- Cronos breaks out of a descending channel, targeting a 50% upside if momentum holds.

- On-chain activity and cautious market sentiment support CRO’s current bullish trend.

As a seasoned researcher with years of market analysis under my belt, I find myself increasingly intrigued by Cronos (CRO). The past 24 hours have seen a remarkable surge, with CRO breaking out of a prolonged descending channel and showing no signs of slowing down.

In the last 24 hours, Cronos (CRO) has drawn considerable interest as it soared by 25%, currently trading at $0.137 per token when the news was released.

Boasting a market capitalization of $3.64 billion, an 8.12% surge, and a staggering 62% rise in 24-hour trading volume, CRO’s bullish run has ignited interest across the financial landscape. Yet, the debate persists: will CRO maintain its upward trajectory and keep climbing higher?

Breakout from a massive descending channel: What’s the next target?

Lately, CRO has burst free from a long-standing falling trendline, a pattern often indicative of an upcoming change in bearish market conditions. This liberation, evident on the graph, implies that the downward force might be easing off, potentially paving the way for an optimistic turnaround.

In simpler terms, if the trend continues for this breakout, the next significant level to watch out for is approximately $0.204. This level holds great importance psychologically and reaching it would represent an impressive potential increase of about 48% from its current value.

Achieving this goal depends on consistent purchasing activity and growing impetus. Consequently, whether the surge persists or falters greatly hinges on CRO’s capacity to surpass and maintain positions above close resistance points.

CRO technical indicators point to further volatility

Technical signs reinforce the positive trend for CRO, as evidenced by a recent moving average (MA) crossover. Specifically, the 9-day MA currently at $0.0964 has crossed above the 21-day MA, which is now at $0.0838. This crossing indicates a change in momentum, suggesting that buyers are increasingly dominating the market.

Furthermore, the Average True Range (ATR) has dramatically increased to 0.0103, indicating a surge in market volatility. Such a rise in ATR may lead to substantial price fluctuations in CRO over the next few days. Therefore, it’s crucial for traders to pay close attention to support and resistance levels.

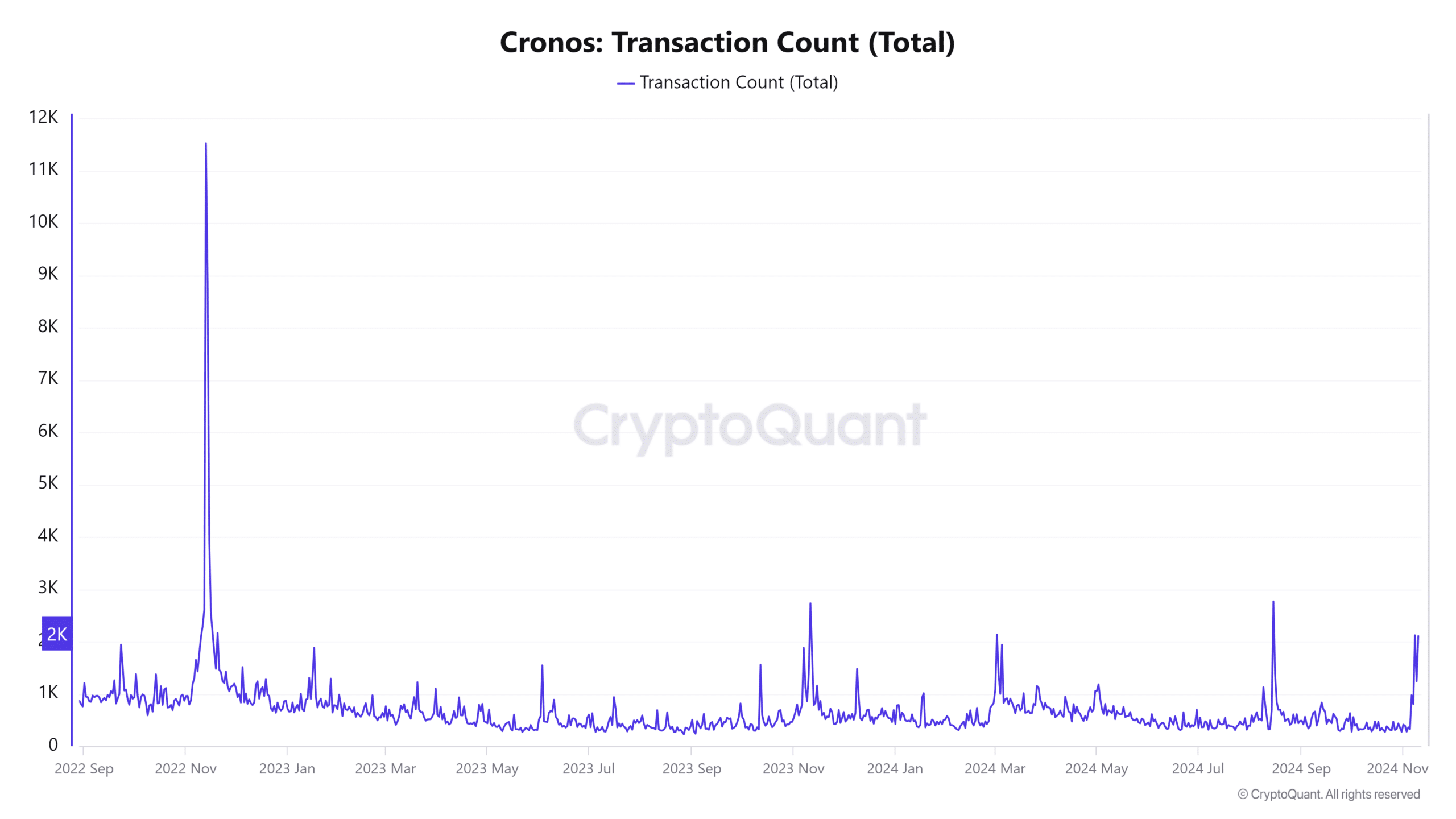

On-chain metrics show rising engagement

According to CryptoQuant’s analysis, there’s been a boost in network activity for CRO, which supports a bullish perspective. In the last 24 hours, the number of active addresses has risen by approximately 1.44%, and transaction counts have increased by 1.47%. This now totals around 2,317,000 transactions.

The increase in network activity suggests a higher level of interaction within the CRO ecosystem, indicating increased trust and involvement from both users and investors, which points to growth.

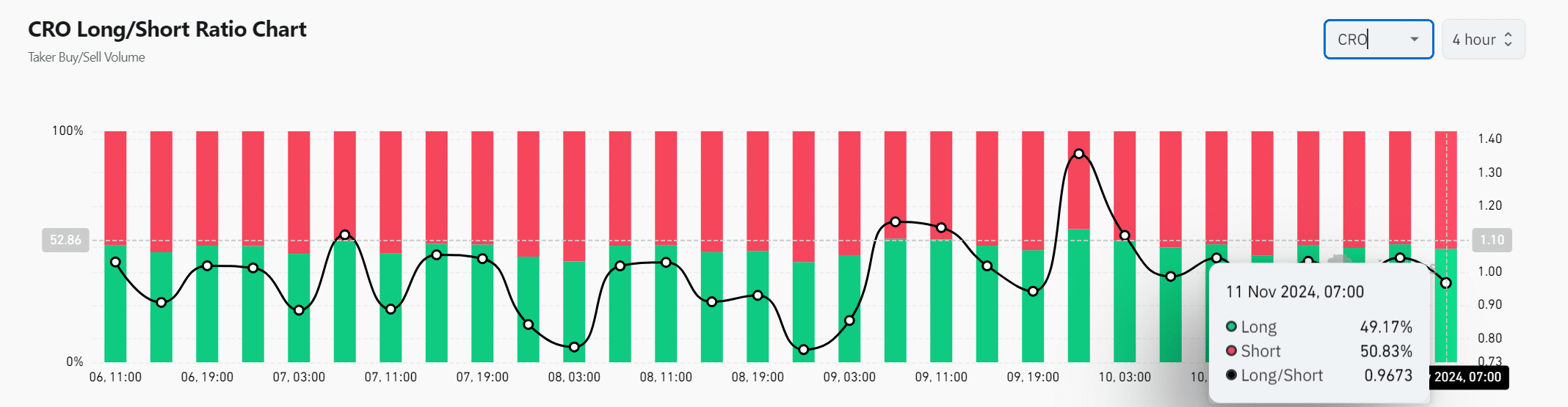

Market sentiment: Long/short ratio indicates cautious optimism

The balance between long and short positions, as represented by the long/short ratio, is nearly equal at present, with 49.17% of trades being long and 50.83% being short. This equilibrium indicates a cautious optimism among traders, leaning slightly towards bearish sentiments, which suggests that they are uncertain about the longevity of the current market rally.

However, a shift in sentiment could quickly fuel further gains if the ratio begins favoring longs.

Can CRO maintain its upward momentum?

Showing strong signs of upward momentum after breaking out from a downward trendline (descending channel), supported by favorable technical signals, increasing network activity, and a generally cautious market atmosphere, Cronos seems poised for continued growth.

The token’s continued rise hinges on persistent buyer enthusiasm and strength at crucial resistance points.

As volatility rises, it remains to be seen if the current surge in the altcoin market will prove sustainable, with the Chief Risk Officer’s (CRO) forthcoming actions providing insights into its enduring strength within the competitive landscape of altcoins.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-11 20:08