- Stellar surged past the $0.097 and $0.103 resistance levels that have been significant recently

- It is likely to target $0.162 and $0.197 next, but short-term volatility can be anticipated too

As a seasoned researcher with over two decades of experience in the crypto market, I must say that Stellar’s [XLM] recent surge past its significant resistance levels has been quite intriguing. The bullish momentum is promising, but I’ve learned time and again in this volatile world that short-term volatility can be a rollercoaster ride!

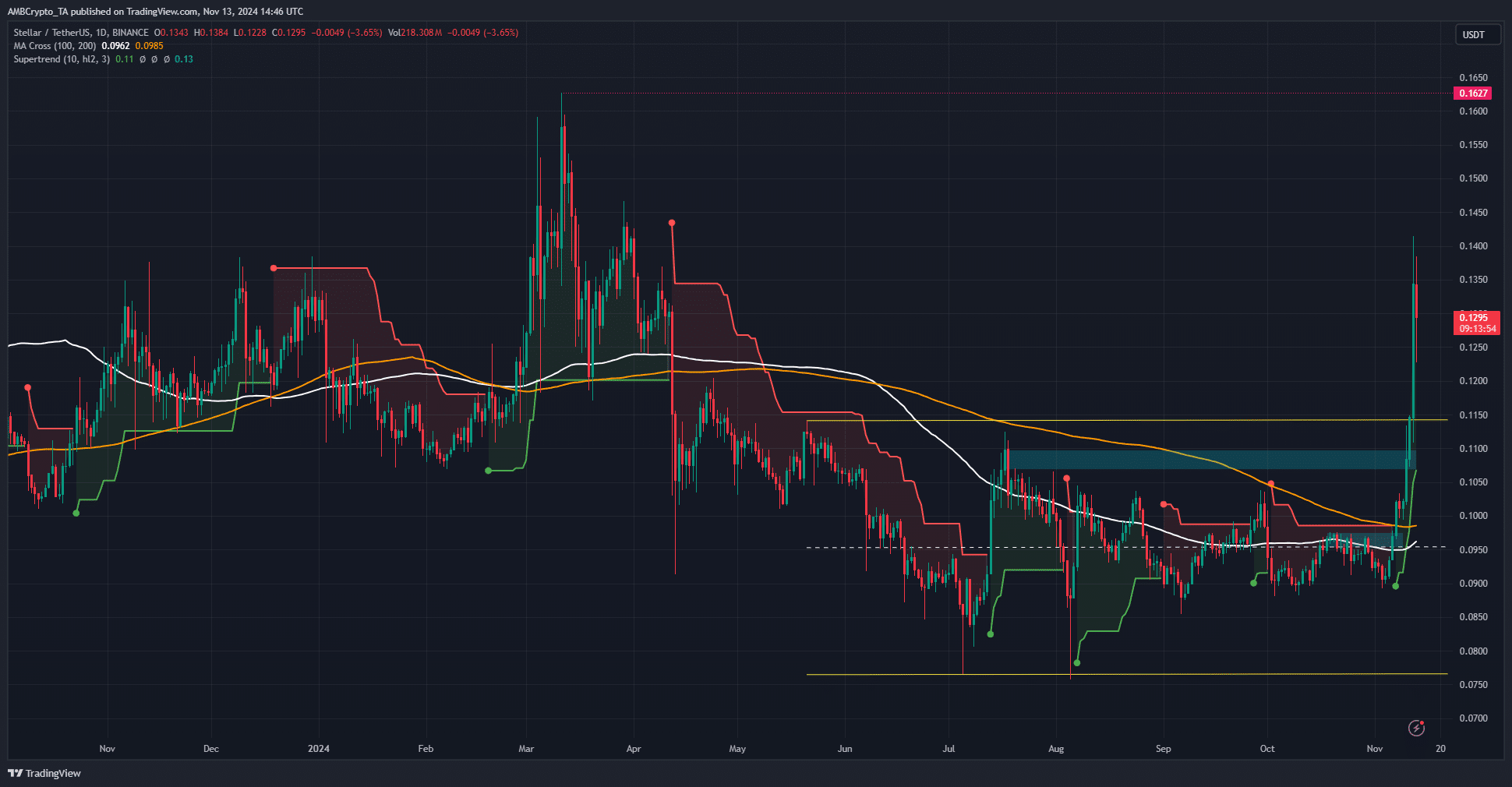

Starting from November 4th, Stellar (XLM) experienced a 57.22% surge, peaking at $0.1415 on November 12th. Since that high point, there has been a 7.84% decline. At the time of reporting, the technical indicators were signaling a bullish trend.

To put it simply, the fluctuations in the value of the token suggest substantial increases could occur. However, it’s important to note that XLM is currently 85% lower than its peak price of $0.875, and there’s no certainty that it will rise to those levels again during this market cycle.

XLM achieves range breakout in style

Similar to numerous other alternative cryptocurrencies, XLM coin has surpassed the price range it has been confined to for approximately six months. This daily market trend turned bullish when the lower high of $0.097 was exceeded on November 7th.

Since August, the $0.1-$0.103 range has served as a strong resistance point for Stellar, but it surprisingly surged beyond this barrier. This rapid surge caused the Supertrend indicator to switch to a bullish stance and emit a buy signal. If it remains bullish, it could turn bearish if the $0.107 support level is breached.

Previously in July, the price range between $0.107 and $0.11 was where the highest prices were recorded. If the price drops back towards $0.115 or $0.11, it may present an excellent chance for purchasing, indicating potential low prices.

Currently, the 100 and 200-day moving averages haven’t crossed each other upward (bullishly) as of now. Yet, the price has significantly risen over these averages, indicating that a bullish event known as the “golden cross” is imminent.

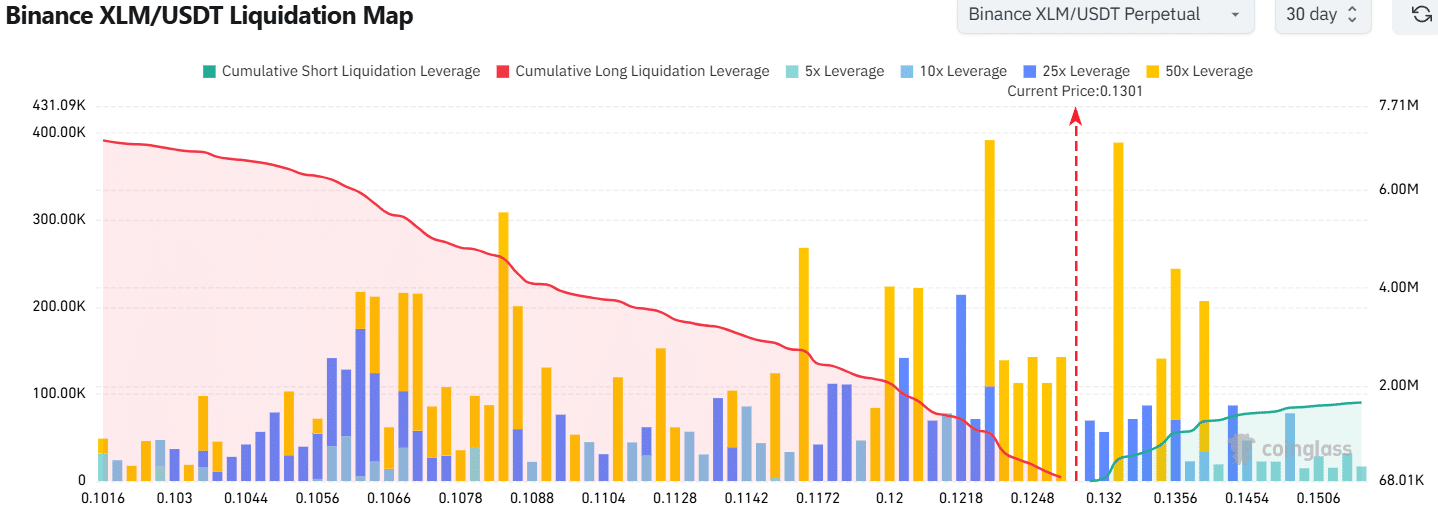

Liquidation levels overhead could cause a cascade

The analysis showed that significant amounts of both short and long positions were found at the prices of approximately $0.1322 and $0.123, respectively. Most of these positions held high levels of leverage and were situated near the current market value.

Read Stellar’s [XLM] Price Prediction 2024-25

In simpler terms, this means that Stellar’s price can quickly move towards either of those zones, absorbing the available liquidity in that region, and then continue its upward trend.

As I delve into my analysis, it’s yet unclear which zone Bitcoin [BTC] will visit first, but a potential drop to around $0.123 and $0.115 might offer enticing buying opportunities. Keeping a keen eye on Bitcoin’s momentum is advisable for traders considering a long position. However, it’s crucial to meticulously manage the associated risks throughout this process.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- LPT PREDICTION. LPT cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Elden Ring Nightreign Recluse guide and abilities explained

2024-11-14 11:35