- BONK has hiked by over 80% in the last seven days

- At the time of writing, the memecoin was well inside the oversold territory

As a seasoned researcher with a knack for deciphering market trends and an unwavering curiosity about the ever-evolving crypto space, I find myself utterly fascinated by the recent meteoric rise of BONK. The memecoin’s staggering 80% hike in just seven days has left me both astounded and intrigued.

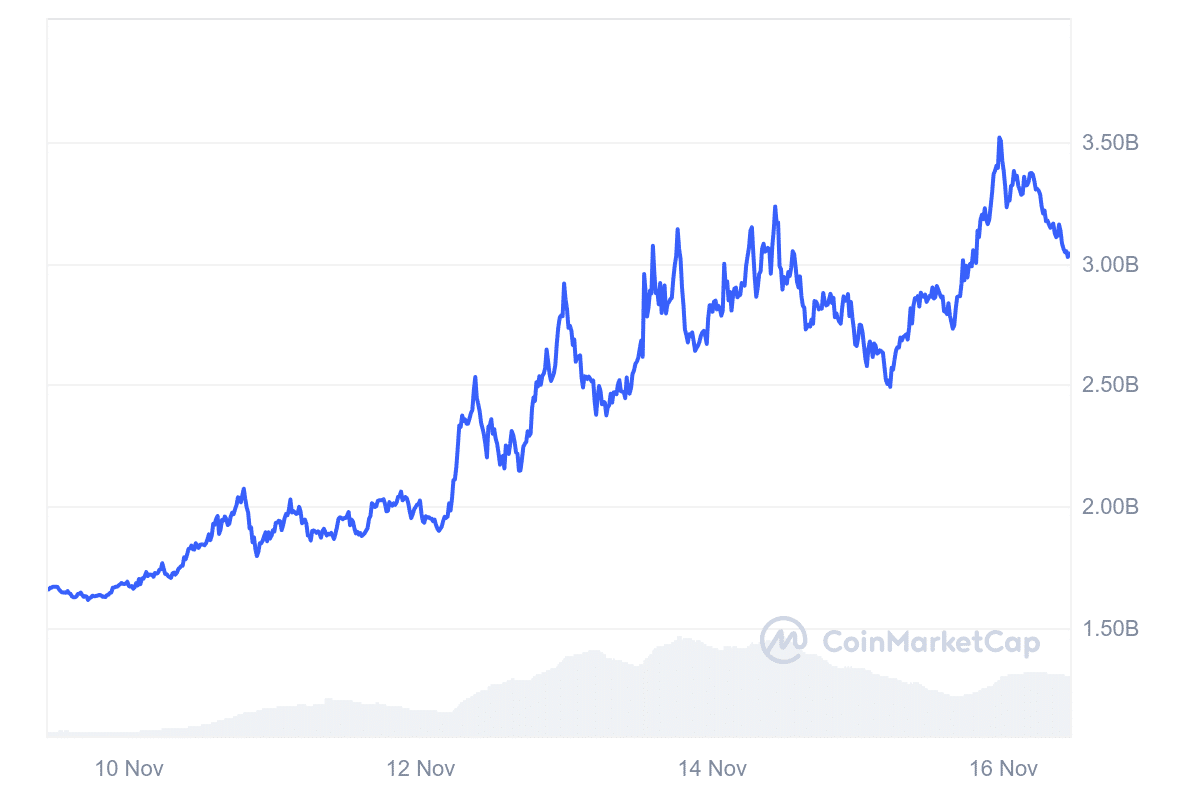

Recently, BONK surpassed the $3 billion market cap mark, which reinforced its status as the second most prominent meme coin on the Solana blockchain network. Furthermore, it now ranks fifth among all meme coins across the broader market.

It’s important to note that this exceptional trek has been matched with an increase in trading activity, escalating volumes, and substantial price fluctuations.

BONK’s market cap and volume explosion

For the past week, BONK’s market cap has experienced a significant surge, reaching over $3 billion at its highest point. However, it has since dipped slightly. This rapid climb was also evident on CoinMarketCap’s chart, suggesting an increasing level of investor attention and interest.

As per the latest data, BONK has moved into the second spot among memecoins built on the Solana network, surpassing many others due to its impressive market cap of more than 3.7 billion dollars.

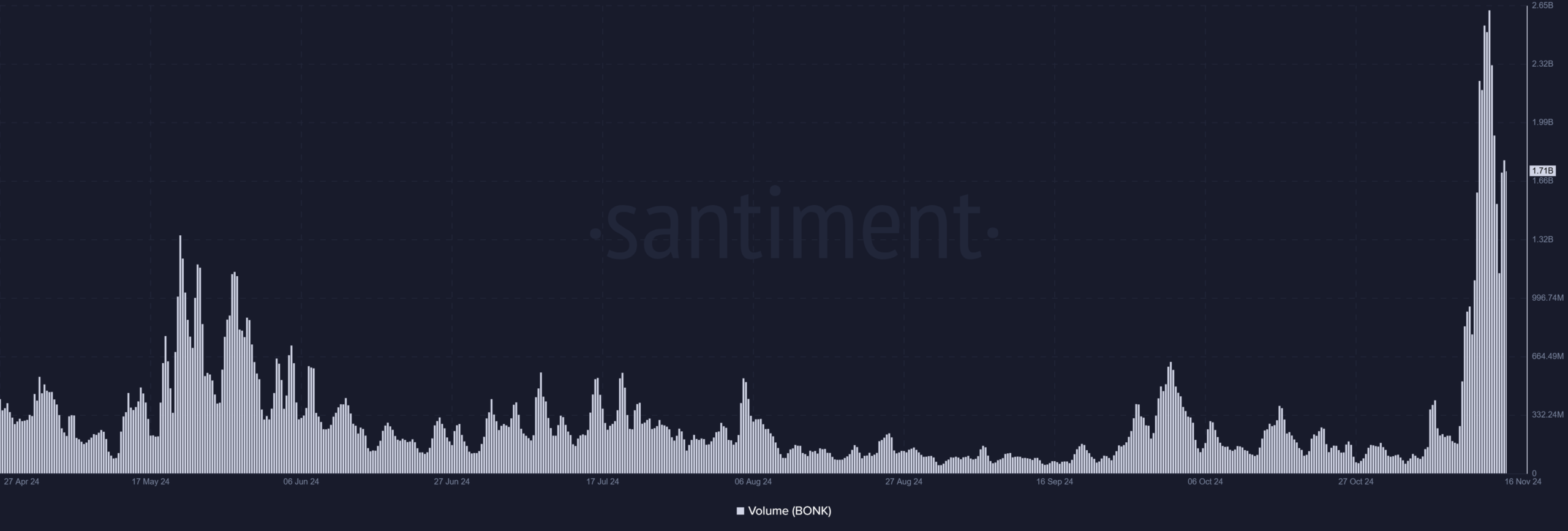

Furthermore, a significant increase in trading activity, as demonstrated by Santiment’s volume graph, suggested increased user involvement. The value of BONK skyrocketed to more than $2.6 billion on the 14th of November, showing high liquidity levels and enhanced speculation.

The increase in activity isn’t limited to BONK; it’s also boosting optimistic feelings towards Solana. Currently, the trading volume is nearly 1.7 billion dollars.

Key technical indicators signal potential for more gains

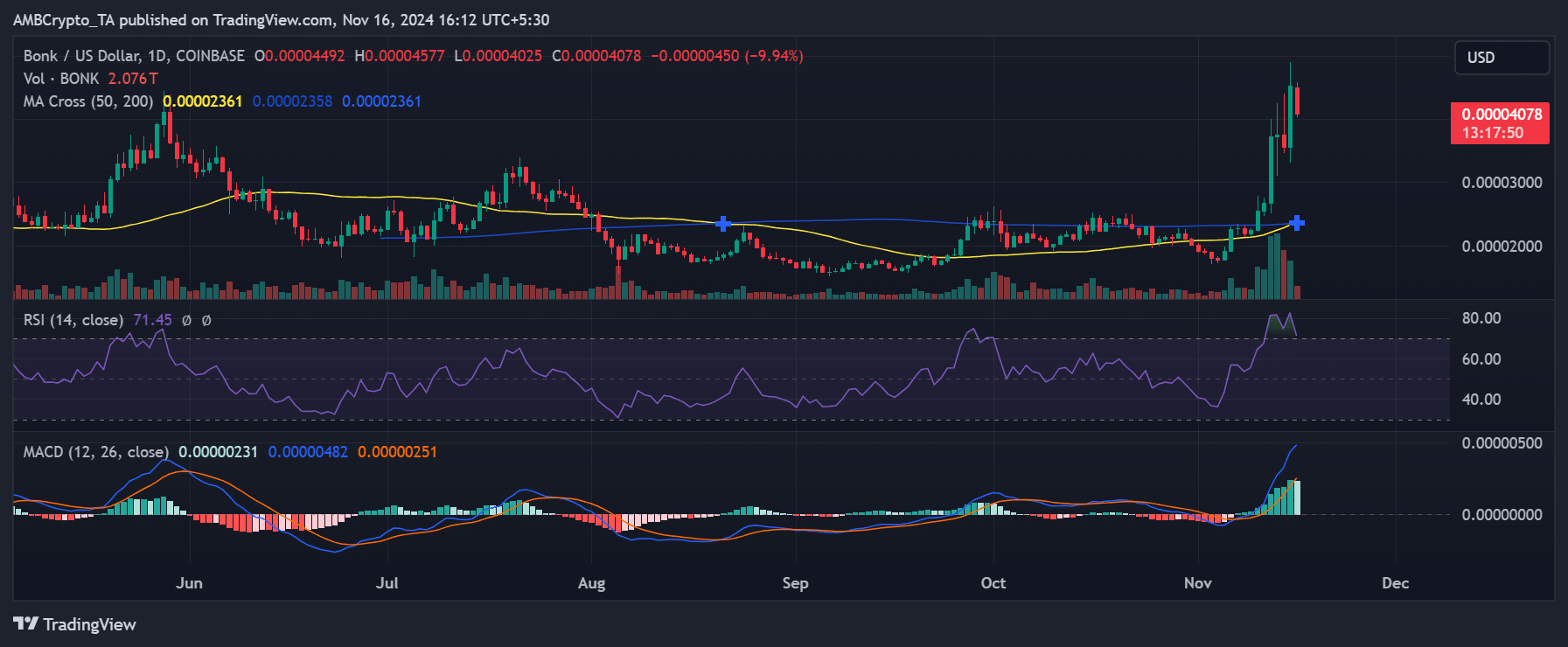

Technically speaking, it appears that BONK might be showing positive trends. On its daily chart, there’s an emerging golden cross where the 50-day and 200-day moving averages are intersecting – this is often a sign of a possible prolonged upward movement.

Historically, such formations attract traders seeking confirmation of long-term bullish momentum.

Currently, BONK is being exchanged at $0.00004065, representing a 10.23% decrease over the past day. However, it’s important to note that despite this temporary drop, the Relative Strength Index (RSI) stands at 71.18, indicating continued buying activity in an overbought market condition. Additionally, the Moving Average Convergence Divergence (MACD) suggests a bullish trend, although it hints at a possible slowdown as the price action stabilizes on the charts.

Important areas to focus on are the immediate support at approximately 0.000035 USD and resistance around 0.000045 USD. If the price goes above this resistance, it could lead to more growth. On the other hand, falling below the support might trigger selling activity.

Correlation with Solana’s price action

BONK’s meteoric rise can also be closely tied to Solana’s recovery in the broader market.

As a crypto investor, I’ve noticed an intriguing pattern between Solana and BONK. With a correlation coefficient of 0.82, it seems that when Solana’s price climbs upwards, BONK tends to follow suit, riding the wave of optimism within the ecosystem. This suggests a strong connection between these two cryptocurrencies.

Solana has demonstrated robustness, as evidenced by a surge in developer involvement and increased adoption statistics propelling its growth trend. Moreover, the thriving success of BONK underscores the solidity of Solana’s ecosystem, reinforcing its standing among the fierce competition within the blockchain industry.

Outlook for BONK

It appears that BONK is looking promising based on its increasing market value, active trading, and the formation of a golden cross. Although temporary setbacks might happen, given its strong connection to Solana, this memecoin could potentially experience more development in the future.

Keeping a watchful eye on BONK’s ongoing market momentum, I advise a measured approach for both traders and investors, given the potential for market fluctuations. Yet, with strategic focus on key resistance levels and technical indicators lining up favorably, I believe BONK may exhibit more upward trends in the near future.

Read More

- Masters Toronto 2025: Everything You Need to Know

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-11-17 06:16