- The long-term risk for Chainlink was low as at press time.

- LINK consolidates in a falling wedge as Smart Money remain bullish.

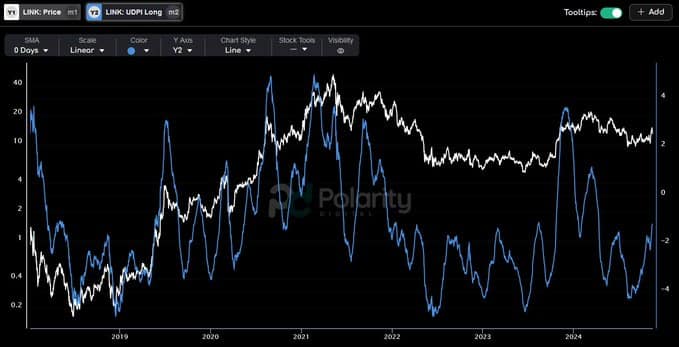

As a seasoned researcher with years of hands-on experience in the crypto market, I can confidently say that the long-term risk for Chainlink (LINK) is indeed low at press time. The UDPI Long reading suggests we’re in a period of low risk, historically associated with price stability or increase.

Chainlink (LINK) remains among the leading cryptocurrencies, as suggested by its latest UDPI Long signal, which indicates that Link is currently experiencing a phase of reduced risk.

Historically, drops in the UDPI have typically been followed by periods of price stability or growth. For instance, the risks dips around early 2020 and late 2022 were actually associated with market rallies. This implies that when the perceived risk decreases, it tends to stimulate increased buying activity.

Before significant price increases, these risk ditches frequently materialize, encouraging the buildup of LINK as long as the UDPI Long indicator remains relatively low.

Even though there may be some doubts about Chainlink, these trends seem to indicate that it could experience growth during periods when the market is favorable.

Historical patterns suggest that as risk levels decrease, the value of LINK typically increases, which lends support to the idea that a “altseason” could be advantageous for Chainlink.

These low-risk periods are often viewed as optimal times to invest, anticipating potential rallies.

LINK consolidated in a falling wedge

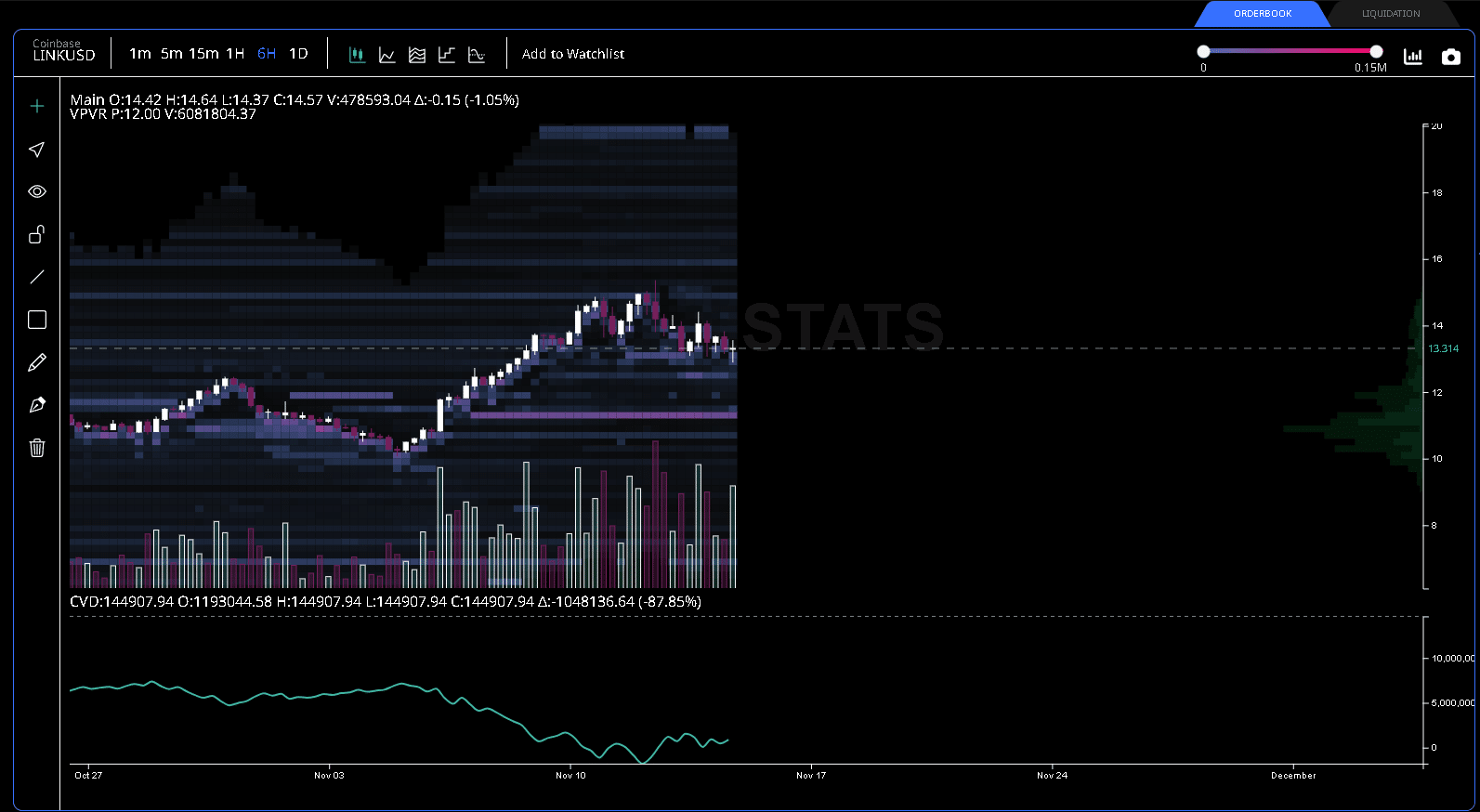

On the hourly chart for LINK, there was a distinct falling wedge formation, marked by two lines that gradually converged and contained the price movement.

When the price surpasses the upper boundary of this technical pattern, it usually indicates a possibility for a bullish turnaround.

Over the specified timeframe, I’ve noticed that the price of LINK has been confined to a relatively narrow range, suggesting a decrease in volatility and potential buildup stages, which could indicate accumulation by investors.

On numerous occasions, the cost of LINK has approached the barrier level, with each effort gradually reducing the price fluctuation and building excitement for a potential breach.

In light of the current trend and safe timeframe, it offers a chance for traders to buy more or even start a new position with LINK.

A clear jump above the upper boundary line on the graph might initiate a fresh upward movement, especially if there’s an increase in trading activity.

Volume and sentiment

Utilizing Chainlink’s Volume Profile Visible Range (VPVR) and Cumulative Volume Delta (CVD) provided valuable insights regarding the market’s behavioral patterns and trends.

According to VPVR analysis, there was an increase in trading activity at multiple price points, with particularly high volume observed approximately at $13.00. This significant surge in trading volume implies a high level of investor interest and could serve as a potential turning point for upcoming price fluctuations.

As a seasoned investor with over two decades of market experience, I have learned to interpret trends and patterns that can help predict potential profits. This week’s data from CVD showed an overall increase, which caught my attention due to its strong buying pressure compared to selling activity. Such accumulation by traders is often a sign of anticipation for future price rises, a pattern I have observed many times throughout my career. Based on this observation and my analysis, it seems that now might be a good time to consider investing in CVD if one shares the belief in a potential upswing in its market value.

Given the bullish attitude among ‘Savvy Investors’ – those who consistently outperform the broader market – and a bearish sentiment from the general public, this situation often offers a classic chance for going against the herd (contrarian opportunity).

Given the present discrepancy in attitudes, where Smart Money appears optimistic as indicated by Market Prophit, it seems prudent to consider adopting a long stance for LINK.

This tactic tends to be lucrative, particularly when the general retail opinion stayed pessimistic. This suggested that many might have been overlooking the underlying bullish indicators that savvy investors were picking up on.

Read More

2024-11-16 04:08