- Raydium gained by nearly 300% in price as fees increased by more than 10x from September

- The sudden, swift gains have led to an overextended RAY market

As an analyst with over two decades of experience under my belt, I’ve seen my fair share of market fluctuations and trends. The recent surge in Raydium [RAY] has been nothing short of remarkable, with its price skyrocketing by nearly 300% since early October. However, this swift rise has raised some concerns about an overextended RAY market.

Raydium’s token [RAY] experienced a remarkable surge of approximately 280% from October 10th to November 9th, followed by a downturn on the price charts. Interestingly, the Automated Market Maker (AMM) and liquidity provider operating on the Solana blockchain have also seen a significant increase in fees during the past month.

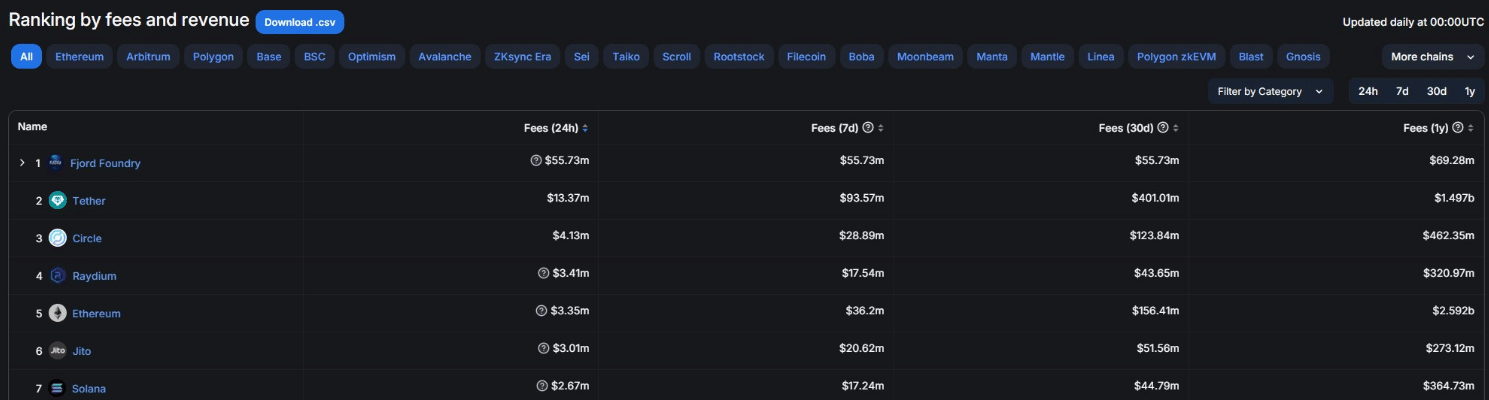

On October 21st, I witnessed Raydium amassing daily fees amounting to an impressive $3.4 million, outpacing Ethereum‘s daily fee of $3.35 million for the same day. It’s worth mentioning that, since the Dencun upgrade in March, Ethereum has been experiencing a consistent decline in its fees.

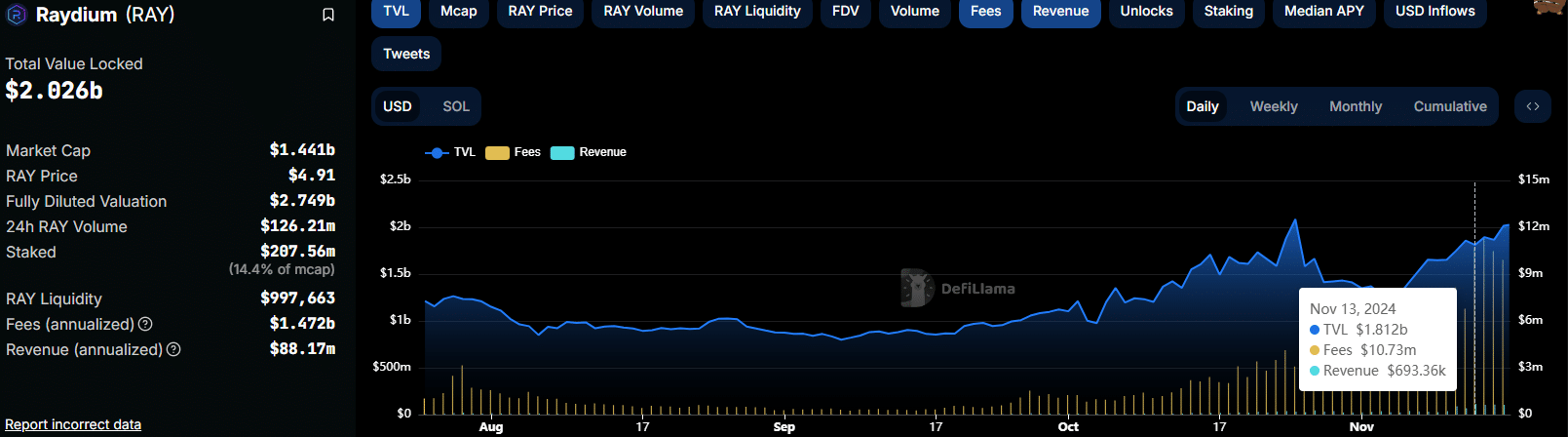

Raydium revenue up by leaps and bounds

In September, the fees for Raydium were roughly $300,000. However, on November 13th, they skyrocketed to $10.73 million, generating a revenue of approximately $693,360. A portion of these fees is allocated towards purchasing RAY tokens and distributing them to token holders who have staked their tokens for marketing purposes.

The significant increase in income is primarily due to the growing fame of memecoins within the Solana system, which boosted the desire for SOL. This surge in demand led to increased transaction fees for Raydium, causing the price of RAY to rise as a result of higher demand.

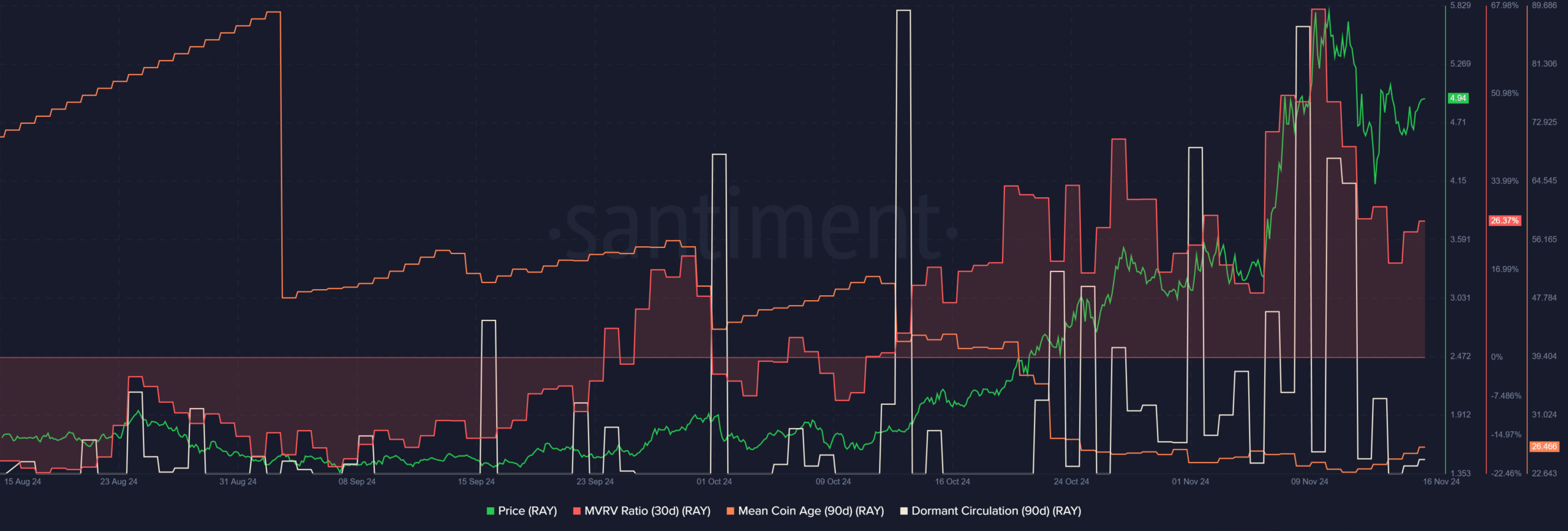

According to AMBCrypto’s analysis, it appears that the cryptocurrency RAY could experience a short-term pullback, as its 30-day MVRV Ratio currently stands at 26.37%, reaching a recent peak of 67.3% on November 9th. This suggests that the currency might have become overvalued and could potentially correct itself.

During that period, I noticed an increase in dormant tokens being circulated, which suggested more token transactions were taking place. This could be indicative of increased selling pressure, possibly due to profit-taking activities.

Additionally, the Mean Coin Age (MCA) has been decreasing since September, but it has shown signs of recovery in recent days. However, at the current moment, it’s not indicating accumulation just yet. This suggests that more profit-taking might occur, which could potentially depress the value of Raydium tokens.

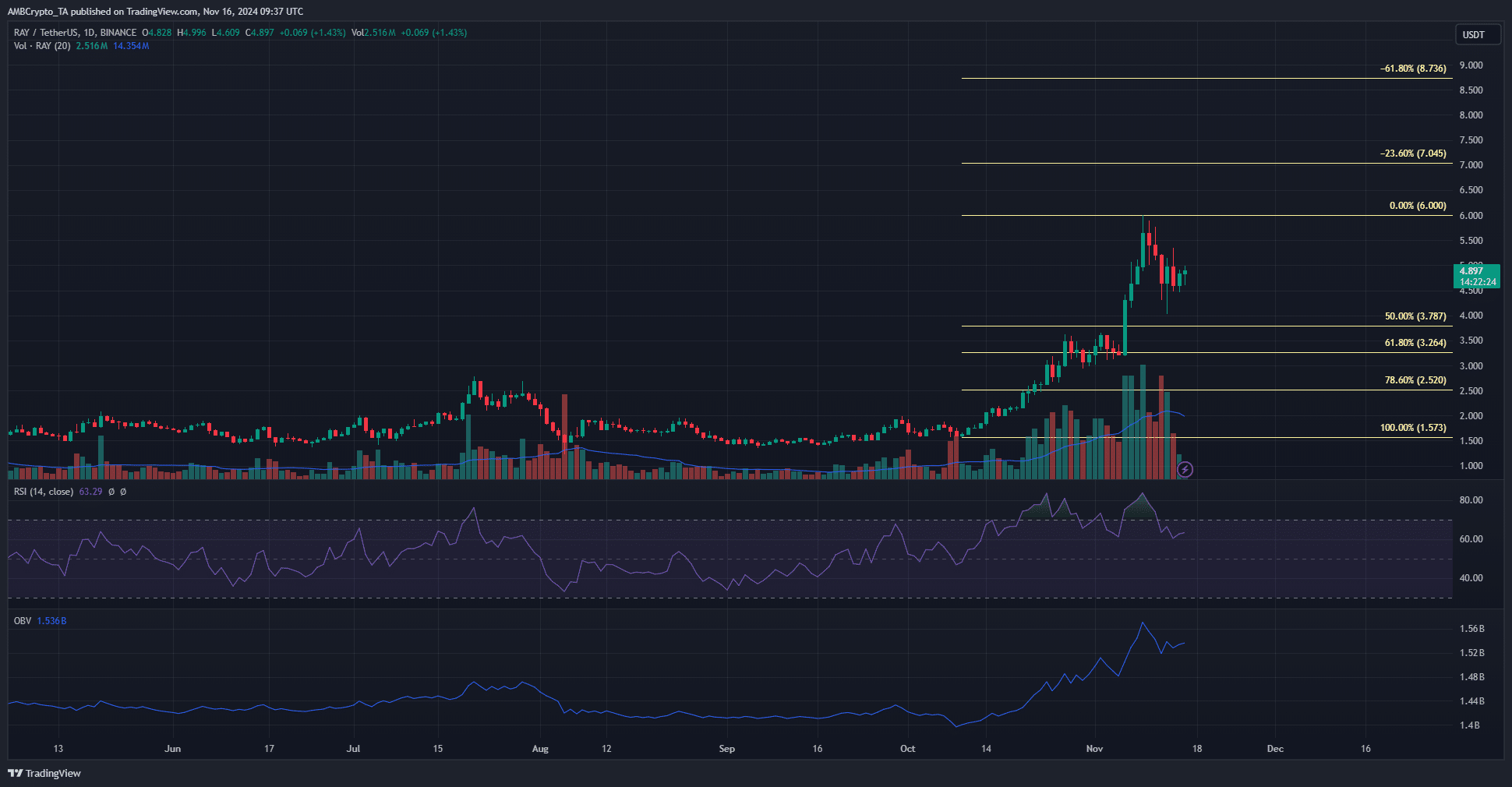

RAY price charts suggest a dip towards $3.5 is possible

As a crypto investor, I’ve been closely monitoring the price charts, and the technical indicators have consistently shown a robust bullish sentiment. After a brief rejection at $6, the Relative Strength Index (RSI) dipped from 83.66 to 62.3, which, while lower, still suggests a healthy bullish trend. The On-Balance Volume (OBV) continues its upward trajectory, signaling persistent buying pressure. Furthermore, trading volume has been steadily increasing over the past month, indicating growing interest in the market.

Read Raydium’s [RAY] Price Prediction 2024-25

Ultimately, the Fibonacci retracement levels highlighted $3.78 and $3.26 as significant points to keep an eye on.

In the near future, the $4-level could function as a compass, helping us determine if the bears are initiating a more significant retreat.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-11-17 02:15