- If the recent resistance-turned-support level holds, GOAT could build on its bullish momentum.

- Technical indicators and on-chain metrics both point to continued strength for GOAT.

As a seasoned crypto investor with battle-scarred fingers from previous market rollercoasters, I must admit that GOAT’s recent performance has caught my eye. With its impressive surge of 788.99% over the past month and an additional 66.12% in just seven days, it’s hard not to be intrigued by this meteoric rise.

Over the last month, Goatseus Maximus (GOAT) has experienced a significant increase of approximately 788.99%, and just within the last week, it has gained an additional 66.12%.

Given a 2.12% increase at the current press, the crucial query becomes whether GOAT will continue on its upward trend.

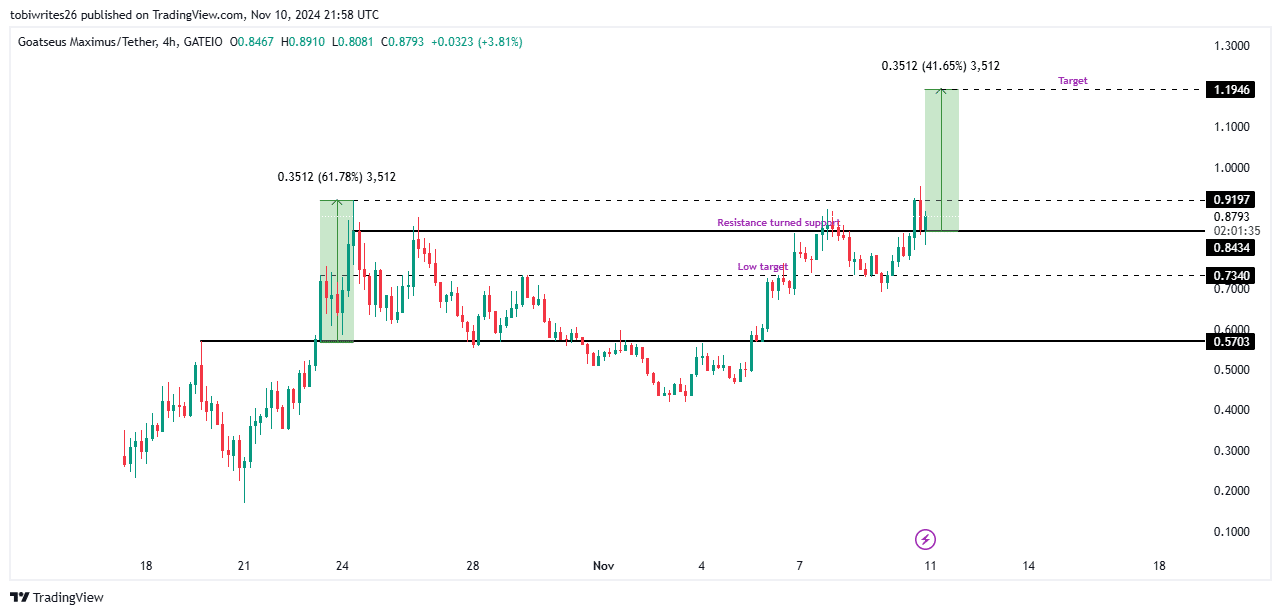

GOAT eyes potential 41.65% rally, pending key resistance break

The GOAT has reached a crucial point following its recent record-breaking peak. If the asset is to maintain its upward momentum, it needs to surpass a significant barrier at $0.8434 – a level that historically has caused declines.

Should the resistance be effectively turned into support, GOAT might experience an additional 41.65% growth, potentially hitting $1.1946 – a development reminiscent of its surge in September of last year.

If we make this shift, it’s quite probable that GOAT’s total market value will exceed one billion dollars, breaking the previous record of around 930 million dollars.

If the resistance persists and causes a decrease in price, GOAT might pull back to around $0.7340. At this level, it could potentially encounter support that would help initiate an upturn.

Upward momentum stays strong as technical indicators turn bullish

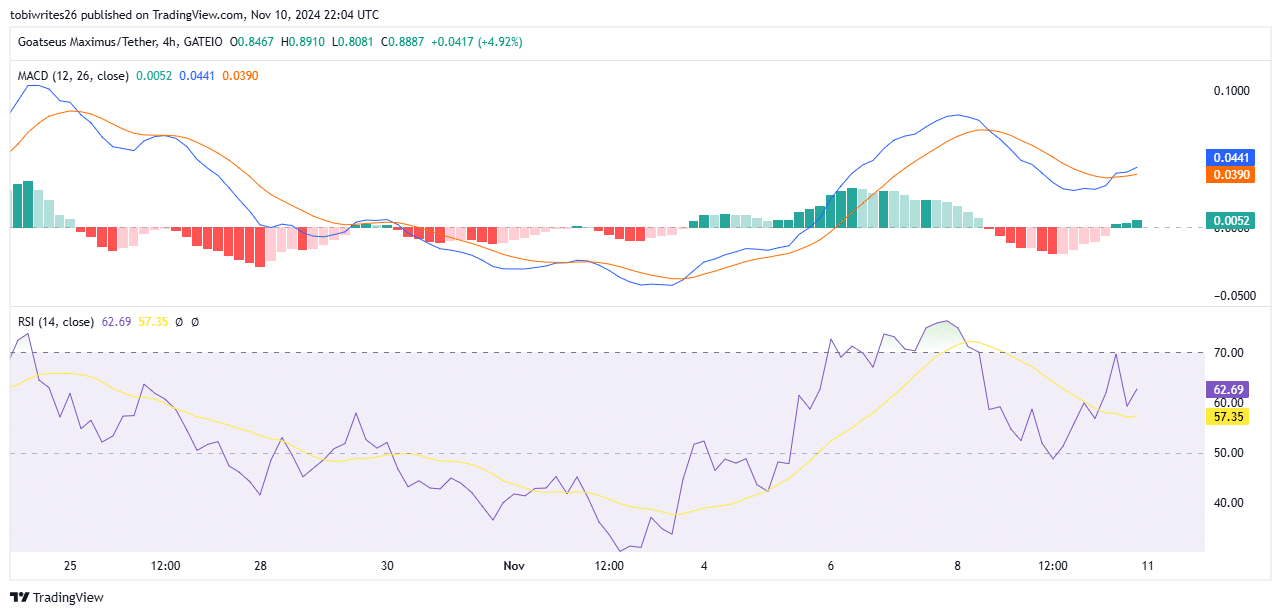

To evaluate the market’s potential direction, AMBCrypto examined the Relative Strength Indicator (RSI) and the Moving Average Convergence Divergence (MACD), both suggesting a positive or upward trend.

As an analyst, I’m observing a favorable perspective based on the Relative Strength Index (RSI) readings. At this moment, we’re looking at a reading of 62.69, which signifies robust buying activity and a strong possibility for further uptrend. This suggests that the momentum in the price is positive and potentially indicative of a sustained upward direction.

In much the same way, the MACD (Moving Average Convergence Dynamics) indicates a bullish indication when it forms a Golden Cross, which occurs when the blue MACD line moves above the orange signal line. This intersection often signifies an increase in upward movement, as it’s usually supported by growing volume and profits.

As the technical indicators signal a growing trend, the on-chain metrics offer deeper understanding about the investor mood within the market.

Additional pressure on GOAT’s market trend

Analysis of data from Coinglass shows that there’s been a 3.87% decrease in open interest for GOAT over the last 24 hours, suggesting an uptick in selling activity and more investors taking on short positions.

Right now, the Long/Short ratio stands at approximately 0.9448, indicating that there are more investors betting on a decline (bears) than those anticipating a rise (bulls) in the market. Moreover, a substantial long position liquidation worth around $2.57 million could foreshadow a possible decrease in the asset’s value.

If these trends carry on, it’s possible that GOAT might keep falling, aiming towards the potential lower support level at 0.7340.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- How to Get to Frostcrag Spire in Oblivion Remastered

2024-11-12 13:13