- Ethereum is establishing itself as a unique asset, carving out its own identity.

- Several factors are contributing to this development.

As a seasoned analyst with over two decades of experience navigating the volatile waters of the financial markets, I have witnessed firsthand the ebb and flow of trends, fads, and genuine game-changers. In my humble opinion, Ethereum is undoubtedly carving out its own identity as a unique asset in the crypto market, and this bull cycle is proving to be a significant turning point for ETH.

2 years back, the crypto world experienced a significant shakeup due to the downfall of FTX, causing widespread panic and prompting stringent scrutiny from regulators. However, fast-forwarding to the present day, we find that the terrain has undergone a remarkable metamorphosis.

After making a strong comeback, Ethereum (ETH) is taking the front seat. In just a few trading days, it has managed to break free from a four-month downtrend, recording daily increases nearly reaching 10%.

During the initial stages of bull markets, funds frequently move from Bitcoin towards alternative cryptocurrencies, as investors pursue fresh avenues for potential gains by exploring new investment possibilities in the altcoin market.

Yet, as the uncertainties surrounding elections gradually subside – an occurrence that momentarily boosted Bitcoin’s dominance above 60% – Ethereum is steadily establishing itself as a unique investment category, rather than merely being considered another high-value alternative coin.

Might this development lead Ethereum (ETH) to surpass Bitcoin [BTC] in performance, as investors regain confidence in ETH and see its potential anew?

Ethereum is on a journey of self-discovery

Investors have strongly responded to Trump’s supportive stance on cryptocurrencies, which has helped Bitcoin approach nearly $80,000 in value.

Currently priced at $79,500 during the latest update, Bitcoin has experienced an increase of more than 15% since the election results were declared just a few days ago.

Yet, this swift expansion within a brief period might trigger a note of caution for investors, especially the less experienced ones, often referred to as “the nervous investors” or “those who tend to sell quickly when Bitcoin encounters potential risks.

As a crypto investor, I see this development as a promising chance for Ethereum. Similar to how it leveraged opportunities during the mid-May cycle, Ethereum could potentially seize this shift and make the most of it. The insights from AMBCrypto suggest this possibility.

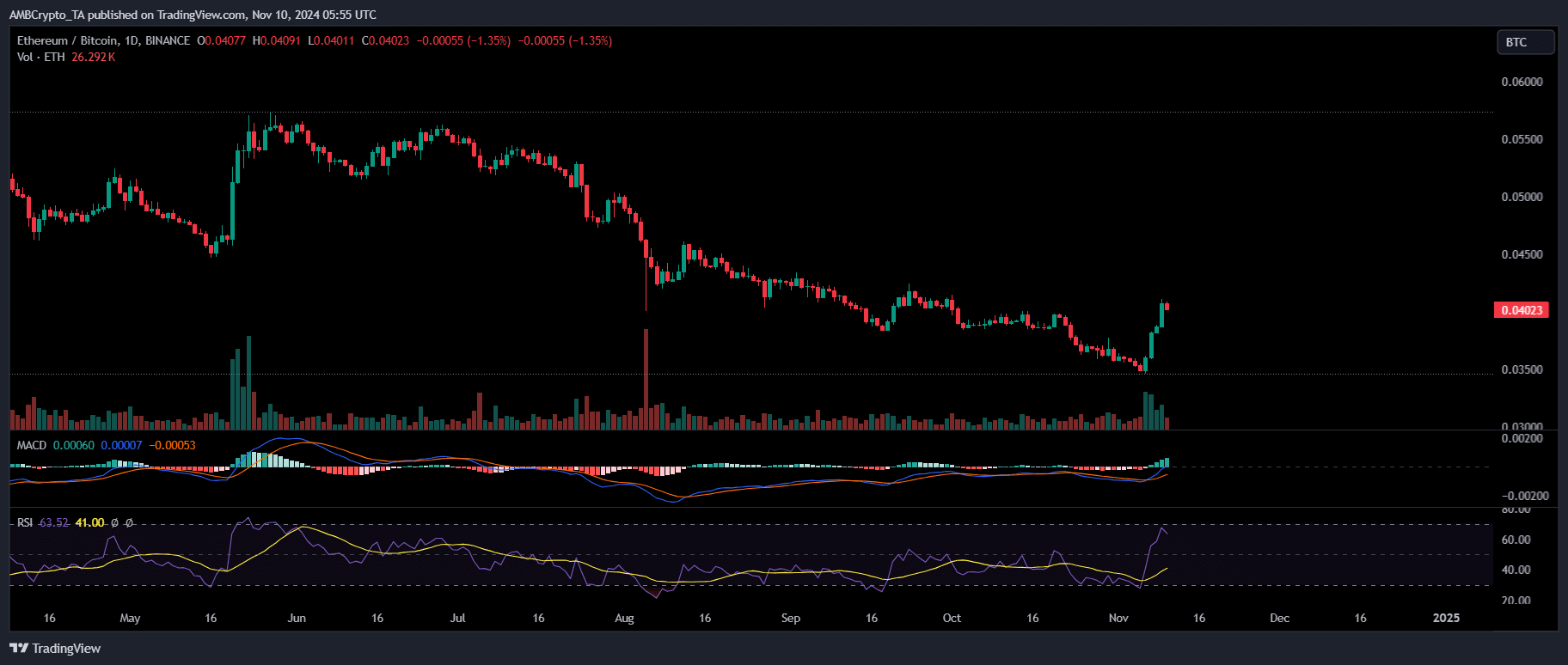

Source : TradingView

After six months of persistent decline, Ethereum showed a strong lead compared to Bitcoin. The last instance of this occurrence was marked by an impressive daily increase for Ethereum, indicating a jump of approximately 20% within just one day.

In a similar vein, recently, a significant influx of funds from Bitcoin has contributed significantly to Ethereum surpassing the $3,000 mark.

Yet, this transition may indicate a greater autonomy for Ethereum vis-a-vis Bitcoin, potentially shaping them as separate investment entities within the marketplace.

There is sufficient evidence to back this notion

Initially, it’s worth noting that Ethereum’s weekly growth has nearly doubled compared to Bitcoin, climbing an impressive 30%. This significant increase is being fueled by substantial investments in ETH Exchange Traded Funds (ETFs), showing double-digit growth.

As a seasoned crypto investor with over a decade of experience, I can confidently say that the recent surge in capital influx into ETH ETFs is indeed a game-changer. Having closely monitored the market since their launch four months ago, I have to admit that the initial impact on ETH’s price was minimal. However, this latest development suggests a significant shift in investor sentiment towards Ethereum, which could potentially drive up its value substantially. This is an exciting time for crypto enthusiasts like me, as we watch the market evolve and adapt to new opportunities.

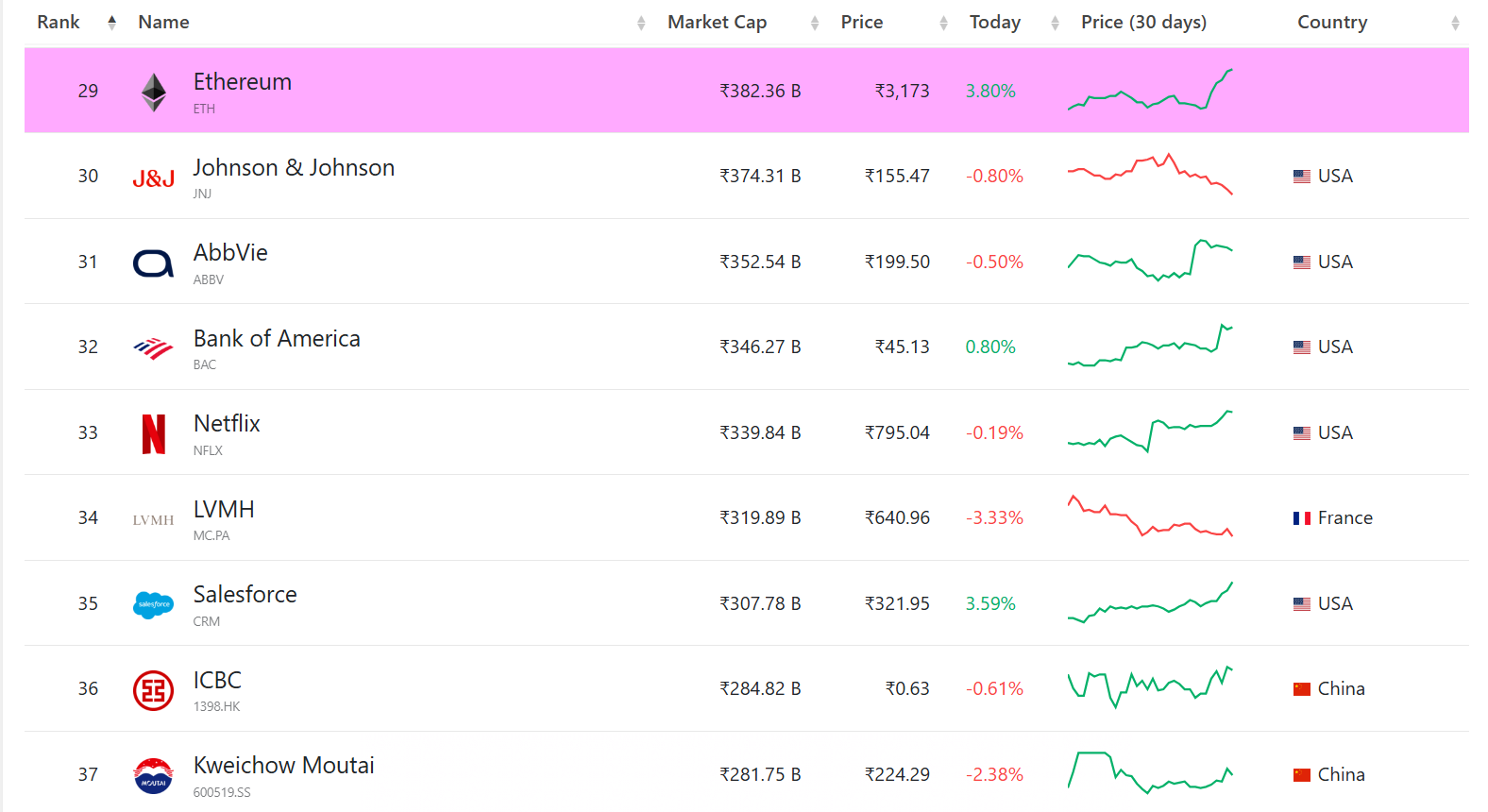

Indeed, this latest increase indicates a change, pushing Ethereum once again among the top 30 most valued assets globally, boasting a market capitalization of approximately $382.36 billion.

Source : CompaniesMarketCap

The increasing number of organizations endorsing Ethereum indicates a strengthening belief in its future value. This institutional endorsement plays a vital role in counteracting immediate pressures that might otherwise cause ETH prices to fall.

As an analyst, I’ve observed that the label “Ethereum killer” for Solana seems to hold some truth. Over the recent market cycle, Solana has managed to draw substantial liquidity from Bitcoin and consistently trades above $200, indicating its growing significance in the crypto space.

This event sparked a lot of discussion in the market, leaving analysts questioning whether a transition might be happening, as Ethereum could be yielding to its competitor.

As a researcher observing the cryptocurrency landscape, I’ve noticed that while Solana currently outshines Ethereum in multiple aspects, Ethereum’s 7-day performance in crucial metrics has been remarkably robust.

Compared to Solana, Ethereum’s weekly revenue has surged by 250% while its daily transactions have grown by 10%, significantly outperforming Solana’s 67% and 3% respectively. This demonstrates Ethereum’s strength and resilience in the market.

Consequently, the current bull market has significantly transformed Ethereum. Although it could encounter some resistance at certain levels and potentially move sideways, the upward trend has undoubtedly enhanced its prospects for the long run.

In simple terms, Ethereum appears ready to make a significant jump, possibly reaching beyond the $3,500 threshold in the coming days.

Read More

2024-11-10 15:04