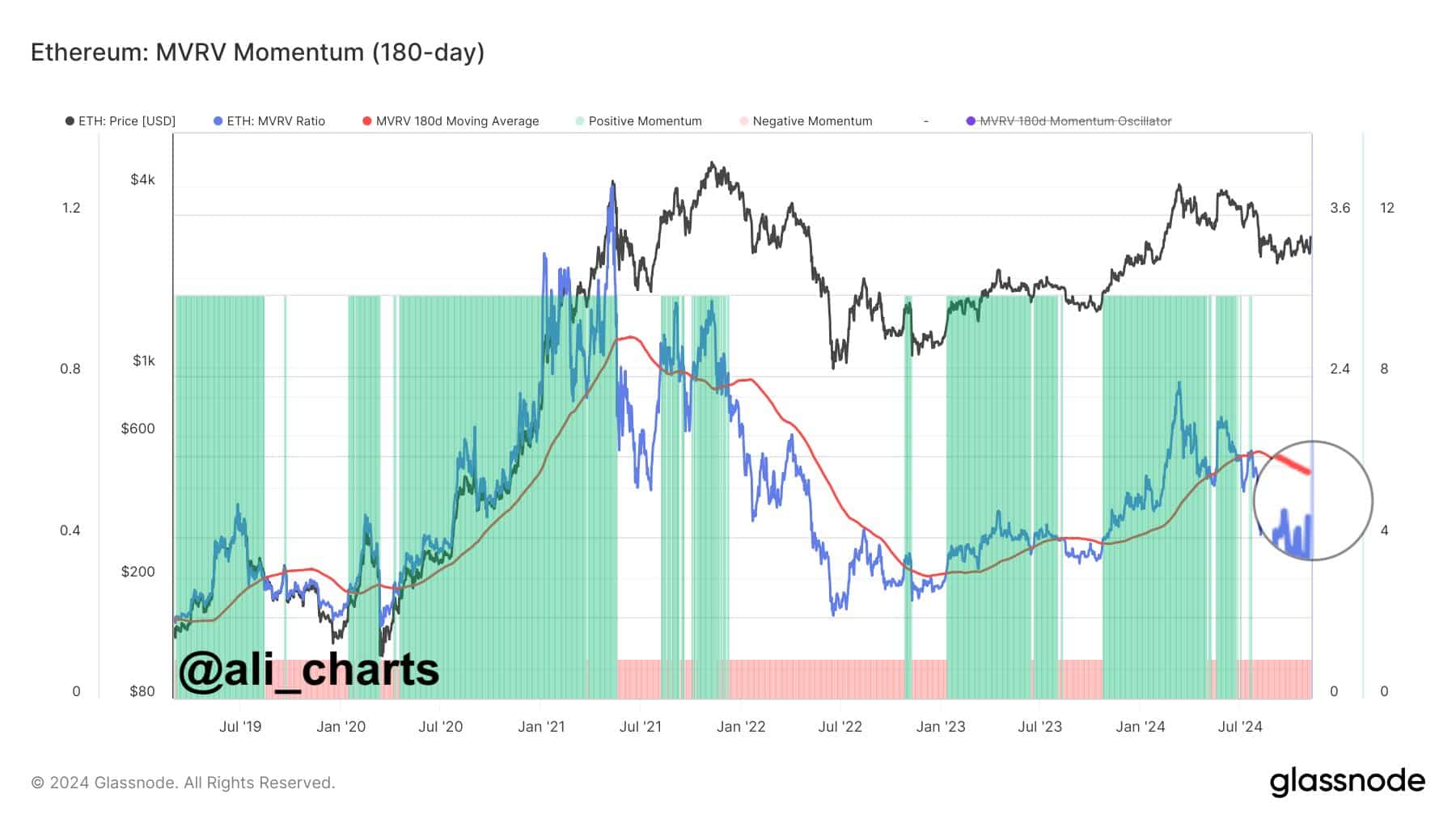

- Ethereum’s MVRV momentum neared a bullish cross, with technical indicators signaling strong upward potential

- Higher derivatives activity and short liquidations lent fuel to Ethereum’s bullish momentum

As a seasoned crypto investor with battle-tested nerves and a knack for spotting trends, I find myself intrigued by Ethereum’s current trajectory. The MVRV Momentum nearing a bullish cross above the 180-day moving average is reminiscent of the green shoots that often precede a garden’s bountiful harvest. The technical indicators, such as ETH‘s recent break above a descending channel and the MACD crossing above the signal line, are like fertile soil for potential gains.

Currently, Ethereum (ETH) appears to be picking up momentum as it moves towards a significant MVRV crossover point above its 180-day moving average. This event, which traders closely monitor, is typically an indication of bullish performance and often signifies the onset of Ethereum’s most robust upward trends. By pointing out when ETH is underpriced compared to its holders’ average profit margin, this signal helps traders identify instances where Ethereum might be undervalued.

After Ethereum’s latest surge from $2,400 to $2,800, members of the cryptocurrency community are watching this milestone as a possible trigger for even greater increases.

Currently, Ethereum (ETH) is being exchanged at $2,829.58 after experiencing a 7.19% increase in the last day. But since this critical point hasn’t been reached yet, there could potentially be more growth for Ethereum’s upward trend. So, one might wonder, could this signal an imminent significant surge?

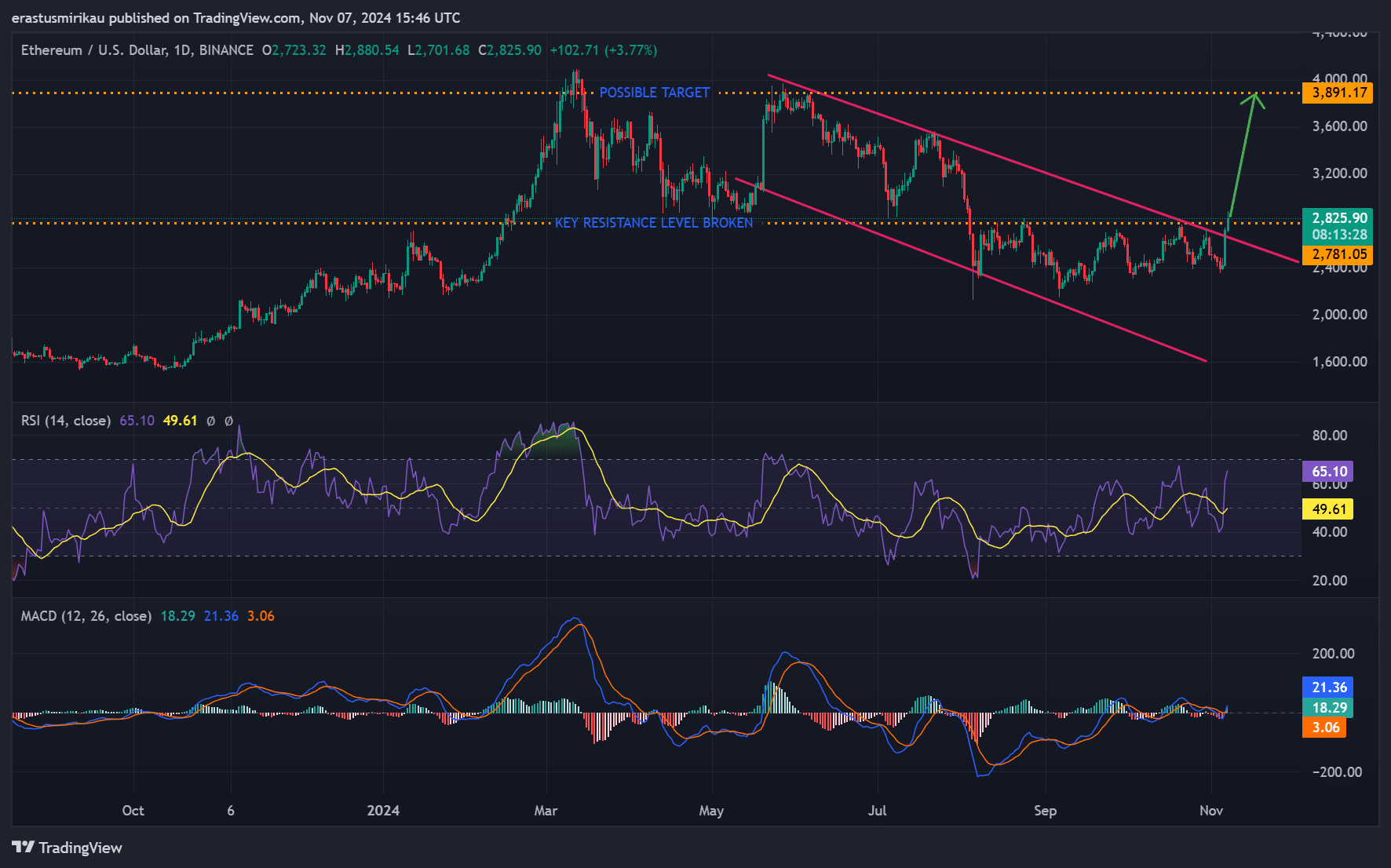

ETH chart analysis – Technical indicators signal strength

Looking at Ethereum’s daily graph, crucial technical signs point towards an optimistic trend. Ether has recently surpassed a falling trendline, implying a change in direction. As we speak, the Relative Strength Index (RSI) stands at 65.10, slightly below the overbought level. This implies there’s potential for additional upward progression.

As the MACD line moved above the signal line, suggesting a bullish trend, and Ethereum approached a significant resistance level, there’s potential for further price increases if buying pressure holds steady. This combination of technical indicators underscores Ethereum’s robust position, potentially paving the way for a potential surge towards its next goal of $3,891.

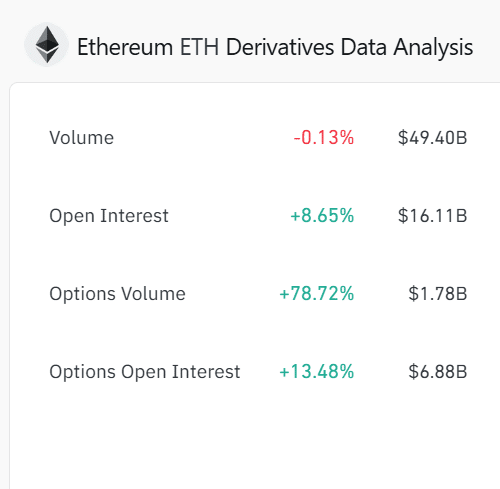

ETH derivatives data – Rising investor interest

The data on Ethereum’s derivatives further supports a favorable viewpoint. The total open interest increased by 8.65%, reaching a new high of $16.11 billion, demonstrating an uptick in trader participation. Moreover, the Options Open Interest experienced a 13.48% rise, amounting to $6.88 billion. Strikingly, the volume for options trading skyrocketed by as much as 78.72%.

As a researcher exploring the realm of blockchain technology, I’ve noticed a surge in interest and optimism regarding Ethereum’s imminent growth. This is evident from the increasing number of individuals strategically investing, hinting at their confidence in its near-term prospects.

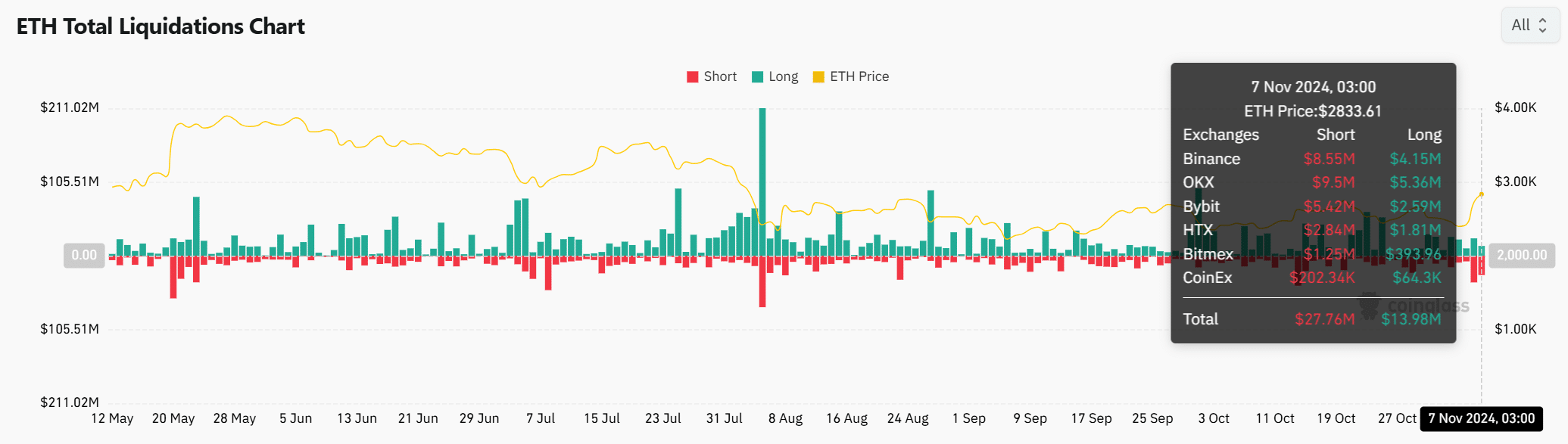

Ethereum liquidation levels – Shorts face pressure

The data from the liquidation process provides additional evidence of the current market trends for Ethereum (ETH). On November 7th, a total of $41.74 million was liquidated, with short positions accounting for $27.76 million. This significant number of short liquidations suggests growing stress on bearish investors, potentially leading to increased backing from buyers.

If Ethereum’s value keeps rising, more short sellers might be forced to exit their positions, which could further boost the positive trend.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Will Ethereum’s MVRV momentum cross confirm a rally?

As Ethereum approaches a significant MVRM (MVRV Ratio Momentum) intersection, robust technical signals, escalated derivatives trading, and a surge in short liquidations hint at an impending price increase. Yet, it’s advisable to exercise caution until the crossing takes place.

Should the prediction prove accurate, this signal might propel Ethereum towards its projected goal of $3,891. Will Ethereum proceed on an upward trajectory and fulfill optimistic forecasts, or will it encounter resistance that hinders its progress? The coming decisions for Ethereum are pivotal and are eagerly anticipated by many market observers.

Read More

2024-11-08 13:11