- Bitcoin rally is approaching a pivotal point, with the strength of the bulls being put to the test.

- A short-squeeze could be the catalyst needed to push Bitcoin towards the next key level of $110K.

As a seasoned researcher who has been observing and analyzing cryptocurrency markets for years, I can confidently say that the current Bitcoin rally is at a critical juncture. The bulls have shown remarkable resilience thus far, but a short-squeeze could be the catalyst needed to propel Bitcoin towards its next key level of $110K.

As an analyst, I find myself observing a striking market exuberance, as Bitcoin [BTC] surpasses its all-time high at $93,490. Social media buzzes with forecasts of prices exceeding $100,000. Historically, such fervor at peak sentiment has served as a cautionary tale for seasoned traders. They understand that euphoria can often mark the market’s zenith.

Lately, a minor bearish divergence suggested a potential break, as Bitcoin momentarily dropped by 0.57%, stabilizing near $87K. Yet, the bulls quickly regained dominance, triggering a 3% surge the following day that established a new record peak.

At a crucial juncture, the bulls advanced powerfully, breaking through doubt in the market and aiming steadfastly towards the prestigious $100,000 mark.

Currently, Bitcoin is surging further, which will likely trigger a response from those looking to sell. Consequently, the true challenge for the bullish investors is approaching since significant dips seem imminent in the near future.

Key resistance factors in Bitcoin’ rally to $100K

With Bitcoin’s ongoing rise, traders find themselves holding substantial gains that haven’t been realized yet. This could mean the current rally might slow down or even reverse, leading to a potential price adjustment.

Mentally speaking, when prices reach very high points, it often leads to a sense of apprehension among people. With continuous worries about potential regulatory adjustments, several traders might decide to secure their profits and reduce possible losses. This action could potentially lead to a decrease in the market due to less buying activity.

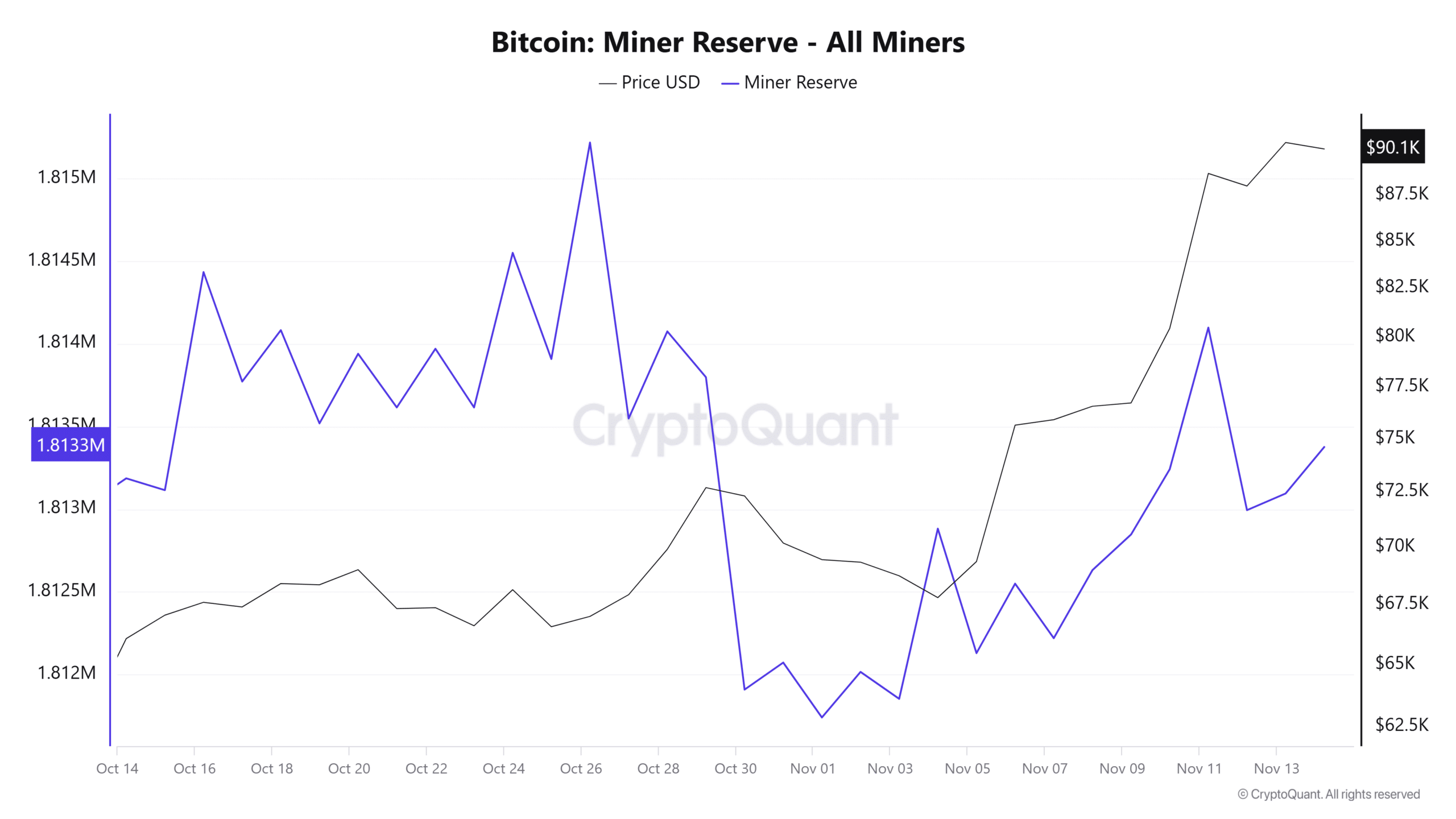

A classic example of this is Bitcoin miners offloading their holdings.

On the very same day that the rally paused for the first time following the election, causing Bitcoin to drop to around $82,000 after reaching a new all-time high of $87,000 the day before, there was an extraordinary withdrawal of 25,000 Bitcoins by miners.

Source : CryptoQuant

Essentially, some miners could be hesitant that Bitcoin will hit $100K. Given this uncertainty, they might be trying to seize the opportunity by cashing out at today’s high prices, securing profits – particularly to cover their costs – before market fluctuations become too extreme.

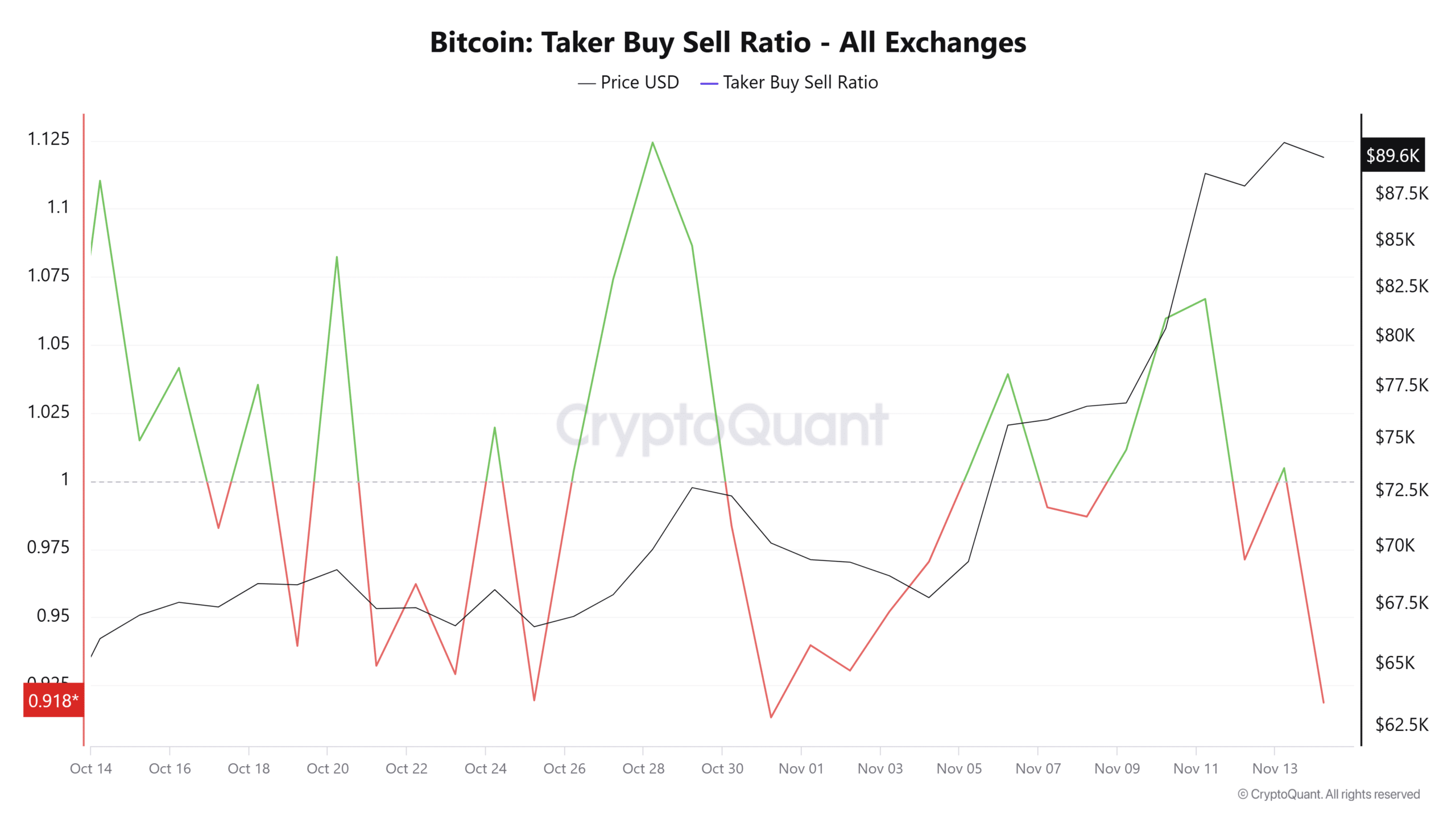

Beyond the fluctuations caused by mining activities, there’s a noticeable power shift occurring within the derivative market, as large sell orders are increasingly becoming more popular. This trend is clearly visible, indicated by the prominent red arrow pointing downwards.

Source : CryptoQuant

To maintain the ongoing Bitcoin surge, it’s essential to turn the current upward trajectory around. As previously stated, encountering resistance is imminent due to escalating selling pressure on multiple fronts.

Instead, keep an eye out for a possible parabolic rise, as it appears more and more probable. The latest 3% increase indicates that the buyers have successfully offset the pressure through massive buying sprees.

$100K seems inevitable, what is next?

Given the present market trends, there seems to be a strong optimism, or “bullishness,” for several significant factors. Investors, often referred to as “bulls,” view the drop around $82K not as a setback, but rather as an excellent chance to buy, thereby continuing the journey towards $100K.

Furthermore, it’s worth noting that a significant 62% of long positions in the continuous futures market are currently held by whales. This suggests a high degree of institutional certainty.

Additionally, there’s been a significant spike in retail investor interest, reaching a 52-month peak. This surge, particularly noticeable over the past month, suggests that both big investors and individual traders are showing strong enthusiasm.

It appears that surpassing the $100K milestone could be feasible, although there might be small setbacks in the process. The intriguing part is observing the events following the achievement of this goal.

Source : Ali/X

Historically, whales, or large-scale investors, often act contrary to the masses, purchasing Bitcoin when others are fearful and selling it when they’re overly optimistic. As per a well-known analyst, in the past week, these whales have amassed approximately 100,000 Bitcoins, which equates to more than $8.60 billion dollars.

Read Bitcoin (BTC) Price Prediction 2023-24

Looking at it from a psychological standpoint, when Bitcoin reaches $100K, there’s a strong possibility that widespread panic selling might occur due to multiple factors, including bears trying to force a long squeeze.

In this scenario, the bulls will face their true trial as short-term traders capitalize on the chance to oppose Bitcoin and the fear of missing out (FOMO) diminishes. If the bulls can maintain their strength, it could lead to a significant short position liquidation, potentially paving the way for a surge in Bitcoin prices towards $110K.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-11-14 17:13