- WIF is set to break past its all-time high at $4.86.

- Short-term selling pressure could induce volatility, watch the $3.9 level.

As a seasoned crypto investor with a knack for spotting trends and navigating the volatile market, I find myself both exhilarated and cautiously optimistic about WIF’s current trajectory. The 42% surge within 24 hours and the staggering 82.6% increase in seven days are numbers that don’t lie, and they paint a picture of a coin on the cusp of great things.

In the last 24 hours, Dogecoin (DOGE) increased by 42%, while over the past week it surged by a whopping 82.6%. However, despite Bitcoin‘s (BTC) recent impressive growth, these gains have yet to significantly impact the altcoin market as a whole.

As a researcher examining the Bitcoin Dominance graph, it’s evident that supportive data was clearly displayed. However, the current atmosphere in the cryptocurrency market is electrifyingly optimistic. The Crypto Fear and Greed Index, which serves as an indicator, currently reads 86, signaling extreme greed – a phenomenon often observed during a bullish trend.

dogwifhat challenges all-time high and gears up for more gains

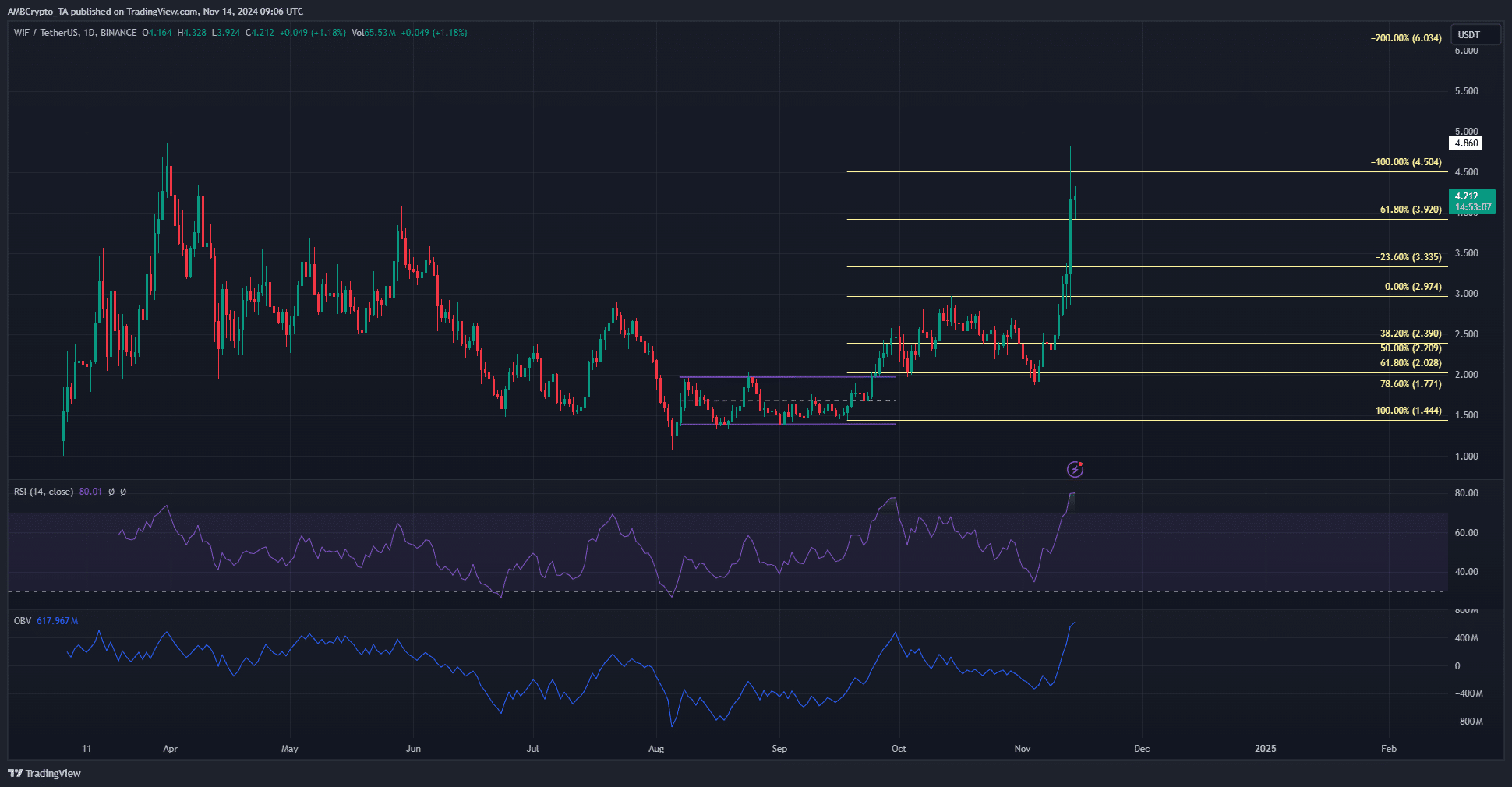

Starting from November 4th’s low, Dogwhathit has experienced a remarkable increase of 125.7%. Interestingly, its Relative Strength Index (RSI) currently stands at 80, exceeding both the highs seen in March and September. However, it is essential to note that this rise doesn’t necessarily mean the market will experience a substantial pullback soon.

The OBV also made a new local high, signifying increased buying pressure as the meme coin rallied hard. This was a strongly encouraging sign for holders and more reason for a bullish WIF price prediction.

On November 13th, I almost reached an all-time high at approximately $4.86 with WIF. It peaked at $4.83 before briefly retreating to $3.92. Interestingly, the 61.8% Fibonacci extension level has functioned as a reliable support in the past few hours.

To the north, the 200% extension level at $6 is the next WIF price prediction target.

Short-term selling pressure on the rise

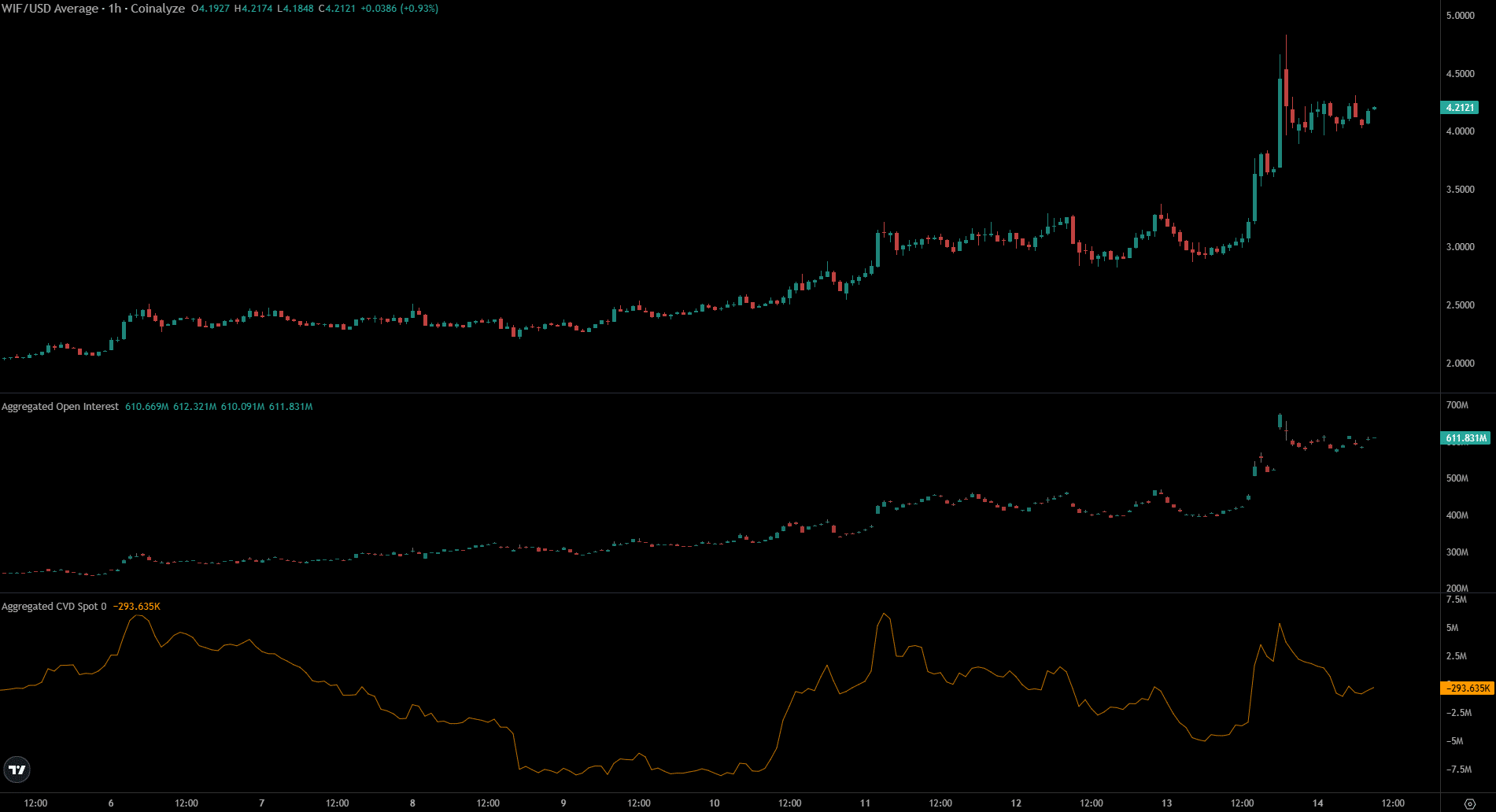

Starting from $360 million on November 11th, the Open Interest has now reached $611 million as we speak. Additionally, over this period, the price has experienced a significant increase of approximately 71%.

Collectively, they exhibited strong optimism among investors and robust demand for future contracts.

Realistic or not, here’s WIF’s market cap in BTC’s terms

The spot CVD began to decline in recent hours. This was likely to be a short-term blip that could induce volatility. The long-term trend remains firmly bullish.

Goals exceeding $6 remain acceptable, but falling beneath $3.9 could signal the start of a more significant downturn.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Elden Ring Nightreign Recluse guide and abilities explained

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

2024-11-14 22:15