- Ethereum has surged to a three-month high above $2,900 as bullish sentiment strengthens.

- The rising estimated leverage ratio and funding rates point towards rising speculative activity from derivative traders.

As a seasoned analyst with over two decades of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The recent surge in Ethereum (ETH) has certainly piqued my interest, given its three-month high above $2,900.

As an analyst, I’m observing a significant surge in Ethereum (ETH) prices. In just two days, the cryptocurrency has seen a 20% increase, with its value fluctuating between $2,400 and $2,950. At this moment, Ethereum is trading at an impressive $2,922 – a level not reached in over three months.

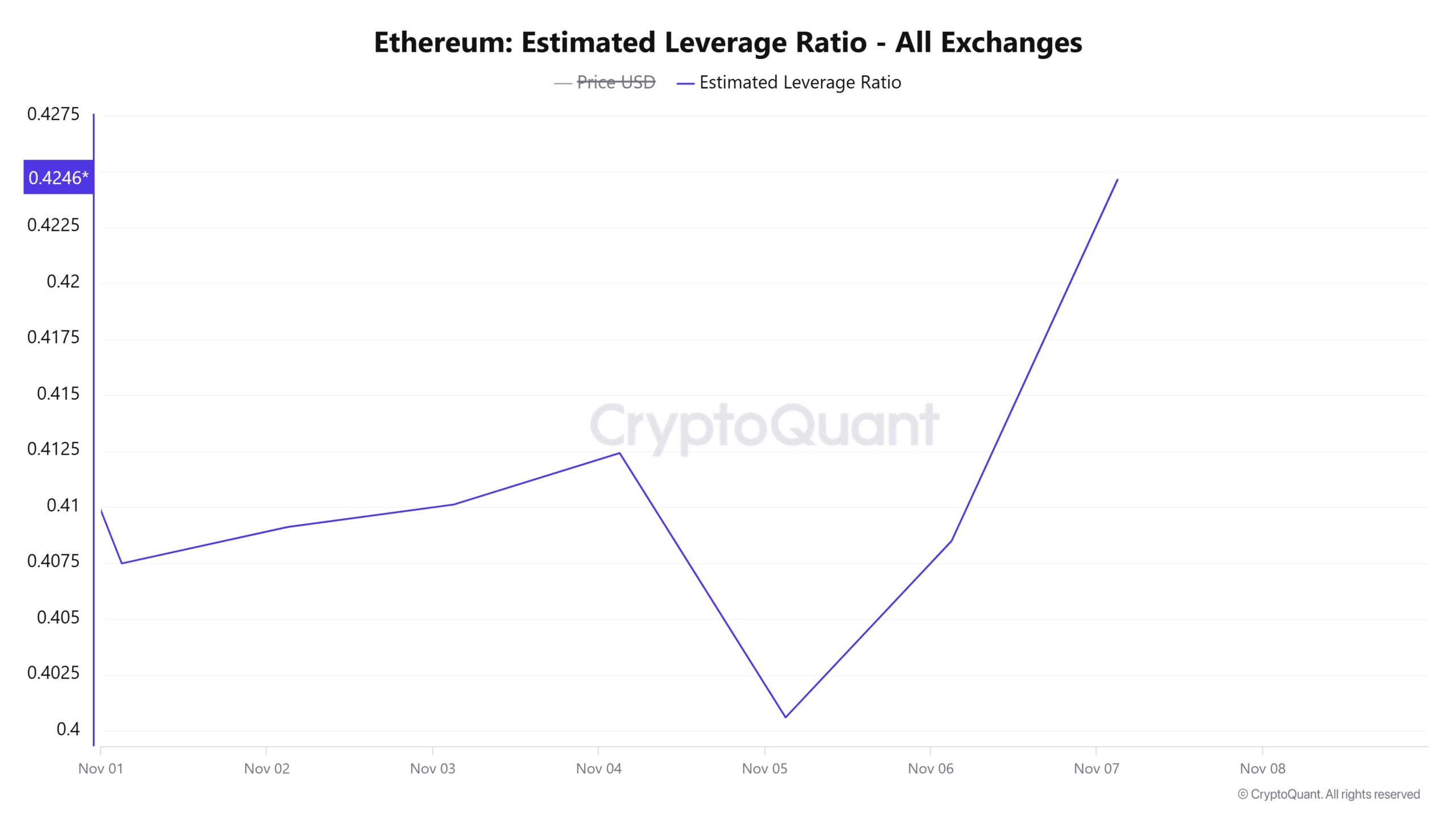

Lately, there’s been an increase in positive returns, but at the same time, market fluctuations have become more pronounced. Notably, the calculated leverage ratio has seen a considerable jump over the past few days, reaching its highest point in a week.

As we speak, this figure is reporting as 0.42. This indicates that nearly half (42%) of the active positions in the derivatives market rely on leveraged investments. An accumulation of such leveraging often boosts market volatility.

Nevertheless, the calculated leverage ratio hasn’t reached critical points as of now, which leaves some space for Ethereum to persist in its upward trend.

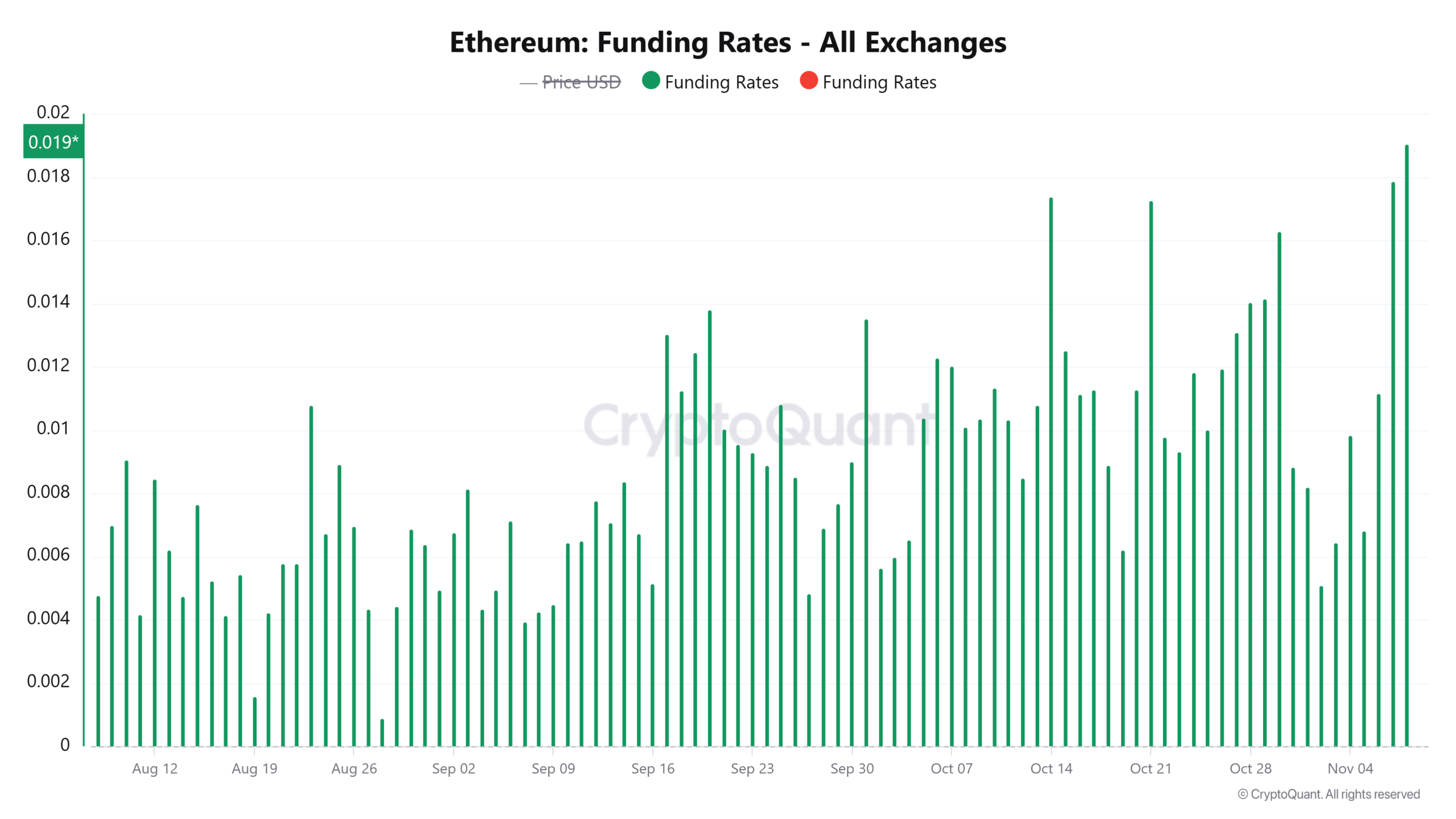

Funding rates & open interest hit multi-month highs

It seems that the fresh opportunities available on the derivatives market are for long-term investments. This is evident as the funding rates have reached a three-month peak.

When interest rates on investments increase, it often means more investors are taking long positions. This rise suggests these investors are prepared to pay higher premiums to sustain their investments, implying a generally optimistic outlook within the market.

Currently, Ethereum’s open interest is soaring, reaching a five-month peak of approximately $16.61 billion, as reported by Coinglass statistics.

Over the past two days, the total value of active bets or positions on Ethereum (ETH) has surpassed $3 billion, indicating a significant level of speculation surrounding ETH.

An uptick in trading transactions and active derivative contracts might lead to heightened market volatility. This surge could potentially signal that the Ethereum market may be approaching a state of excessive excitement.

However, technical indicators suggest that an ETH bull run could also be underway.

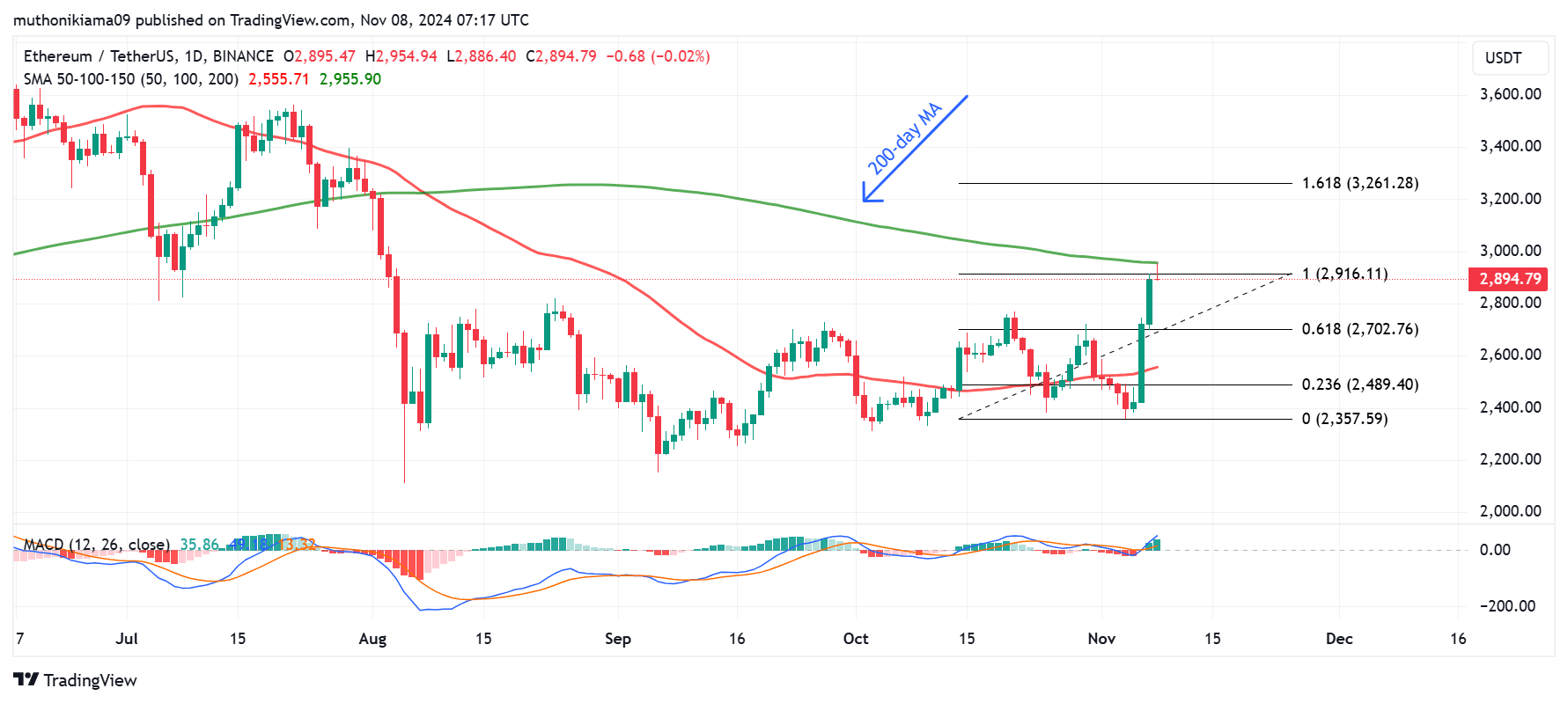

Ethereum tests 200-day moving average

Right now, Ethereum is undergoing significant testing at the 200-day Simple Moving Average (SMA) on its daily chart. Should Ethereum successfully overtake this price point at approximately $2,955, there’s a possibility it might trigger a prolonged upward trend.

Turning this resistance around might open up a path for a potential 12% surge that could reach the 1.618 Fibonacci level, which is approximately $3,260.

Based on the Moving Average Convergence Divergence (MACD), it seems that further growth is imminent. In fact, this indicator has now switched to a positive value and demonstrated a significant surge upward, indicating that the current upward trend is becoming stronger.

Pay close attention, traders, as indications of profit-taking might lead to increased selling activity that causes the price to fall and touch the support level at $2,700. If the price falls below this support, it may trigger a downward trend.

Are inflows to ETH ETFs driving the rally?

On the 7th of November, the cumulative investments into Ethereum ETFs on the spot market peaked at $79.74 million, a figure not seen since August as per data from SoSoValue.

Among all Ethereum-focused ETFs, it was the Fidelity Ethereum Fund (FETH) that saw the largest investment inflow amounting to $28 million, closely followed by the BlackRock iShares Ethereum Trust with an influx of approximately $23 million.

Read Ethereum’s [ETH] Price Prediction 2024–2025

In the past fortnight, the VanEck Ethereum Trust experienced a significant increase in investments totaling $12 million, representing its initial inflow in this period.

If the demand for ETH ETFs continues, it could bode well for Ethereum’s price.

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-11-08 23:04