- Optimism may surge 340% as it nears a breakout from a bullish ascending triangle.

- On-chain data revealed growing adoption and reduced exchange inflows, fueling bullish momentum.

As a seasoned crypto investor with a knack for spotting promising altcoins, I find myself increasingly optimistic about Optimism (OP). With its bullish ascending triangle nearing a breakout, I am eagerly anticipating another potential 340% surge – a trend that has been consistent in OP’s past performance.

Over the last five months, OP has been finding it challenging to move beyond the $2 barrier, repeatedly getting stuck in a horizontal pattern.

Even during the consolidation period, crypto analyst Ali posits that this trend has shaped into an ascending triangle structure, which historically indicates a bullish outlook.

This setup could pave the way for a rally toward the projected Fibonacci target.

Potential for strong gains?

Previously, optimism showed a pattern of price increase that resembles the one we’re seeing now. The initial breakout of an ascending triangle led to a significant surge in price from approximately $1.00 to a high of around $3.23, resulting in a substantial 220% profit.

A second breakout occurred near $1.06, pushing the price to $4.77, marking a 350% increase.

Currently, analysts are noticing a possible third peak at approximately $1.85. Given Optimism’s past behavior, there is potential for the price to rise towards $7.20, which aligns with the 1.618 Fibonacci retracement level.

This would represent a 340% gain from the breakout level, mirroring past performance.

Current market dynamics and price movement

Currently, the price of Optimism stands at $1.81, representing a 11.09% boost in the last 24 hours and a significant 31.03% surge during the past week.

At the moment of reporting, the 24-hour trading volume stood at about $1 billion, while the total market value was estimated to be around $2.27 billion. The number of OP tokens in circulation was approximately 1.3 billion.

Presently, Optimism’s value is nearing the $1.85 resistance point. If it manages to surpass this barrier, it would strengthen the case for an upward trend breakout from the ascending triangle formation, potentially triggering a prolonged bullish surge.

It appears that the historical trends indicate a resemblance between Optimism’s market configurations in 2022 and 2023, with each setup potentially resulting in significant price spikes.

On-chain data reflects positive sentiment

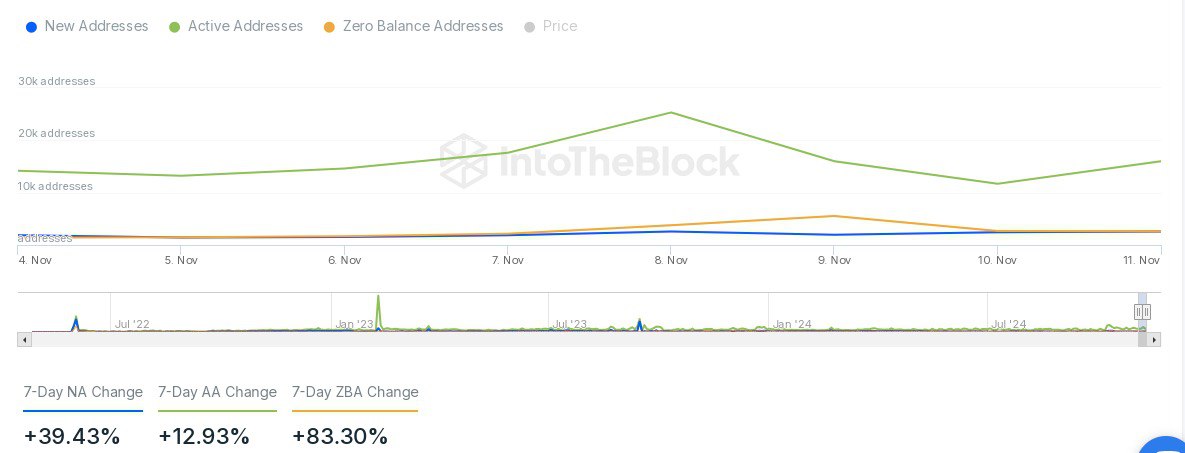

As an analyst, I’ve noticed a surge of interest in the Optimism network. Over the past week, there’s been a significant jump of nearly 40% in new accounts created. Additionally, the number of active addresses has climbed by approximately 13%, demonstrating increased engagement within the platform.

Furthermore, a rise of 83.30% in the number of zero-balance addresses implies that dormant wallets are becoming active again on the network. This trend indicates growing user involvement and acceptance.

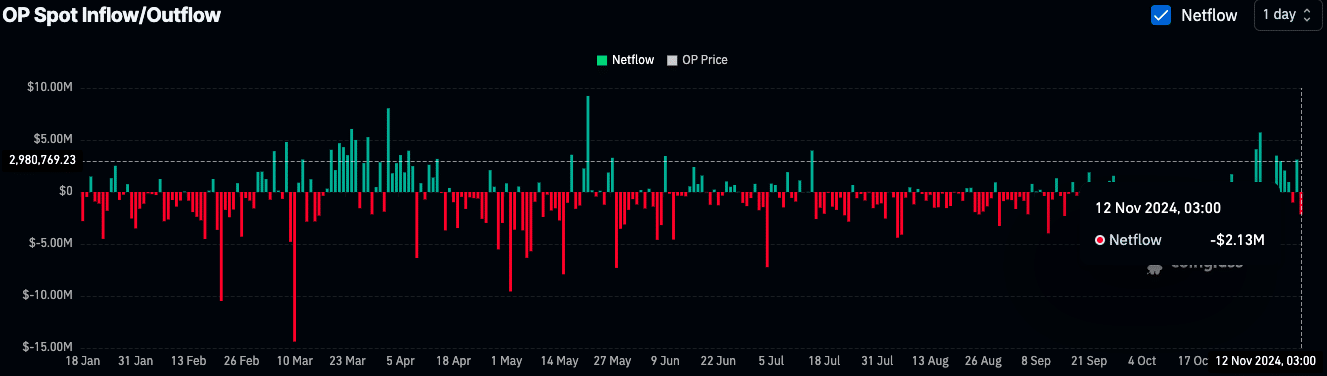

Exchange netflows also painted a bullish picture, according to Coinglass data.

12th of November saw Operator (OP) registering an outflow of approximately $2.13 million in assets, suggesting that investors might be transferring their tokens away from exchanges, possibly for long-term storage.

historically, these outflows tend to occur during periods when prices rise, suggesting a decrease in the supply available for sale.

Sustained trading activity supports growth

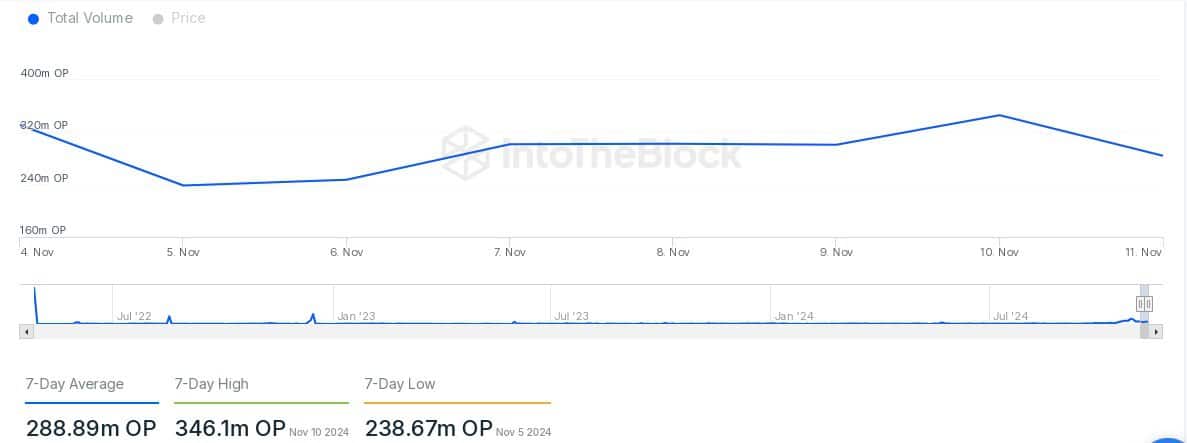

The transaction volume data adds strength to the positive perspective, as Optimism’s daily average transaction volume over the past week amounted to approximately 288.89 million OP, peaking at 346.1 million on the 10th of November.

Read Optimism’s [OP] Price Prediction 2024–2025

The lowest recorded volume was 238.67 million OP on the 5th of November.

Based on my years of experience in the financial markets, I have learned that a steady flow of trading activity is often a sign of consistent liquidity and network utility. This kind of activity can serve as a solid foundation for potential future price growth. I’ve seen it countless times in my career where this pattern has led to significant increases in value for investors who were patient and stayed the course.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Cynthia Erivo’s Grammys Ring: Engagement or Just Accessory?

2024-11-12 19:04