- Ethereum’s weekly transaction volume hits $60 billion as activity surges across its network.

- 78% of Ethereum holders remain in profit amid growing usage and bullish on-chain signals.

As a seasoned crypto investor with a decade of experience under my belt, I find myself increasingly impressed by Ethereum’s [ETH] performance and potential. The recent surge in weekly transaction volume to $60 billion is nothing short of remarkable, especially considering that it’s the highest since July. This robust activity underscores the network’s resilience amidst market fluctuations and points towards a bright future for ETH.

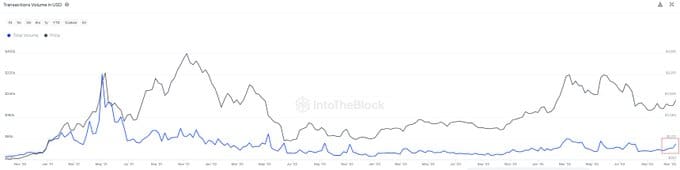

Over the past week, there was a significant surge in activity on Ethereum’s [ETH] mainnet, with approximately $60 billion worth of Ether transactions being settled. This is the highest weekly transaction volume recorded since July, suggesting an increasing interest in the network.

According to IntoTheBlock’s data, there has been a consistent increase in transaction volume on the network since the middle of 2022, a period when overall market activity decreased. Interestingly, even though Ethereum’s price is currently below its record highs, it continues to draw substantial attention and activity.

Price and volume dynamics

Historically, Ethereum’s price and transaction volume have tended to rise together due to heightened speculation. This trend continued into late 2021 and early 2022, with both metrics reaching their highest points. Yet, as the market began to shift bearish in mid-2022, so did Ethereum’s price and transaction volume.

Currently, Ethereum is being exchanged for approximately $3,178.93 per unit, and its trading volume within the last 24 hours reached an impressive $48.48 billion. Although there was a minor decrease of 0.70% in the asset’s value over the past day, it has experienced a significant increase of 28.92% over the course of the previous week.

The recent surge in transaction volume signals growing usage despite price fluctuations.

Key on-chain metrics

According to DefiLlama, the total value locked within Ethereum stands at approximately $59.327 billion. The cumulative market capitalization of stablecoins circulating on this network amounts to around $89.517 billion.

Over the past day, Ethereum handled a transaction volume of approximately $2.387 billion and received $72.74 million in deposits.

Yesterday saw a total of 391,248 active addresses, and an additional 64,793 new addresses came into existence. Furthermore, the network logged approximately 1.23 million transaction occurrences.

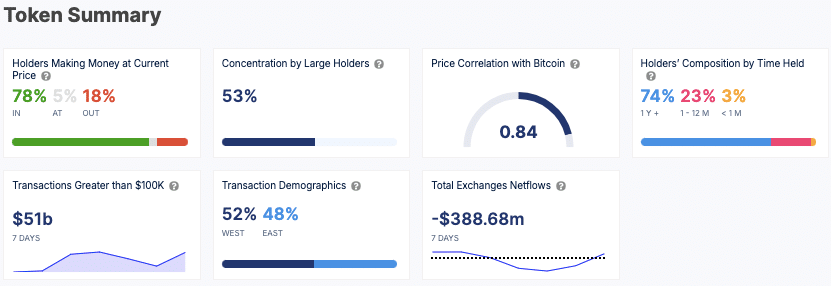

Over the last week, high-priced deals amounting to more than $100,000 collectively totaled an impressive $51 billion, indicating substantial investment from significant players.

Holder composition and market signals

1) The earnings potential of Ethereum stays robust as about three-quarters (78%) of its holders are currently making a profit. A significant portion (53%) of the total tokens are in the hands of larger investors, suggesting a high degree of wealth centralization.

This digital asset exhibits a significant relationship of 0.84 with Bitcoin, indicating that its price fluctuations tend to mirror those observed in the overall cryptocurrency market.

A large number of Ethereum owners tend to be long-term investors, with approximately 74% keeping their coins for over a year. The outflow of $388.68 million in ETH from exchanges during the last week implies decreased selling pressure as more users transfer their assets into personal wallets, suggesting an increase in holding rather than selling.

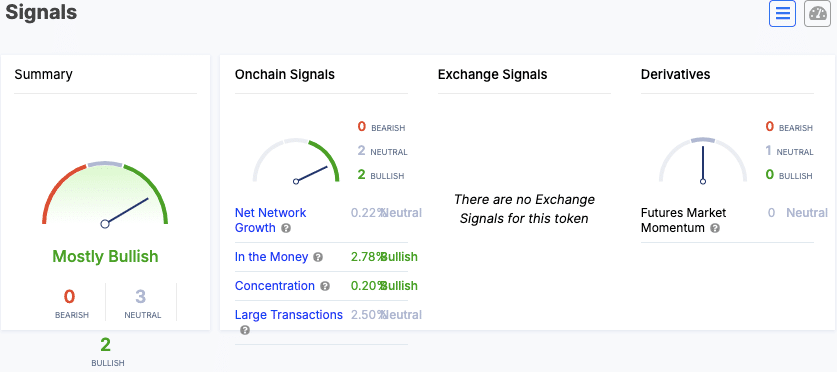

The market outlook appears largely optimistic, as key factors such as “In-the-Money” and “Concentration” exhibit favorable patterns.

Read Ethereum’s [ETH] Price Prediction 2024–2025

As an analyst, I find that our network growth and significant transactions are holding steady, neither positively nor negatively affecting the current status. Meanwhile, the trends in the futures market are similarly neutral, providing no clear indication of direction at this time.

As a crypto investor, I’m excited to see that Ethereum’s increasing transaction activity and robust on-chain statistics suggest a vibrant and interactive network – it’s clear that there’s plenty of action going on!

Read More

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- PI PREDICTION. PI cryptocurrency

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- How to Get to Frostcrag Spire in Oblivion Remastered

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- First U.S. Born Pope: Meet Pope Leo XIV Robert Prevost

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-11-12 11:08