- Bitcoin’s price surged following Donald Trump’s presidential win, nearing the $90,000 milestone.

- BlackRock’s Bitcoin ETF and crypto stocks reached record trading volumes amid Bitcoin’s rally.

As a seasoned researcher who has witnessed the crypto market’s ebb and flow for years, I can confidently say that we are currently experiencing one of the most fascinating periods in Bitcoin’s history. Trump’s presidential win seems to have ignited a bullish phase that could potentially push BTC to unprecedented heights. The surge in trading volumes for Bitcoin ETFs, crypto stocks like MicroStrategy and Coinbase, and even BlackRock’s spot Bitcoin ETF, is nothing short of astounding.

Bitcoin [BTC] seems to have started a bullish trend after Donald Trump’s election as the 47th U.S. President, suggesting an increase in its value.

It’s worth noting that some people were speculating about the stock market, suggesting that a Trump victory might drive Bitcoin up towards the highly anticipated price of $100,000.

Currently, Bitcoin is almost touching the $90,000 mark, and it appears that this significant level might be achievable soon. However, market experts are advising a note of caution, pointing out that the direction of future price fluctuations remains unpredictable due to persisting volatility in the market.

Apart from Bitcoin’s significant price rise, the wider cryptocurrency market is also experiencing noteworthy advancements.

Impact of Bitcoin nearing $90K

As a researcher, I’ve observed an impressive 11% surge in the price of Bitcoin within a 24-hour period on November 12th, pushing it up to $89,700. This rally has ignited increased trading activity in U.S.-based Bitcoin exchange-traded funds (ETFs), as well as notable crypto companies such as MicroStrategy Inc. (MSTR) and Coinbase Global Inc. (COIN).

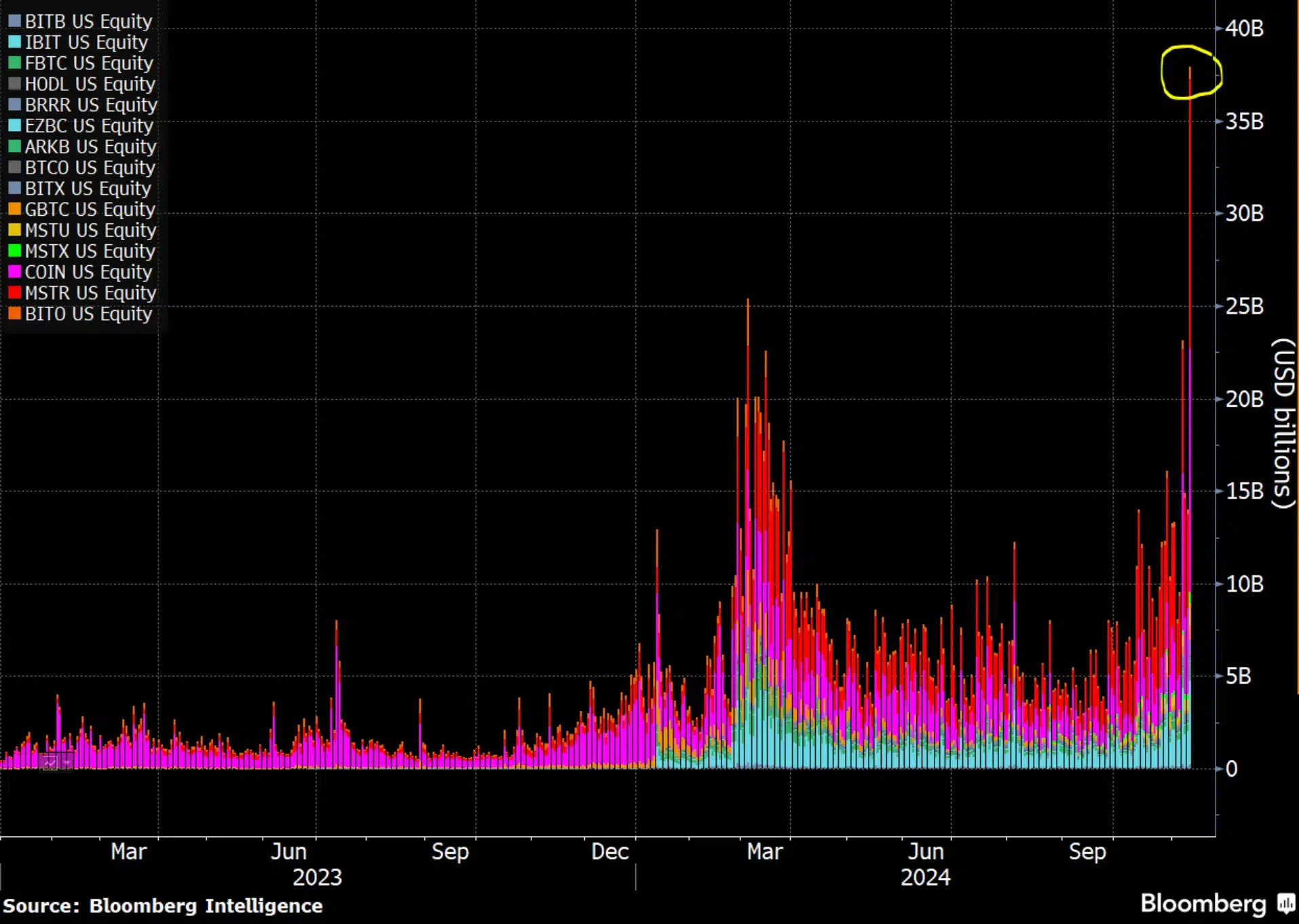

The cumulative daily trades for these assets reached an unprecedented $38 billion, marking a substantial jump compared to the prior peak of around $25 million, which was set in March.

Remarking on the same, Bloomberg Intelligence and ETF analyst Eric Balchunas said,

Today, the Bitcoin Financial Sector (ETFs, MSTR, COIN) recorded a trading volume of $38 billion, breaking numerous records. Notably, IBIT alone traded $4.5 billion, signifying a strong week for inflows. This day has been exceptionally active and could potentially be referred to as something like “Bitcoin Influxion” or “Crypto Surge Day.

Bitcoin ETF, too, sees a surge

In fact, not only traditional players such as Bitcoin ETFs, MSTR, and COIN saw an increase, but BlackRock’s spot BTC ETF also broke its own trading volume records.

A few days following Donald Trump’s victory, BlackRock’s Bitcoin ETF saw a massive surge in investments, totaling over $1.1 billion on a single day, establishing a new record.

On the 11th of November, MicroStrategy experienced a significant increase, as its stock price jumped more than 25% to reach $340. Similarly, Coinbase saw a rise almost approaching 20%, reaching an unprecedented $324.20 – marking the first time it surpassed $300 since 2021.

In the course of my recent analysis, it was particularly noteworthy to find that MSTR and COIN ranked among the top five most actively traded stocks during initial trading sessions. Remarkably, these up-and-comers outperformed industry titans such as Apple and Microsoft, a fact underscored by ETF analyst Eric Balchunas’ observations.

Community reaction and more

As an analyst, reflecting on the significant influence that followed Trump’s victory, I chimed in on Balchunas’ tweet, expressing my thoughts.

@EricBalchunas, I’m wondering what the general sentiment is on Wall Street right now. Does the data appear striking to others? It seems from a distance that the Trump administration’s influence might be causing all assets to rise.

Indeed, even though Bitcoin’s recent price increase has sparked enthusiasm, it remains unclear if Trump’s victory is the sole cause of this uptrend, or if additional factors might be contributing as well.

Consequently, it’ll be fascinating to observe whether Bitcoin’s current trend continues or if a dip is imminent in the forthcoming days as the market readjusts.

Read More

2024-11-12 15:04