- At press time, the asset was trading near a level of strong selling pressure that could drive its price lower

- While bearish sentiment seemed to be mounting, a recovery remains possible

As a seasoned crypto investor with battle scars from countless market cycles, I’ve learned to read between the lines and navigate through the turbulent seas of digital assets. The current state of TON is a perfect example of why we keep our eyes glued to the charts and our emotions in check.

Recently, TON’s results have shown some ups and downs, with fluctuations in both short-term and long-term periods. At this moment, it has experienced a decrease of 4.95% over the last month, but managed to rise by 1.19% within the past week.

In my analysis, the recent trends in TON’s market behavior seem to indicate a possible steep drop, with selling pressure on the rise. This could potentially lead to a further descent in its value.

Selling pressure meets resistance as TON struggles at key level

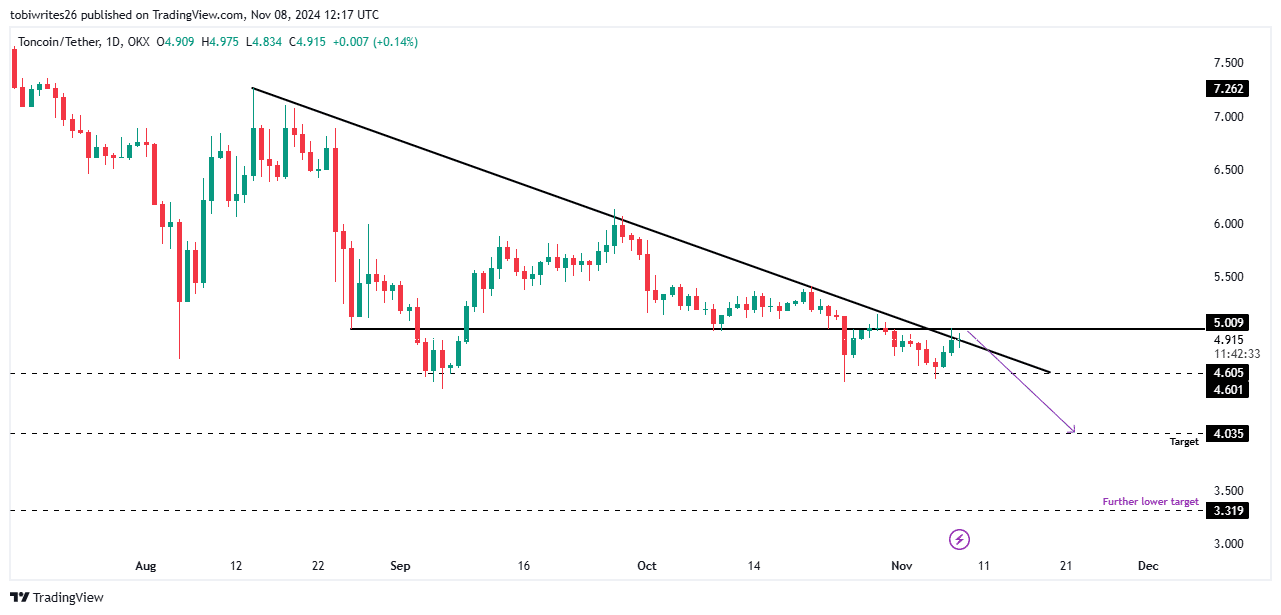

At the moment, the price of TON has reached a crucial juncture on its graph. Although it has formed a bullish triangle shape, which typically indicates an uptrend, TON hasn’t broken above this pattern as of now and seems poised for a potential decline, at the present instant.

At approximately $5.009, it appeared as though TON encountered a substantial barrier where selling was particularly strong, potentially causing the price to either halt or decrease further.

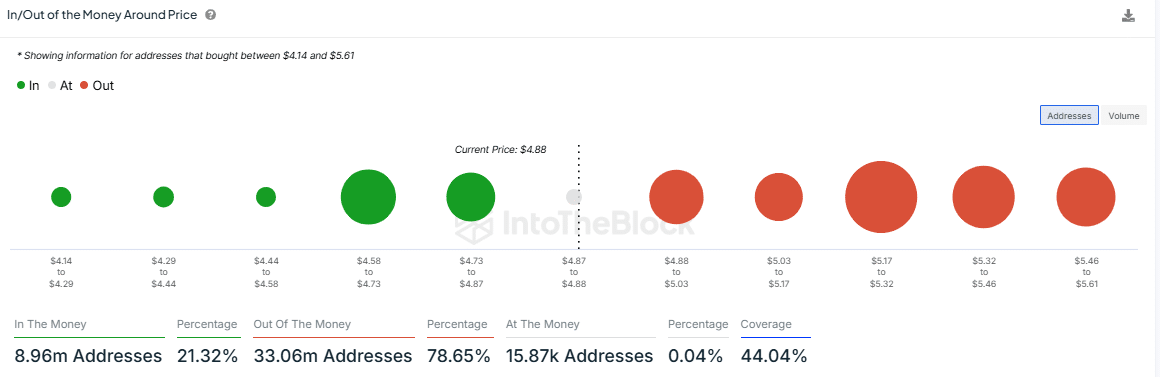

As a crypto investor, I’ve noticed a significant resistance level in my portfolio, which lines up with the In/Out of the Money Around Price (IOMAP) indicator. This suggests that an average price of approximately $4.93 (ranging between $4.88 and $5.03) has accumulated around $80.9 million worth of TON sell orders from about 5.1 million different addresses.

It’s important to note that the IOMAP shows where buyers acquired tokens in relation to the price at the time of purchase, which can help pinpoint significant levels of support and resistance.

Under increasing sales demands, it seems probable that TON will aim for its next potential support at approximately $4.035 – a price point not seen since March 2024 earlier. Should these pressures persist, the asset may encounter additional drops reaching around $3.319.

Bears in control as selling pressure drags TON south

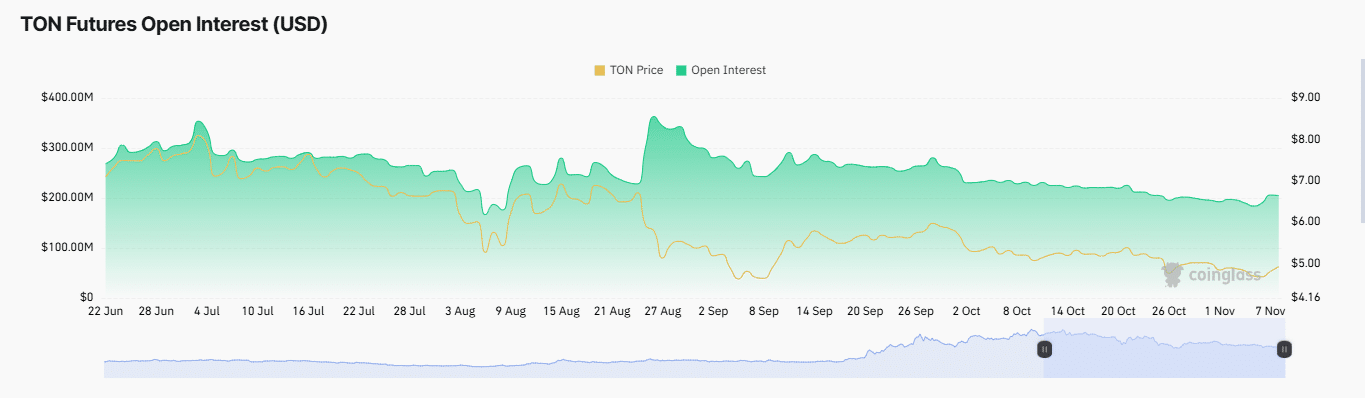

Based on AMBCrypto’s evaluation, there has been continuous selling demand for TON in recent times. Notably, the Open Interest, which signifies the quantity of active futures contracts, has been decreasing steadily since August 27.

The drop in Open Interest suggests less involvement in the market, which may have led to a continued fall in TON’s price and a deeper move towards a bearish market trend.

Market activity and liquidity, as indicated by Open Interest, have not shown signs of reversing. Consequently, TON may continue to experience pressure heading downwards without this crucial factor.

In addition, it was found in recent analysis that long traders have been racking up losses due to TON’s price moving contrary to their optimistic predictions. At this moment, around $151,620 worth of these long positions have been closed out. With prices continuing to fall, it is expected that more liquidations will occur, intensifying the overall downward trend.

As a crypto investor, I noticed that both the Open Interest was dwindling and the long liquidations were surging, which suggested a probable extension of TON’s downward trend.

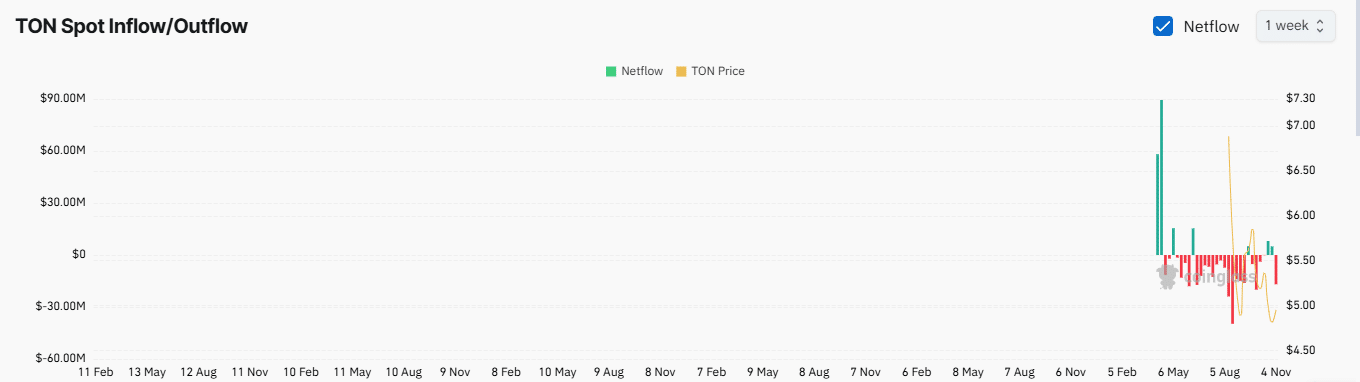

On the positive side, there seems to be optimism arising from recent exchange outflow data. Specifically, significant TON tokens leaving exchanges, according to Coinglass, could indicate that investors are choosing to hold onto their assets for a longer period instead of selling them immediately. This movement of assets off exchanges is often a sign of confidence in the asset, particularly when it’s intended for long-term holding.

In the past day, approximately $3.35 million in TON has been taken out of exchanges, while around $17.38 million has been withdrawn in the last week. This could potentially strengthen TON’s price by counteracting the recent decline.

Should this persistent pattern of withdrawals hold, it might provide stability for TON. Conversely, if the rate of withdrawals slows down, TON could potentially incur more losses as seen on its price charts.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- BLUR PREDICTION. BLUR cryptocurrency

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- The Boys season 4: Release date, cast, trailer and latest news

- Apple Watch Series 10 UK release date, price and when you’ll be able to pre-order

- Pauly Shore Honors “One of a Kind” Richard Simmons After His Death

2024-11-09 12:07