activity on the Chainlink network has soared by an astounding 14,000%.

As a crypto investor, I’ve noticed an interesting trend: the number of active addresses on the blockchain is mirroring the price surge. Just within the last four days, daily active addresses on this network have jumped from approximately 1,930 to a whopping 2,750 at the time of this writing. This growth in activity indicates increased interest and participation, which could potentially drive further growth.

An uptick in the number of active addresses on a blockchain network often indicates growing user interaction and activity. This trend can serve as a positive indicator, potentially signaling forthcoming price increases.

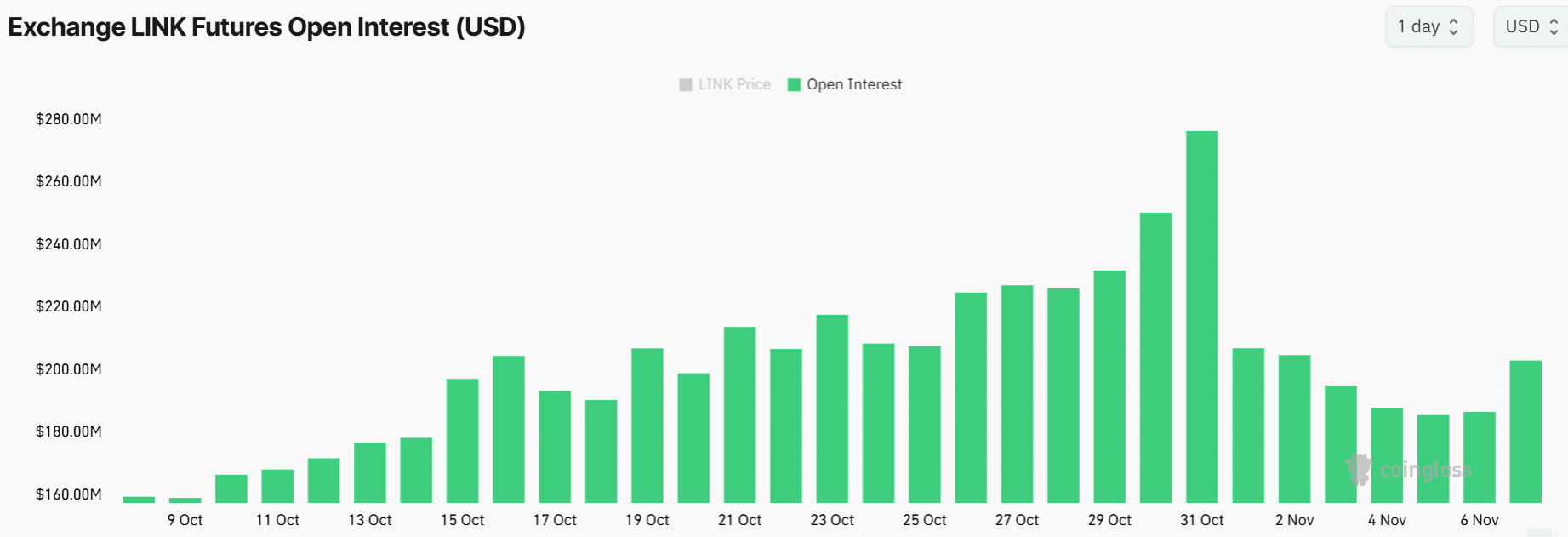

Open Interest spikes

A look at derivatives data shows that speculative activity around LINK is on the rise again. After Open Interest dropped earlier this week, it since surged to $203M at press time.

Read Chainlink’s [LINK] Price Prediction 2024–2025

The rising Open Interest has coincided with a spike in Funding Rates to the highest level month-to-date. This shows that derivative traders are now opening long positions and betting on more gains for Chainlink.

Increased buying demand and growing interest among both immediate and future traders might provide the necessary boost for LINK, potentially driving its price to record new peaks.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- WCT PREDICTION. WCT cryptocurrency

2024-11-07 09:11