- Spot Ethereum ETFs have experienced five consecutive days of positive netflows.

- The short-term decline is partly driven by derivative traders taking short position.

As a seasoned researcher with years of experience navigating the tumultuous waters of the cryptocurrency market, I find myself intrigued by the recent developments surrounding Ethereum [ETH]. After closely monitoring the market, I can confidently say that the short-term decline seems to be a temporary blip on ETH’s radar.

In the last seven days, the value of Ethereum (ETH) has soared by 22.5%, peaking at $3,444.25 – a figure not reached since July 24 this year. But, it’s fallen by 6.37% since then.

Based on AMBCrypto’s assessment, it seems that the current downtrend is likely short-lived and may not significantly affect Ethereum’s future perspective.

Five-day buying streak adds to ETH bullish outlook

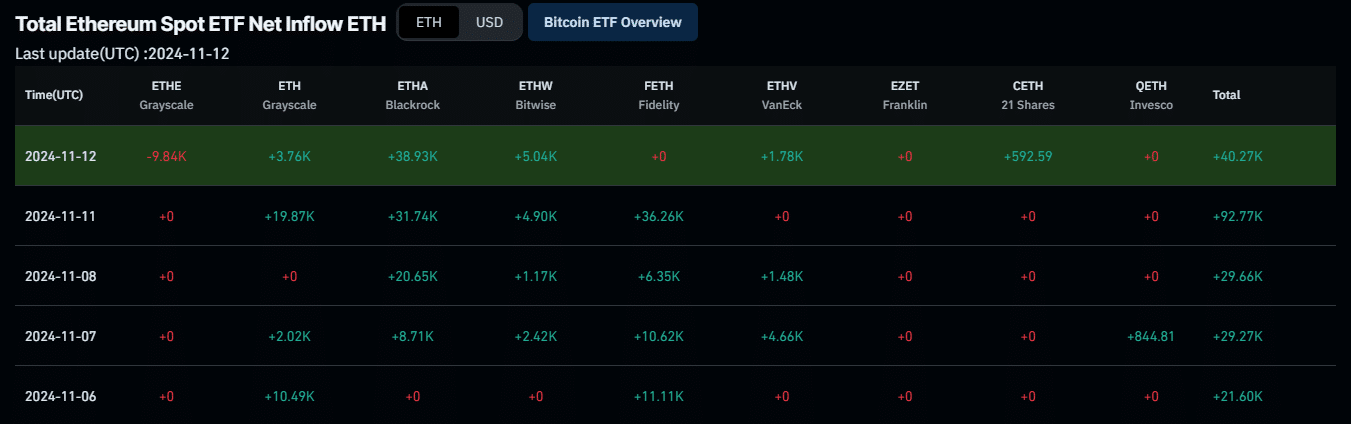

The positive perspective on Ethereum was picking up speed, fueled by a continuous five-day purchasing spree from traditional investors, who have been progressively investing more in ETH.

These investors have been consistently purchasing spot ETH ETFs from several major platforms.

Currently, according to the latest data from Coinglass, there has been a net inflow of 213,570 Ether into Spot ETH Exchange-Traded Funds (ETFs), indicating that more Ether is being purchased than sold.

Even though there have been recent ups and downs in the price, this persistent buying indicates that established investors continue to show a robust long-term belief in Ethereum, positioning themselves for the upcoming stage of growth.

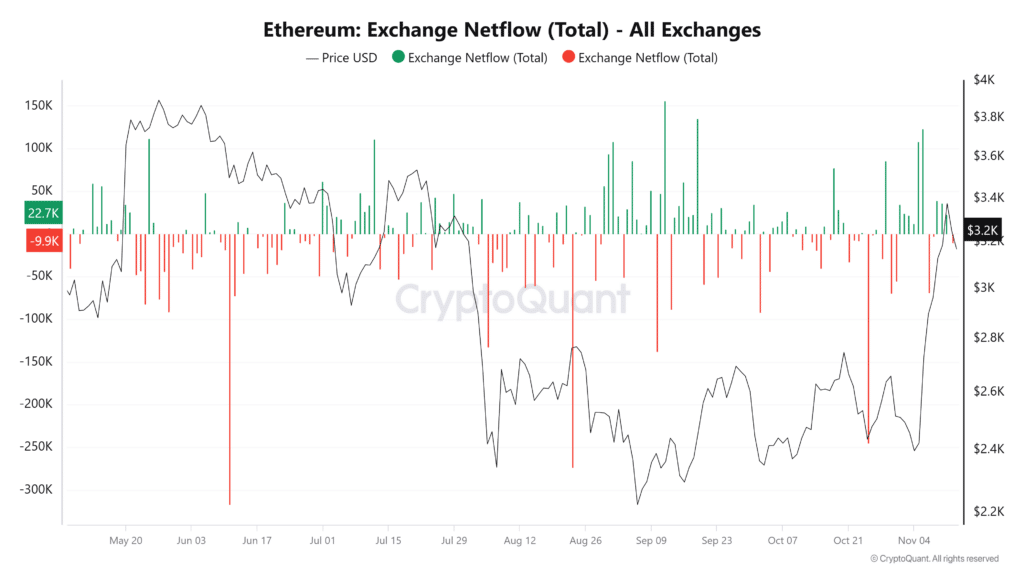

Additionally, as institutional investors are making this shift, we at AMBCrypto have noticed a comparable pattern emerging among certain active spot traders.

Over the last day, while conventional investors continued their activities, certain traders have seen a change, as Exchange Netflow indicates a reversal – an outflow of 9,957.59 Ether, based on data from Cryptoquant.

Derivative traders turn bearish on ETH

In the last day, derivative traders have become pessimistic about Ethereum (ETH), as large amounts of long positions have been closed out, a sign of selling pressure.

A prolonged liquidation takes place when the market price goes down contrary to the expectations of long-term investors who anticipated an increase in value, causing them to sell off their holdings rapidly due to the unfavorable trend.

Based on Coinglass’ data, it appears that approximately $98.73 million in long positions were forcibly liquidated due to the market moving negatively.

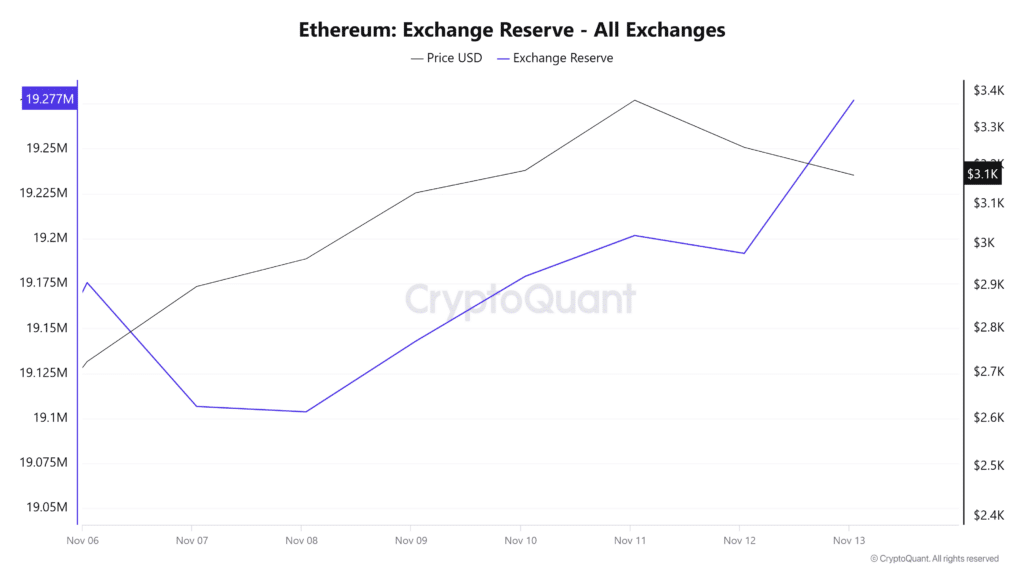

At the same time, the increasing amount of Ether in exchange reserves on Ethereum seems to point towards more Ether being moved into exchange accounts, possibly hinting that certain traders are readying themselves for sales.

Considering these circumstances, it seems probable that Ethereum’s value might continue to drop. But the crucial point to ponder is: just how much lower could it potentially fall?

AMBCrypto has conducted further analysis to project potential price levels for ETH’s downturn.

A minor dip before resuming bullish rally

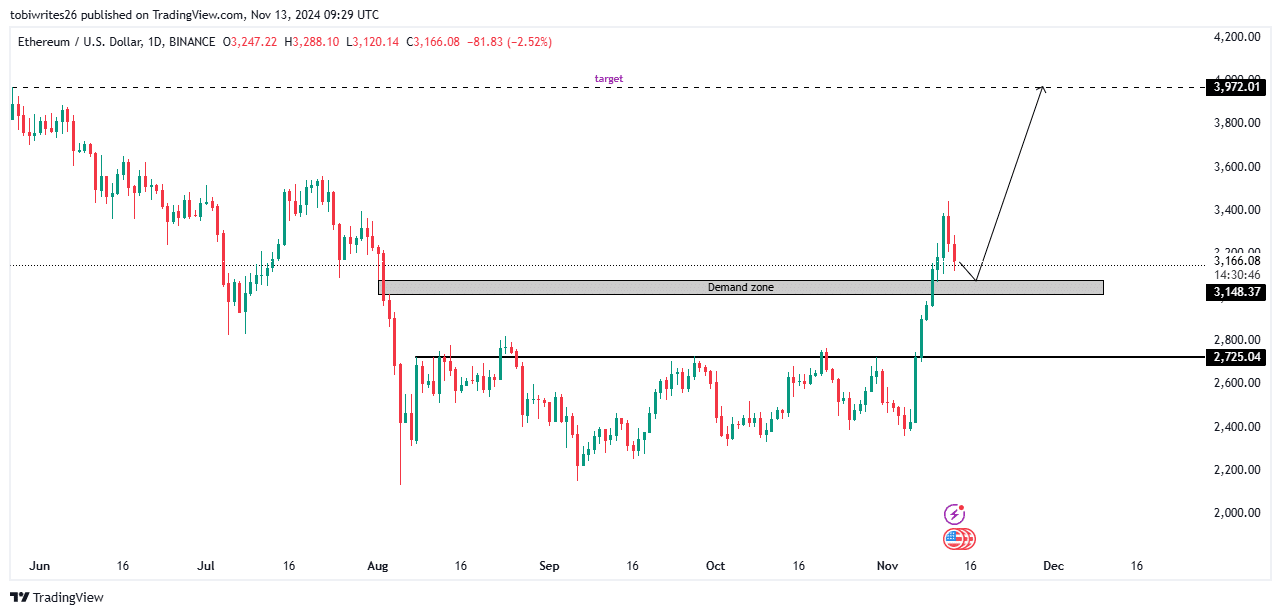

ETH appears to be holding onto a robust upward trend, but it may experience a minor dip ahead of its renewed ascent.

Based on today’s Ethereum (ETH) price analysis, the area where a potential drop may occur is expected to range from approximately $3,079.89 to $3,015.91.

In this area, it’s anticipated that there will be enough demand to help Ethereum regain momentum towards its upward trend.

Read Ethereum’s [ETH] Price Prediction 2024–2025

Once ETH reaches this level, it is anticipated to make a significant upward move toward $3,972.01.

If the negative outlook continues, there’s a possibility that Ethereum (ETH) might experience a further decline, reaching approximately $2,725.04. This drop could act as a trigger, leading to a fresh wave of bullish momentum.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-13 23:04