- Bitcoin surged to $93,477 before a slight dip; major withdrawals from Binance reflect investor sentiment.

- Key metrics, including MVRV ratio and open interest, show strong market engagement amid the price rally.

As a seasoned crypto investor with more than a decade of experience navigating the digital asset landscape, I have witnessed Bitcoin’s incredible journey from its inception to becoming the world’s most valuable cryptocurrency. The latest surge to an all-time high of $93,477 was indeed thrilling, but as always, it pays to remain cautious and analyze market dynamics for insights into potential future movements.

Bitcoin’s (BTC) bullish surge has propelled it into unexplored heights. This premier digital currency reached its most recent record high of $93,477 on the 13th of November, marking another series of record-breaking levels.

In spite of reaching an unprecedented peak, Bitcoin has experienced a minor dip and is now being traded at approximately $90,031 – a decrease of 3.4% compared to its highest point, but still demonstrating a 4.1% increase over the last day.

The rally, while notable, has also brought into focus investor behavior and market dynamics, as activity around exchanges signals potential shifts in sentiment and strategy.

Big moves on Binance

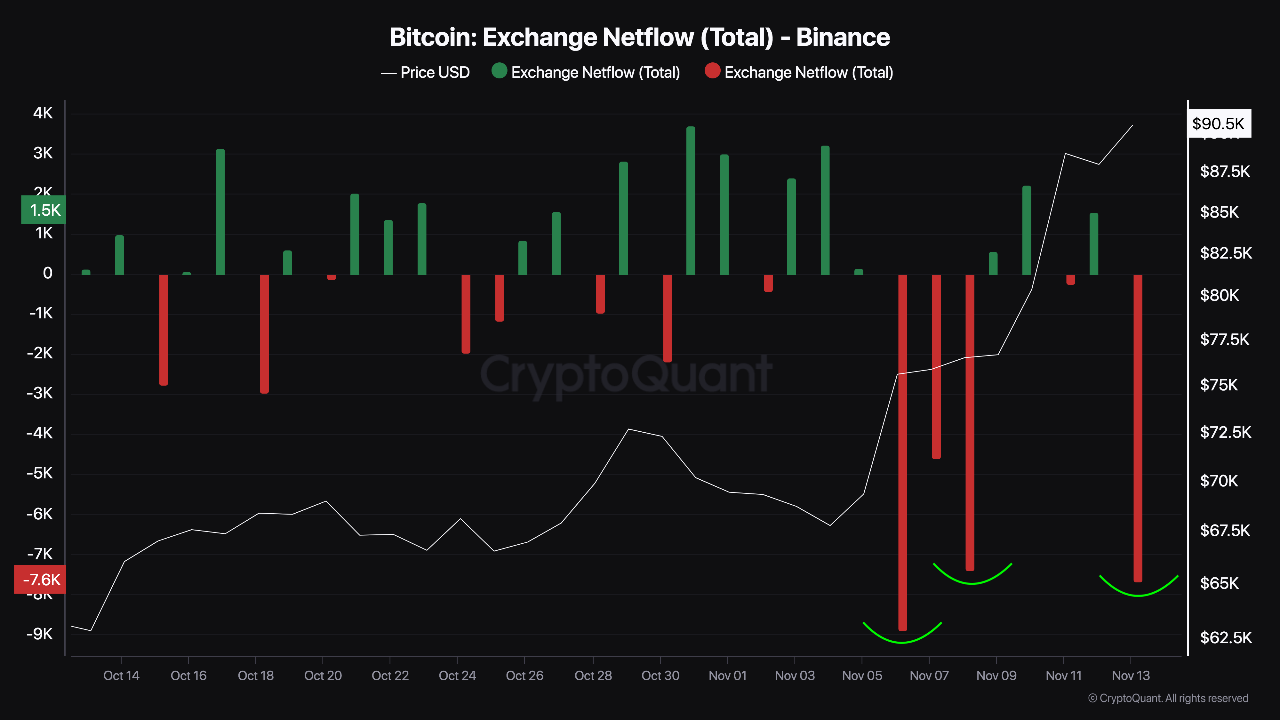

Analyst Darkfost from CryptoQuant drew attention to an important pattern that emerged concurrently with Bitcoin reaching its latest all-time high.

As reported by Darkfost, a notable amount of Bitcoin, approximately 7,500 coins, has been taken out from Binance, one of the leading global cryptocurrency trading platforms. This substantial withdrawal is the second largest of its kind in 2021, according to available data.

Based on the expert’s viewpoint, this action might be an indication of changing investor attitudes. It seems to express optimism about the asset’s future worth and may point towards a move towards long-term investments instead of frequent buying and selling.

Moving Bitcoin from trading platforms to personal wallets could suggest that investors are preparing for potential profits or market improvement, demonstrating optimism in the crypto market.

How is Bitcoin faring fundamentally

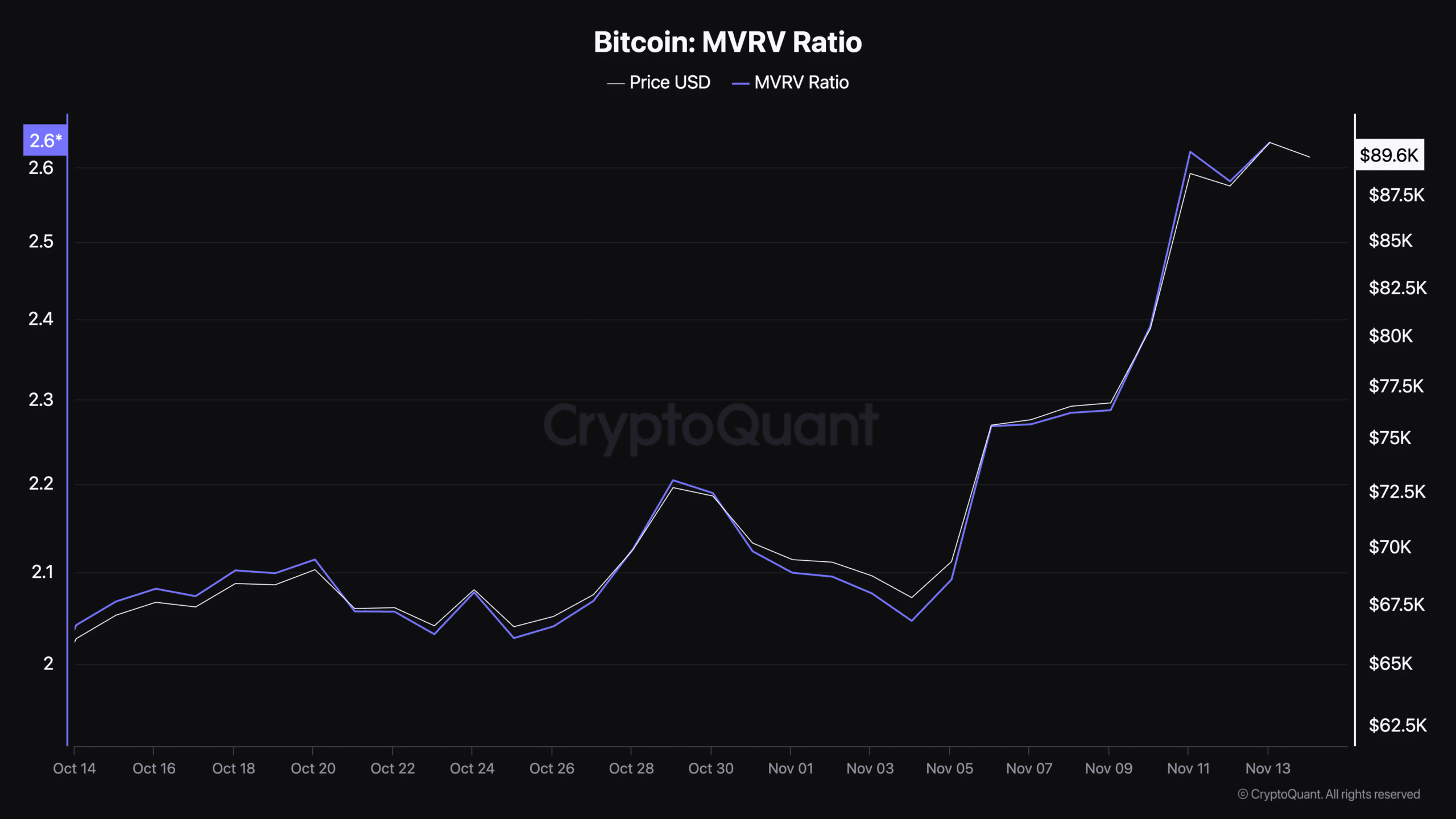

Apart from observing trading activities, Bitcoin’s core indicators also provide valuable insights into its performance during this ongoing surge. A significant metric to consider is the Market Value to Realized Value (MVRV) ratio, which compares Bitcoin’s market capitalization with the actual value of its held coins.

By analyzing this particular measure, we can determine if the value of Bitcoin seems too high or too low when compared to its past price fluctuations.

When an MVRT (Market Value Realized to Value) ratio surpasses 1, it means the asset is being traded at a price higher than its total purchase cost, possibly suggesting that some investors may be preparing to cash in on their profits. At this time, Bitcoin’s MVRT has climbed to 2.58, hinting that many investors have experienced substantial returns.

Historically, these levels tend to line up with increased investor enthusiasm and, at times, market adjustments. An inflated MVRV ratio indicates substantial profits, but it’s essential for investors to exercise caution since there’s still a risk of market fluctuations.

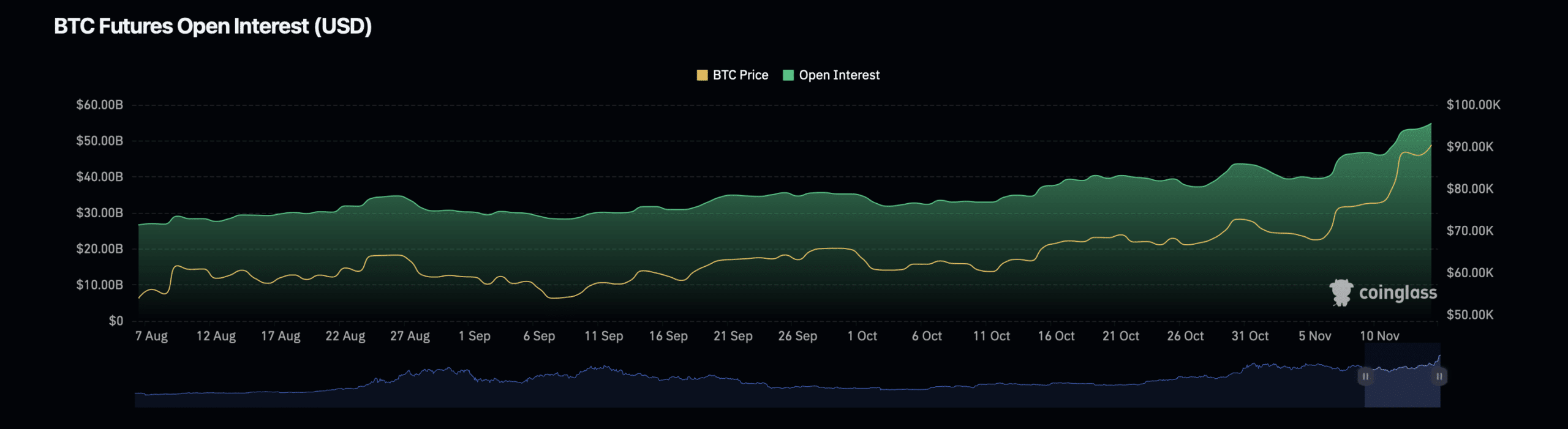

A significant factor to keep an eye on when tracking Bitcoin is its open interest – this term represents all the active derivative agreements, like futures and options contracts, that are currently in play.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

According to information from Coinglass, the value of open Bitcoin contracts has gone up by approximately 4.23%, amounting to around $54.85 billion. This surge suggests a rising level of speculation, potentially indicating more active trading or increased faith in the market.

On the other hand, the open interest volume of Bitcoin decreased by 1.51% to reach approximately $182.70 billion. This drop in open interest might suggest that the market is stabilizing or experiencing a change in its dynamics as traders reevaluate their positions after the recent surge.

Read More

2024-11-15 01:12