- Ethereum has all the right reasons to push for a $3K gamble this weekend

- But first, a few speed bumps need to be addressed

As a seasoned analyst with over two decades of experience navigating market ebbs and flows, I see promising signs for Ethereum [ETH] pushing toward $3K this weekend. The post-election liquidity, coupled with Bitcoin’s historic drop in reserves, is creating an ideal environment for altcoins to thrive. However, it’s essential to keep a watchful eye on potential hurdles such as the dormant whale holding $1.14 billion in ETH and Solana’s recent surge.

After the election, altcoins are reaching record highs. Ethereum [ETH] has jumped more than 15%, going above $2.9K for the first time in three months. At the same time, Bitcoin‘s historic reduction in reserves is sparking fear of missing out (FOMO), which could lead other altcoins to follow suit.

Nevertheless, Ethereum (ETH) encounters some challenges: A large whale, holding approximately $1.14 billion in ETH, has become active again, causing concern about a potential sell-off. Despite robust inflows, Ethereum remains behind Solana, which is rapidly approaching the $200 mark.

With Bitcoin targeting $78K, ETH’s path to reclaiming dominance might be a tough climb.

The upcoming weekend will be crucial for Ethereum

Initially, Bitcoin’s dominance stood at almost 61% after reaching an all-time high, but it has since decreased to approximately 58%. On the other hand, Ethereum’s market share has been on the rise during this timeframe, nearing 14%, suggesting that investors are increasingly shifting their capital towards alternative cryptocurrencies.

Just as anticipated, the mid-November period holds significant importance for the altcoin market. Now that the election excitement has subsided and the market is in an extremely enthusiastic state, altcoins appear primed for a possible upward trend.

In other words, if Bitcoin stays between $74,000 and $78,000, this situation could occur. A period of Bitcoin stability (consolidation) would set up a favorable environment for investors to concentrate on high-value altcoins, which is in line with the current market sentiment.

Reducing the FOMC rate provides additional backing for short-term Bitcoin (BTC) investors to maintain their holdings. Although there might be some selling pressure during the weekend, a significant, prolonged downtrend seems improbable.

Opportunistic Ethereum supporters stand ready to capitalize on the current circumstances. With less resilient traders exiting their positions, anxiety could cause more investors to flock towards Ethereum, possibly paving the way for a surge towards the $3K mark.

Still, plenty of hurdles ahead

Following a rocky beginning in November, Ethereum’s comeback is worth mentioning. In the previous month of October, ETH encountered challenges, experiencing three refusals and falling short of breaking above $2.7K. These setbacks affected its progress in the bull market.

Currently, Solana stands out as the leading altcoin, breaching the $160 barrier with only minor hindrances. Interestingly, it has even surpassed Binance Coin (BNB) to claim the 4th spot, and is now on the verge of reaching a massive market capitalization of $100 billion.

It’s quite conceivable that Solana will once more take center stage. Moreover, the significant increase in value by an 8-year-old wallet might create unfavorable opinions, possibly preventing Ethereum from reaching $3K.

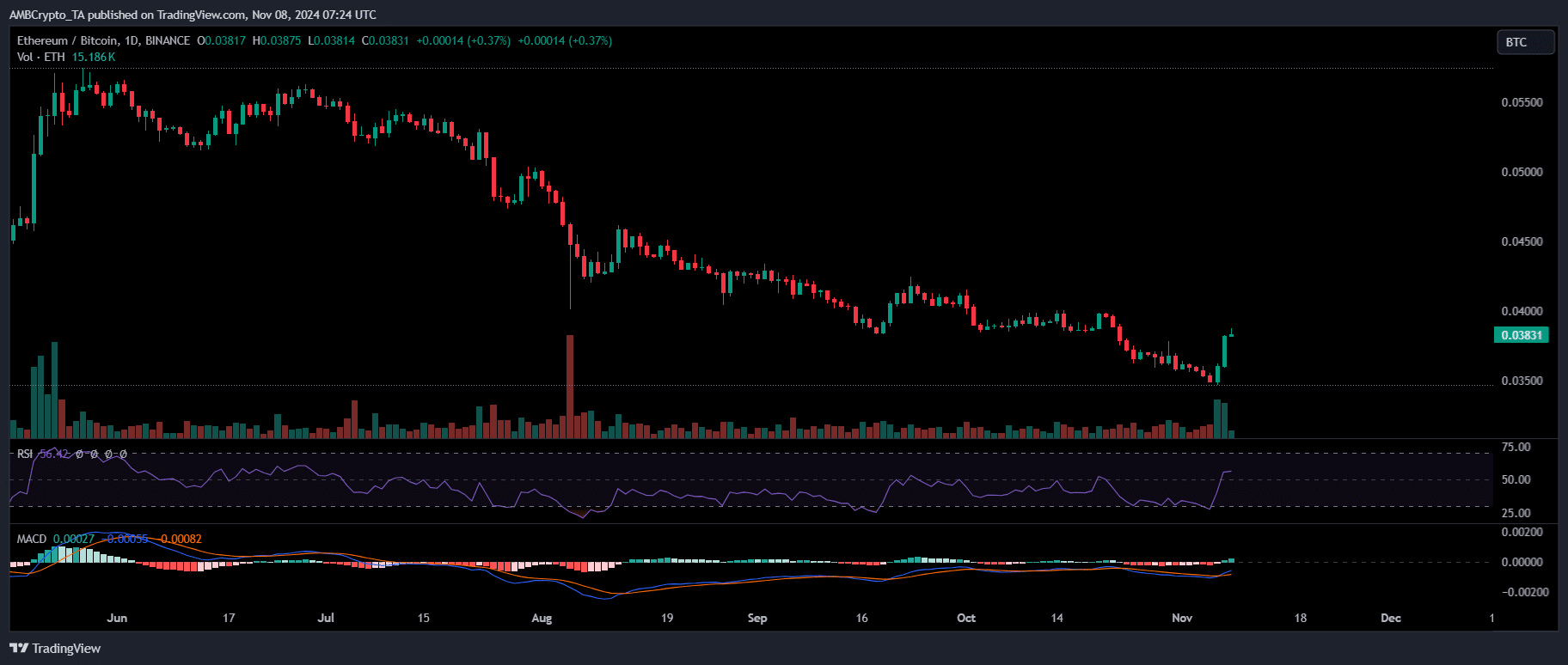

Source : TradingView

Even amidst these hurdles, Ethereum’s escalating supremacy in relation to Bitcoin has piqued the interest of AMBCrypto. Over a five-month period, ETH has managed to surpass Bitcoin’s performance.

Given the current circumstances, it’s reasonable to anticipate that the groups who have earned 80% profit from their Ethereum (ETH) investments are likely to retain their ETH, reducing the likelihood of a price drop over the weekend. This assumption is backed by several indicators: Bitcoin remains stable within the $74,000-$78,000 range, Ethereum continues to attract liquidity, and short-term investors appear unwilling to sell their holdings at this time.

Nevertheless, the impact of whales and long-term investors should not be underestimated. In case dormant whale accounts become active again, Ethereum might face some tricky situations. A significant force might be required to guide Ethereum through these possible hurdles.

The catalyst ETH needs is here

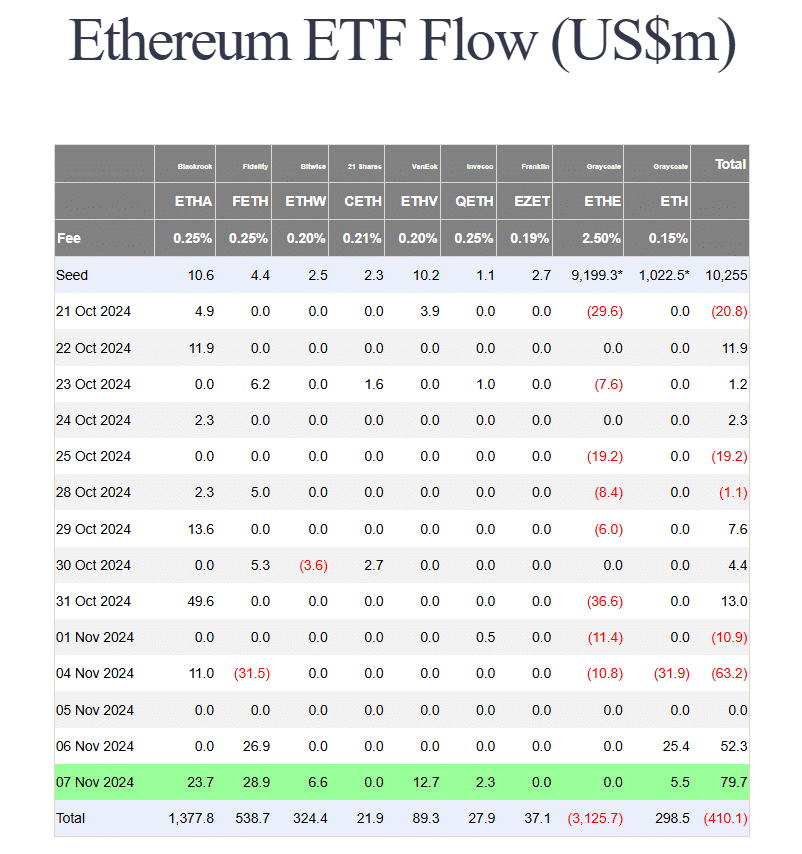

For the past fortnight, the total inflow has been approximately -$75M, mainly because events in October halted ETH’s growth momentum. However, factors that have hindered ETH’s progress this year, such as underperformance from the ETH ETF and seasonal lows, appear to be changing now.

A gradual, consistent influx might boost ETH, given that Ethereum is currently the only alternative coin apart from Bitcoin offering a clearly defined and accessible Exchange-Traded Fund (ETF) product.

Source : Farside Investors

To put it simply, as Ethereum becomes increasingly integrated into the institutional world, this development might serve as a significant trigger, potentially alleviating any downward pressure on Ether’s price movement.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Although there have been worries that Ethereum’s ETFs are not bringing enough liquidity, a shift in this pattern could generate the necessary impetus, allowing Ethereum to persevere in the long run and possibly regain its leading position.

Given the significant influx of approximately $80 million into exchange-traded funds focused on specific spots, marking an end to a two-month dry spell, it’s plausible that Ethereum could reach $3,000 before the month is over.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-08 16:08