- Litecoin’s price action is at a crucial stage right now, oscillating in a broadening wedge pattern

- LTC’s derivatives data depicted a slight near-term edge for market bulls

As a seasoned analyst with over a decade of experience in the crypto market, I have seen my fair share of bull and bear cycles. The current state of Litecoin (LTC) has me intrigued and cautiously optimistic.

The latest surge in Litecoin’s value has pushed it beyond significant barriers on the price chart, potentially indicating a breakthrough towards higher levels.

Currently, Litecoin (LTC) is being exchanged for approximately $78.55 per unit, marking an increase of 4.19% over the past 24 hours. The intriguing query that arises now is: Will the buyers continue to drive the momentum and attempt to breach stronger resistance levels, or are we looking at a possible reversal pattern?

Litecoin chalked out a bearish pattern on the daily chart

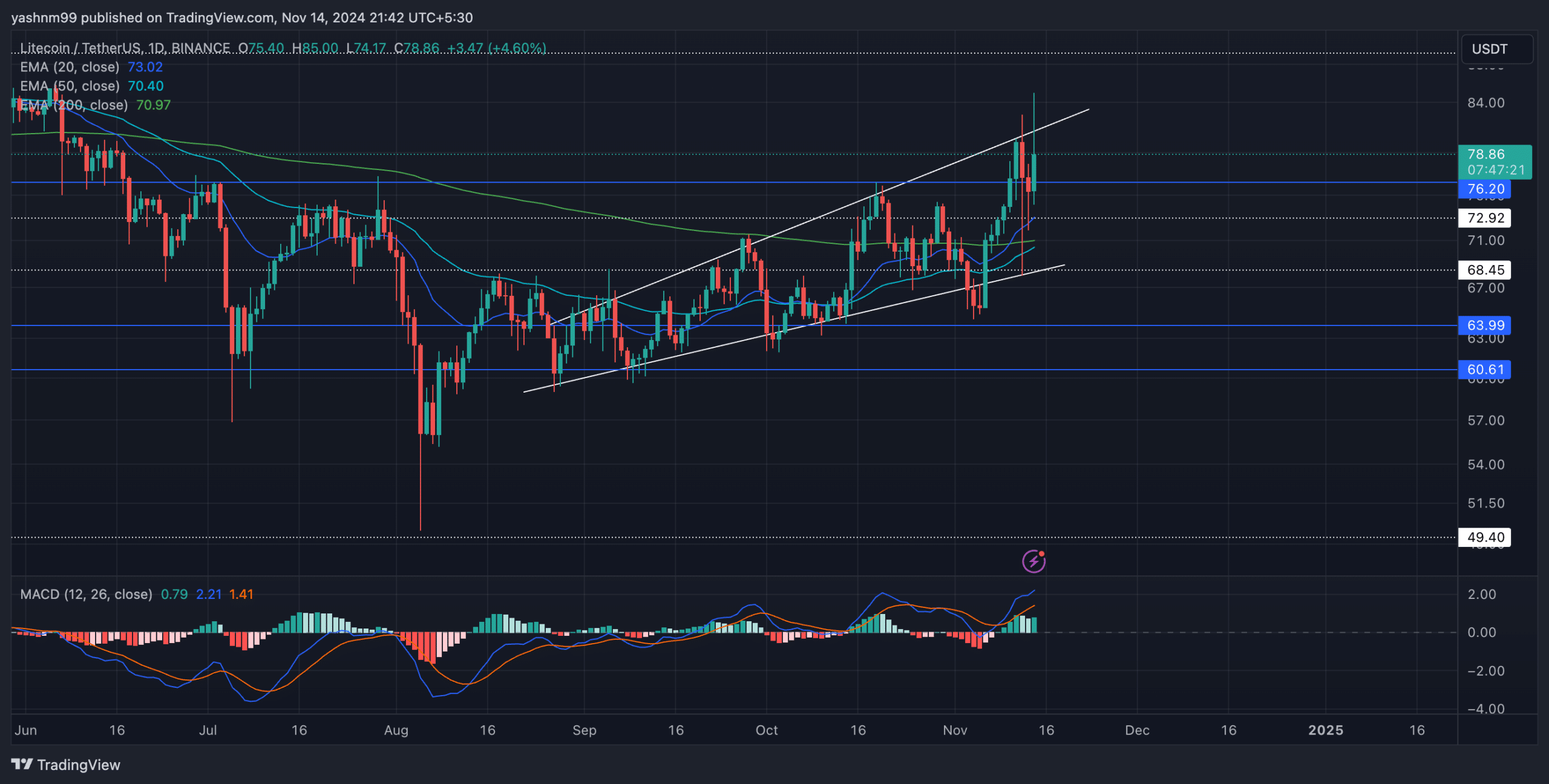

For the past three months, Litecoin’s price fluctuations have been following a widening upward channel shape, known as an ascending broadening wedge pattern. This pattern often reflects uncertainty or indecision among traders, as Litecoin has moved around its significant moving averages and touched the edges of this wedge multiple times.

Currently, Litecoin (LTC) has surpassed its 20-day, 50-day, and 200-day Exponential Moving Averages (EMA). As we speak, LTC appears to be at a crucial point, as the price is attempting to break through the upper limit of the widening triangle pattern.

If LTC manages to overcome this current resistance, it may surge forward towards the upcoming significant resistance at $89. But if the market trend reverses according to the pattern’s direction, a dip back towards the support of approximately $72 might occur instead.

Any recurring drop in price might find some stability around $64 or $60.61. These figures could play a significant role in shaping the mid-term direction for the cryptocurrency.

In simpler terms, the MACD (Moving Average Convergence Divergence) signal suggested conflicting feelings. The MACD line being above the Signal line suggests a slight lean towards buyers (bullish), yet both lines reside in positive zones, hinting that purchasing desire persists. Nevertheless, if the MACD lines were to reverse or fall below the zero line, it could indicate an increase in selling activity.

Litecoin derivatives analysis

The information about derivatives suggests a relatively optimistic perspective on LTC, as trading volume skyrocketed by 105.54% to reach $1.29 billion. Furthermore, Open Interest increased by 2.56%, suggesting that more positions are being established during the recent price spike. This activity might suggest that traders are preparing for a significant market shift, potentially signaling their belief in a prolonged upward trend.

The balance between long (buy) and short (sell) positions among traders remained relatively even, with a ratio of approximately 0.93, suggesting a balanced sentiment. Conversely, on platforms like Binance and OKX, the long/short ratios were more positive, indicating a greater preference for buying over selling. Specifically, the top traders on Binance’s LTC/USDT market showed a strong bias towards buying, with a long/short ratio of 2.55, suggesting they anticipate further price increases.

Traders need to keep an eye on overall market trends, particularly Bitcoin‘s fluctuations, because they tend to impact Litecoin’s course. The current trend and positive derivatives data suggest that buyers could potentially drive prices higher. Yet, if any pattern breaks down, it might trigger a temporary drop before another upward movement occurs.

Read More

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- How to Get to Frostcrag Spire in Oblivion Remastered

- Assassin’s Creed Shadows is Currently at About 300,000 Pre-Orders – Rumor

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Is the HP OMEN 35L the Ultimate Gaming PC You’ve Been Waiting For?

- Whale That Sold TRUMP Coins Now Regrets It, Pays Double to Buy Back

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

2024-11-15 13:43