- Bitcoin at $80K means higher stakes, setting the stage for massive market volatility.

- Now, more than ever, it’s crucial for whales to act.

As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride for the past decade, I can confidently say that we are standing at the edge of a precipice with Bitcoin teetering around $80K. The current market conditions remind me of a game of Jenga – one wrong move, and it all comes tumbling down.

With excitement mounting about Donald Trump’s potential future actions on the cryptocurrency market, Bitcoin [BTC] has seen an enormous spike in enthusiasm, propelling it near the $80K mark.

Despite not having reached an excessively risky stage at present, the market’s inherent high-risk characteristics may discourage certain investors from participating.

Investment expert Robert Kiyosaki stresses the importance of steering clear from hopeful assumptions and sticking to solid investment strategies, irrespective of the prevailing market price.

Meanwhile, another reputable analyst has voiced concerns as Bitcoin nears a significant price level in its history.

Under these challenging circumstances, AMBCrypto has examined the current market patterns and determined that an unseen factor could be crucial in preventing Bitcoin from experiencing a possible reversal.

The market is primed for volatility

During the latest presidential election, I observed that it required approximately two months of fluctuating market behavior before Bitcoin surpassed the $40K mark for the first time. Along the journey, there were discernible dips in its value.

Yet, it’s worth noting that the recent trend shows more frequent green candlesticks for the last five days. Nevertheless, it’s crucial to consider the significant value Bitcoin currently holds, as this factor adds greater importance to the situation.

As the price inches closer to $80,000, the risks have increased, and even a slight downturn might provoke notable market fluctuations.

One factor fueling this uncertainty is the high leverage ratio in perpetual trades, as highlighted by another AMBCrypto report, making BTC vulnerable to sudden swings.

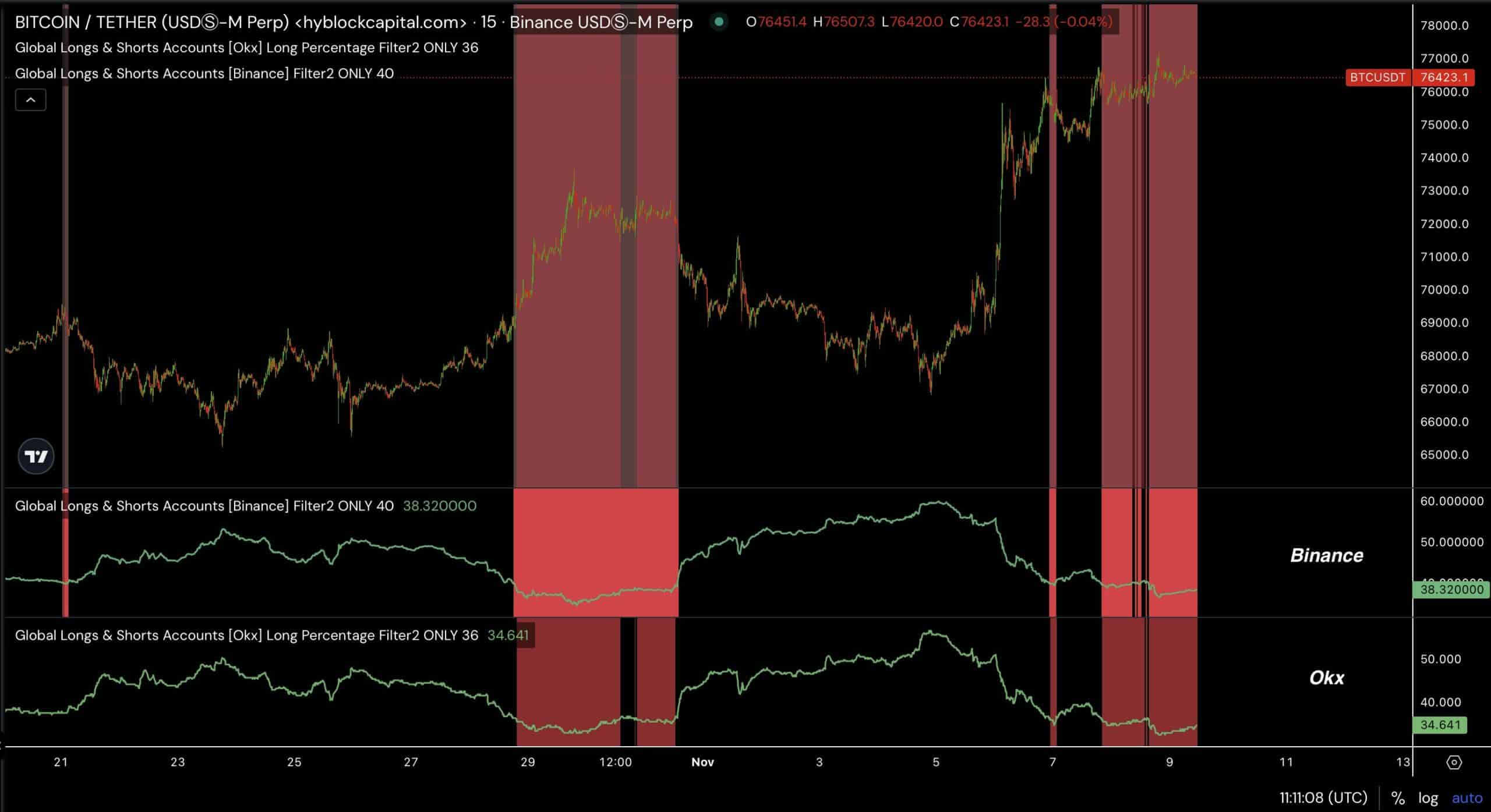

Source : HyblockCapital

At present, a significant portion of the market fluctuations can be attributed to transactions happening on prominent exchanges such as Binance and OKX.

There’s been a noticeable decrease in the number of traders who are going long, whereas short positions are becoming more popular again. This situation could lead to a possible ‘short-squeeze’.

In a similar fashion to the time around late October, Bitcoin experienced a rise to approximately $72,000, followed by a drop down to about $67,000 within a short span of time, as depicted in the chart above.

Furthermore, as the election season approached, there was an influx of investors who bought Bitcoin, causing approximately $371 million worth of short positions to be closed abruptly.

As a researcher examining these extended positions, it’s crucial to consider potential risks that may arise. If the fear of missing out (FOMO) subsides or buying interest wanes, there could be an increased chance of market saturation – a situation often referred to as ‘overheating’. This risk is particularly pronounced when the Relative Strength Index (RSI) remains in overbought territory. Consequently, it’s essential to stay vigilant and prepare for potential adjustments in strategy.

Bitcoin needs a catalyst to absorb the pressure

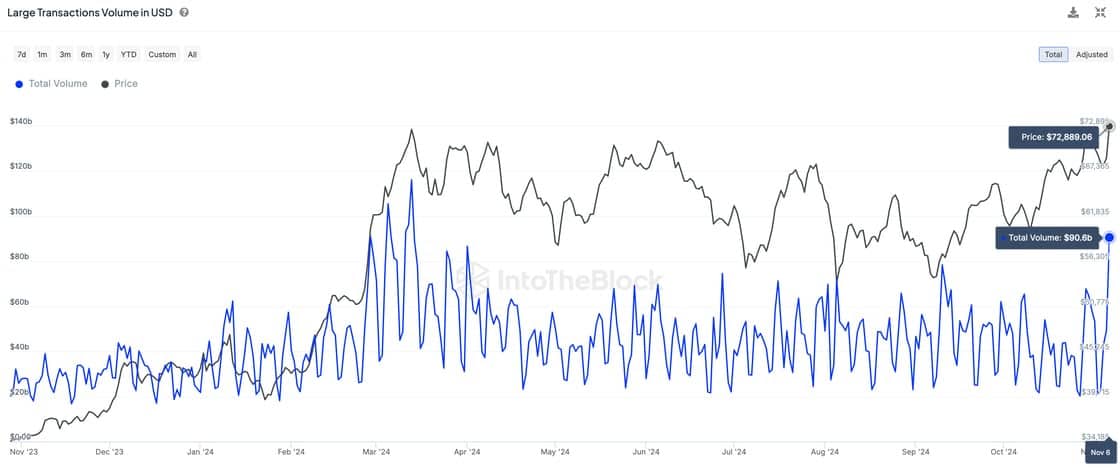

After the election, there was an increase in significant Bitcoin transactions, peaking at around $90 billion, which suggests a rise in whale activity. Given the current price, their opinion about it being the ideal time to enter the market has become particularly important.

Source : IntoTheBlock

According to AMBCrypto’s chart interpretation, the ongoing accumulation by large investors resembles the situation in March, where Bitcoin reached its all-time high (ATH) of $73,000.

Yet, that high point was subsequently met with a dip, influenced in part by fluctuations in the futures markets, as previously mentioned.

To maintain Bitcoin’s price above $80K, strong backing by significant investors (HODLers) is crucial. Keep an eye on this key factor in the upcoming days.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Overall, Bitcoin remains bullish, with a potential short-term surge above $80K.

However, as volatility rises and more traders take on short positions, the consistent buying by large investors (whales) becomes essential for counteracting the pressure and sustaining a sense of security in the market, particularly given the significant implications at play.

Read More

- Gold Rate Forecast

- Masters Toronto 2025: Everything You Need to Know

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- PI PREDICTION. PI cryptocurrency

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

2024-11-11 00:08