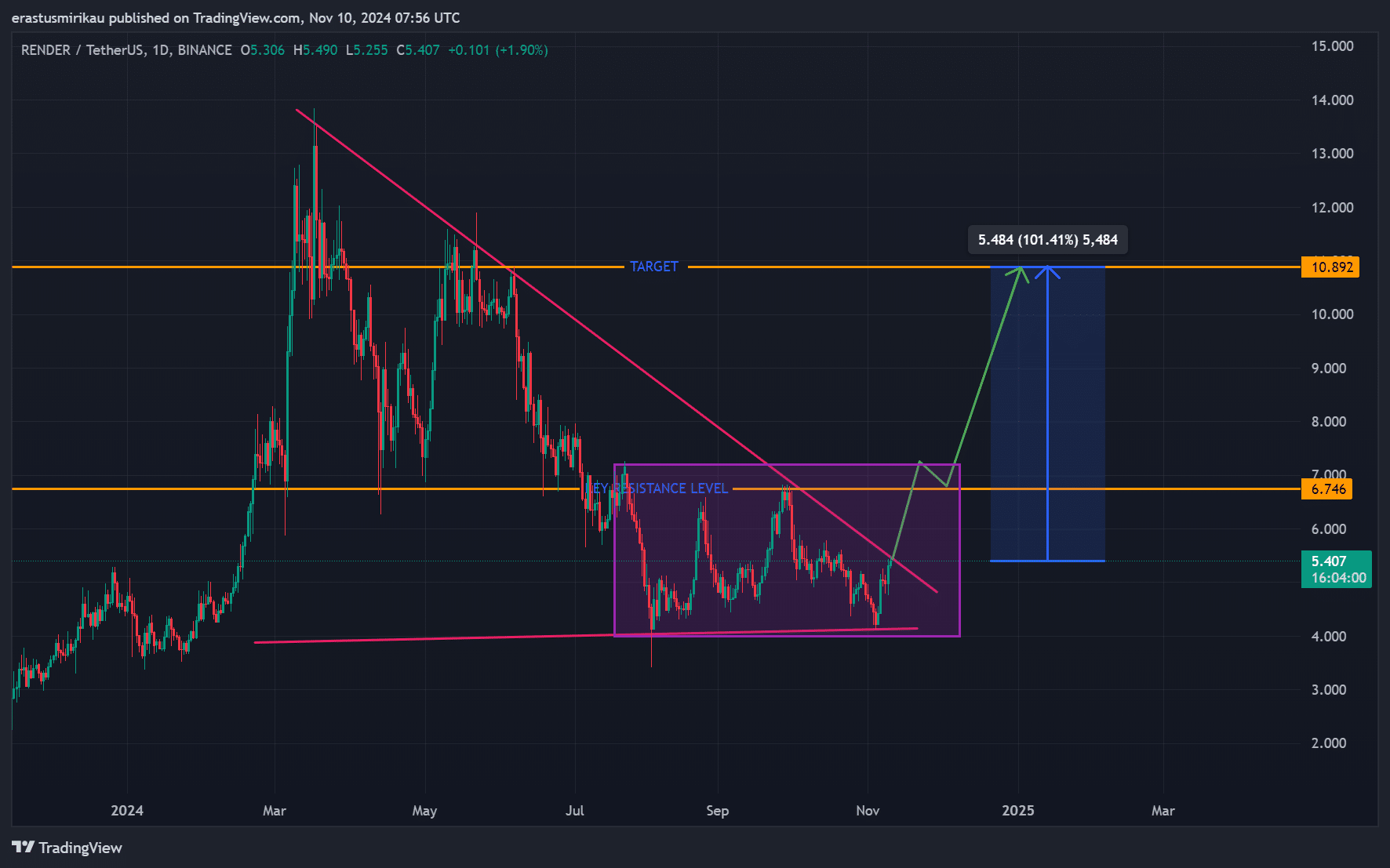

- A bullish pennant pattern and key resistance at $6.75 indicated potential upward momentum.

- On-chain data showed cautious optimism, with high NVT signaling strong speculative interest.

As a seasoned crypto investor with scars from the 2017 bull run etched into my memory, I find myself intrigued by the current state of RNDR. The bullish pennant pattern and the cautious optimism shown by on-chain data have me keeping a watchful eye on this coin.

As an analyst, I find myself observing RNDR at a pivotal moment, striving to break away from a prolonged slump and leverage the potential of a positive trend surge.

Currently, RNDR is being bought and sold for $5.41, representing an increase of 6.16% over the previous 24 hours. This surge, along with a bullish pattern called a pennant formation, might propel RNDR above its significant barrier at $6.75.

If it proves successful, RNDR could potentially reach between $10 and $15. But the question is whether this upward trend will persist, or if strong resistance will prevent further progress.

Is RNDR primed for a breakout?

Recently, RNDR has been confined within a specific pattern, with boundaries set by a downward sloping trendline and a horizontal floor around the $4.10 mark acting as a base of support.

This configuration is shaping up as a bullish pennant structure, which typically signals an upcoming robust increase. For now, the $6.75 barrier stands as the immediate obstacle.

If RNDR experiences a breakthrough at its current stage, it would substantiate the existing pattern, potentially leading to significant growth. The optimal objective for a successful breakthrough is set at approximately $10.89, which represents a potential increase of more than 100%.

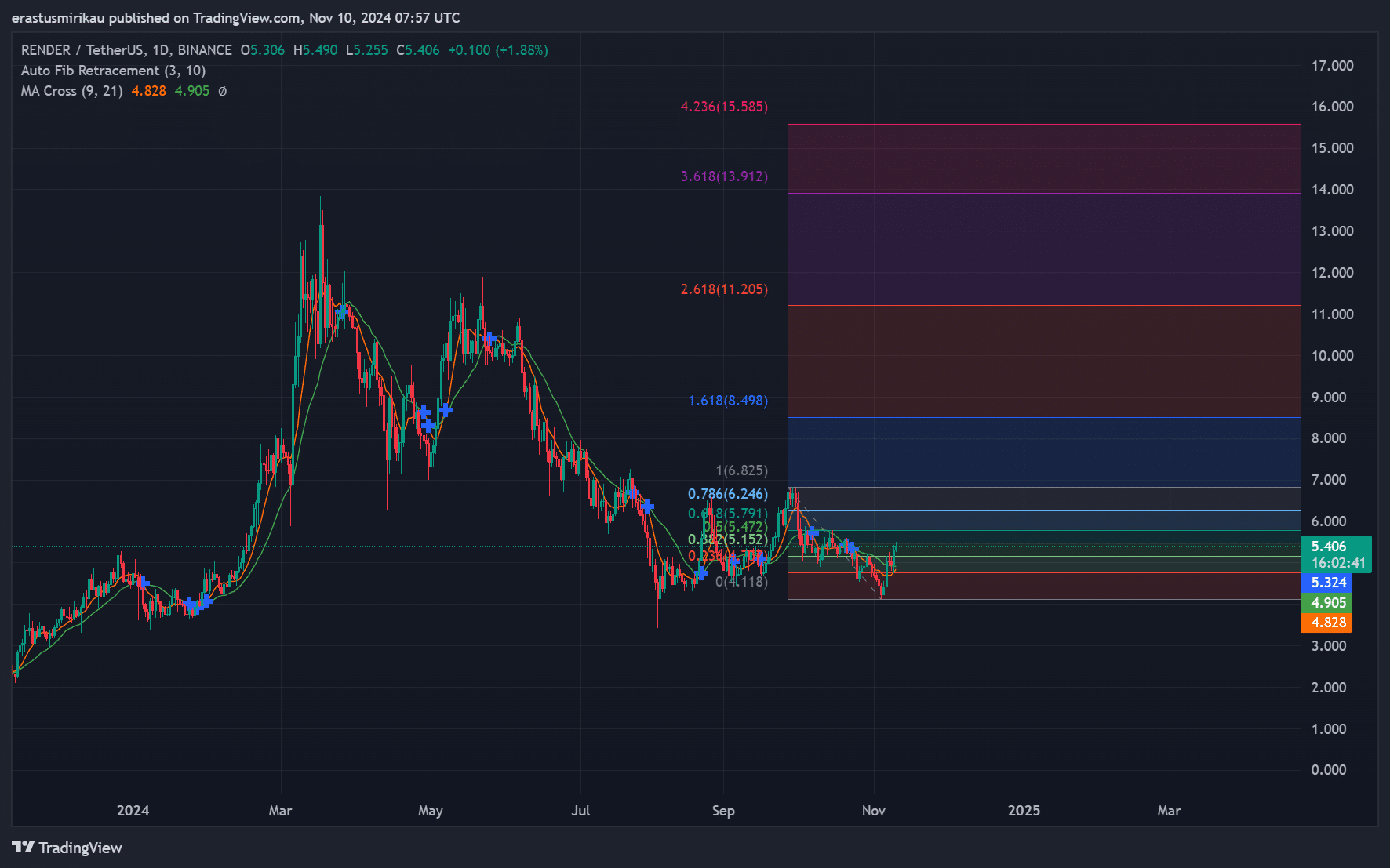

As a crypto investor, I’ve noticed an exciting development: the convergence of the 9-day and 21-day moving averages is indicating a potential surge in short-term optimism for the market.

This blend tends to occur before upward price increases, implying that traders might keep on amassing holdings.

In simpler terms, when we consider the pattern of this moving average together with increasing trading volume, it makes the forecast for RNDR more optimistic, suggesting a potential breakout could happen if positive trends continue.

Fibonacci retracement levels offer valuable perspective on potential price movements. The 0.786 level near $6.24 shares a strong similarity with the crucial $6.75 resistance point, making it more noteworthy and significant.

Consequently, going beyond the current price level might push RNDR prices up to reach potential Fibonacci levels, with possible milestones at $8.49, $11.20, or even as high as $15.58.

Mixed signals but a bullish lean

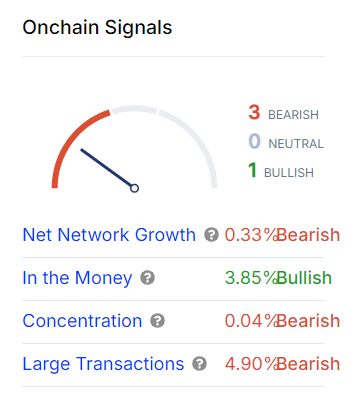

On-chain indicators provide a detailed perspective. The Net Network Growth, specifically, demonstrated a slight decrease of approximately 0.33%, suggesting that there’s been relatively little new participation from users.

Nevertheless, the “In the Money” indicator showed that about 3.85% of investors were profiting from their investments. This could indicate that certain investors are experiencing profits, which might motivate them to continue holding onto their investments, as they expect more value growth in the future.

Conversely, large transactions have decreased by 4.9%, indicating caution among major holders.

Consequently, though on-chain information indicates a blend of attitudes, the general inclination tilts somewhat towards optimism since an increasing number of investors find themselves in advantageous positions, which strengthens their desire to hold.

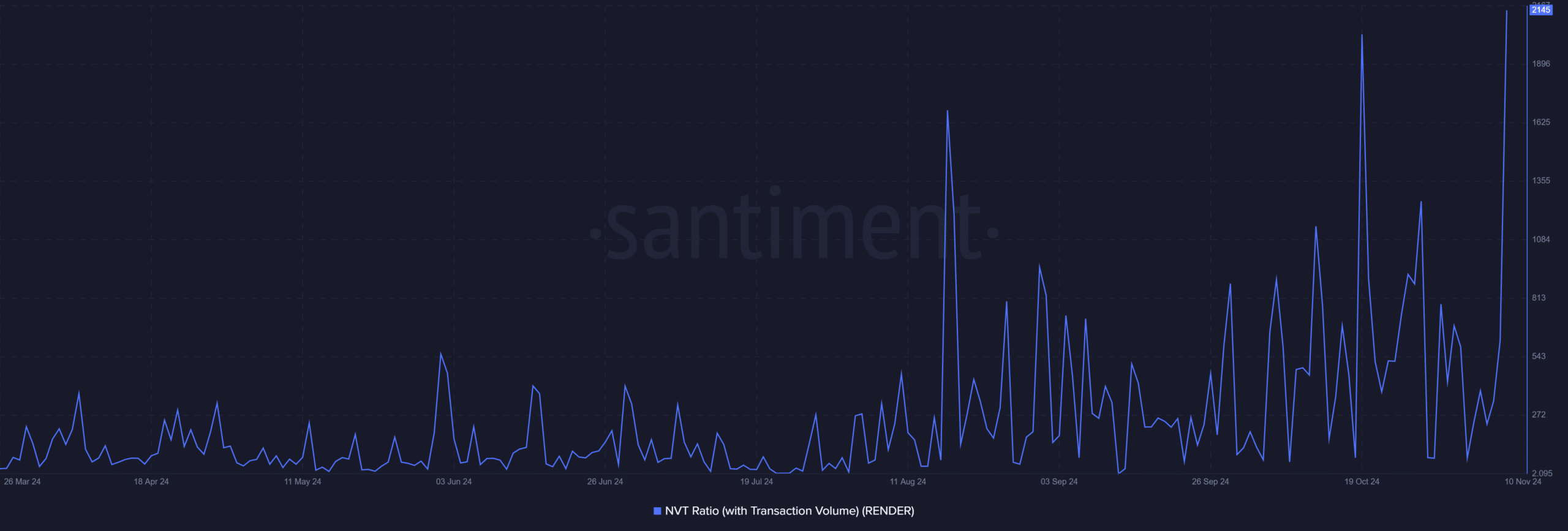

RNDR NVT ratio signals speculative interest

The Render’s NVT (Network Value to Transactions) ratio, currently at 2145.55, suggests a possible overvaluation compared to the volume of transactions being conducted.

In rising market conditions, a higher NVT ratio may indicate speculative activity, hinting that traders anticipate price growth.

As a researcher, I find that high Non-Volatile Tokens (NVT) might warrant a note of caution due to potential overvaluation. However, these elevated levels could also suggest robust investor confidence in future price appreciation, as they seem to be betting on continued growth.

In summary, the technical structure of Render Token seems to suggest a likely breakthrough above the $6.75 barrier, which could lead to reaching new peak levels for RNDR.

Read Render’s [RNDR] Price Prediction 2024–2025

As an analyst, I’m observing a somewhat ambiguous on-chain picture, but the bullish pennant formation and current market momentum have me optimistic about potential future gains. If this developing breakout transpires, we could be heading towards midterm objectives of $10 and potentially beyond.

Keep an eye on this particular level, because if it’s surpassed significantly, it could signal the start of the next rise in RNDR’s price trend.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-10 23:04