- XRP’s NVT ratio has surged to new highs, suggesting a growing gap between its market cap and actual network activity

- High NVT ratios have historically led to corrections, making XRP’s current rally appear speculative.

As a seasoned researcher with years of experience analyzing various digital assets, I find myself cautiously optimistic about XRP’s recent surge. While the current rally is undeniably impressive, the soaring NVT ratio serves as a red flag that warrants closer scrutiny.

The dramatic rise in XRP’s current pricing has sparked interest among not only active traders but also long-term investors. However, the significant increase observed in the Network Value to Transactions (NVT) ratio, along with other on-chain signals, creates doubts about whether this uptrend is sustainable.

As the cost continues to rise, an increase in the Network Value to Transactions (NVT) ratio indicates a widening gap between the market’s valuation and the level of network activity.

This investigation aims to determine if these indicators point towards a potential opportunity or a cautionary note for the future trajectory of XRP.

XRP NVT ratio surges

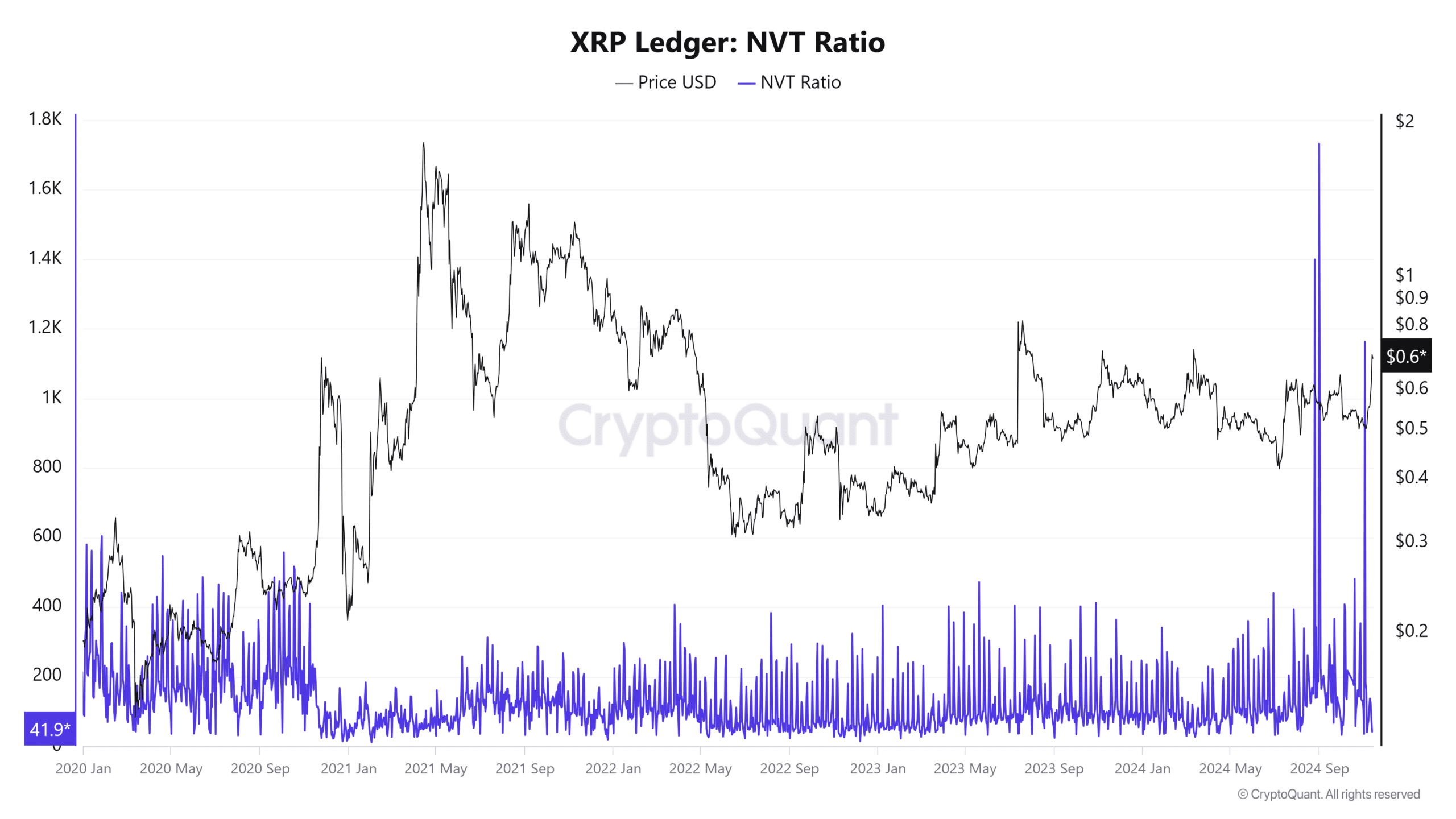

Over the past few years, the Network Value to Transaction (NVT) ratio of XRP has shown considerable volatility. Specifically, from 2020 up until early 2021, this ratio varied between 200 and 600, suggesting a well-balanced market.

Between mid-2021 and early 2022, it surged past 1,000, suggesting instances of overvaluation due to speculative activity.

Lately, the Network Value to Transaction Ratio (NVT) has spiked up to approximately 1,800, which is quite high, indicating a potential mismatch between XRP’s trading value and its actual transaction activity.

Historically, these types of spikes tend to be followed by price adjustments. For XRP to maintain its current price levels, there should be a significant increase in on-chain transactions or activity.

Keep a close eye on trading activity, as a lack of growth might indicate an upcoming drop in prices.

Speculation or continued momentum?

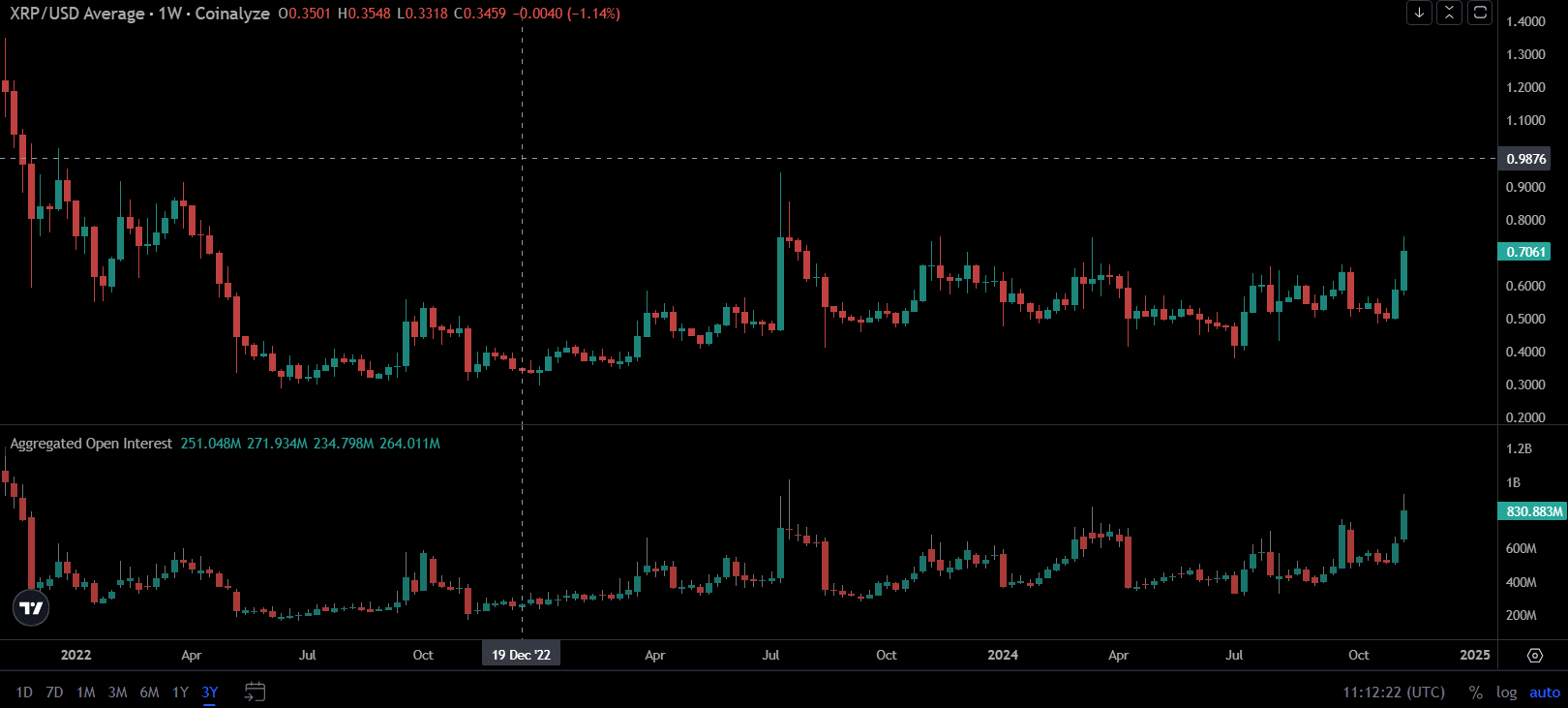

The surge in XRP’s price recently has coincided with a significant spike in Open Interest, amounting to approximately $830 million. This suggests that the market is experiencing increasing anticipation and borrowing activity related to XRP.

As a researcher, I’ve observed an interesting pattern historically – peaks in Open Interest tend to align with substantial price fluctuations. However, these spikes can stir up worries about excessive leveraging, potentially leading to market volatility or corrections.

A higher funding rate suggests a robust optimistic trend, driving prices up, yet it also amplifies the potential for a downturn if the momentum weakens.

With a high Non-Venture Token (NVT) ratio, it appears that speculation could be moving faster than actual blockchain transactions, which raises doubts about the longevity of this upward trend.

Network health

XRP’s 24-hour trading volume stood at $6.81 billion at press time, according to CoinGecko.

As a seasoned investor with over two decades of experience in the crypto market, I’ve learned that high figures can be deceptive and require thorough analysis before making any investment decisions. In my personal journey, I’ve witnessed numerous instances where impressive market activity didn’t always translate to long-term success. Therefore, when I see a significant figure associated with XRP, I immediately recognize the need for further examination in relation to XRP’s overall network health. This is not just about making quick profits; it’s about making informed decisions based on a comprehensive understanding of the asset’s underlying fundamentals and potential long-term impact.

Increased trade activity might indicate a heightened market curiosity and accessibility, which could boost the likelihood of XRP’s price increase.

But when paired with a growing Non-Volatility Token (NVT) ratio and rising Open Interest, this data might just as well indicate escalating speculation instead of genuine expansion fueled by the network’s utility.

Read Ripple’s [XRP] Price Prediction 2024-25

As a cryptocurrency investor, I’ve learned that when you see a high volume of trades and a lot of speculation, it usually indicates short-term price fluctuations rather than long-term growth in value.

To keep the rise in XRP’s price steady, it’s crucial to have a more equal balance between trading volumes and network activity.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Disney Cuts Rachel Zegler’s Screentime Amid Snow White Backlash: What’s Going On?

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Disney’s Animal Kingdom Says Goodbye to ‘It’s Tough to Be a Bug’ for Zootopia Show

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

2024-11-15 07:04