- Whales accumulate over 100k Bitcoin in a week.

- Metrics suggested potential bullish breakout as selling pressure subsided.

As a seasoned analyst with years of experience navigating the volatile seas of the cryptocurrency market, I find myself intrigued by the recent developments in Bitcoin [BTC]. The combination of technical patterns, on-chain metrics, and large investor activity has set off my radar, hinting at a potential change in BTC’s price trajectory.

The cryptocurrency market is abuzz lately, primarily because of the latest advancements in Bitcoin [BTC].

Combining information about whale activities, technical chart patterns, and blockchain indicators suggests a possible shift in Bitcoin’s price direction.

Is this the moment that will lead to the next big rally?

The calm before the storm?

Over the past few weeks, Bitcoin has experienced both highs and lows, frequently shifting from buying demand to selling pressure.

Bitcoin appears to be finding its footing following a minor drop, hinting that the market could be preparing for a substantial shift.

This could be the setup for a possible breakout, with large investors heightened interest.

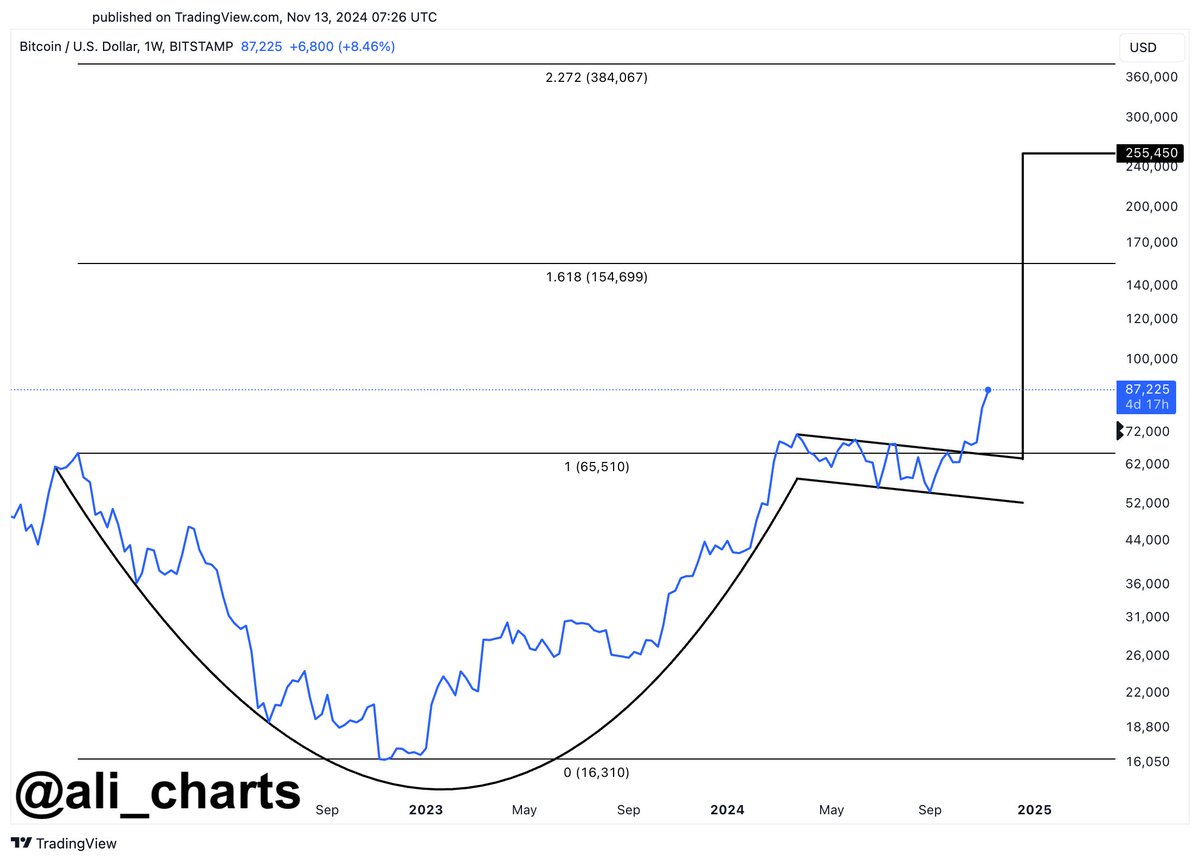

Based on a recent tweet by analyst Ali Martinez, there are signs that Bitcoin might be forming a ‘cup-and-handle’ pattern, which is often associated with positive outcomes.

If this pattern holds, BTC could aim for a target price as high as $255K.

BTC whales make moves

The on-chain information reinforced this perspective, presenting numerous positive signals. As per the same expert, large investors (whales) have acquired approximately 100,000 Bitcoin within the last week, equating to roughly $8.60 billion in value.

Buying Bitcoin on a massive scale tends to coincide with price increases, because major investors (or “whales”) frequently influence market opinion by leading the trend.

Profit-taking or diamond hands?

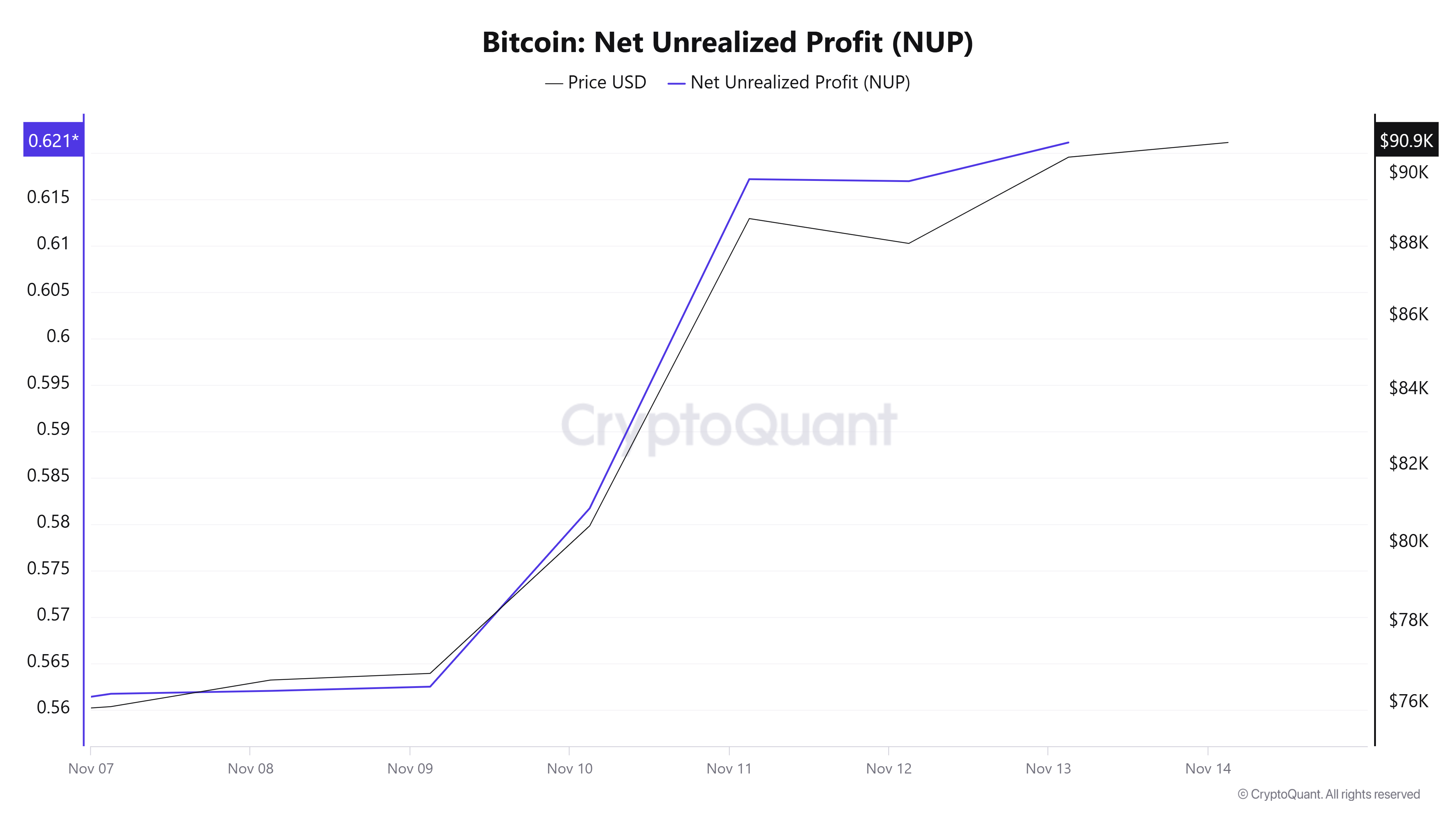

According to an analysis by AMBCrypto on Santiment, there was a rise in net unrealized profits from the 9th to the 11th of November, suggesting a period where selling pressure became more prominent.

Since that time, it appears that the rate of selling has decreased, indicating a trend towards holding instead. This could open up opportunities for Bitcoin’s future growth.

What does the MVRV have in store?

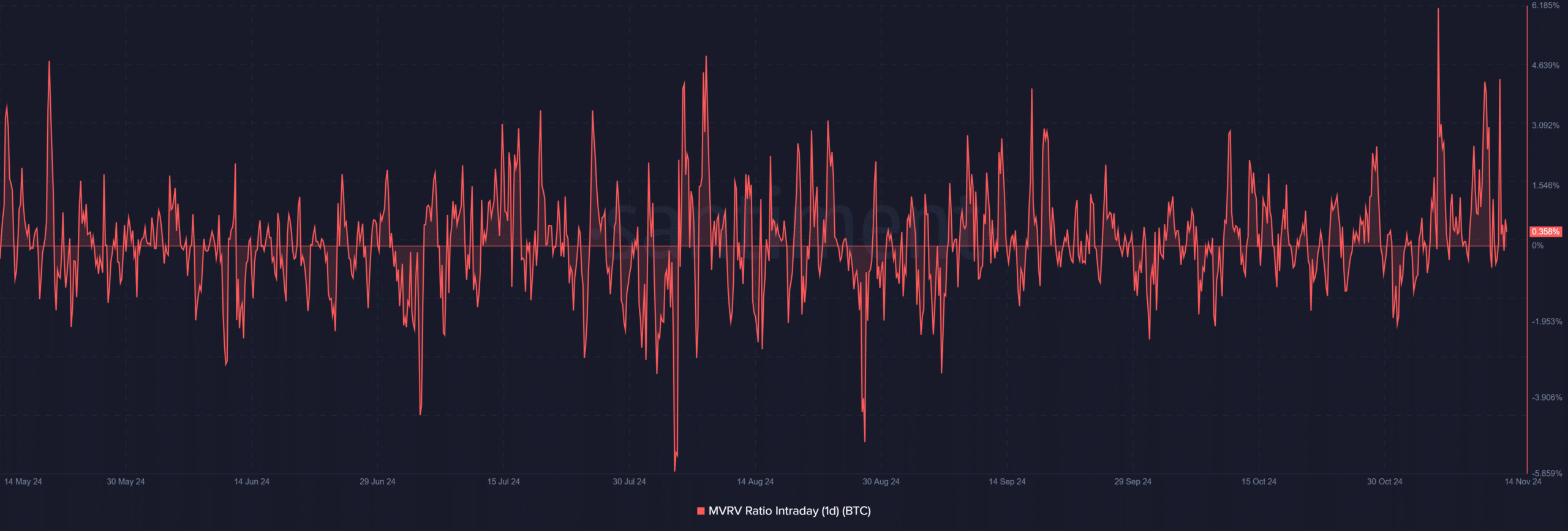

Furthermore, reinforcing the optimistic views previously mentioned, it’s worth noting that the Bitcoin Market Value to Realized Value (MVRV) ratio stood at 0.36%. This suggests that Bitcoin is slightly overvalued compared to its realized price.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This suggested that Bitcoin is not overbought and retains potential for upward movement.

Historically, when the MVRV (Merkle Value to Realized Value) ratio has reached similar levels, it has frequently been followed by price increases, suggesting that the conditions could be favorable for further Bitcoin growth.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-11-15 09:11