- RAY hits 2-year high as its price goes parabolic since September.

- Assessing the link between RAY’s price action and Raydium’s performance on key metrics.

As a seasoned crypto investor with a knack for spotting undervalued gems, I’ve been keeping a close eye on RAY, the native token of the Raydium DEX on Solana [SOL]. The parabolic surge in its price since September has caught my attention, and it’s not just because it’s outperforming Bitcoin [BTC] in this bull run.

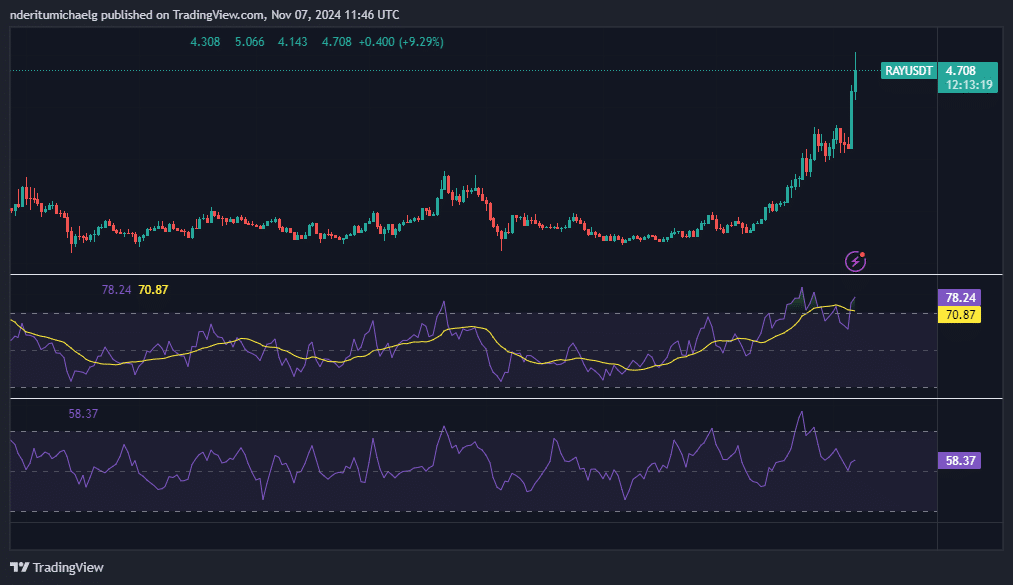

RAY, the native token on the Raydium DEX on Solana [SOL], just hit a new 2-year high.

Over the past two months, its returns have surpassed those of Bitcoin [BTC], even reaching new heights on the 6th of November for BTC as well.

Reflecting on RAY’s price trajectory, I noticed a remarkably parabolic trend that could be traced back to September, hinting at strategic accumulation during that period. Initially, the token was trading around $1.35 in September, but as October unfolded, it became evident that the bullish sentiment had taken over completely.

In just the past day, RAY reached an impressive height of $5.06, marking a spectacular 276% surge from its lowest recorded price in September.

In comparison, Bitcoin saw a 45% increase in value from its lowest point in September to its most recent record high.

Even though the current performance shows that RAY has not yet reached its record high of $17.80 from last August, it still possesses a significant potential for expansion before attaining that level once more.

Nevertheless, short term pullbacks are likely to occur now that RAY is extremely overbought.

The symbol showed a bearish divergence in relation to its upper low on the Relative Strength Index (RSI). Meanwhile, the Money Flow Index (MFI) is decreasing, hinting at increased selling or profit-taking activity.

Reflection of Raydium’s performance?

2024 saw the Solana blockchain thriving with significant practical uses, and Raydium has been reaping rewards as a leading decentralized exchange (DEX) within this ecosystem.

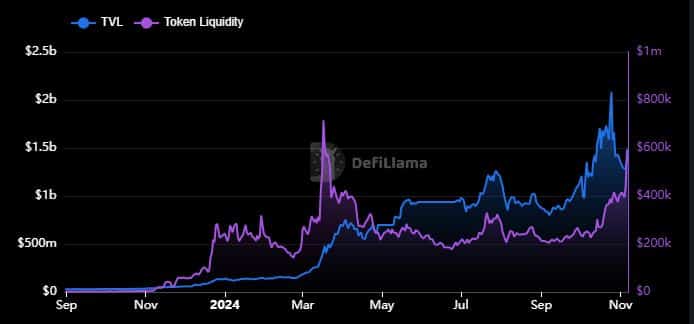

12 months back, Raydium’s Total Value Locked (TVL) was under $40 million, and its token liquidity stood at less than $10,000.

In recent times, both measures have shown remarkable expansion. Specifically, TVL (Total Value Locked) reached an all-time high of $2.08 billion in October, but it has since decreased to $1.50 billion. On the other hand, the liquidity for RAY tokens has skyrocketed to a staggering $597 million.

2024 has seen a significant surge in both the TVL (Total Value Locked) and my token liquidity within the Raydium Decentralized Exchange, which mirrors the expanding ecosystem of Solana. As a researcher closely observing this space, I find it exciting to witness this momentum and growth that Raydium DEX has been experiencing.

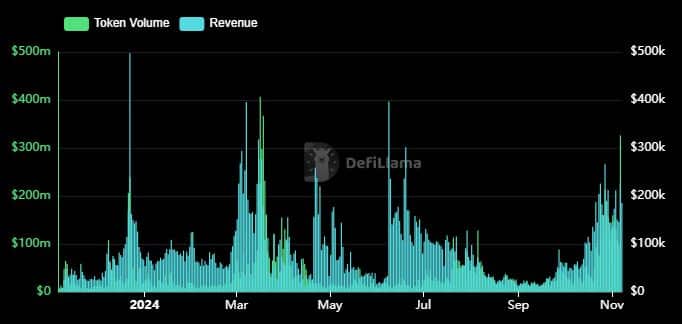

However, that growth and network activity was more evident in Raydium’s revenue and volume data.

In March, June, and October, both volume and income experienced their greatest increases, while they decreased for the remainder of the period.

In other words, the largest transaction volume recorded from January 2024 onwards peaked at approximately $406 million in March. At the same time, the maximum revenue earned reached about $395,000 also in March.

The most recent figures show a steady increase in token volume and income since September, mirroring the surge in activity during favorable market conditions.

Read Raydium’s [RAY] Price Prediction 2024–2025

It also aligns with the observation that the same metrics dipped during slow or bearish months.

From the given data, it’s evident that Decentralized Exchange (DEX) usage significantly influenced Ray’s demand. This pattern is expected to persist as the bull market intensifies further.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

2024-11-08 02:16