- Render reclaimed the $5.2 level as support, setting up the recent move

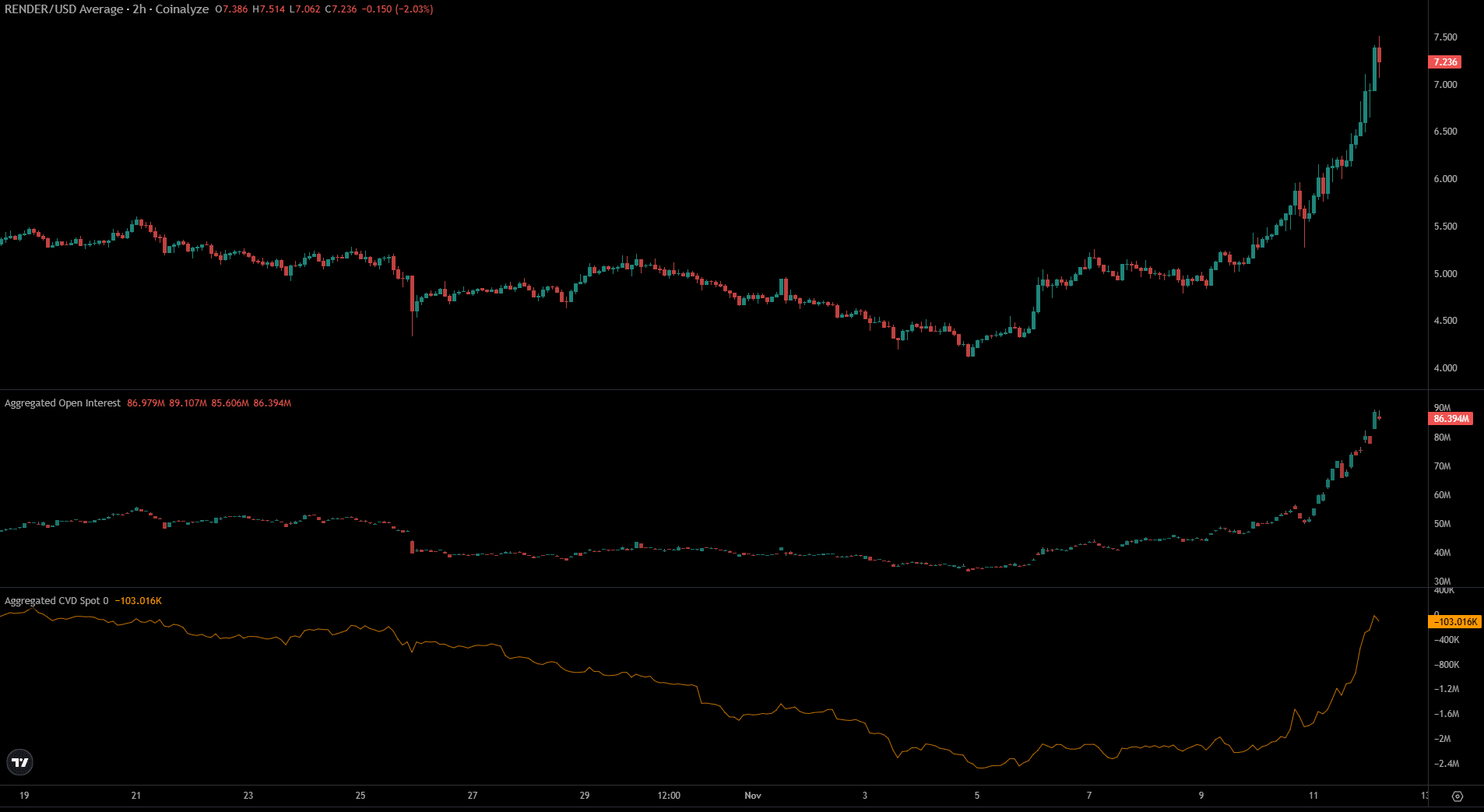

- There was strong demand for RENDER in both spot and futures markets

As a seasoned researcher with years of experience in the dynamic world of cryptocurrencies, I find myself consistently amazed by the resilience and potential of projects like Render (RENDER). The recent surge in RENDER’s price is nothing short of impressive, and it’s evident that this altcoin has a strong foundation and a dedicated community behind it.

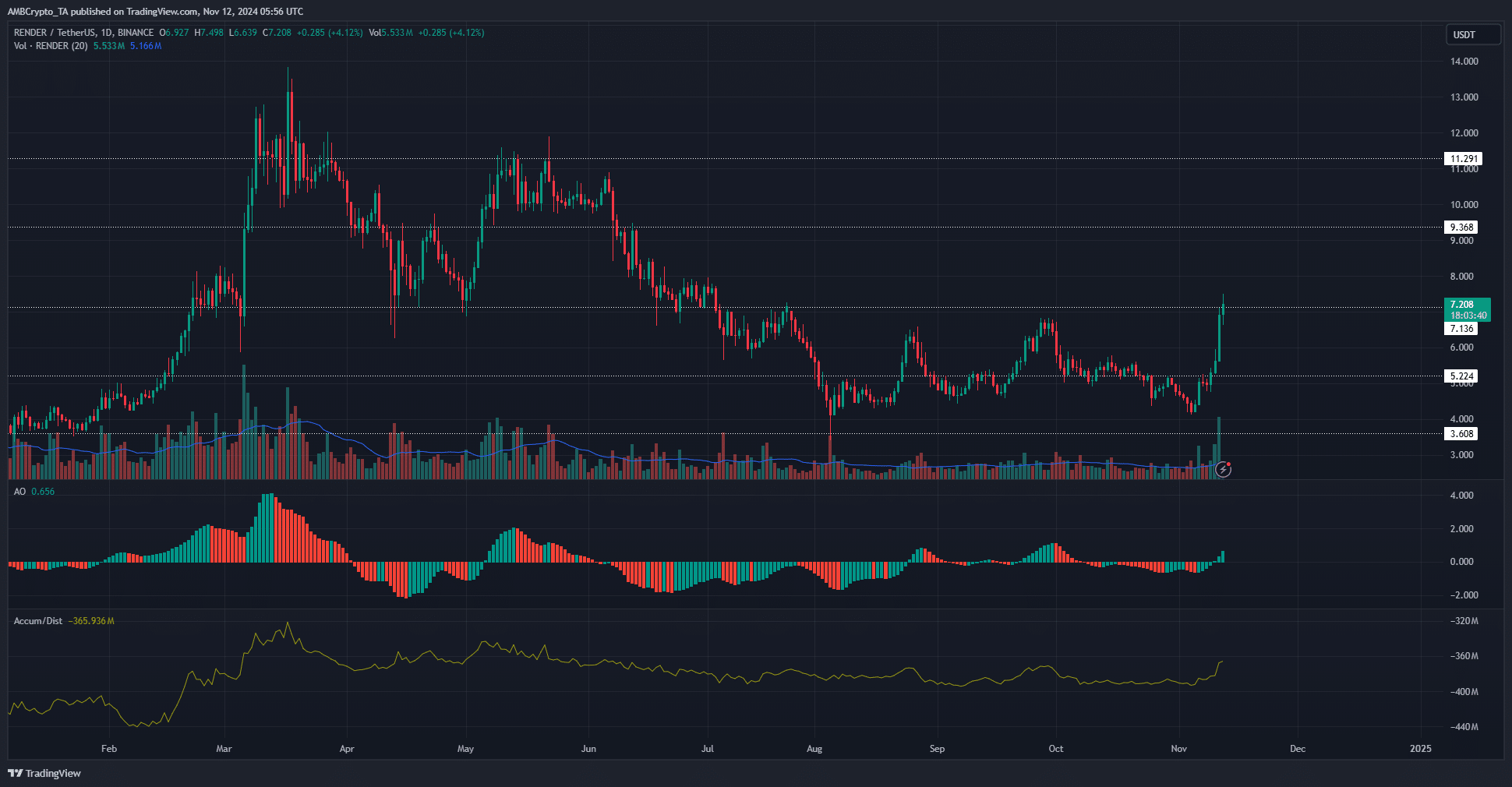

Over the weekend, the price of RENDER coin noticeably increased at an accelerated pace. Prior to breaking the significant $5.22 barrier, its growth had been relatively slow. However, once that level was breached, and the market structure turned bullish, RENDER experienced a remarkable surge of 38% in less than three days.

In simpler terms, there are two significant price levels ahead in the higher timeframe that are approximately 29% and 56% above our current market value. The token might advance towards these prices and possibly even surpass them. However, a potential drop in Bitcoin‘s [BTC] price could momentarily dampen the overall sentiment in the short term.

Render reclaims key level

Over the last four days, I’ve seen my token soar to new heights as it closed a daily trading session above $5.22. Since then, it has surged an impressive 38.5%, and as I write this, it’s up by a staggering 78.17% from its low on the 4th of November.

In simpler terms, a few days following the market’s shift towards optimism, the Awesome Oscillator signaled a positive trend by crossing over. Meanwhile, the A/D Indicator started to ascend, indicating an increase in demand from buyers.

Despite the token’s efforts to break through the resistance between $6.6 and $6.85, the Accumulation/Distribution (A/D) line has remained relatively stable. This suggests that during the last few months, there might not have been significant buyer confidence, as indicated by weak accumulation.

With RENDER poised to surpass the $7.13 mark, investors may find it appealing given its robust track record. Potential obstacles lie ahead at $9.36 and $11.3 as these levels could act as strong resistance points.

Strong demand spotted in the lower timeframes

Over the last seven days, we’ve witnessed remarkable progress, which was characterized by a significant increase in Open Interest and the spot Contracts for Verification (CVD). Specifically, the Open Interest surged from $43.8 million to an impressive $86.4 million within just three days.

Is your portfolio green? Check the Render Profit Calculator

As a researcher, I observed a remarkable turnaround in the Cardiovascular Disease (CVD) sector around early November. After initially declining, it started to level off and then surged higher as the overall market sentiment shifted towards greed. Looking ahead, it seems plausible that we could witness further gains for CVD in the forthcoming weeks.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Solana – Long or short? Here’s the position SOL traders are taking

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

2024-11-12 16:07