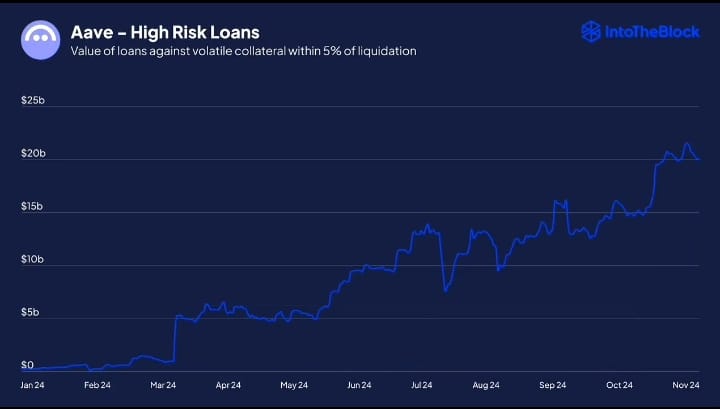

- High-risk DeFi loans surged as market sentiment drove demand for leverage.

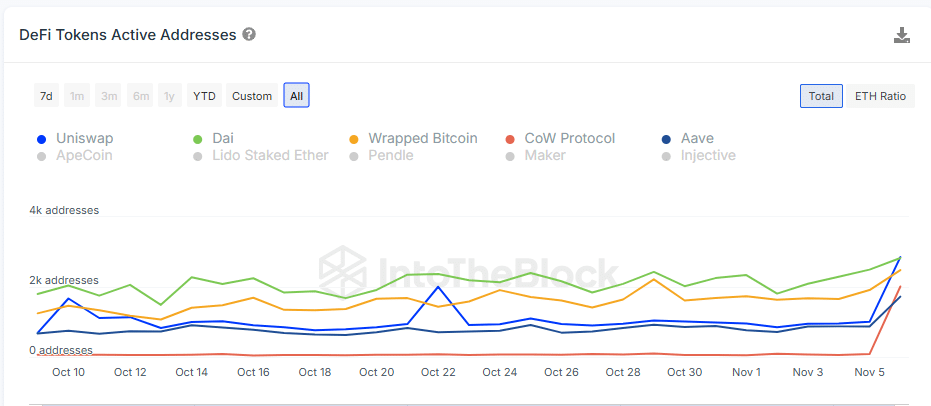

- DeFi tokens active addresses hitting new all-time highs.

As a seasoned crypto investor with battle scars from the 2017 bull run and subsequent bear market, I can’t help but feel a sense of deja vu when I see high-risk DeFi loans surging and active addresses for DeFi tokens hitting new all-time highs. It seems that history is indeed repeating itself, albeit with more sophisticated tools and platforms.

As Bitcoin (BTC) reached a fresh all-time high, there was an increase in high-risk loans, boosting demand for leverage. The DeFi lending platforms Aave and Moonwell displayed a notable rise in the amount of high-risk loans, according to IntoTheBlock, with the collateral being very close to being liquidated.

The rising pattern indicates a growing interest among crypto market participants to take on more risk for potentially larger profits, particularly during periods of market growth.

Significantly, the increase in risky loans indicated that comparable tendencies were present among other Decentralized Finance (DeFi) lending platforms as well. Consequently, it appeared that the general mood in the market favored bold investment tactics.

Yet, the outcome of the latest U.S. elections might bring unpredictability that could negatively impact these leveraged investments.

Major political occurrences frequently spark unexpected shifts in financial markets, thereby enhancing the possibility of forced repayments for these high-risk loans.

As a financial analyst, I find myself constantly navigating the delicate equilibrium that DeFi participants must maintain – striving for lucrative yields while concurrently managing considerable risks in this perpetually unpredictable market landscape.

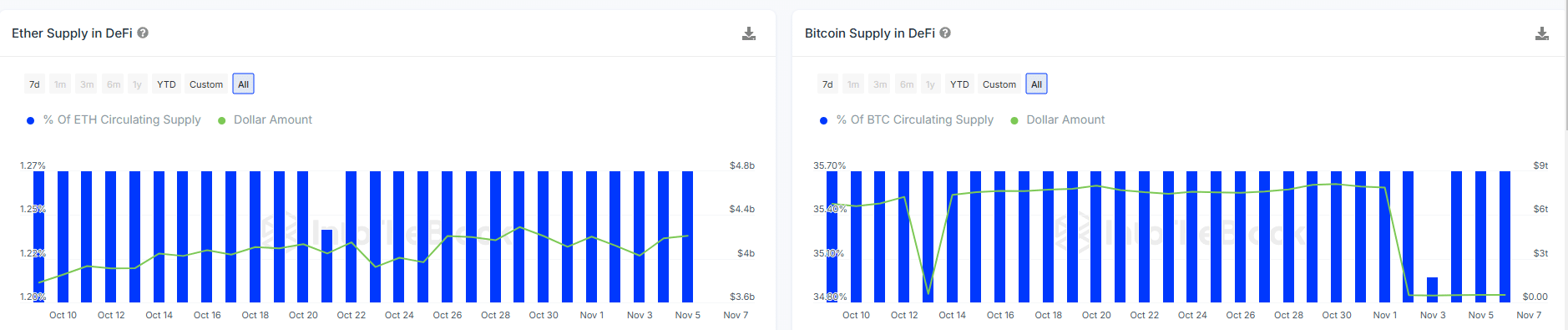

Difference in supply of ETH and BTC in DeFi

Even though Bitcoin’s total dollar value in DeFi experienced a minor drop, it still towered significantly over Ethereum‘s. This indicates a more extensive market reach and larger commitment from users who are utilizing Bitcoin within the DeFi ecosystem.

As an analyst, I find myself observing a trend that suggests Bitcoin may become more vulnerable to the consequences of high-risk loans, particularly when market emotions amplify the desire for leveraged positions.

Due to Bitcoin’s growing influence in Decentralized Finance (DeFi), major market fluctuations or instability might have a stronger impact on Bitcoin’s value and stability than they would on Ether.

Therefore, individuals involved with Bitcoin need to be extra cautious and closely monitor possible market fluctuations that could result from risky financial activities within the Decentralized Finance (DeFi) sector.

DeFi tokens active addresses at ATH

The graph indicated a significant surge in the number of actively used addresses for various DeFi tokens, possibly because more individuals are betting or searching for high-risk, high-reward possibilities within DeFi.

The significant surge in transactions, particularly involving Wrapped Bitcoin (WBTC), underscores the expanding adoption of leveraged trading and a sense of urgency to join in, potentially leading to overvalued asset prices.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Historically, high levels of activity have tended to precede market tops for Bitcoin (BTC). Sudden realizations about overvaluation or significant economic incidents can lead to a quick drop in BTC prices.

Users dealing with Bitcoin should exercise caution. The surge in active users and the use of leverage indicates an increased potential for market fluctuations. Such instability might impact Bitcoin’s trajectory imminently, potentially creating a temporary peak that could trigger a downturn.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-11-08 21:11