- Litecoin sees demand surge as Spot inflows soared to 2021 levels.

- Bullish breakout attempt resulted in heavy liquidations and extreme volatility.

As a seasoned researcher with years of experience in the cryptocurrency market, I find myself intrigued by the recent developments in Litecoin [LTC]. The surge in spot inflows and open interest to levels not seen since November 2021 is undeniably a positive sign, hinting at renewed investor interest. However, the extreme volatility witnessed recently, resulting in heavy liquidations, is a reminder that the crypto market can be as unpredictable as a roller coaster ride.

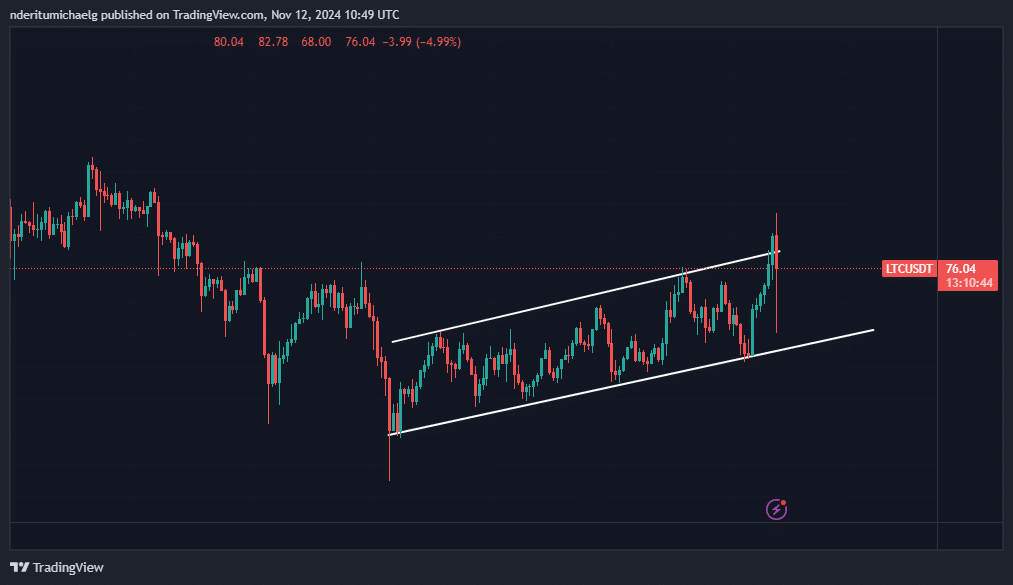

Over the past few months, Litecoin [LTC] has exhibited a pattern of gradual uptrend since August, which some might label as consolidation. Despite not being as prominent in the recent excitement over the past two months, it now appears that this could change.

This month, supporters of Litecoin have shown increased activity, yet it’s equally noteworthy that its liquidity conditions seem to be shifting as well.

Recent data shows that LTC just experienced its highest spot net inflows since November 2021.

As a crypto investor, I found last November’s peak in Litecoin’s price to be particularly noteworthy, as it coincided with the height of its bullish trend in 2021. However, this milestone might indicate that we could be on the cusp of an impressive surge for LTC.

So far, the data suggests that there is a resurgence in interest in LTC.

It has been discovered recently that more individuals are accumulating Litecoin, with a 31% increase observed in their holdings over the past month.

According to IntoTheBlock, this recent surge might indicate a significant increase in the value of cryptocurrencies, as the shift in funds within the crypto market appears to be commencing.

It wasn’t only the derivatives market that saw an increase in liquidity; data from Coinglass indicates that Litecoin’s Open Interest (OI), as reflected by Weighted Funding Rates, has reached its peak in the past six months.

This confirmed a peak in the derivatives segment.

The surge in open interest may explain LTC’s recent volatility. The cryptocurrency has been locked in a consolidation phase since August through which it moved in an ascending upward channel.

Litecoin volatility triggers surge in liquidations

Over the past day, there’s been significant market turbulence where the price has tried to burst through its established limits.

Initially, there was a false decline in price to $68, mimicking a bearish trend. However, this was quickly followed by an unexpected increase in demand, causing the price to soar and reach a peak of $82.78.

At the moment of reporting, LTC had retreated to $75.71, which is a return to the rising price channel where it’s been consolidating. However, this significant price fluctuation suggests a potential shakeout involving both short and long positions.

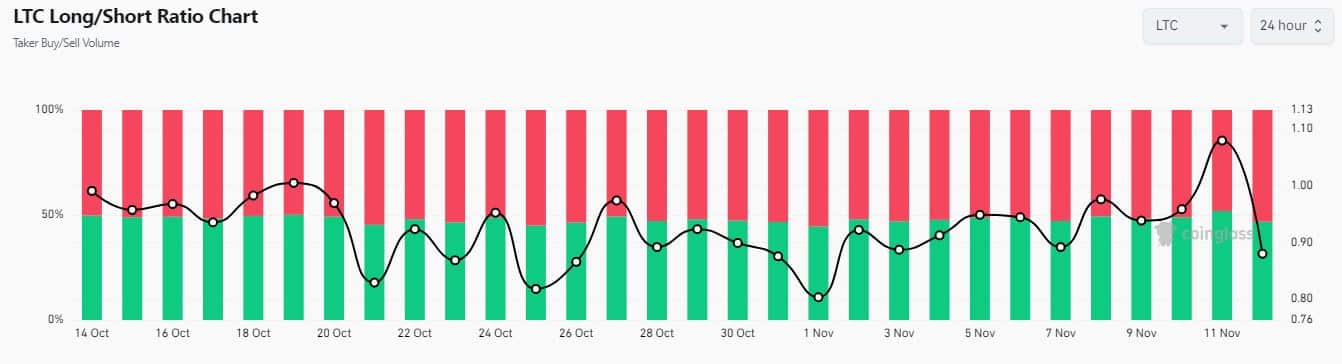

As a cryptocurrency investor, I’ve noticed that Litecoin’s price trend exhibited a robust increase in demand starting roughly from November 6th, leading to six consecutive days of positive growth.

As a result, demand for long positions has increased significantly, and as of the 11th of November, these long positions have tipped the scale.

Read Litecoin’s [LTC] Price Prediction 2024–2025

In the past day, a total of approximately 3.09 million dollars worth of Litecoin positions (long and short) were liquidated on trading platforms. Positions that were long (betting on an increase in price) accounted for around 2.04 million dollars, while those that were short (betting on a decrease in price) amounted to about 1.06 million dollars.

This result seems to indicate that the recent retreat following an attempt at a breakout might have eliminated any long positions.

Read More

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Masters Toronto 2025: Everything You Need to Know

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

2024-11-13 04:07