- Bitcoin remains stable above $75K despite a 1.7% pullback.

- Rising new address creation and increased open interest signal strong market participation, but warrant careful observation.

As a seasoned researcher with over two decades of experience observing financial markets, I find myself continually intrigued by the fascinating dynamics of Bitcoin [BTC]. The resilience displayed by BTC in maintaining its position above $75K following a 1.7% pullback is reminiscent of a well-anchored ship sailing through stormy seas.

Bitcoin (BTC) has demonstrated remarkable strength, managing to hold its value above the $75,000 mark. This steadiness follows Bitcoin reaching a brand new record high of $76,872 on November 7th.

Despite a minor decline of 1.7%, Bitcoin has maintained its strength near the $75,000 level, indicating robustness in its current position.

Experts linked this progression to a mix of growing market trust, fresh financial resources, and changing ownership patterns.

In the midst of the current market trends, an analyst from CryptoQuant, known as Mignolet, shared his views on Bitcoin’s shifting cycle. He suggested that the prerequisites for Bitcoin to progress into the second stage of its ongoing market phase were coming together.

Following Phase 1, I observed that the Long-Term Holders (LTH) started to disperse their accumulated supply once more, as I detailed in my explanation.

In order for Bitcoin to advance into its next phase, it was crucial to see a significant rise in Short-Term Holder (STH) supply due to fresh capital injection. Mignolet highlighted that this additional liquidity flow was already starting to happen, resembling trends seen during the 2017 market cycle.

The cyclical behavior implied that Bitcoin’s market dynamics were once again setting the stage for a potential uptrend, driven by increased activity and new entrants into the market.

Indicators point to growing momentum in Bitcoin metrics

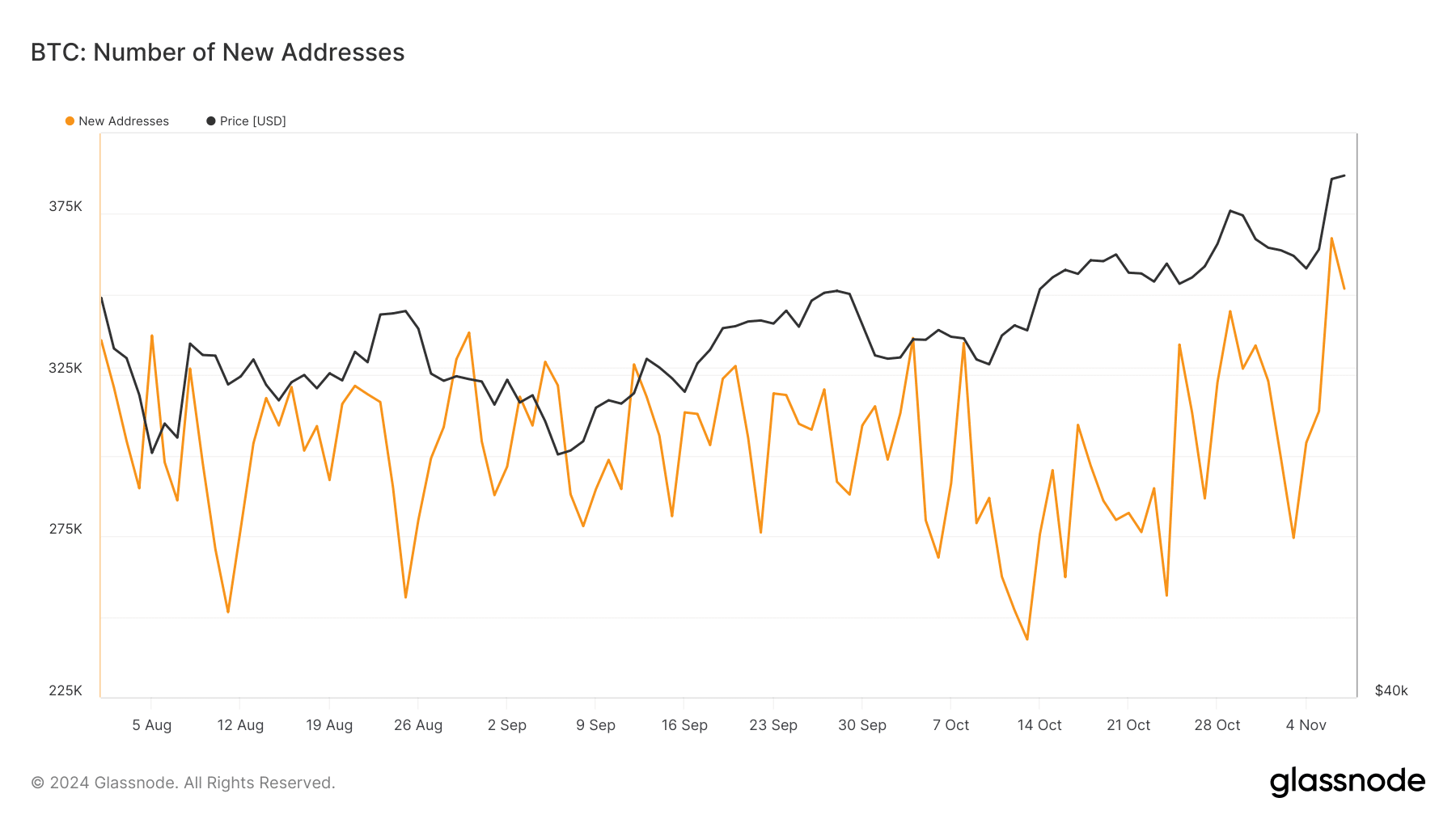

Besides examining user activities, several crucial statistics offer more understanding about Bitcoin’s market condition. One such statistic is the count of newly created Bitcoin wallets (or addresses). Based on data from Glassnode, this metric has been steadily increasing. After dipping to roughly 242,000 new wallets in mid-October, it has risen to surpass 350,000 new wallets.

It seems like this rise might indicate a higher number of individuals getting involved in the market, potentially boosting demand and offering prolonged support for Bitcoin’s value.

An increase in newly created addresses often signals growing curiosity and acceptance, elements that may sustain a continuous price uptrend as long as they remain consistent.

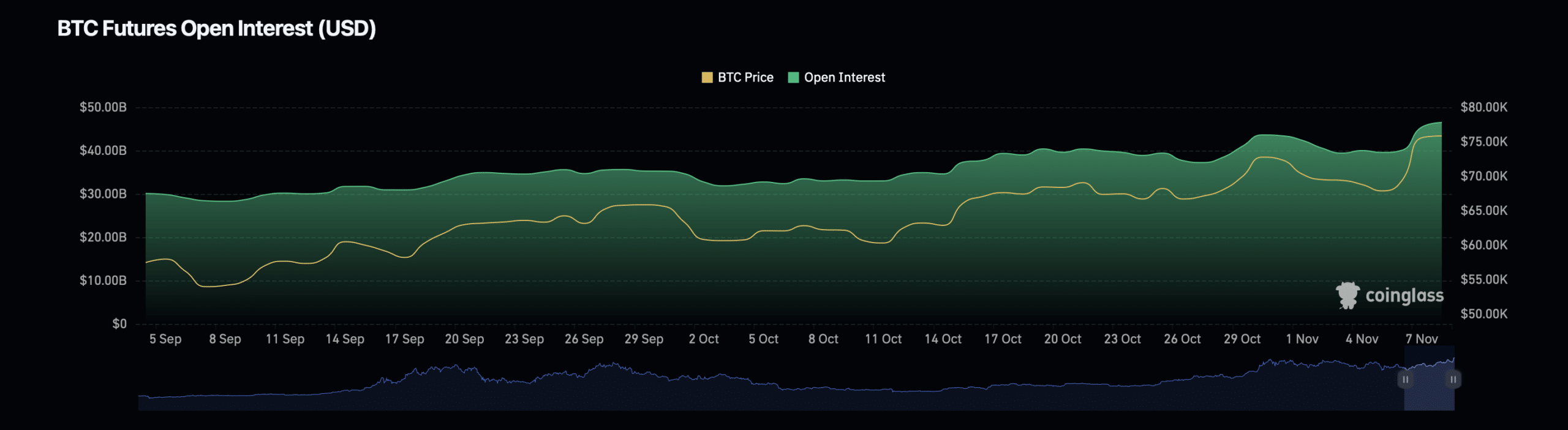

Another noteworthy metric was Bitcoin’s open interest in futures contracts, which showed a moderate increase. Data from Coinglass indicated that open interest has risen by 1.32% to a current valuation of $46.59 billion.

As a researcher observing the market dynamics, I noticed an increase in positioning by traders, suggesting they anticipate continued price fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

However, it is essential to note that Bitcoin’s open interest volume has experienced a notable decline, falling by 41.01% to a current valuation of $69.81 billion.

A decrease in trading position volumes might suggest that certain traders are liquidating their positions, perhaps as a cautious response to the recent price adjustments.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-08 19:35