- Sei Network’s growth can be highlighted by a 124.75% surge in daily active addresses

- High development activity and significant long liquidations underlined both commitment and volatility around SEI

As a seasoned analyst with over two decades of experience navigating the volatile crypto markets, I find myself intrigued by Sei Network’s [SEI] recent surge in daily active addresses. The 124.75% spike to 182,825 is nothing short of impressive and suggests a burgeoning interest in SEI that could potentially propel it into the top blockchain networks.

Recently, the Sei Network [SEI] has experienced remarkable growth, as shown by a significant increase of 124.75% in daily active users, bringing the total to approximately 182,825. This sharp rise in user interaction suggests growing curiosity towards SEI, sparking discussions about its prospective impact within the cryptocurrency community.

Despite the surge in user adoption, which suggests excitement, the overall market outlook is still unclear. Could SEI capitalize on this momentum to establish itself as a leading player in blockchain networks? Let’s delve into SEI’s technical factors and on-chain statistics to predict its potential path.

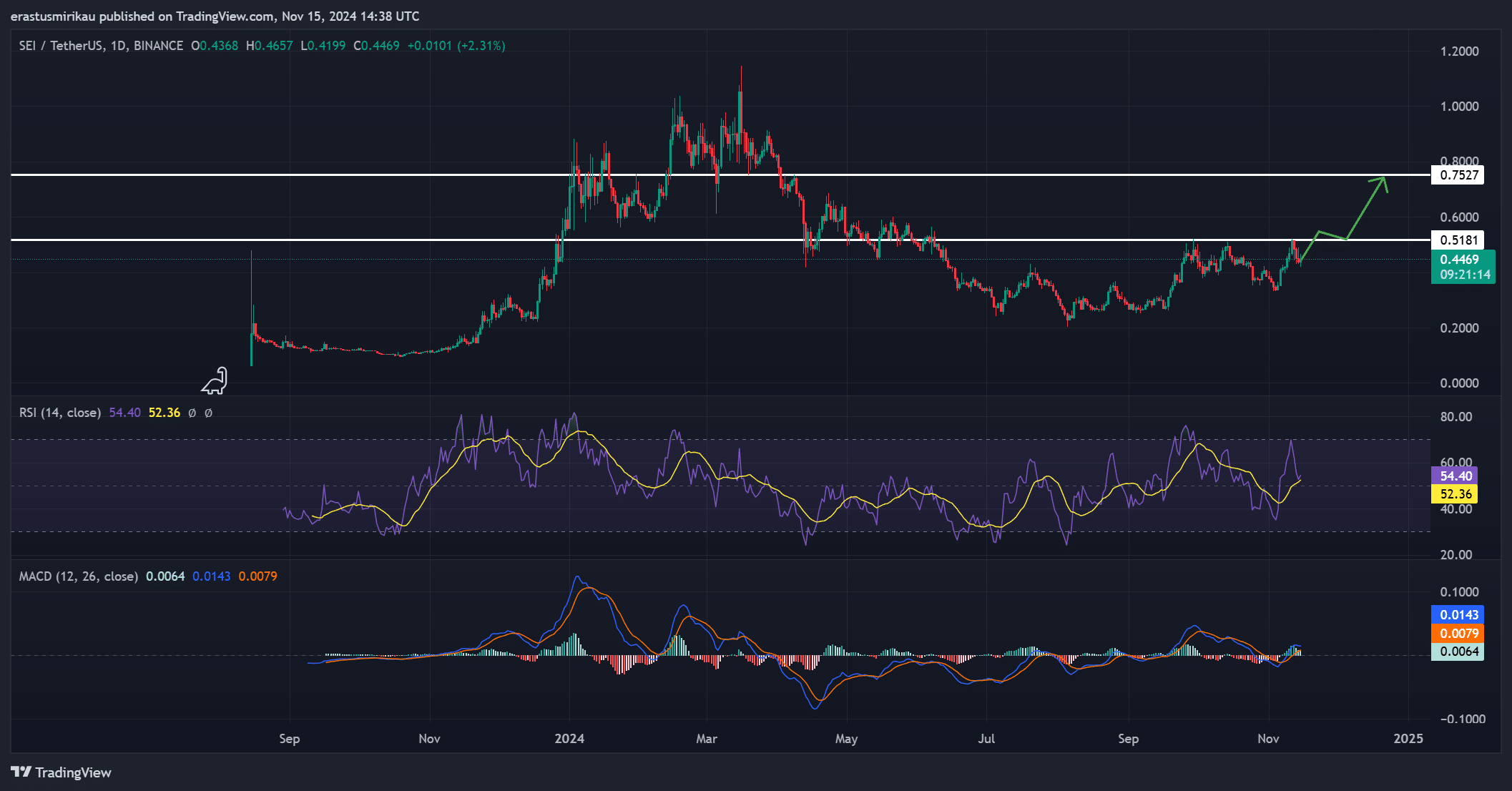

Technical analysis – Will SEI overcome key resistance levels?

To maintain its positive momentum, SEI needs to surpass the significant resistance point at $0.5181 – a level it’s currently testing. If successful, a secondary target of $0.7527 could be within reach. It’s crucial to keep an eye on these levels because breaking through them might signal a continuation of the bullish trend, while failing could trigger a correction and impact trader confidence.

Moreover, the Relative Strength Index (RSI) stood at 52.36, implying that Stock Exchange Inc. (SEI) might have some room for further growth, as it’s not yet signaling an immediate overbought condition. The Moving Average Convergence Divergence (MACD), exhibiting a slight positive divergence accompanied by a recent crossover, hints at potential increasing momentum for SEI.

A sustained push beyond $0.5181 could mean a bullish rally towards higher resistance levels.

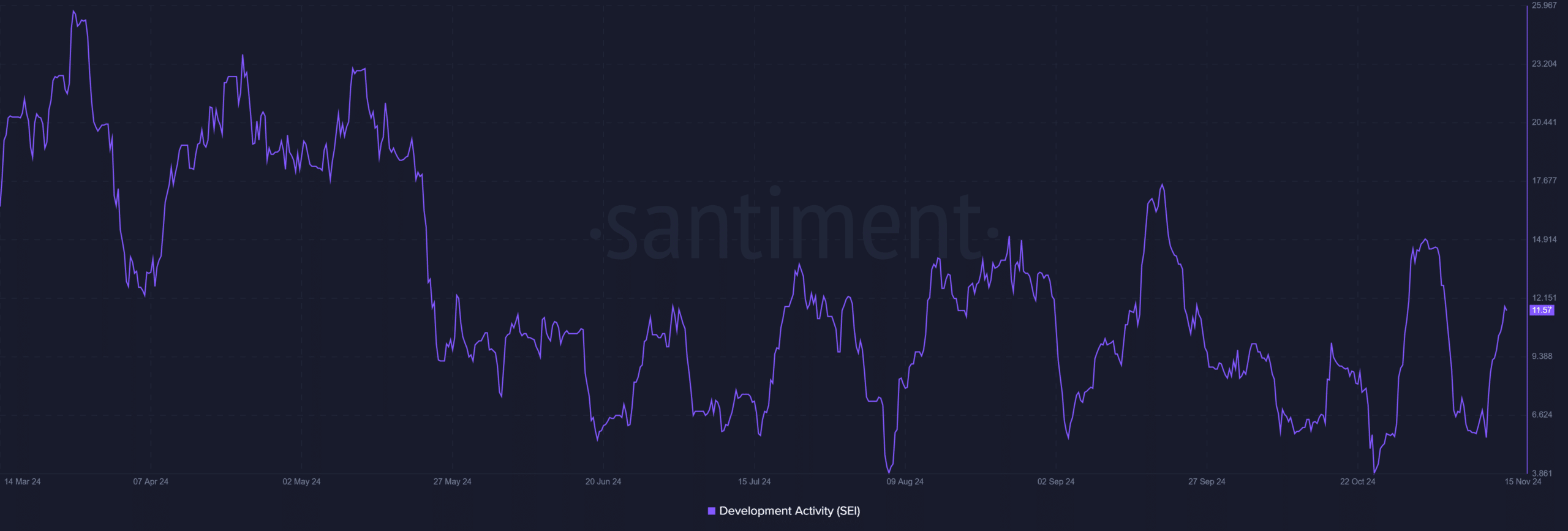

Development activity – Consistent progress reflects growth potential

Progress in development has consistently risen, moving from 10.57 to 11.57, demonstrating ongoing advancements and unwavering devotion from developers. This consistent upward trend reflects the team’s commitment, a crucial factor in preserving faith among investors.

Moreover, a high level of project development usually indicates a strong foundation, which can draw in long-term investors. Consequently, as SEO (Search Engine Optimization) matures, it serves to confirm to investors that the team is dedicated to sustainable growth rather than temporary excitement.

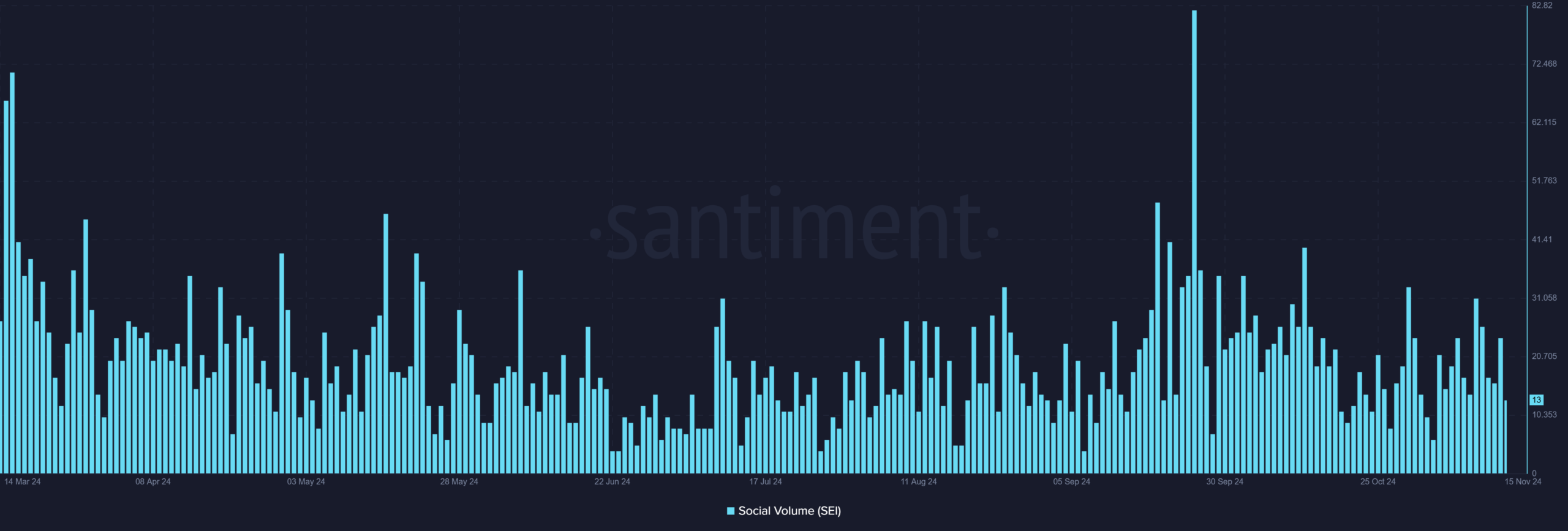

SEI social volume – Is the hype fading?

In just one day, there was a significant decrease in social activity, falling from 24 to 13. This sudden drop could be an indication of less online conversation, possibly pointing towards a decline in public engagement or enthusiasm.

Although a decrease in social activity might not always indicate an ending, it could be indicative of a shift from excitement to steady, sustainable growth. If SEI manages to maintain progress and surpass certain developmental thresholds, this could trigger renewed interest. This fresh attention would foster its growth within a more stable market climate.

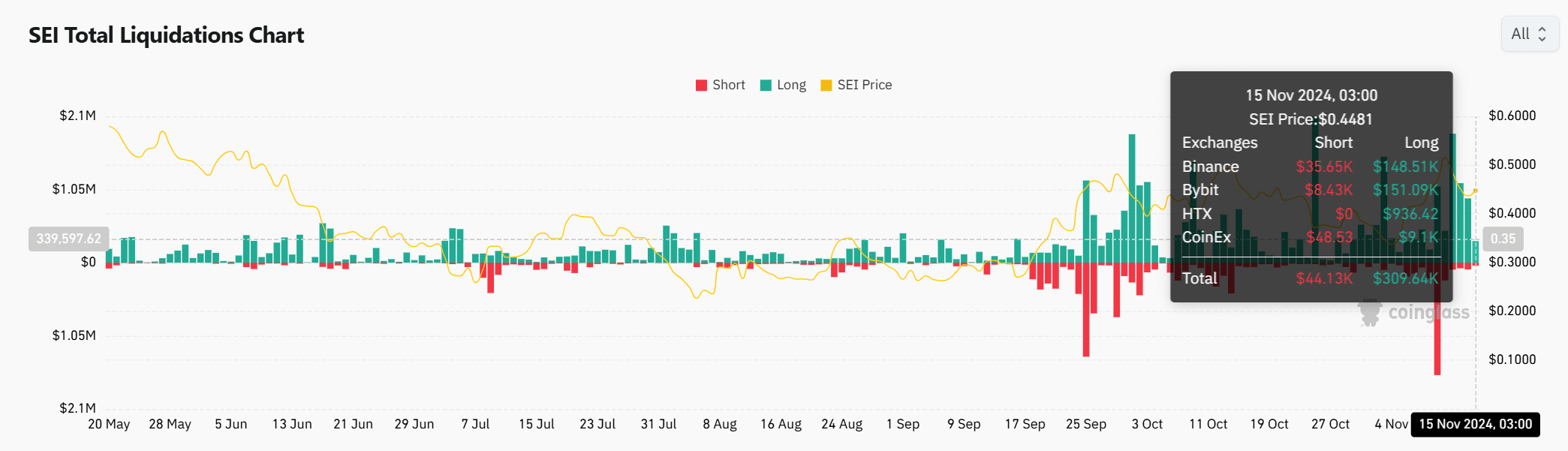

Liquidations – Bulls and bears battle for control

The significant increase in liquidations indicates a fierce struggle between buyers and sellers regarding SEI’s price trend. At present, long liquidations amounted to $309,640, far exceeding short positions at $44,130. This disparity underscores bullish confidence, yet it also points towards high market volatility near the $0.4481 price point.

In a nutshell, Binance had more positions (longs) closed at a loss ($35,650) compared to positions closed at a profit ($148,510), while Bybit had fewer shorts closed at a loss ($8,430) compared to longs closed at a loss ($151,090). If these high liquidation levels continue, it’s possible that SEI could experience additional price fluctuations as the bulls and bears fight for dominance.

Realistic or not, here’s SEI’s market cap in BTC’s terms

In summary, Sei Network’s current expansion and ongoing progress provide a robust basis for potential prosperity. Yet, it is crucial for SEI to surpass certain resistance points and maintain its development momentum to establish itself effectively in the highly competitive cryptocurrency sector.

Should it meet these objectives, the Sei Network might effectively leverage this momentum and create an enduring impact.

Read More

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-16 12:08