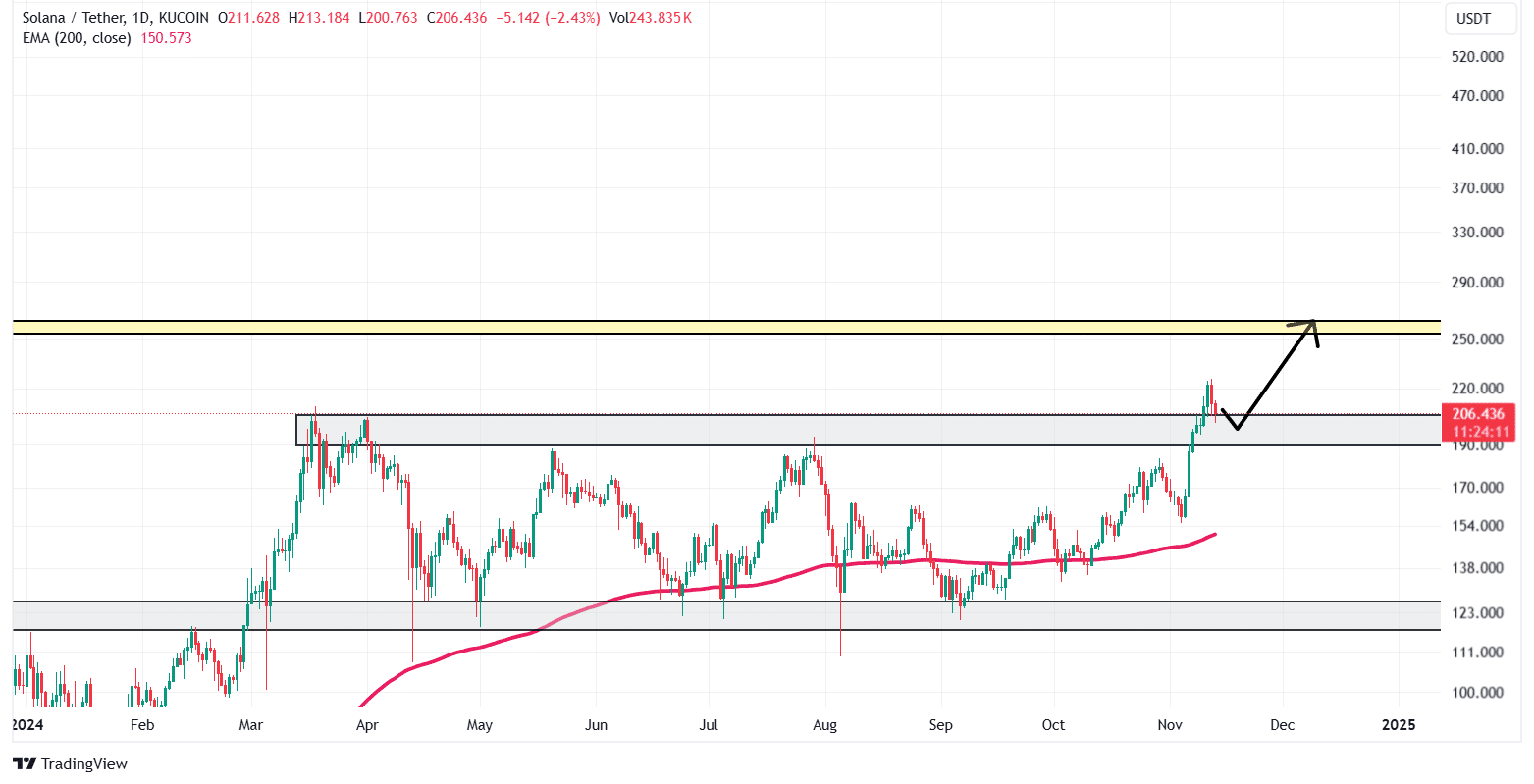

- Following the confirmation of the breakout, Solana could potentially rise by 25% to hit the $260 level.

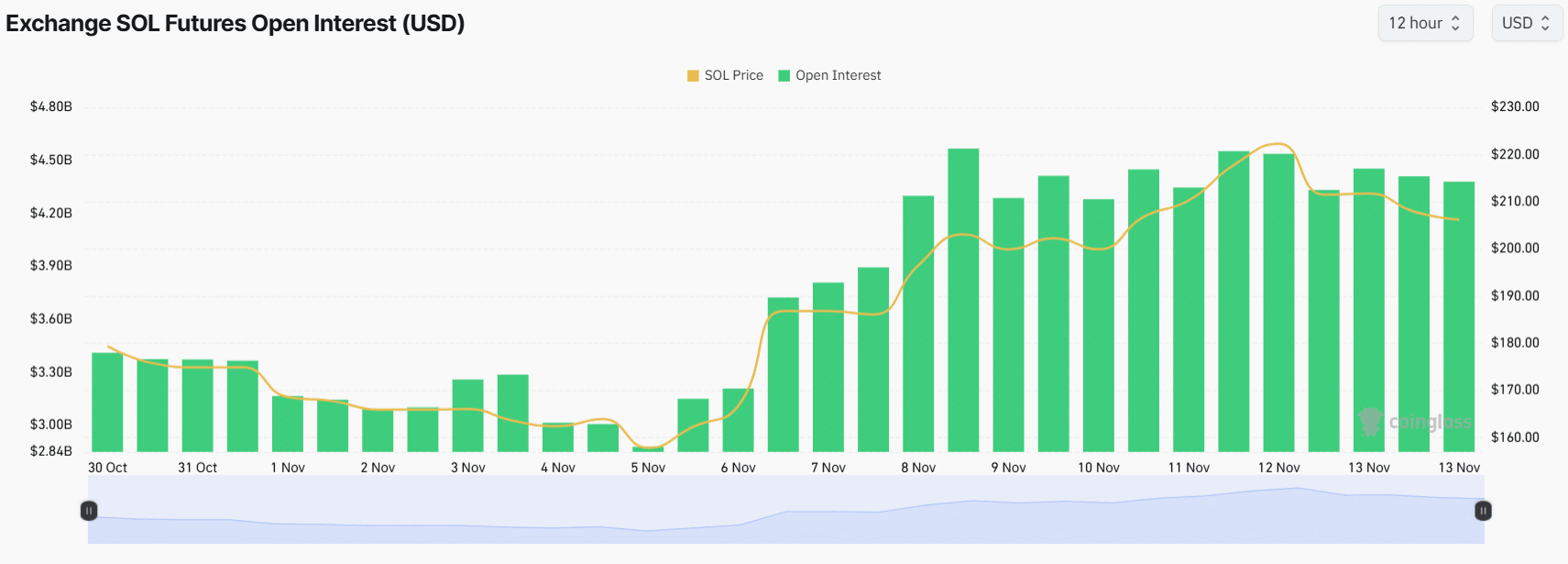

- SOL’s Open Interest has surged aggressively, indicating increased participation from traders.

As a seasoned researcher with years of experience in the crypto market, I have witnessed my fair share of ups and downs, bull runs, and bear markets. However, the current situation of Solana (SOL) is particularly intriguing.

In the past day, it seems like the total cryptocurrency market has undergone a period of adjustment or decline in prices.

In the current situation, it’s worth noting that Solana (SOL), the fourth-largest digital currency, has once again tested the resistance level at which it initially broke out. There’s a high likelihood that positive price action could develop over the next few days.

As a researcher delving into market trends, I’ve identified several factors that could be fueling this optimistic speculation. These include the strong uptrend in prices, favorable on-chain indicators suggesting a bullish sentiment, and increased activity from both ordinary traders and influential ‘whales.’

Solana technical analysis

At the moment, Solana’s value was holding steady near a significant support point of approximately $200. Given the current market trends and past performance, it appears quite likely that the price could jump by around 25%, potentially reaching close to $260 in the near future.

Currently, Solana (SOL) is being traded at a price higher than its 200-day Exponential Moving Average (EMA) in the daily chart.

Simultaneously, the Relative Strength Index (RSI), suggested a possible upward trend, as its reading approached the region of oversold conditions.

Bullish on-chain metrics

Beyond SOL’s optimistic perspective, on-chain indicators also strengthen its bullish tendencies. As reported by the on-chain analysis company Coinglass, Solana’s Open Interest has experienced a substantial increase.

Over the last couple of hours, the Open Interest (OI) has grown by approximately 3.5% and within the past four hours, it has surged by around 5.2%. This suggests that traders have been actively engaging with this asset, indicating potential positive momentum ahead.

Major liquidation levels

As of now, key selling (lower) and buying (higher) thresholds are set at $199.5 and $210.8 respectively, as per Coinglass’s analysis. It appears that traders have taken on excessive debt (over-leveraged) at these price points.

If the feelings stay consistent and the price climbs up to $210.8, around $52.7 million in short positions will have to be closed out.

Read Solana’s [SOL] Price Prediction 2024–2025

If the sentiment changes and the price falls to around $199.5, it’s estimated that about $110 million in long positions will need to be sold off (liquidated).

It seems like bulls are leading the charge for assets at the moment, potentially propelling them higher in the near future during the next few days.

Read More

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- The Lowdown on Labubu: What to Know About the Viral Toy

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

2024-11-14 03:03