- AVAX was testing a crucial support level, with on-chain metrics showing positive signs.

- The altcoin liquidity level has a potential short-term retracement, but the overall market remains bullish.

As a seasoned researcher with years of experience in deciphering the intricacies of the crypto market, I find myself intrigued by Avalanche [AVAX]’s current situation. The altcoin’s 48-hour surge of 24% is indeed impressive, but the crucial support level it’s testing at $28 raises a few eyebrows.

Over the past 48 hours, I’ve observed a substantial 24% increase in the value of AVAX, Avalanche, following a rebound from its $22 price mark.

At the moment, the value of the altcoin was being tested against a significant support level from a prior symmetrical triangle, which was approximately $28.

If this technical pattern persists without interruption, it might transform a potential support level into a barrier, which could possibly obstruct the upward price movement of the altcoin.

AVAX’s positive sentiment

Delving deeper into the on-chain data provided by AMBCrypto, I’ve noticed some promising trends. Specifically, there’s been a significant surge of 49% in whale activity and a noteworthy uptick of 14% in trading volume, as per IntoTheBlock’s latest findings.

As a crypto investor, I noticed a surge in activity surrounding AVAX, which could suggest that established market players and active traders are heavily involved. This might be an indication of a favorable outlook for the token.

Short-term retracement ahead?

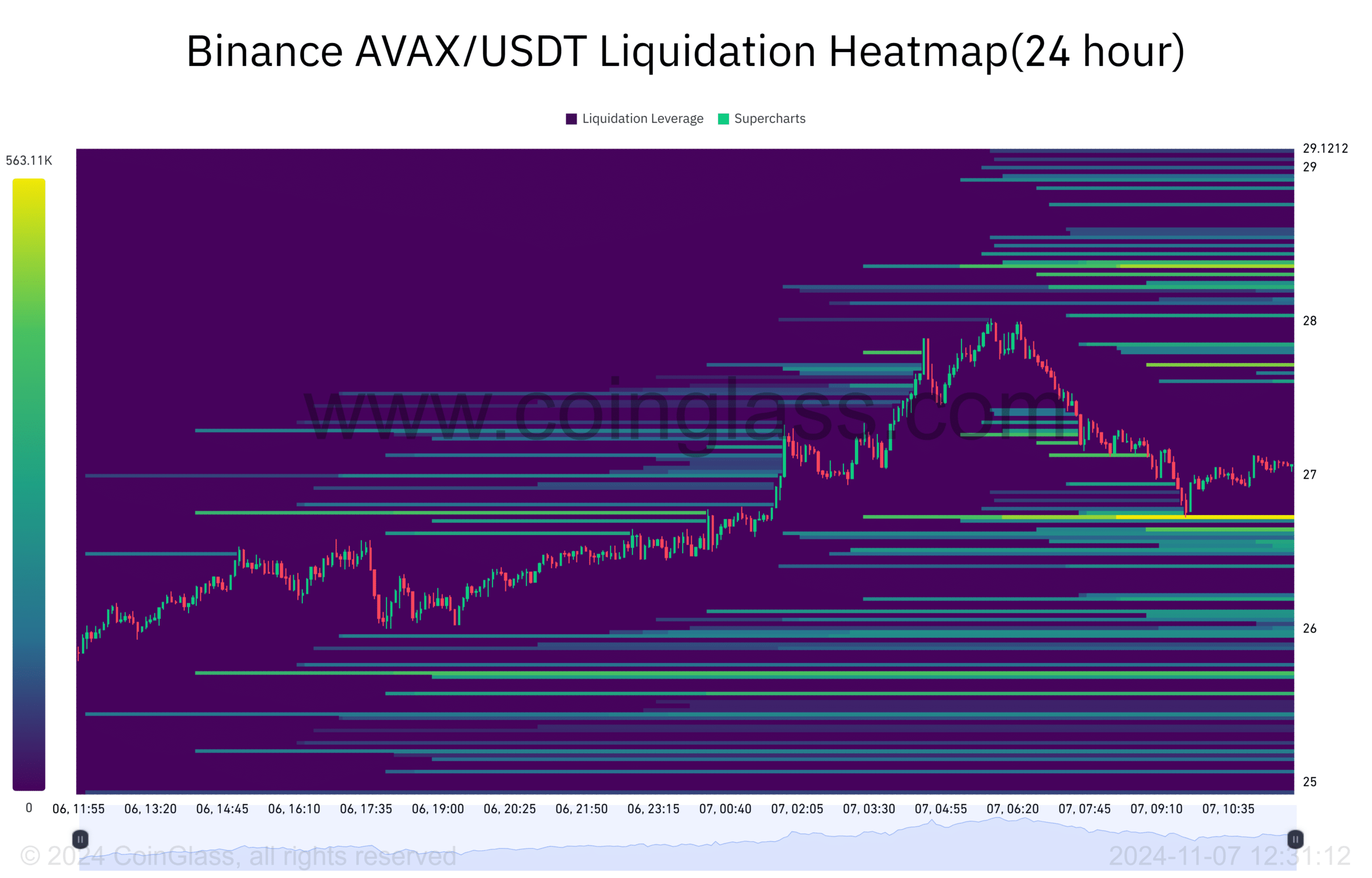

The liquidation heatmap data further complicated the picture.

According to AMBCrypto’s analysis using data from Coinglass, there’s a substantial liquidation pool valued at approximately 563K in AVAX at the price point of $26.73. This finding implies that a potential brief reversal or pullback in AVAX prices might occur.

At this point, the level may function either as a point of support or resistance, contingent upon the market’s response and the strength of the whale’s influence and trading dynamics.

For Avalanche, it appears that large transactions have been increasing significantly, suggesting the presence of ‘whales’ entering the market.

After the next round of liquidations, Avalanche (AVAX) might briefly dip before it’s expected to surge again. This potential dip is due to the process of leveraging subsequent liquidations.

What’s next for AVAX?

Observers will keenly anticipate how the market reacts as Avalanche (AVAX) approaches the resistance level of its past symmetrical triangle.

Read Avalanche Price Prediction 2024–2025

Should the underlying support turn into a potential resistance point, it’s possible that the altcoin’s bullish trend might persist, potentially leading to another price surge.

If the resistance level at $28.16 remains strong, there might be a temporary pullback in the market.

Read More

- OM/USD

- ETH/USD

- Lisa Rinna’s RHOBH Return: What She Really Said About Coming Back

- Solo Leveling Season 3: What You NEED to Know!

- Carmen Baldwin: My Parents? Just Folks in Z and Y

- Jellyrolls Exits Disney’s Boardwalk: Another Icon Bites the Dust?

- Aimee Lou Wood: Embracing Her Unique Teeth & Self-Confidence

- Inside the Turmoil: Miley Cyrus and Family’s Heartfelt Plea to Billy Ray Cyrus

- Leslie Bibb Reveals Shocking Truth About Sam Rockwell’s White Lotus Role!

- Solo Leveling Season 3: What Fans Are Really Speculating!

2024-11-08 05:11