- Is Bitcoin going to crash? Multiple factors pointing towards it as BTC approaches $100K.

- A return of FOMO could be essential to reversing the trend.

As a seasoned researcher who has witnessed the crypto market’s rollercoaster ride since its inception, I can’t help but feel like a veteran gambler observing a high-stakes poker table. The current state of Bitcoin (BTC) is indeed intriguing, with $100K within reach and the potential for a ‘crash’ lurking around the corner.

Currently, intense greed is dominating the fear-greed scale, echoing the pattern seen in March when Bitcoin [BTC] reached an all-time high of $73K. However, it plummeted to $67K within just five days due to strong selling activity and a dwindling faith in a sustained upward trend.

Contrary to the other bike, this one has been characterized by more frequent green candlesticks on its daily chart, with a daily peak of approximately 3%. This price level is often considered too daring.

This indicates that investors are embracing risk for outsized returns, keeping the bears in check and $100K within reach. However, the possibility of a ‘crash’ still cannot be ruled out.

As Bitcoin reaches $100K, the fear of missing out (FOMO) which has been a significant driving force for new investors, is expected to diminish. The high price point might become too expensive for many potential entrants.

Could this create conditions ripe for a potential correction ahead?

Will Bitcoin continue as the safe-haven?

With doubts swirling about future government regulations due to worries about the country’s debt, the incoming government might take actions aimed at resolving these problems. This could possibly result in an escalation of prices as the budget deficit expands.

In this climate, Bitcoin’s appeal as a “safe-haven” could be tested once again.

It’s unlikely that a substantial tax reduction could offset these impacts, considering the existing large-scale trillion-dollar debt we owe in interest payments.

Looking ahead, these policies may significantly influence Bitcoin’s upcoming price trends. There’s a possibility of a steep drop if investors start favoring safer investment options once again.

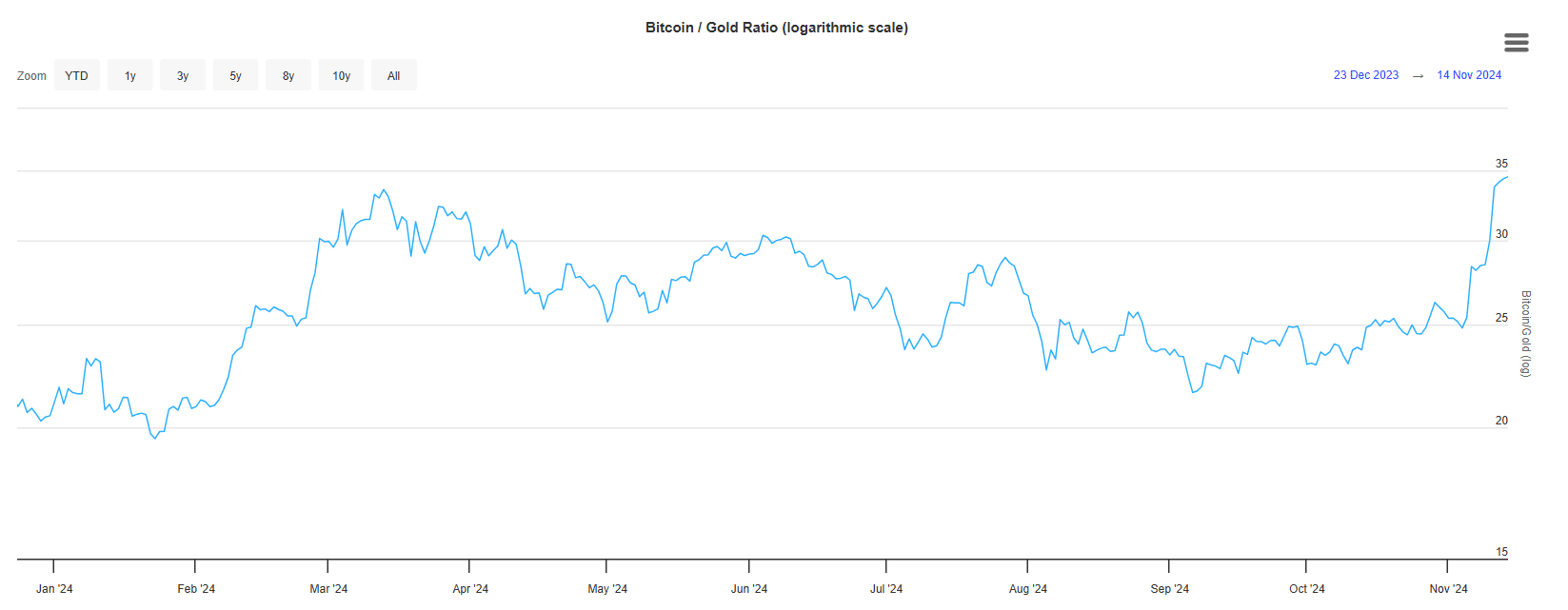

Notably, following the latest election outcomes, the Bitcoin-to-Gold ratio has reached approximately 35, which represents a significant annual peak. Essentially, this means that one Bitcoin is currently worth around 35 times more than an ounce of gold.

Generally speaking, a greater proportion indicates stronger belief in Bitcoin’s role as a savings mechanism, a belief that was reinforced by its 9% surge in price on the day of the election results, surpassing many other investment options.

Given the current economic instability, there’s a possibility that this trend may flip. Gold, which was previously seen as a protective measure against inflation, might regain investor interest as a safe haven.

Should this situation continue over the next few days, there’s a possibility that Bitcoin might experience a downturn, possibly returning to around $70,000. Consequently, it’s essential to keep a close eye on these trends.

Is Bitcoin going to crash as investors diversify?

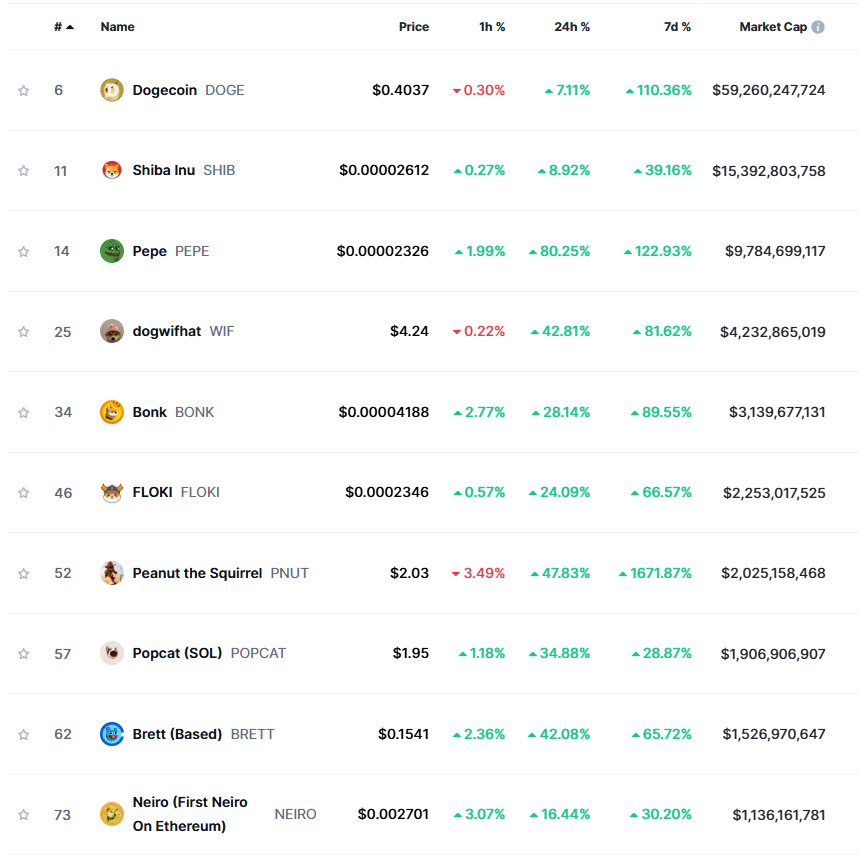

In recent weeks, numerous meme coins have been surging significantly more than Bitcoin itself, often reaching new peak values. Such a pattern is usually indicative of a market reaching its pinnacle.

It appears that individual investors are shifting their focus from Bitcoin to meme-based cryptocurrencies, possibly due to their affordability and attractive nature, as they usually cost less than one dollar.

The current development aligns with AMBCrypto’s previous notions regarding the impact of FOMO (Fear Of Missing Out). On the flip side, as Bitcoin nears the $100K mark, an increase in sell-off activity is anticipated.

Conversely, investors could choose to invest in different types of assets, which might diminish Bitcoin’s allure and potentially reduce the sense of urgency among those who are hesitant about missing out on it.

It’s quite possible that the fear of missing out (FOMO) could resurface among traders once Bitcoin reaches a point they consider a “dip”. This could strengthen the possibility of a price drop or crash.

Where could the next dip happen?

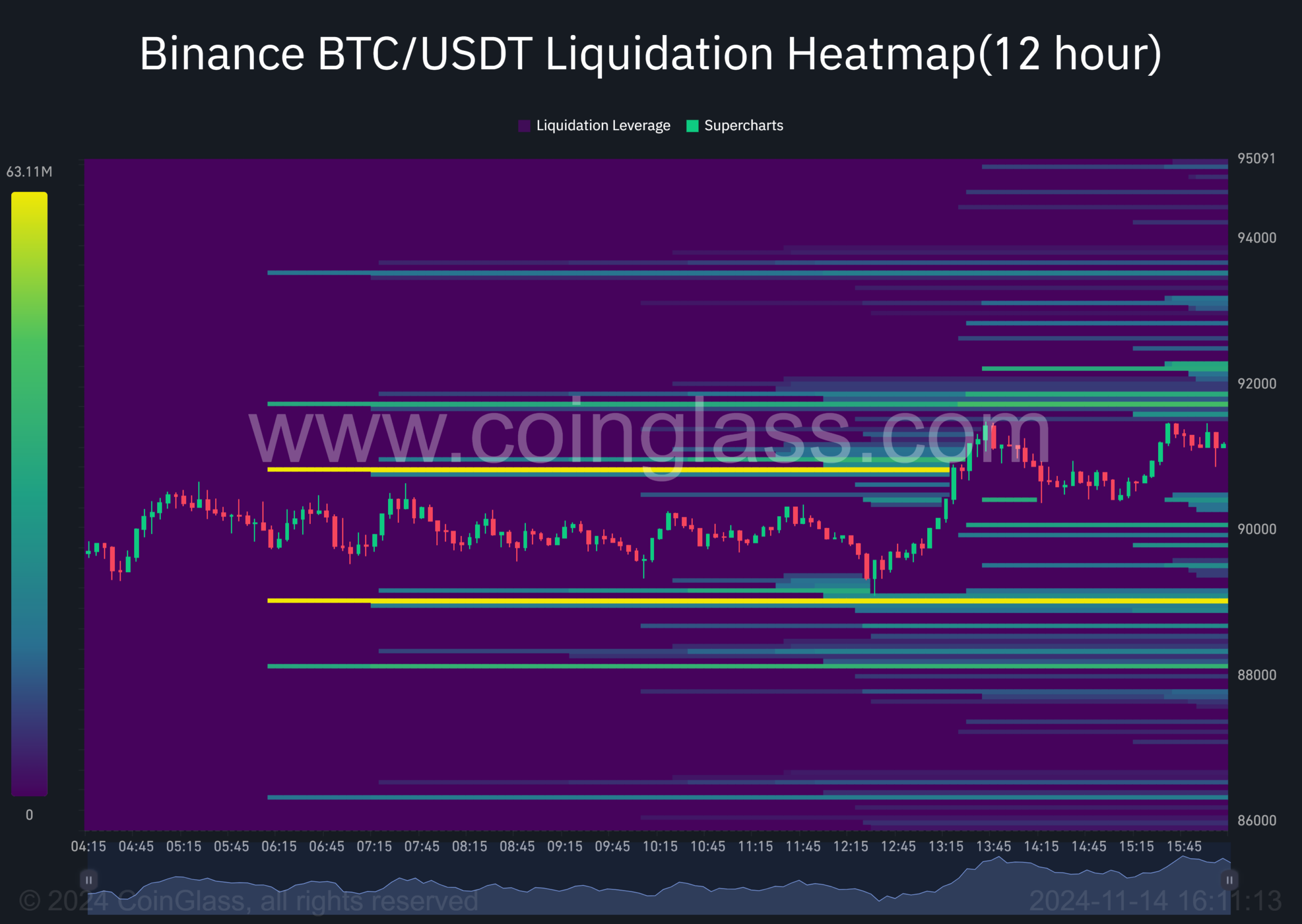

Examining the 12-hour timeframe, a substantial area of trading activity centered approximately at $89,000 indicates a potential danger zone. There are roughly $63 million worth of trades that could be forced to close if market conditions worsen.

Over the last seven days, Bitcoin has shown a strong upward trend, driven by an increase in long-term investments which have pushed its value beyond 20%. At the moment of this writing, it reached a high of $91K.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

As a crypto investor, I must acknowledge that the ongoing changes within institutions and financial systems have cast some doubt on Bitcoin’s future prospects. While I remain optimistic about its potential, it’s crucial to stay informed and adaptable as we navigate these shifting market conditions.

Consequently, when Bitcoin reaches $100K, a potential crash might occur due to traders moving their attention to different investments, while they wait for further excitement (FOMO) to rejoin the market again.

Read More

2024-11-14 23:04