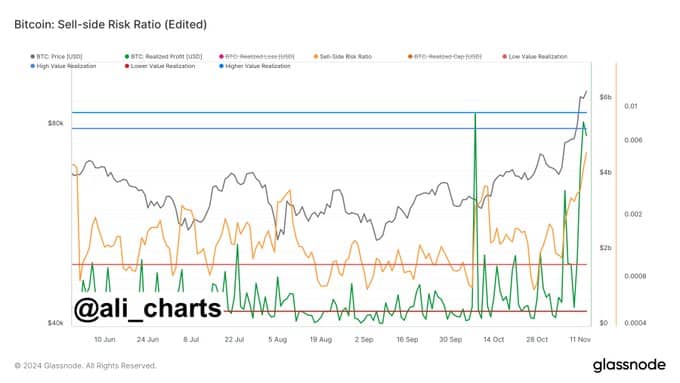

- Bitcoin realized $5.42 billion in profits

- With rising netflows, BTC faced short-term selling pressure near $90k

As a seasoned crypto investor with over a decade of experience navigating the rollercoaster ride that is the digital asset market, I find myself cautiously optimistic about Bitcoin’s current performance. The recent surge in realized profits and the resilience shown by BTC despite short-term selling pressure near $90k are encouraging signs of growing investor confidence.

As a researcher studying the cryptocurrency market, I’ve found that as per the analysis of market expert Ali, Bitcoin (BTC) has realized approximately $5.42 billion in profits. This comes as the Sell-side Risk Ratio spiked to 0.524%. This metric measures the risk-reward balance for sellers, and at this level, it’s still below its historical highs. This suggests that while there is selling pressure, it hasn’t yet reached extreme levels, indicating a more moderate market scenario.

Despite this, however, traders are advised to exercise caution as profit-taking intensifies.

As a researcher, I’ve observed an interesting trend in the market: Realized profits are significantly outpacing realized losses. At this moment, profits have skyrocketed to approximately $8 billion, while losses are relatively contained at around $1 billion. This imbalance suggests a wave of market optimism, as investors seem to be focusing more on capitalizing on gains rather than incurring losses.

Bitcoin’s market remains resilient despite recent price drop

At the moment of reporting, Bitcoin was being traded at approximately $91,000 per coin, and over the past 24 hours, a trading volume of about $84.43 billion has been recorded. Despite experiencing a downturn on the price charts in recent times, Bitcoin experienced an increase of nearly 4% over the last day.

Concurrently, information from IntoTheBlock showed approximately 307,000 wallets bought Bitcoin at an average cost of around $89,200. This price range might be significant for either providing support or serving as a barrier of resistance, contingent upon the market trends.

Market observers are keenly observing whether Bitcoin can maintain its current price level, as investors ponder the possible direction of its price movement next.

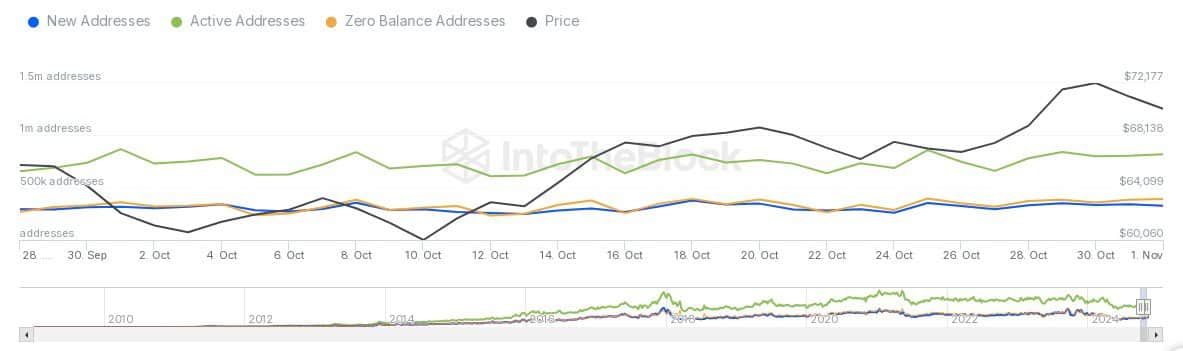

Network activity reflects growing adoption

The rise in Bitcoin’s price coincided with increased activity on the network. Notably, there was a surge in both new and active user accounts, indicating higher engagement.

New addresses have risen steadily too, reflecting fresh inflows of users into the ecosystem. Active addresses, representing daily transaction participants, also climbed to ~1.1 million, showcasing sustained network engagement.

To put it simply, the count of accounts with no funds hasn’t shown a significant rise, suggesting that there haven’t been many more inactive or forgotten digital wallets.

This pattern seems to indicate that the community continues to have faith and active involvement with Bitcoin, despite its price going up or down in the market.

Short-term selling pressure?

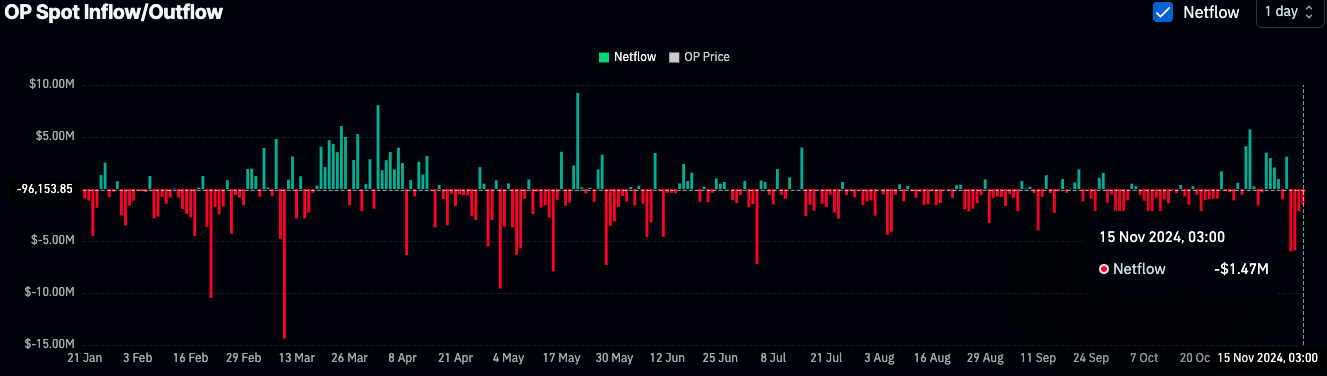

On November 15th, there was an inflow of approximately $128.46 million, which might indicate an increase in selling demand.

In the past, an increase in funds entering exchanges has often led to temporary adjustments (corrections) due to traders aiming to profit from recent market increases.

Despite some fluctuations, Bitcoin’s strength persists, boosted by phases of accumulation earlier in the year. From May to August, a series of continuous outflows suggested massive withdrawals from exchanges, frequently associated with institutional investors or long-term holders.

The buildup period probably contributed significantly to Bitcoin’s latest surge, during which its value soared from approximately $25,000 to more than $90,000.

Broader economic factors could shape Bitcoin’s future

As per a current analysis by AMBCrypto, the direction of Bitcoin’s price might be affected by uncertainties related to government regulations and the amount of national debt.

The incoming government might implement financial policies aimed at managing debt issues, potentially increasing the likelihood of higher prices.

Furthermore, reaching a peak ratio of 35 between Bitcoin and Gold, it means that Bitcoin’s value is currently thirty-five times greater than gold’s price, setting a new annual record. This suggests Bitcoin’s persistent success in comparison to conventional assets, including during periods of economic instability on a broader scale.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-16 11:04