- With major institutions betting on its future, Bitcoin is increasingly being seen as a store of value

- Massive amounts of USDT is flooding the market, indicating signs of liquidity

As a seasoned researcher with years of experience tracking market trends and analyzing data, I can confidently say that the recent shift towards Bitcoin [BTC] as a lower-risk asset is an intriguing development. The 10% weekly gains pushing BTC to a new all-time high of $77,000 is a testament to this trend.

Investors started shifting their funds from conventional stocks to Bitcoin (BTC), considering it a less risky investment option with great prospects.

As a crypto investor, I’ve noticed an impressive surge in Bitcoin’s value, with weekly gains reaching 10%. This phenomenal rise has taken Bitcoin to a record-breaking high of $77,000. Interestingly, this upward trend seems to be fueled by the increasing apprehension surrounding Trump’s economic policies, particularly the ongoing tariff disputes with China and the escalating national debt.

Under the new government’s plans to make the U.S. a leader in cryptocurrency, the traditional role of Bitcoin as a secure investment could potentially change.

Big institutions are betting on Bitcoin’s future

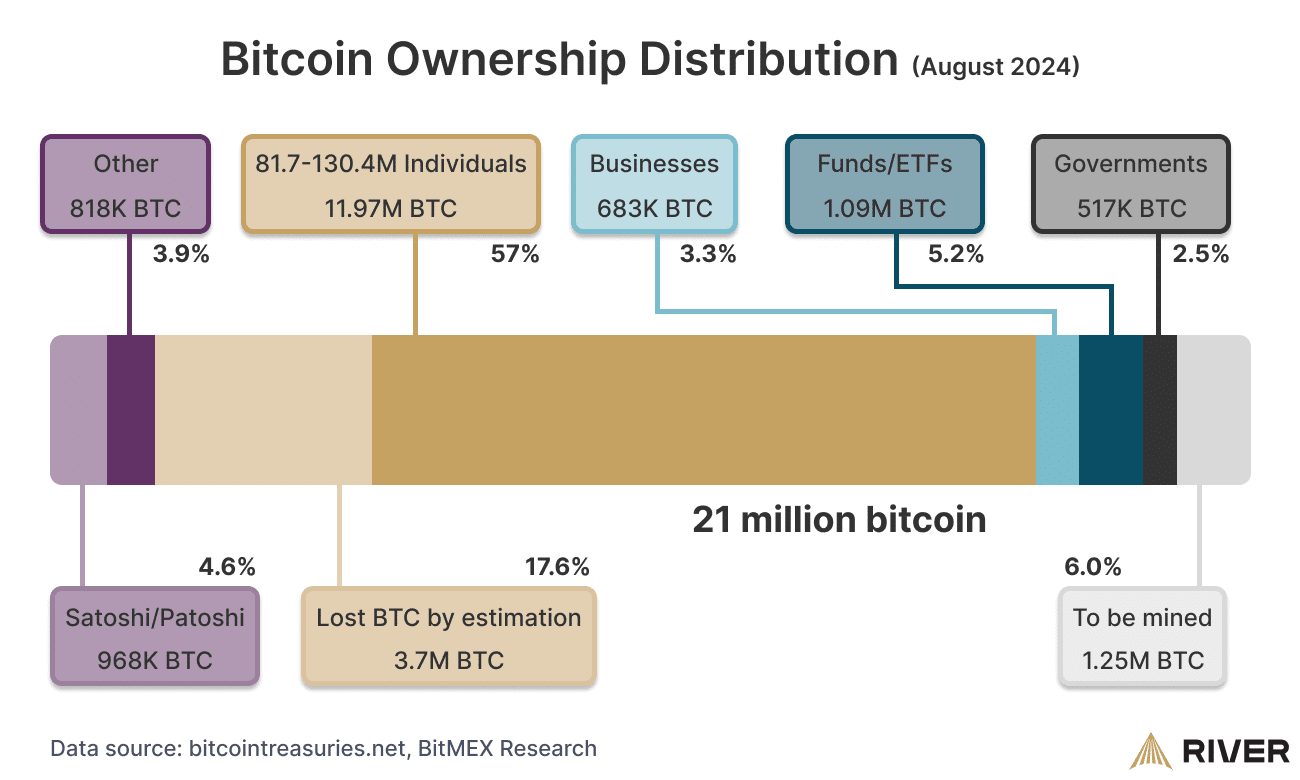

As the total number of Bitcoins is capped at 21 million, more and more investors are accumulating Bitcoin, viewing it as a reliable form of value preservation. Notably, a report from financial analysts at River has shed light on the distribution of Bitcoin ownership among major players.

This backing was crucial, especially as the derivative markets have evolved since the last presidential election, with Open Interest (OI) hitting a record $45 billion.

Increased institutional involvement provides stability over the long term, cushioning against market fluctuations driven by speculation. Consequently, during the past day, there were liquidation events totaling $36.28 million, with $25.20 million worth of short positions being settled.

Furthermore, Bitcoin ETFs set new records with substantial investments, following closely on the heels of the election results. This trend has provided retail investors with a firm position, as they see the current market conditions as an opportunity for potential high returns at a higher risk.

Given that major establishments are wagering on Bitcoin’s future, it might indicate a bullish trend approaching for the upcoming days. Currently, predictions suggest that Bitcoin will maintain its position between $74,000 and $78,000.

Maintaining its current pace, Bitcoin could potentially reach $80,000 before the closing trades in November. There are other bullish indicators that support this prediction as well.

Massive liquidity is coming but…

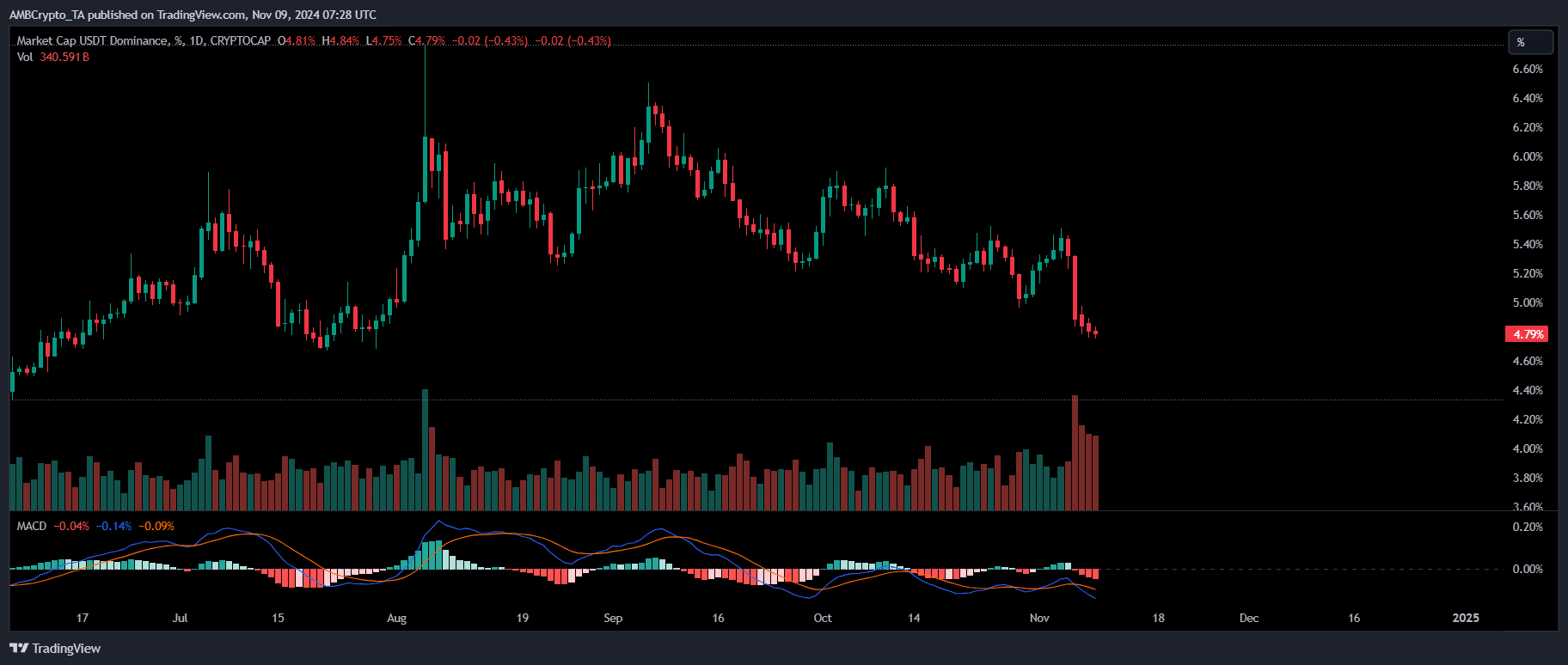

In contrast to past cycles, USDT’s market dominance didn’t bounce back after a dip; instead, it has been steadily decreasing this time around. Even though Bitcoin entered a high-risk zone, the dominance of USDT displayed continuous red trends, reaching a daily low of 6% on Election Day.

When the U.S. Dollar Tether (USDT) market share decreases significantly, it often indicates that Bitcoin’s market bottom is approaching. This shift happens because investors tend to move their stablecoin investments back into Bitcoin, viewing the current price as a favorable entry point.

Recently, Tether’s Treasury has produced a billion USDT tokens, considering the present market situation where Bitcoin appears to be a more secure investment choice.

Even though there seem to be positive trends, it’s possible that the market is reaching a boiling point at present. The Relative Strength Index (RSI) suggests that the market might be overbought, as approximately 74% of its recent price movement over the past fortnight has been upward.

In simpler terms, when weak holders decide to sell (cash out), it could lead to a temporary price drop (reversal). Therefore, keeping an eye on large accounts is important because their continued support will help counteract this selling pressure. At the moment of reporting, Bitcoin was at a critical juncture.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Temporary investors (short-term holders, or STHs) could choose to cash out their gains, leading to a temporary dip. Yet, the general market mood remains optimistic, suggesting a potential surge towards $80k by the end of the month.

One influential aspect fueling this pattern is the growing apprehension concerning ‘Trump trades.’ Consequently, Bitcoin appears to be a more secure investment option compared to stocks, thereby stimulating increased institutional interest in it.

While a small dip did seem possible, BTC’s bull rally appeared poised to continue at press time.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-11-09 14:15