- Cardano’s price broke through another crucial price level on the charts

- ADA’s price level fueled FOMO within the market

As a seasoned crypto investor with years of experience navigating the volatile digital asset landscape, I’ve seen my fair share of market euphoria and despair. Watching Cardano (ADA) break through yet another crucial price level has piqued my interest once again.

There’s been a lot of buzz surrounding Cardano (ADA) lately as its price movements have stirred up conversations about it possibly hitting a significant milestone by the middle of 2025. Both technical indicators and on-chain data are sending conflicting messages, making this ambitious goal intriguing for both investors and experts in the field.

Let’s dive into the data to evaluate whether ADA’s price has what it takes to climb these heights.

Cardano’s price momentum – A breakout in progress?

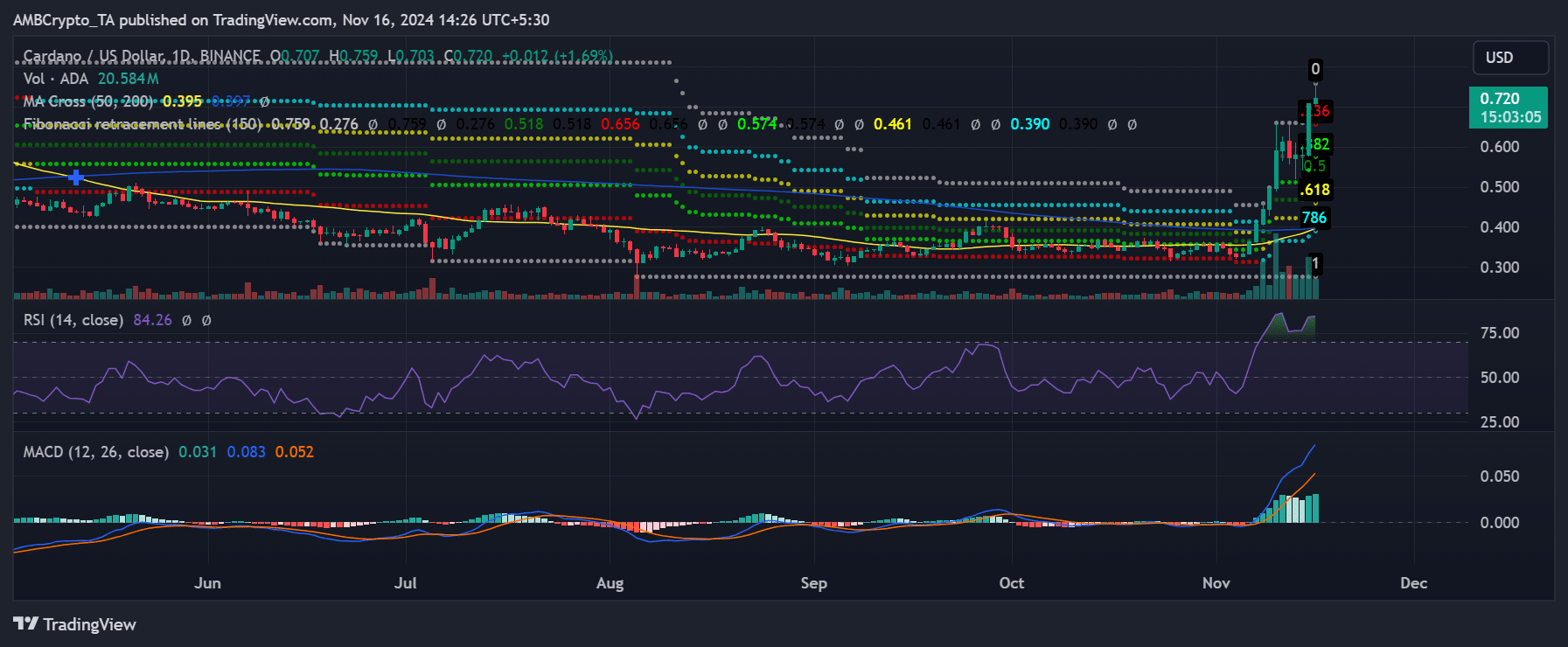

Currently, Cardano is hovering around $0.72, boosted by more than 20% growth over the past day. This upswing has propelled it to break free from both its 50-day and 200-day moving averages, which stood at $0.39 and $0.38 respectively.

Making such a move typically indicates robust short-term bullish power, as it suggests that buyers are currently dominating the market.

Furthermore, the Relative Strength Index (RSI) increased to 82.81, moving the cryptocurrency into an overbought state. This could suggest robust buying activity, but it might also indicate a forthcoming brief price adjustment. Given that traders often choose to cash out their gains in such situations.

Another key indicator to note is the Fibonacci retracement level. Cardano has tested the 0.618 retracement level, going past $0.7 – A critical resistance zone. Breaking through this level could pave the way towards $0.80 – A key target in its upward trajectory.

Simultaneously, the MACD line was climbing, indicating a favorable trend, and supporting the existing bullish feeling. Yet, it’s crucial to maintain strong momentum to surpass the approaching resistance barrier.

Cardano’s on-chain metrics – Network activity and accumulation

As I write this, the activity taking place on the blockchain suggests an enticing depiction of Cardano’s prospective expansion.

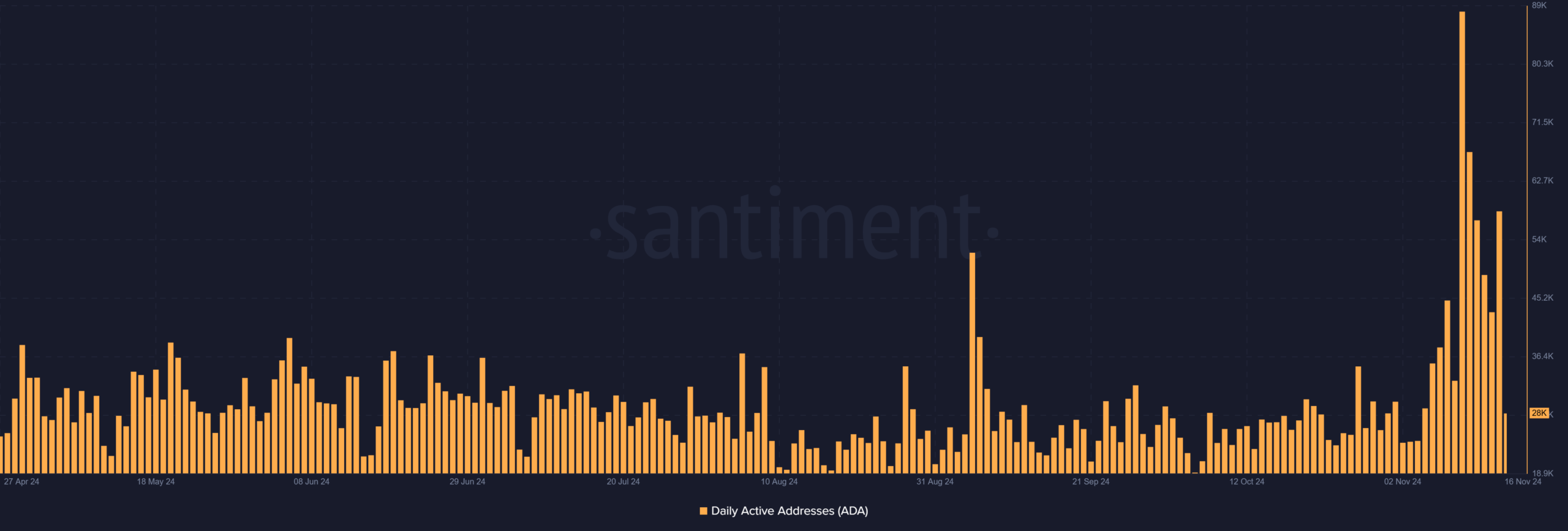

In my analysis, I observed that daily active addresses surpassed 58,000 during the previous trading session, as reported by Santiment. This significant increase suggests a noticeable uptick in network activity.

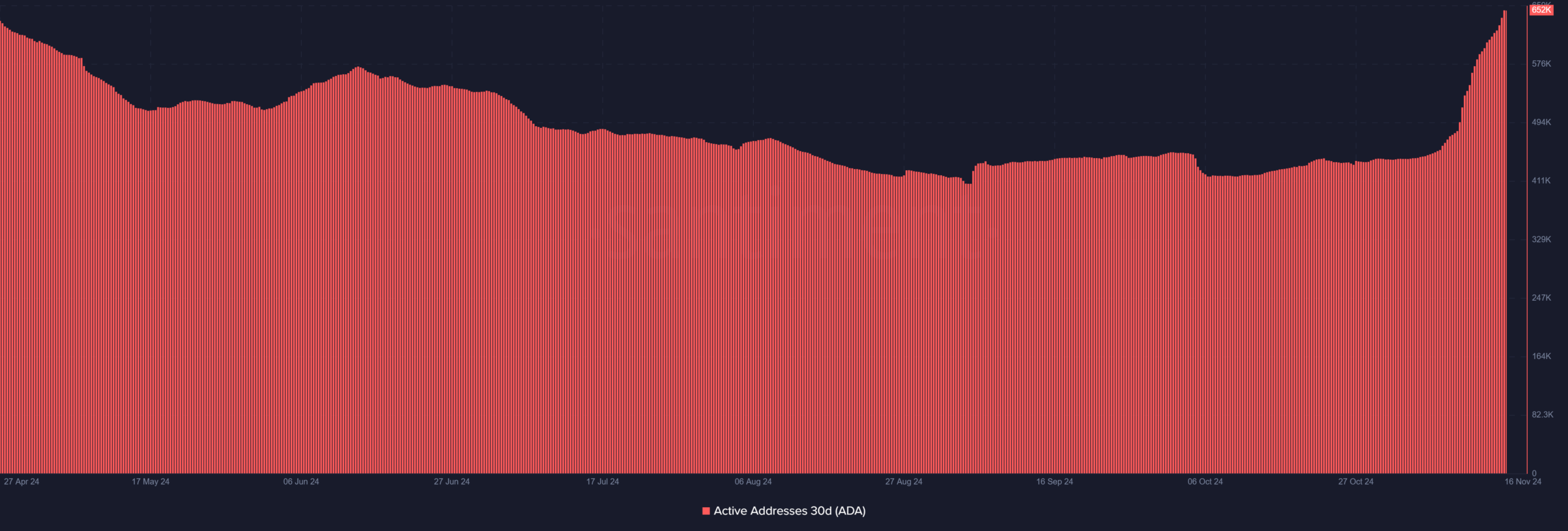

Furthermore, within the last month, there was a significant rise in daily active addresses, reaching approximately 637,000, which highlights ongoing user interaction and involvement.

This data suggests that the Cardano ecosystem is picking up momentum, which could be a positive indicator for its future expansion.

Derivatives data – Long liquidations hint at FOMO

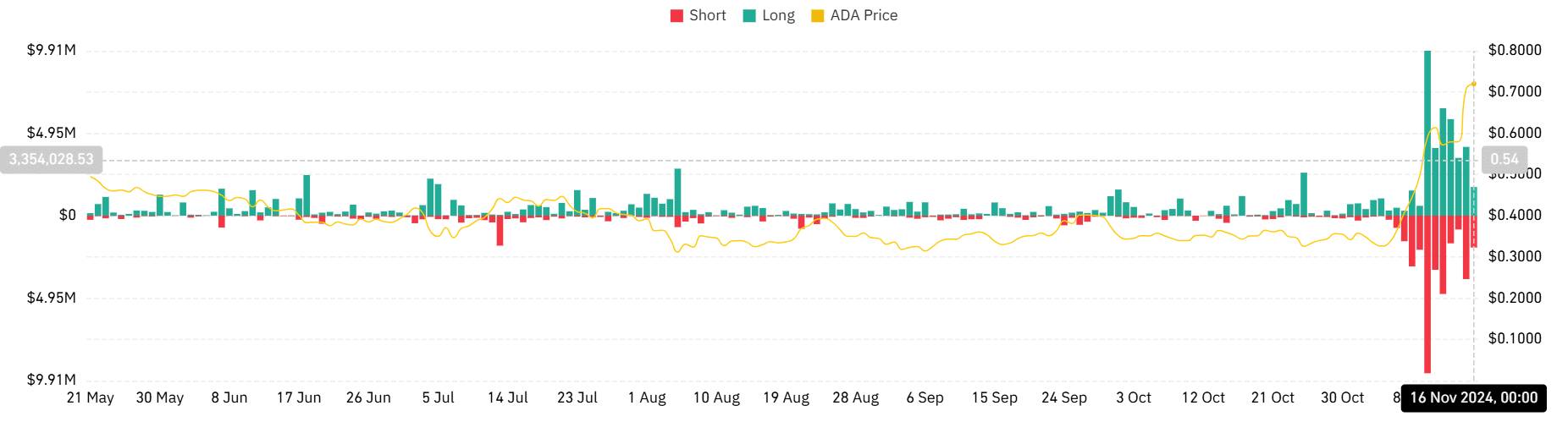

Cardano’s latest rally has sparked increased trading activity in the derivatives market.

Indeed, data from Coinglass showed an increase in long positions and a corresponding rise in short position closures. This pattern suggests increasing optimism among traders, but also highlights the dangers of excessive borrowing. Moreover, it appears that the $0.55 level could now serve as a robust support area based on the high frequency of liquidations observed around this price point.

Furthermore, during this upward trend, funding rates have persistently been positive, suggesting that traders are willing to pay extra to keep their long positions open.

This bullish sentiment is in line with the broader optimism surrounding Cardano’s price action. However, caution is warranted, as excessive leverage could amplify volatility in the event of a market correction.

– Realistic or not, here’s ADA market cap in BTC’s terms

As an analyst, I’ve been closely observing the recent progress and expansion of the Cardano network, and it appears that we may be on the verge of a potential rally. However, reaching this ambitious goal relies heavily on Cardano’s capacity to sustain its bullish momentum, break through significant resistance levels, and effectively leverage the growth within its ecosystem.

Read More

2024-11-17 04:08