- BTC’ bull run is fueled by a favorable political climate, keeping BTC strong in the $74K-$75K range.

- However, caution remains, suggesting a potential pullback ahead.

As a seasoned researcher with over a decade of market analysis under my belt, I must say that the current Bitcoin [BTC] climate is both exhilarating and nerve-wracking. The favorable political landscape has indeed fueled BTC’s strength, keeping it steady in the $74K-$75K range. However, I remain cautiously optimistic, as the market’s volatility hints at potential pullbacks ahead.

The eagerly anticipated election outcomes have been announced, and as pro-cryptocurrency leaders gain momentum, Bitcoin [BTC] has reached an unprecedented peak. However, this is just the beginning of the challenge.

Despite the general consensus that this setup is ideal due to robust fundamentals maintaining BTC’s price above $68.7k, a note of caution is necessary. The unpredictable fluctuations in the options market and continuous influx of new demand within on-chain activities suggest that the market may experience some significant shifts or fluctuations in the near future.

As I delve into the market trends, a thrilling yet puzzling sense envelopes me. The optimism is palpable with such robust bullish energy, yet the road ahead seems shrouded in uncertainty.

Decoding the current market mood

From a psychological perspective, ordinary investors are significantly investing in Bitcoin, fueled by a positive, long-term perspective on its growth. This action aligns with the idea that Trump’s pro-cryptocurrency policy stance may be influential.

After Trump took office, there was a significant increase in trading across all asset types. Bitcoin stood out as the frontrunner, experiencing a surge of almost 9%.

As an analyst, I’m observing a significant economic transition taking place, which could trigger a sense of Fear of Missing Out (FOMO) among investors. This FOMO might keep Bitcoin steadfast within the $74K – $75K price range in the immediate future.

However, the path to $100K may be overly optimistic. While macroeconomic factors are fueling the current bull cycle, the human element – tracking price action – must not be overlooked.

As a researcher, if a prompt withdrawal isn’t achieved, there’s a possibility that risk could become influential, similar to what happened during the March peak when investor enthusiasm skyrocketed, leading to inflows into U.S. Bitcoin ETFs, causing Bitcoin to reach an all-time high of $73K.

In a span of merely seven days, Bitcoin (BTC) bounced back close to $60,000, driven by excessive enthusiasm in the market. Given past trends, it’s essential to keep a close eye on the current BTC price level as it might hold significant implications.

Strong fundamentals signal continued growth potential for BTC

At present, Bitcoin finds itself in a situation where there’s significant potential for both high gains and losses. The market remains relatively unstable due to its volatility, but it hasn’t yet reached an overly extended state. Consequently, investors continue to speculate that BTC’s value will increase, acknowledging the inherent risks associated with their investment decision.

Psychologically speaking, this optimism arises more from “expectations” than actual “implementation.” Investors are confident that potential regulatory adjustments could transform the U.S. into a leading hub for cryptocurrency.

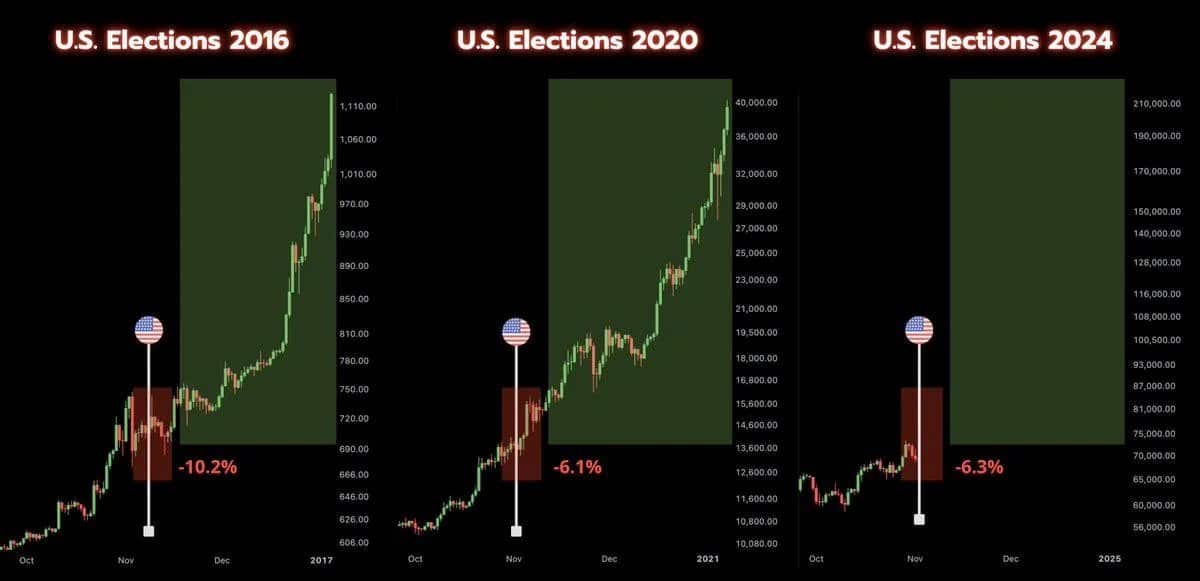

Historically, the period following an election has often seen a surge in Bitcoin prices. Interestingly, Bitcoin’s value has never dipped below its initial post-election price once the results have been announced. This particular juncture could be a promising time for potential profits.

Source : X

Following elections, a sense of doubt often prevails among investors as they look towards secure investments such as Bitcoin. With the economy awaiting confirmation, there’s an expectation that Bitcoin will garner increased attention, possibly causing its value to reach $80K.

Essentially, findings from AMBCrypto indicate that Bitcoin may still have room to rise. The Relative Strength Index (RSI) is yet to reach extremes, and fear of missing out (FOMO) is prevalent, which strengthens the case for further expansion.

Still, caution is warranted

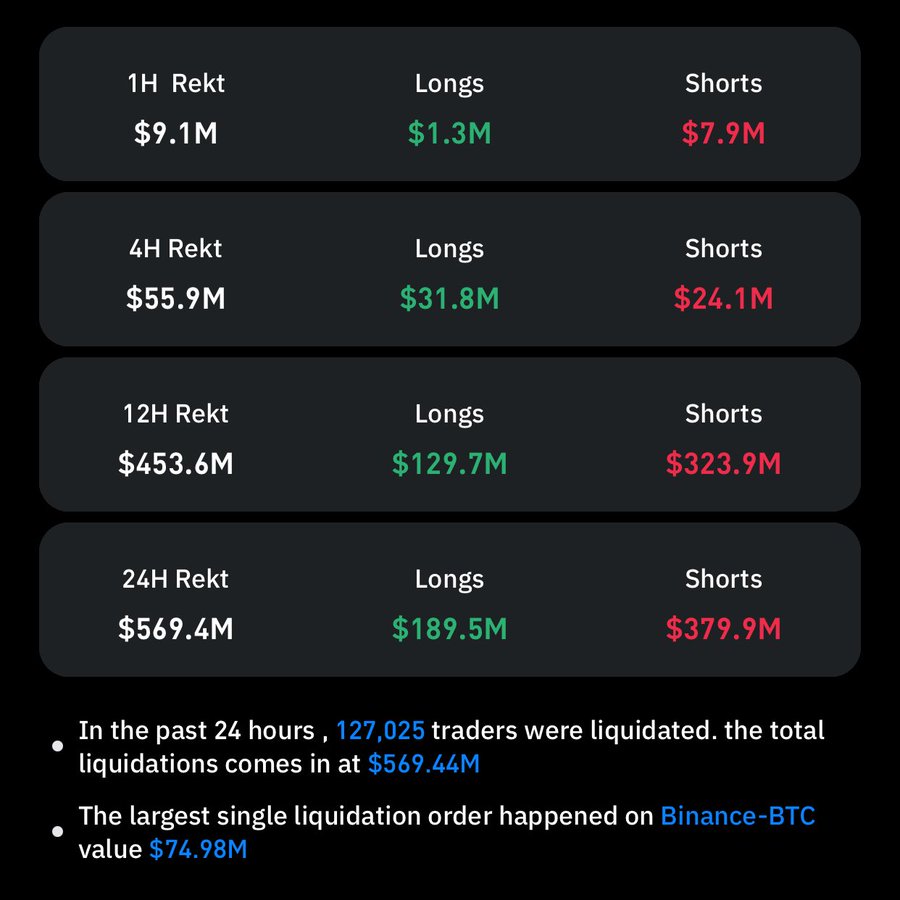

During the lead-up to the election, Bitcoin seamlessly absorbed liquidity, resulting in significant discrepancies between buying and selling prices due to its rapid rise. This surge also led to a massive single short liquidation on Binance, compelling short-sellers to close their positions, effectively offloading $380 million worth of short positions.

Source : Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Due to an increase in long positions in the Bitcoin derivatives market, short sellers were compelled to repurchase Bitcoin, leading to a significant surge. Nevertheless, it’s important to exercise caution – any change could lead to another wave of short selling, giving rise to opportunities for bears to profit, much like what happened at the March peak.

It appears quite probable that Bitcoin could reach $78,000 in value, but this might change if the dominance of the options market were to shift. Subsequently, a decline may occur once the market becomes overheated and the election-related excitement subsides, allowing Bitcoin to surpass $80,000 only after that.

Read More

2024-11-07 20:19