- The drop in price has been largely attributed to retail traders offloading the asset, anticipating a continued downtrend.

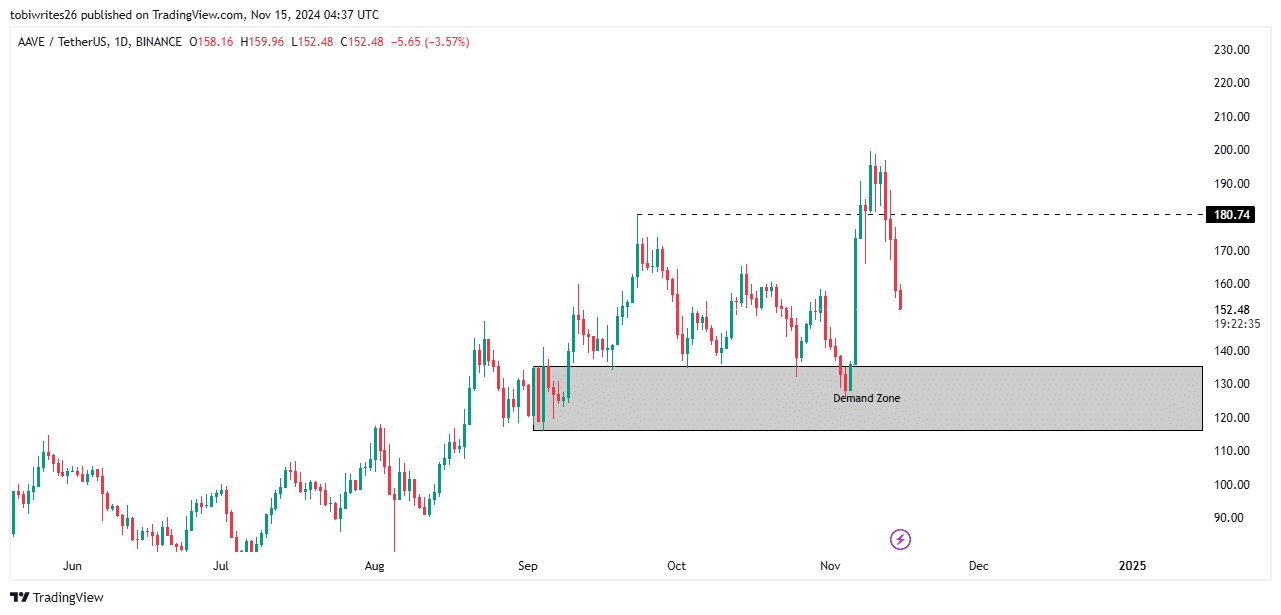

- Technical chart data indicates that AAVE’s next target lies within a demand zone at a lower price level.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I can confidently say that the recent drop in AAVE’s price has left me scratching my graying beard in puzzlement. Despite its past successes, AAVE seems to have hit a snag, and I find myself watching its chart more than I care to admit.

As an analyst, I’ve observed a challenging period for Aave [AAVE] lately. Despite its significant market influence in past months, it hasn’t been able to secure substantial gains recently. Over the last week, the token has experienced a dip of 14.01%, and in the past 24 hours, this downward trend persisted with an additional loss of 11.89%.

As an analyst, I’m observing that the current slump isn’t showing signs of abating anytime soon. Following my assessment at AMBCrypto, it appears that AAVE is currently trailing behind, and I foresee more downward movements before we might start seeing any signs of a potential rebound.

AAVE searches for new demand zone in downturn

The coin’s value is currently falling sharply, and this downward trend is likely to persist until it reaches a point where there’s enough trading activity (liquidity) to either halt the drop or potentially change the market trend.

Currently, it’s estimated that the possible price range for this demand area will extend from approximately $135.34 down to $116.21, as indicated on the graph.

If this current level persists, it’s possible that AAVE might retrace its steps towards past record highs, possibly hitting around $200. Continued market strength could further propel the asset to even greater heights.

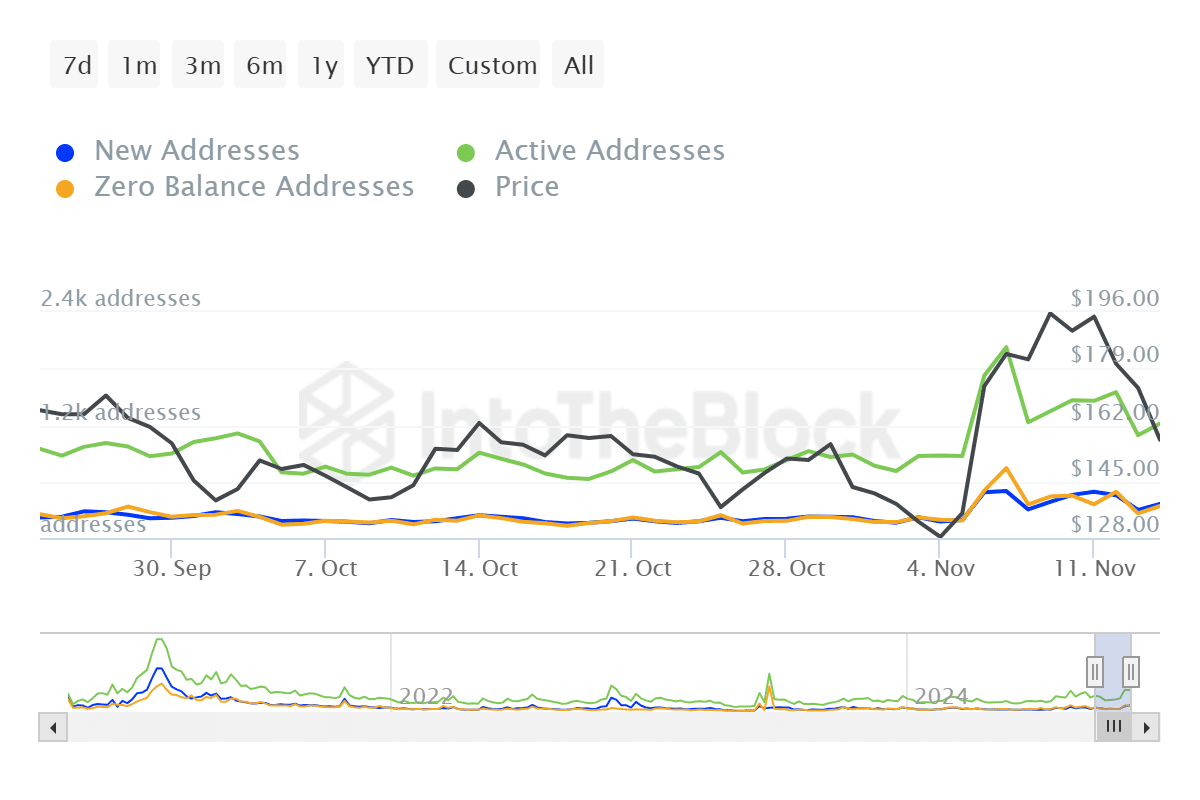

Retail traders drive AAVE market drop

In simpler terms, the drop in AAVE’s market worth is mostly due to individual investors choosing to offload (sell) this asset.

Based on information from IntoTheBlock, there was a significant increase in the number of active wallets over the past 24 hours, peaking at 1,220 during the analysis period.

An escalation in the number of active addresses, along with a persistent downward trend in the market, indicates that traders are leaning towards selling rather than buying.

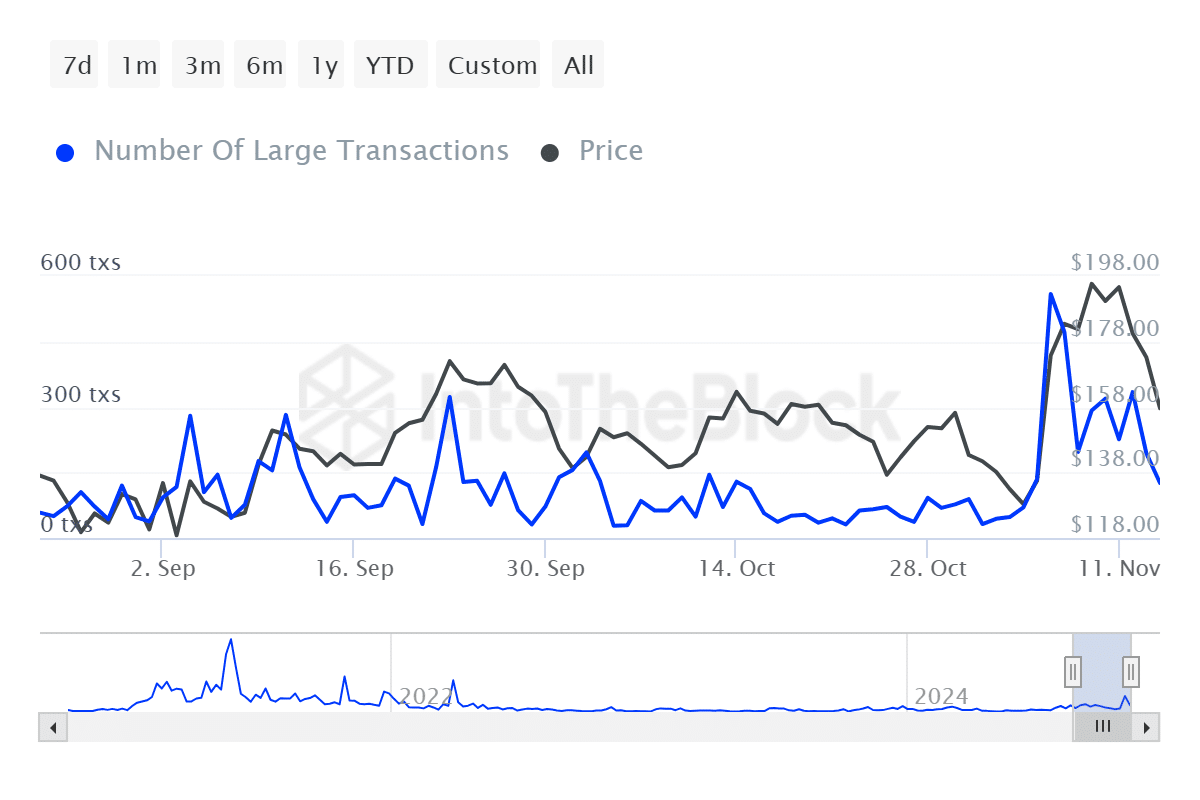

Currently, big investors, often referred to as “whales,” are maintaining a non-committal position. The frequency of major trades has noticeably dropped, going from a peak of 334 transactions on November 12th, down to just 126 at the present moment.

If the price of AAVE attracts large investors who find it advantageous, this inactive whale (large investor) might become more active, particularly within a region where buying interest is high and could escalate.

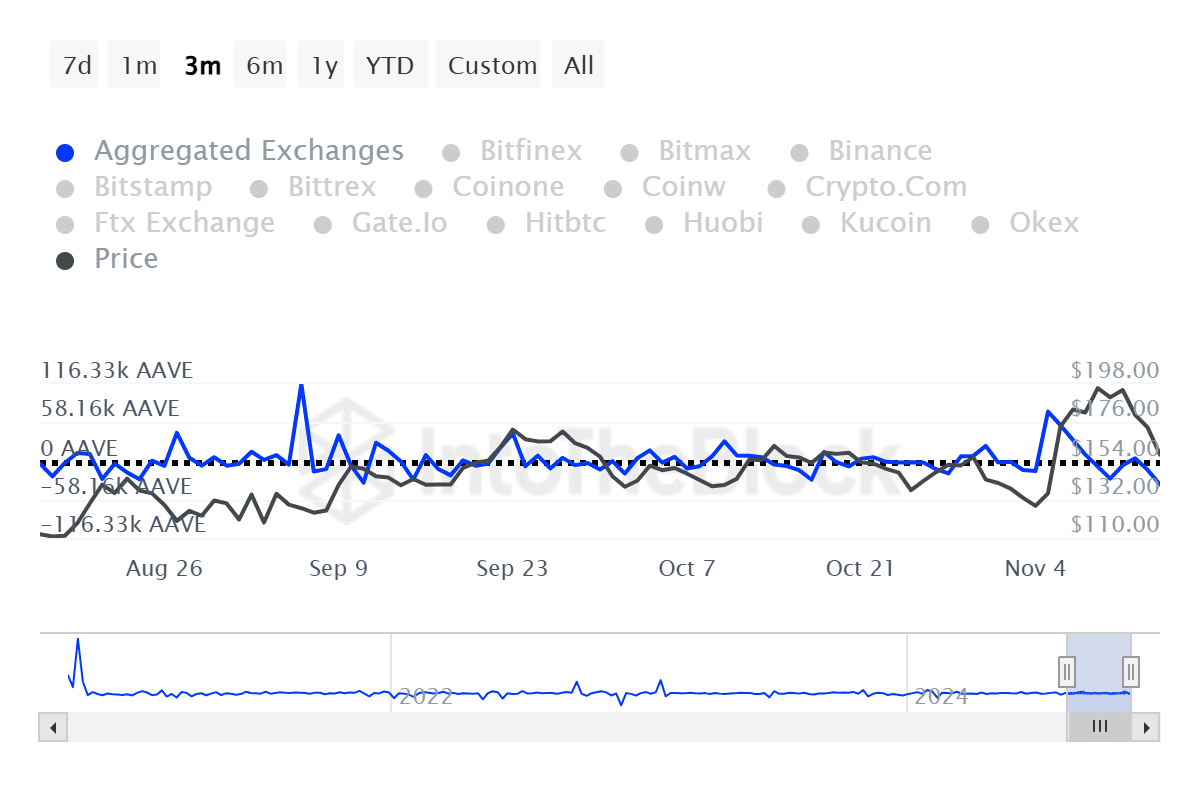

Traders shift to long-term holding

It appears that further examination shows a continued optimistic outlook for AAVE in the market, as more traders are transferring their assets from exchanges to secure, long-term storage, suggesting they believe the price will rise.

Read Aave’s [AAVE] Price Prediction 2024–2025

Over the last 24 hours and the previous 7 days, approximately 22,090 and 67,460 AAVE tokens were taken out of exchanges, as indicated by Netflow data from IntoTheBlock.

Reducing the availability of AAVE on exchanges by not listing it, tends to decrease the amount readily available for quick sale. This reduction can foster demand, suggesting a generally positive perspective regarding the future value of the asset.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-11-15 19:03