- APT pivots in favor of the bulls after entering key Fibonacci range, indicating possibility of more upside.

- Aptos’ on-chain data revealed that the state of activity with the network and whether it could support more upside.

As a seasoned crypto investor with a knack for spotting trends and analyzing data, I’ve been keeping a close eye on Aptos [APT]. After the recent bearish streak, it seems like APT is gearing up for another bull run. The Fibonacci retracement range indicated that we might be in for more upside, and the price action since the pullback has confirmed this.

Over the past week, I’ve noticed a downtrend with Aptos [APT]. Yet, the remarkable surge it’s experiencing these past couple of days has me believing we might be witnessing a resumption of the bullish momentum that kicked in around mid-September.

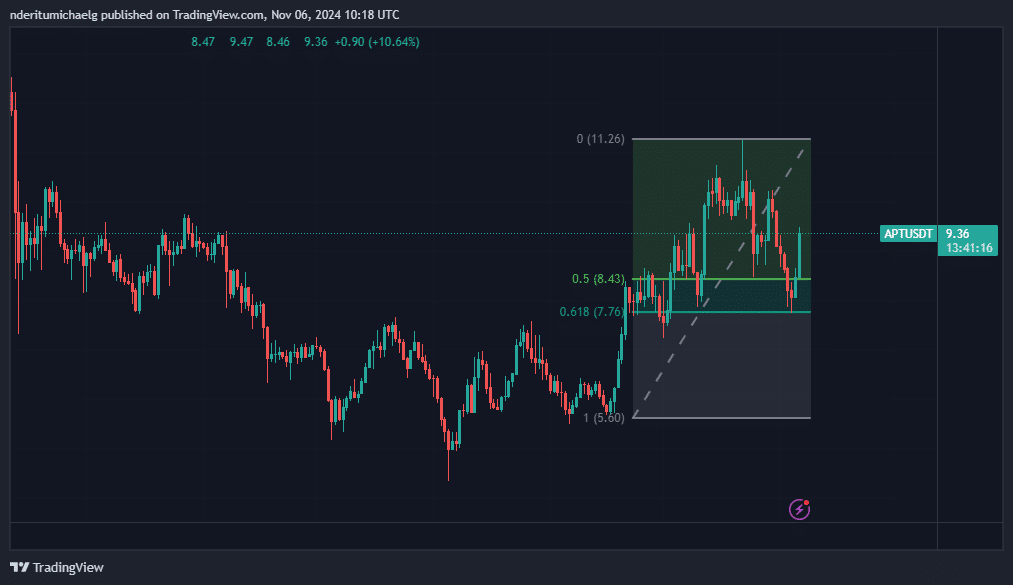

APT recently pulled back by as much as 30% from its October top. However, the pullback concluded at a noteworthy price range.

The predicted pullback was assumed to end between approximately $7.68 and $8.43, which was determined by using the Fibonacci retracement method from the stock’s lowest price in September to its highest price in October.

Earlier this week, APT dipped down to $7.74, but then it showed signs of a positive reversal (bullish pivot), indicating that the predicted Fibonacci retracement level was accurate.

After a surge of approximately 21%, the value of the cryptocurrency now stands at around $9.38 as we speak. Even with this rise, it is currently 19% below the levels it reached in October, indicating that there’s still a potential increase of 19% left for it to return to its previous lows.

Assessing Aptos network activity

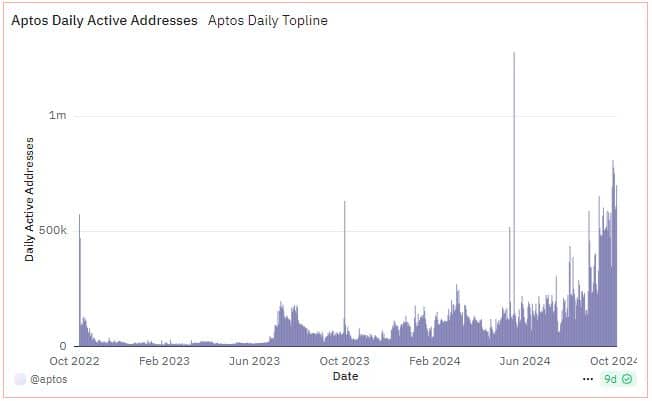

As a network analyst, I’ve observed remarkable expansion across several critical aspects of the Aptos network in late 2024, particularly in terms of address growth. This surge in activity could potentially contribute to the recovery and strengthening of the APT token.

In June, we saw a peak in daily active addresses exceeding 1.27 million, marking the highest number ever recorded. On the other hand, the lowest number of daily active addresses in the second half of 2024 is predicted to be just slightly below 50,000.

Over the past three months, the number of active addresses has steadily increased, peaking at a record-breaking 808,313.

As a crypto investor, I’ve noticed an uptick in daily active addresses, which indicates that the network is buzzing with vibrant user activity, a positive sign for its overall health and growth.

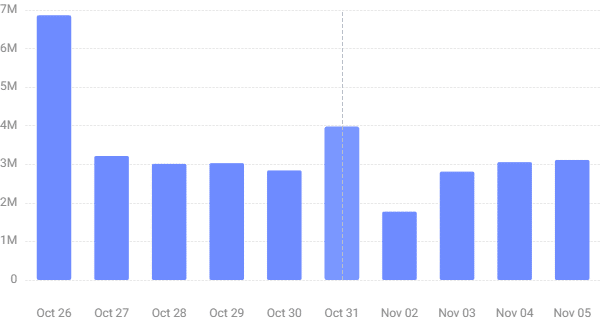

The observed result was mirrored in our daily transaction numbers as well, but there was a significant decrease in transactions from late November onwards.

On October 26th, the network handled a peak of approximately 6.86 million transactions. However, by November 2nd, this number had significantly decreased to about 1.77 million transactions – which is currently the lowest transaction count recorded over the past ten days.

Since then, Aptos transactions have experienced a recovery and reached 3.11 million by the 5th of November.

The decrease in transactions towards late September coincided with the election-related uncertainties in the United States. But as President Trump was re-elected, the markets are anticipating a surge of renewed growth and enthusiasm.

Read Aptos’ [APT] Price Prediction 2024–2025

In simpler terms, a strong, healthy functioning within the network, coupled with generally positive market outlook, could potentially lead to a rebound for APT over the next few weeks.

On the other hand, it’s wise for investors to watch out for sudden big declines since market volatility is likely to increase again.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- WCT PREDICTION. WCT cryptocurrency

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

2024-11-07 10:15