- Hedera is expected to flip the $0.08 zone from resistance to support in the coming days.

- If HBAR witnesses sustained demand, a move toward $0.11 is likely.

As an analyst with over a decade of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. The recent surge in Hedera [HBAR] has been quite intriguing, especially considering its prolonged downtrend.

EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

EUR/USD Faces Historic Test Amid Trump Tariff Turmoil!

Market chaos looms — top analysts release an urgent forecast you must see!

View Urgent ForecastStarting from November 4th, Hedera’s [HBAR] price had been on a prolonged decline. However, the surging bullish sentiment that took hold of Bitcoin [BTC] and many other cryptocurrencies also impacted Hedera, causing its prices to rise subsequently.

As an analyst, I’ve observed a significant surge in the daily trading volume of this token, with a staggering 86% increase, currently standing at approximately $498.5 million as we speak. The bullish structure of HBAR has been reinstated, leading me to ponder just how high this current rally might climb before a potential correction occurs.

The two resistance zones to watch

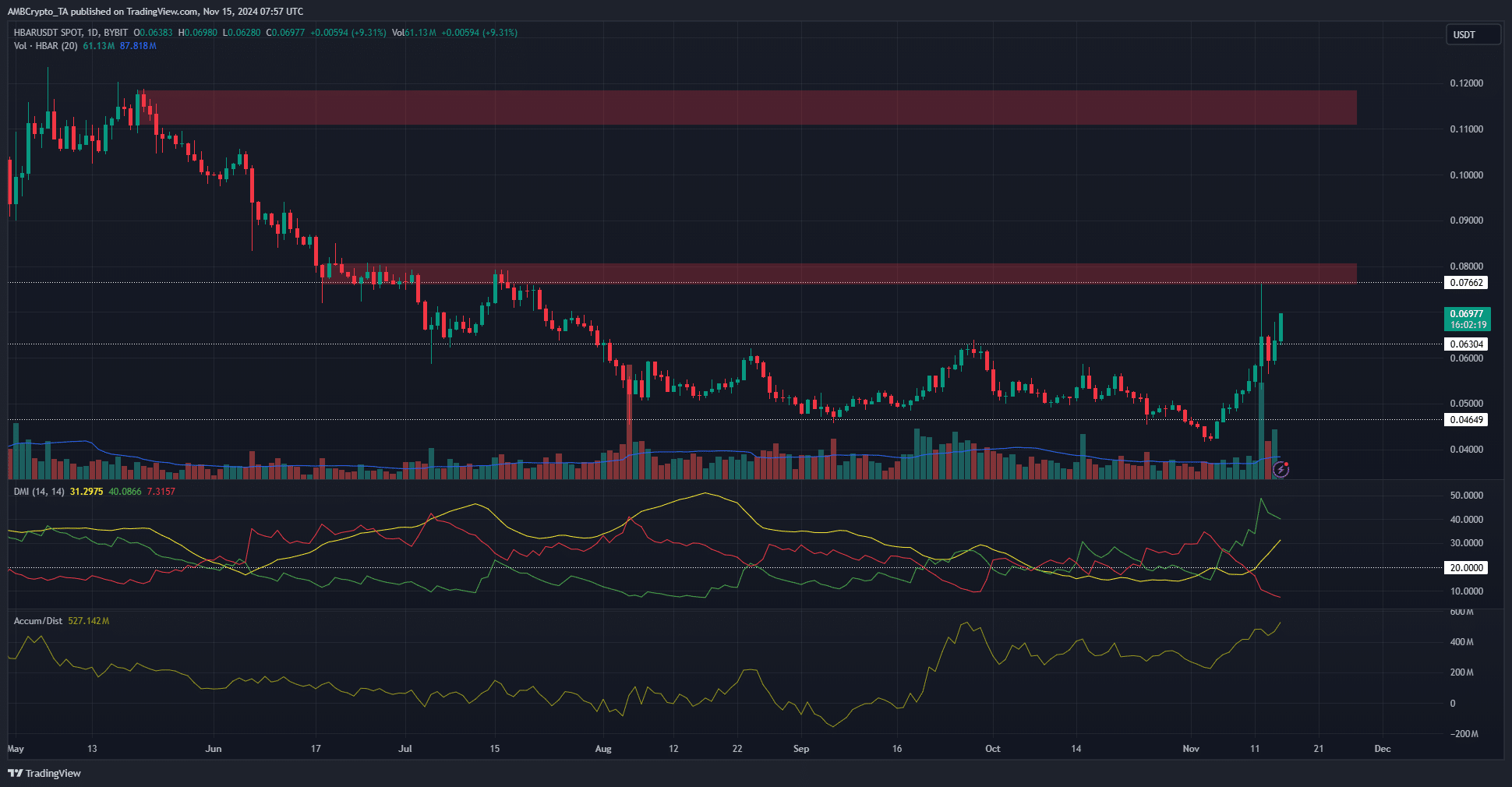

HBAR experienced a robust upward momentum, with its daily pattern indicating a bullish outlook. The crucial level of $0.063 was surpassed, which had acted as resistance since August. This upward push, as per the DMI indicator, indicates that HBAR is currently in a powerful uptrend.

To support this idea, the A/D indicator was also in an uptrend. It noted increased buying pressure in the past ten days. The recent rally was borne by steady demand.

On the 12th of November, high market volatility led HBAR to challenge its resistance at approximately $0.0766, but it was unable to sustain this level. Subsequently, the price has surged past $0.063.

In June and July, the $0.08 area functioned as a tough barrier for price advancement. Additionally, around $0.11, another strong resistance level emerged. This latter zone contained a large number of bearish orders when viewed on the daily chart.

Buying opportunity for HBAR traders?

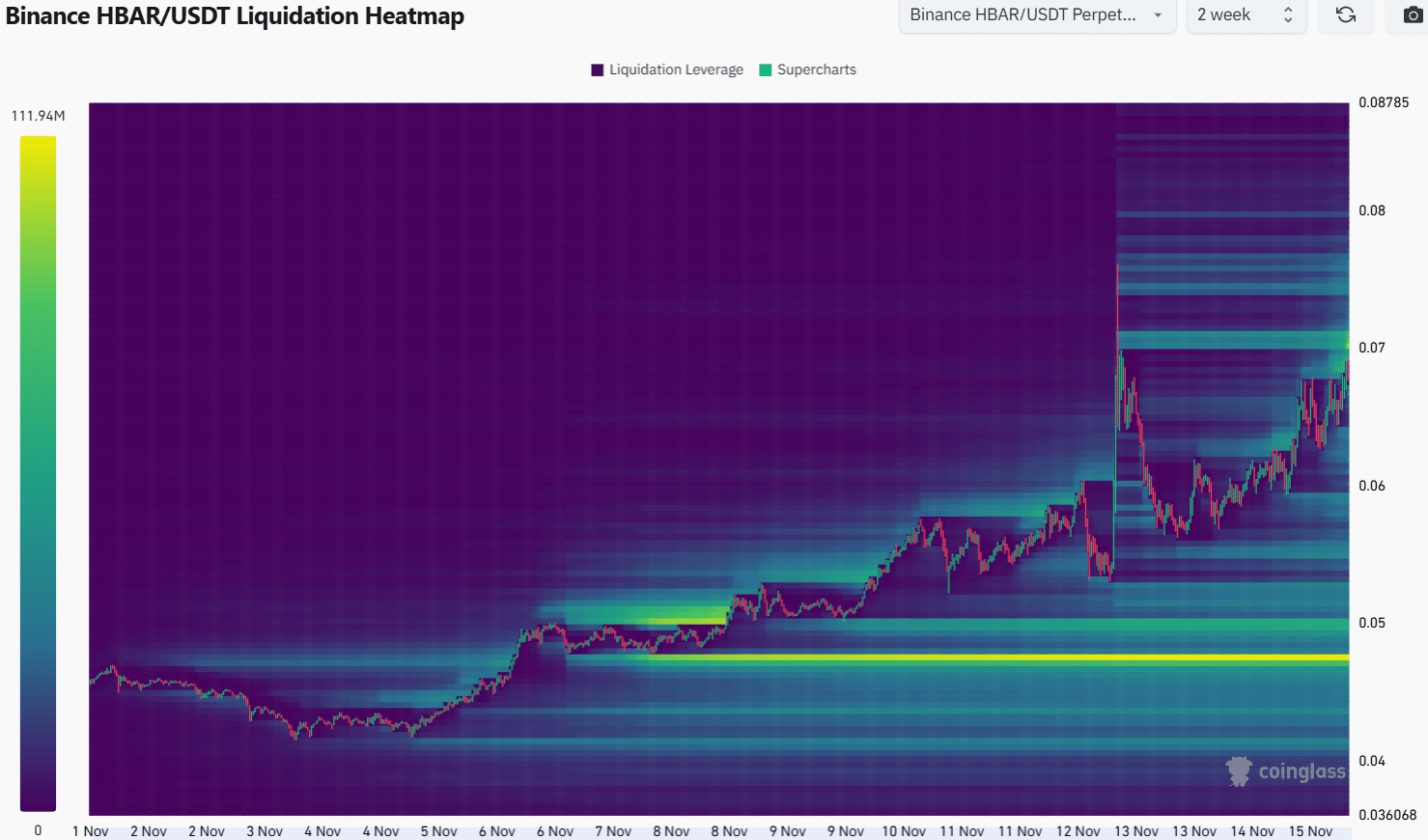

Over the last several months, the market has shown a downward trend, but a strong uptick has occurred recently. As a result, there are no significant long positions for sale above 0.063 USD. The closest such position was found at approximately 0.07-0.0711 USD, and it’s likely that this price range will be revisited in the near future.

Is your portfolio green? Check the Hedera Profit Calculator

A few days back, the market’s instability led to an accumulation of liquidity in this area, despite its overall bullish trend. It’s not unusual because liquidation of short positions typically occurs near peak prices.

For traders, this liquidity build-up was a sign that, after sweeping this liquidity, HBAR might also dip to $0.064 before resuming the upward move.

Read More

- Discover Liam Neeson’s Top 3 Action Films That Will Blow Your Mind!

- Kanye West Praises Wife Bianca’s Daring Naked Dress Amid Grammys Backlash

- Gold Rate Forecast

- OM PREDICTION. OM cryptocurrency

- Nintendo Switch 2 Price & Release Date Leaked: Is $449 Too Steep?

- Netflix’s New Harlan Coben Series Features Star-Studded Cast You Won’t Believe!

- EUR PKR PREDICTION

- Top 5 Hilarious Modern Comedies Streaming on Prime Video Now!

- Attack on Titan Stars Bryce Papenbrook & Trina Nishimura Reveal Secrets of the Saga’s End

- Matty Healy’s Cryptic Response Fuels Taylor Swift Album Speculation!

2024-11-15 15:03